David Larock in Mortgages and Finance, Home Buying

If you want to gauge the overall health of an economy, understanding employment trends is critical. Last week we received the latest Canadian and U.S. employment reports and both were instructive.

If you want to gauge the overall health of an economy, understanding employment trends is critical. Last week we received the latest Canadian and U.S. employment reports and both were instructive.

Canada’s labour force lost another 2,800 jobs in February and continued a recent trend of disappointing job reports. While our overall unemployment rate actually dropped from 7.6% to 7.4%, that was because a record 38,000 Canadians (most of whom are between the ages of fifteen and twenty-four) stopped looking for work. If you adjusted for this change in what is called the ‘participation rate’, our employment rate would have actually increased from 7.6% to 7.7%.

The details in the report showed that our public sector lost more than 13,000 jobs. Although this drop was partially offset by an increase in self-employment, a spike in the self-employed ranks normally occurs when the economy is going through a period of transition, and that category of employment may include people who are doing a bit of temporary work while transitioning between jobs. Our average wage increased, but at slightly less than the rate of inflation. Canadians continue to see their purchasing power erode as average income levels fail to keep pace with rising prices.

By contrast, the latest U.S. non-farm payroll report was more upbeat. It showed 227,000 new jobs being created in February despite U.S. public sector employment contracting by 6,000. There was also a surge in temporary jobs (+45,000) which is normally a leading indicator of economic recovery, and the report added another 61,000 jobs by revising its previously released December and January employment data.

Those are good numbers, but a look at the U.S.’s overall employment picture still leaves room for caution. For one thing, this year’s unseasonably warm winter has provided a significant boost to the payroll numbers, both because fewer people missed work for weather-related reasons and because businesses that are normally affected by cold weather, such as construction, have not had their usual seasonal slowdowns. Also, while the U.S. employment numbers were up again, the average number of hours worked was unchanged at 34.5 hours/wk. and wage growth (average weekly earnings ) only inched up .1%. Just as in Canada, U.S. incomes aren’t keeping pace with U.S. prices.

I think it will be a while yet before releases such as the latest U.S. non-farm payroll report start to raise inflation expectations. There is little upward pressure on labour costs and that will be true for as long as the U.S. economy continues to operate far below its potential capacity.

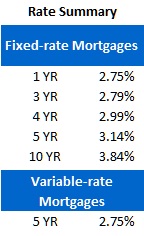

Five-year Government of Canada (GoC) bond yields finished 2 basis points higher for the week, closing at 1.50% on Friday. Fixed-rate mortgage specials are now back with a vengeance, with four- and five-year fixed rates available at 2.99%, and ten-year rates for as little as 3.84%. As I have written many times, there are some very important differences in the terms and conditions attached to the various specials on offer, so be sure you understand the fine print before you sign on the dotted line. Remember William Shakespeare’s words of caution : “All that glisters is not gold.”

The Bank of Canada (BoC) met last week and while it left the overnight rate unchanged (this is the rate on which variable rates are based), the Bank’s accompanying comments were more hawkish than they have been for some time. Specifically, the BoC believes that globally uncertainty has decreased, that Canada’s economic outlook has “marginally improved”, and that our inflation rates are firming. Bond futures traders who had until recently been betting on a BoC rate decrease are now pricing in the small chance of a BoC rate increase by the end of 2012. Until our employment and GDP rates perk up, my money is still on variable rates staying lower for longer.

The bottom line: Today we seem to have a wider-than-normal range of opinions about where interest rates may be headed in the future. While most borrowers are now opting for fixed instead of variable rates (because the gap between them is so small), there is growing debate over whether the five- or ten-year fixed rate is the better way to borrow. To help you weigh that decision, check out my post of last Wednesday which compares the five- and ten-year rates using different interest-rate simulations.

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave

March 12, 2012

Mortgage |