David Larock in Mortgages and Finance, Home Buying, Toronto Real Estate News

When the European Central Bank (ECB) injected more than US$1 trillion in cheap, three-year loans into troubled euro-zone countries using its Long-Term Refinancing Operation (LTRO), investors breathed a sigh of relief. It was widely believed that these loans would buy the euro zone more time – a year at least.

When the European Central Bank (ECB) injected more than US$1 trillion in cheap, three-year loans into troubled euro-zone countries using its Long-Term Refinancing Operation (LTRO), investors breathed a sigh of relief. It was widely believed that these loans would buy the euro zone more time – a year at least.

The plan was to let troubled banks use their existing bonds (even those of “questionable quality”) as collateral for three-year loans at 1%. The hope was that domestic banks would use this money to buy up their government’s sovereign debt in countries like Italy and Spain, bringing their respective bond yields back to sustainable levels.

There’s a bit of genius in the way the LTRO was designed. The framers knew that the most troubled banks and countries would lean on these emergency ECB loans the hardest, and the more sovereign debt could be shifted out of foreign hands and back onto the balance sheets of each struggling country’s domestic banks, the more contained the risk of contagion would become (at least in a relative sense).

The LTRO was arguably the best of the bad options that remained for the ECB, which knows that both struggling Italy and reeling Spain are too big to save, and too big to let fail.

The plan appeared to work in the beginning. Italian ten-year bond yields went from 7% to less than 5% and Spanish ten-year bond yields from 6.5% to less than 5%. But both countries have large debt refinancing requirements this year and must keep retesting the market with new bond issues. In Spain’s case, nervous investors have already pushed the ten-year yield on Spanish bonds back to 5.98% as of last Friday. Only two short months after round two of the LTRO emergency loan program, Spanish bond yields have already returned to unsustainable territory (Italy seems less of a concern these days.)

It’s hard to blame investors who may at some point (and perhaps sooner than we think) decide that they don’t want Spanish debt at any price.

Consider that:

- Spain backed up the trucks during round two of the LTRO and borrowed almost 40% of the entire emergency debt issued by the ECB during that round.

- Spanish unemployment is now at 23% (youth unemployment is above 50%), and the country is mired in a recession that threatens to be deep and long lasting.

- Many Spanish banks are underwater and it is believed that the government’s debt-to-GDP ratio is well above the officially reported 60% level when federal guarantees of local-government debts are factored in (John Mauldin estimates the number to be closer to 90%).

When you throw in a massive housing bubble, new government regulations designed to staunch the flow of cash to banks outside the country and an increase in violent protests, doesn’t this start to look like Greece 2.0 minus the ouzo?

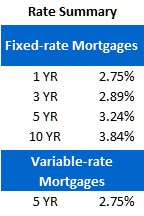

Five-year Government of Canada (GoC) bond yields fell twelve basis points last week as fear once again trumped greed as the market’s main driver of momentum. Demand for the safety of GoC bonds pushed our yields down to 1.52% on Friday, and five-year fixed-mortgage rates are now clustered in the 3.29% range. Most lenders are still taking a breather from their three- and four-year fixed-rate promotions, but if our bond yields stay in the 1.50% range, lower five-year fixed rates are possible.

Variable-rate mortgage holders were made nervous last week by comments from Bank of Canada (BoC) Governor Mark Carney. He said that the BoC might raise short-term rates as an emergency measure to slow consumer borrowing and fight housing-bubble risks. While it seems unlikely that the BoC will do this (it seems more likely that OSFI, our federal bank regulator, will try to tighten lending practices instead), even the possibility that the BoC would take this emergency step reinforces my belief that variable-rate mortgages aren’t worth the risk at current prices. When you can enjoy the stability of an ultra-low fixed rate for a very small premium over the equivalent variable rate, locking in makes sense.

The bottom line: There is a growing risk that Spain will take the euro zone crisis to a new level and that fear will further increase demand for the safety of our GoC bonds. As I have written many times before in this space, unless we experience a severe systemic shock that rocks financial markets everywhere, heightened euro-zone fears should help keep our mortgage rates low for the foreseeable future.

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave