David Larock in Mortgages and Finance, Home Buying, Toronto Real Estate News

Last week was an interesting one for anyone keeping an eye on Canadian mortgage rates.

Last week was an interesting one for anyone keeping an eye on Canadian mortgage rates.

The Bank of Canada (BoC) left its overnight rate unchanged on Tuesday, which was good news for variable-rate mortgage borrowers, but BoC Governor Mark Carney also indicated that the Bank may raise the overnight rate (on which variable-rate mortgages are based) sooner than previously expected. Bond-market investors jumped on this news and five-year Government of Canada (GoC) bond yields immediately surged higher in response.

When I read his comments, I couldn’t help but wonder whether Mr. Carney might not be trying to talk the market up, knowing full well that his comments would push longer-term fixed-rate bond yields (and by association, fixed-mortgage rates) higher, as investors priced in expected future rate increases.

Then the BoC issued its latest Monetary Policy Report on Wednesday, which gives readers the BoC’s view of the world and more importantly, tells us what the Bank is worried about. I read this report with great interest and was surprised at some of the conclusions it draws.

The BoC now seems to have a decidedly sunnier view of the world than most of the experts I read, predicting that our economy will return to full capacity in the first half of 2013, that the euro area’s recession will end in the third quarter of this year, and that the U.S. recovery is being underpinned with solid momentum [Insert image of U.S. Fed Chairman Ben Bernanke coughing loudly in the background].

While the report’s optimistic tone was certainly tempered with a lot of caveats about “elevated risks” and about how future interest-rate policy decisions would be “weighed carefully” against both domestic and global developments, it offered a view of the future that I frankly (and humbly) do not share.

With that on the record, let’s go back to Governor Carney’s warning that short-term rates might be increased sooner than previously expected. His comments were consistent with the report, but I still wondered whether he and the BoC might have had more than one reason for using that moment to excite the market with the prospect of higher rates.

Case in point: Governor Carney has been warning about the growing risk of rising household debt levels for some time and has publicly implored the government to take further action to protect our economy from a debt bubble. He has long argued that more regulation and tougher underwriting standards are the appropriate policy responses, as opposed to raising short-term interest rates, which our broader economy still needs in the face of so much global economic uncertainty.

If Mr. Carney’s comments push longer-term fixed rates higher without his actually having to raise the BoC’s overnight rate, the Governor will have raised the cost of five-year fixed-rate mortgages (by far the most popular among borrowers) without putting undue strain on private sector businesses, which often rely on shorter-term financing and which Mr. Carney hopes will continue borrowing to invest in long-needed productivity improvements.

But after three rounds of changes to the Canada Mortgage and Housing Corporation’s (CMHC) rules for borrowers who have less than 20% equity in their homes, federal finance minister Jim Flaherty is reluctant to keep going back to the well. All three sets of his changes reigned in the riskiest elements of CMHC’s portfolio without unduly affecting the housing market – not an easy balancing act to pull off. Mr Flaherty, who unlike Governor Carney has to run for re-election, appears loathe to tempt his political fate for a fourth time.

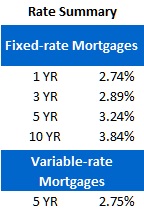

Five-year Government of Canada bond yields finished 13 basis points higher for the week, closing at 1.64% on Friday. It will be interesting to see how the market weighs Mr. Carney’s comments against the next wave of bad news out of the euro zone and the U.S. – which I think will be forthcoming. A few lenders raised their five-year fixed rates mid-week, but this felt like a pre-emptive move in anticipation of even higher bond yields that ultimately did not materialize. Market rates for five-year fixed-rate mortgages are still in the 3.29% range and the best ten-year fixed rates are still holding firm at 3.84%, despite last week’s action.

Variable-rate mortgage holders haven’t had their courage tested for a long time but Governor Carney’s comments brought the possibility of variable-rate increases at least within view on the horizon. I believe that current variable rates are still priced too close to comparable fixed rates to be compelling. But despite the (arguably) increased risk of future rate increases, I think existing variable-rate mortgage holders with discounts of prime minus .70% or better who have a significant amount time left on their mortgages are still well positioned.

The bottom line: Governor Carney has admitted that raising short-term rates to slow household borrowing would be the very last line of defence, but he is now warning that he will do what he must to address the issue if the government will not act quickly enough. I think last week’s press conference was a shot across the bow of the federal finance minister, and I can almost hear Mr. Carney saying: “You [Mr. Flaherty] have better tools to address our rising household debt levels but I will use the more blunt instruments at my disposal if you leave me no other choice”. This issue is coming to a head and the margin of error for all of our decision makers grows smaller by the day.

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave