David Larock in Mortgages and Finance, Home Buying, Toronto Real Estate News

The global economic recovery is on a very tenuous footing. While determined optimists can string together enough positive threads in the latest economic data to make an argument that the downturn is bottoming out, the realist in me isn’t biting. Encouraging signs aside, the world’s largest economies are still far too vulnerable to withstand the next major setback, which could seemingly come from almost anywhere but will most probably originate in Spain, the fourth largest economy in Europe and the twelfth largest in the world.

In fact, I now believe that some kind of Spanish debt default is all but inevitable.

When the European Central Bank (ECB) launched its Long-Term Refinancing Operation (LTRO), which allowed euro-zone banks to pledge (and leverage up) suspect quality debt in exchange for three-year loans with a fixed 1% interest rate, it looked like Spain might have at least bought itself some time.

Its banks used those new loans to refinance their debt and to buy up Spanish government bonds (which foreign investors were only too happy to unload). The program was initially successful, driving Spanish ten-year bond yields down to less than 5% in short order but it also raised the stakes because it further tightened the interdependency between the Spanish government and its banks (most of which were already underwater thanks to non-performing mortgage and construction loans that are tied to Spain’s epic housing bubble).

In the end, Spain’s reprieve from dangerously high bond-yields has been much shorter than most were expecting, with the country’s ten-year bond yield rising all the way back to 5.88% by close of business last Friday. This is dangerously close to the 6 to 7% range which many experts believe is the zone beyond which Spain’s long-term borrowing costs become unsustainable.

Spain’s defensive response to these higher yields has been to renew more of its debt into shorter terms of anywhere from six months to two years. But this band-aid solution will only exacerbate the problem when that debt has to be refinanced in the not-too-distant future. After all, the shorter the term on the debt the sooner you need to retest the market’s confidence by rolling it over - and in the current market the less Spain has to do that the better.

As if on queue, Spain’s debt rating was cut two notches by S&P last week to BBB+ at the same time that its foreign minister called the current situation “a crisis of huge proportions”. It is now widely believed that the Spanish government will have to bail out its banks and the timing couldn’t be worse because it is in no position to do so. We now seem to be speeding toward that “bang moment” when bond market investors don’t want to buy Spanish debt at any price.

Only another bailout by the European Financial Stability Facility or the European Stability Mechanism will buy more time and by that point both emergency funding vehicles will be “all in”, with no dry powder left for Italy, a country which may need its own bailout funds before the dust from the current crisis settles.

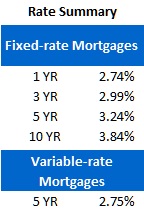

Five-year Government of Canada bond yields finished four basis points higher after what was a fairly volatile week, closing at 1.68% on Friday. If yields continue to rise, I expect lenders to raise their five-year fixed rates but for the time being this perennially popular (and over-rated) term can still be found in the 3.24% range.

Side note: There has been a lot of recent commentary about the potential impact of changes to CMHC’s default insurance program and to the imminent tightening of the underwriting policy guidelines used by OSFI, Canada’s banking regulator. I will discuss those in my Quarterly Mortgage Market Update (which will be posted this Wednesday).

Variable-rate mortgages still don’t come with the kind of discounts that warrant their inherent risk, in my opinion, but there are some encouraging signs on that front. For the past several months it has seemed as if lenders just didn’t want variable-rate business because they would quickly raise their rates if applications for variable-rate loans started to trickle in. But some lenders have recently started to improve their discounts and while their offered rates are still hovering too close to prime, we may be witnessing the early stages of a trend toward more compelling discounts.

The bottom line: Only the Germans appear to have the capacity to pull Spain (and the euro zone) back from the brink but they have been increasingly vocal in their opposition to the kind of quantitative easing it would take to do this and they may be less afraid of contagion risks now that the LTRO has shifted a large portion of Spain’s government debt (and the sovereign debt of the euro zone’s other struggling economies) out of foreign hands and back on to the balance sheets of each country’s domestic banks.

Euro-zone fear continues to fuel demand for the relative safety of GoC bonds, driving down their yields and, by association, our mortgage rates. Last week’s developments lead me to believe that there will be plenty more of that fear to go around for the foreseeable future.

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave