David Larock in Mortgages and Finance, Home Buying, Toronto Real Estate News

Statistics Canada released its latest employment report last Friday, and the data were a welcome surprise. The Canadian economy created 82,300 new jobs in March, smashing analyst expectations. The gains were broad-based, most were for full-time positions, and there were increases in both hours worked and average earnings. The data also showed our unemployment rate dropping from 7.4% to 7.2%, despite the fact that 52,500 more people started looking for work.

Statistics Canada released its latest employment report last Friday, and the data were a welcome surprise. The Canadian economy created 82,300 new jobs in March, smashing analyst expectations. The gains were broad-based, most were for full-time positions, and there were increases in both hours worked and average earnings. The data also showed our unemployment rate dropping from 7.4% to 7.2%, despite the fact that 52,500 more people started looking for work.

While the report was very encouraging, one month does not a trend make. Reactions to the March report should be tempered by a look in the rear-view mirror, which shows more net new jobs in March than were created in the previous ten months combined. With that in mind, maybe we should keep the champagne on ice for at least a month or two more.

The bond market seems to agree with this assessment because so far, reaction to this unexpected bump in the job numbers has been muted. Our five-year Government of Canada (GoC)bond yields were up a little on Friday and down yesterday to start the week. Perhaps the latest U.S. jobs data, which was also released last Friday, gave investors pause.

The latest U.S. employment data disappointed, showing only 120,000 new jobs created in March. This was below the 150,000 new jobs the U.S. needs each month just to keep pace with its population growth and was well below the consensus estimate of 200,000 new jobs the market was expecting. While the employment data from recent prior months were helped by warm winter weather, this time the weather effect may have worked in reverse (meaning seasonal jobs that would normally start in March, like construction, were brought forward into January and February because of warmer-than-normal weather).

The string of positive U.S. employment releases was fun while it lasted but the March report reminded investors that it will still be many years before the U.S. economy comes close to full employment. In fact, less than half of the U.S. jobs lost during the Great Recession have been recovered thus far and the powerful headwinds already acting against U.S. job growth will only strengthen as government stimulus is withdrawn and the U.S. public sector continues to shrink (public sector jobs were down 1,000 overall in the March report).

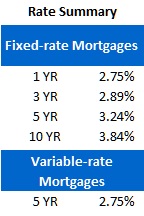

Five-year GoC bond yields finished 7 basis points higher last Friday to close the week at 1.64%. The market rate for a five-year fixed-rate mortgage is around 3.29% but borrowers who shop around can do better. Despite the recent run-up in fixed-mortgage rates, my best ten-year fixed rate is still available at 3.84%, which is a mere .55% above the five-year fixed rate. The cost of adopting a defensive rate strategy has never been lower.

Variable-rate mortgage borrowers saw the Bank of Canada increase its qualification rate from 5.24% to 5.44% on Sunday. This makes it a little harder to qualify for a variable-rate mortgage, which would be a bigger deal if variable rates were remotely worth the risk (which they aren’t, in my opinion, based on today’s rates).

The bottom line: The latest Canadian employment data gave us some much needed good news on the jobs front, but it isn’t likely to act as a catalyst for higher bond yields and mortgage rates. Weak data from the U.S., continued uncertainty in Europe (we managed to go a whole post without mentioning Spain!), and rising tensions in the Middle East should continue to keep investor animal spirits in check for the foreseeable future.

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave