David Larock in Mortgages and Finance, Home Buying, Toronto Real Estate News

Bank of Canada (BoC) Governor Mark Carney has made it clear that he wants to raise interest rates but the economic data are not co-operating.

We saw the latest example on Friday of last week when Statistics Canada released its July Consumer Price Index (CPI) which showed price inflation of only 1.3% over the most recent twelve months. That was lower than the BoC’s 1.6% forecast for the month and remains well below the Bank’s target inflation rate of 2%.

Interestingly, in the latest Bank of Canada Review, published last Wednesday, there is an essay titled “Measurement Bias in the Canadian Consumer Price Index: An Update” which concludes that the CPI probably overstates our inflation by about .5%. Thus, one could argue that our real rate of inflation is now below 1%.

So while Governor Carney continues to try to reign in borrowers with warnings about higher rates, his words continue to ring hollow with many informed observers.

Here are five factors that are contributing to the consensus view that rates aren’t going anywhere until at least 2013:

- Our economy isn’t growing very fast. In the second quarter of 2012 our GDP grew by 1.8% (versus the BoC’s forecast of 2.5%) and the momentum arrow for our third quarter GDP is still pointing downwards. Things don’t look any better elsewhere either, which the BoC acknowledged when it recently lowered its GDP growth projections for the U.S., China, the euro zone, Japan and for the global economy as a whole.

- Consumer spending has fueled a substantial portion of our GDP growth throughout this drawn-out economic recovery. While it’s good news that consumers have been borrowing less lately, that also means they will be spending less and this will slow our economic momentum further.

- Our unemployment rate is still north of 7% and while our employment reports haven’t been all bad, the overall trends show inconsistent job growth, average income growth that is barely keeping pace with inflation, and very little change in average hours worked. That is why It doesn’t look to me as though our economy is going to return to full capacity any time soon, despite Governor Carney’s predictions.

- Currency traders might be drinking Mr. Carney’s Kool Aid because his talk of higher rates appears to be contributing to the rise in the Loonie which now trades at a premiu m to the Greenback. It is somewhat ironic that the prospect of higher interest rates strengthens the Canadian dollar because a higher dollar raises the cost of our exports and acts as a drag on our economic growth, which then makes the prospect of higher interest rates incrementally less likely. Economic forces are often self-correcting.

- The U.S Fed has said that it will keep its policy rate at 0% until at least mid-2013 while the BoC’s comparable overnight rate is currently set at 1%. Governor Carney has repeatedly argued that Canadian monetary policy can operate somewhat independently of U.S. monetary policy, but most experts believe that our independence is more limited. If the gap between our respective policy rates widens further, so too will the difference in our exchange rate. As mentioned in the bullet above, an appreciating Canadian dollar acts as a powerful drag on our economic momentum (particularly in already hard hit Ontario and Quebec) and that magnifies the potential impact of any BoC rate increase. As such, I think that any rate increase in the current environment would risk too much harm to our fragile economic momentum.

Against this economic backdrop, it continues to feel as though Governor Carney is warning us about gettin

g a sunburn in the middle of a rain storm. Given that, I think his actions will continue to contradict his words.

Government of Canada (GoC) five-year bond yields were 14 basis points higher for the week, closing at 1.50% on Friday. Several lenders raised their rates last week and market five-year fixed rates are now back above 3%.

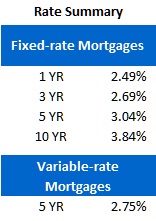

Borrowers considering a variable-rate mortgage still don’t have much of a margin of safety with five-year variabl

e rates (2.75%) priced so close to five-year fixed-rates (3.04%). That’s why I continue to believe that anyone looking to the short end of the interest-rate curve for some interest-cost savings would be better served to consider a one-year fixed rate (2.49%) as an alternative.

The Bottom Line: While most macro-economic indicators imply that interest rates will stay low for the foreseeable future, there is no denying that the current momentum in GoC bond yields could push fixed-mortgage rates somewhat higher over the short-term. If you are in the market for a mortgage, it would be wise to lock in a pre-approval rate now in case the current trend continues.

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave