David Larock in Mortgages and Finance, Home Buying, Toronto Real Estate News

The week ahead will be an important one for anyone keeping an eye on mortgage

rates because the world may look a lot different by close of business this

Friday.

There are several important economic data releases scheduled throughout the

week, including second quarter GDP results for the U.S. (Wednesday) and Canada

(Friday), Canada’s employment report for June (Thursday), the release of the

latest U.S. Beige Book (Wednesday) as well as a slew of other U.S. indices

updates. But the real action will be in Jackson Hole, Wyoming, where the Federal

Reserve Bank of Kansas City is hosting central bankers from around the world at

its annual Economic Symposium.

Jackson Hole was where U.S. Federal Reserve Chairman Ben Bernanke outlined the

U.S. Fed’s plans for its second round of quantitative

easing in 2010 and for Operation

Twist in 2011. As such, investors are expecting Chairman Bernanke to hint at

significant new stimulus measures when he steps to the podium this Friday at his

scheduled post-meeting press conference.

Here are the topics that the experts I read are anticipating he might cover

(with my comments on any potential impact on Canadian mortgage rates in

italics):

- An extension of the Fed’s guarantee to hold its policy rate at 0% out to

2015.

Bank of Canada (BoC) Governor Mark Carney has long argued that Canadian

monetary policy can operate independently of U.S. monetary policy but this is

true only within narrowly defined boundaries. An extension of the U.S. Fed’s

near-zero percent policy-rate guarantee into 2015 should put to rest any talk of

any BoC rate hikes for the foreseeable future.

- A third round of quantitative easing (QE3), whereby the U.S. Fed effectively

prints new money and uses it to buy bonds in the open market.

If the Fed embarks on large-scale bond buying it should, in theory,

stimulate demand and investment by driving down bond yields and thus lowering

the cost of borrowing. But the impact of still lower borrowing rates will be

muted because rates have already been dirt cheap for some time and it’s hard to

imagine that any incremental lowering of borrowing costs at the margin will

stimulate a material increase in borrowing activity at this stage. Furthermore,

since most of the new money that was created during QE1 and QE2 has yet to start

circulating in the U.S. economy, injecting even more liquidity at this stage has

been likened to pushing on a string.

The only predictable outcome from QE3 is a further weakening of the U.S.

dollar, which while good for U.S. exports in the short term is really a

beggar-thy-neighbour policy that might well trigger another round of currency

wars. Given the relative strength of the Canadian dollar and the BoC’s decision

not to embark on quantitative easing, QE3 would in all likelihood further

strengthen the Canadian dollar. A stronger Canadian dollar would have a

dampening effect on our economic growth and as such, would reduce the likelihood

of BoC rate increases for the foreseeable future.

- The launch of a Funding

for Lending Scheme (FLS) similar to the one recently announced by the Bank

of England.

Under this program, the U.S. Fed would offer a lower cost-of-funds rate

to banks that increase the size of their loan books while charging a higher

cost-of-funds rate to banks that lend incrementally less.

This pay-to-play format would alarm those who are skeptical of any

government policy that attempts to actively direct market forces. Would an

incentive to lend (and a disincentive, or tax, for not lending) lead to a raft

of bad loans and/or sow the seeds of another credit bubble? Would the new loans

reach businesses and consumers who really need them, or would lenders just

further line the pockets of their well-heeled clients to avoid falling afoul of

the program? And most importantly, in a country awash in too much debt, won’t

stimulating the demand for more of it just prolong the painful and necessary

deleveraging process that is still inevitable?

I do not think a FLS program would prove effective over the long term

(although the immediate market reaction might be positive) and as such, I don’t

think the knock-on effects for Canadian mortgage rates would be significant.

- A deeper commitment to Operation Twist, whereby the U.S. Fed sells

short-term treasuries and simultaneously buys longer-term treasuries.

Operation Twist is designed to lower longer-term borrowing costs. While

it should also in theory raise shorter-term borrowing costs (which ‘twists’ the

shape of the yield curve) the actual impact on short-term yields has been

minimal because the Fed’s commitment to keep its policy rate lower for longer

has kept shorter-term U.S. treasury yields low regardless.

It was hoped that Operation Twist would stimulate demand for consumer

purchases of houses and cars, but the effect of the first two Twist rounds has

thus far been muted. Most economists remain skeptical about the impact of a

deeper commitment to the program and for that reason, I think this type of

initiative would have a minimal impact on Canadian bond yields (and by

association, our mortgage rates).

- A reduction in the interest rate paid by the Federal Reserve for excess

reserves being held on bank balance sheets.

This would increase the opportunity cost for U.S. banks that are holding

excess cash on their balance sheets and marginally lower the U.S. Treasury’s

interest cost. A lower return for these reserves may incent banks to redeploy

their excess reserves in the form of new loans but the real impact is expected

to be minimal in an environment where the preservation of capital is still of

greater concern than the return on capital. Given that, I think an announcement

that the U.S. Fed is reducing the interest rate it pays to banks on excess

reserves would have very little effect on bond yields and mortgage rates north

of the 49th parallel.

There is also speculation that European Central Bank (ECB) President Mario

Draghi may make a significant announcement at Jackson Hole when he gives a

speech about the future of the euro zone. One theory is that he will outline a

plan to cap Spanish and Italian sovereign bond yields, but it is hard for me to

imagine how the ECB would formally broach this topic before Germany’s

constitutional court rules on the legality of its participation in the European

Stability Mechanism (ESM) on September 12th. (The ESM is the permanent bailout

fund designed to replace the European Financial Stability Facility.)

We’ll find out soon enough.

Five-year GoC bond yields were down 9 basis points for the week, closing at

Five-year GoC bond yields were down 9 basis points for the week, closing at

1.41% on Friday. Despite this, both RBC and TD raised their five-year

fixed-mortgage rates in an attempt to lead the market higher. It will be

interesting to see if other lenders follow suit, especially with the GoC

five-year yields now headed in the other direction. Market five-year

fixed-mortgage rates remain in the 3% range while sub-3% rates are still

available to high-ratio borrowers who know where to look.

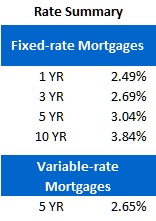

Variable-rate borrowers can now access rates in the prime minus .35% range

(2.65% using today’s prime rate) but I still believe that one-year fixed rates

at 2.49% present a more attractive option to anyone looking to save money at the

short end of the yield curve.

The bottom line: I expect investors to be disappointed when U.S. Fed

Chairman Bernanke gives his press conference this Friday. The reason the U.S.

Fed is looking for creative solutions to aid the slumping U.S. economy is that

it used up all of its heavy artillery long ago. While we may well see a

short-term increase in GoC bond yields as investors shift out of bonds and into

equities in anticipation of a post-announcement stock-market rally, I expect any

effect on our yields (and by association, our mortgage rates) to be transitory.

Side note: If you’re in the market for a mortgage, check out my blog post

from last week called How

to Build Your Mortgage Bunker (while you still can…) for a helpful tip that

will enhance your mortgage’s flexibility at no cost. Then, check back this

Wednesday for a second recommended tweak.

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave

August 27, 2012

Mortgage |