David Larock in Mortgages and Finance, Home Buying, Toronto Real Estate News

It was a strange week for Government of Canada (GoC) bond yields (on which our fixed-mortgage rates are based).

It was a strange week for Government of Canada (GoC) bond yields (on which our fixed-mortgage rates are based).

We began the week with most of the world’s advanced economies in the midst of a market rally that was inspired by European Central Bank (ECB) President Mario Draghi’s best John Wayne impersonation on July 26th in London, when he confidently stated that the ECB would do whatever it takes to save the euro and “believe me, it will be enough”.

I was initially skeptical about how those words would translate into action and expressed concern that the ensuing tide of investor optimism would quickly turn if Mr. Draghi did not follow through with some definitive action when the ECB met last Thursday. Then, after the meeting at the most highly anticipated ECB press conference since the financial crisis began, just as I feared, Mr. Draghi stepped up to the podium and laid a big, fat egg.

When forced to translate his tough talk into action, the ECB President basically said that the ECB might agree to support sovereign bonds from imperiled euro-zone countries but only if they apply through existing bailout mechanisms (like the EFSF and the ESM) and only if existing (glacially slow) procedures are followed. In classic bureaucratic euro-speak, Mr. Draghi’s key statement was that “we will design appropriate modalities over coming weeks.”

Lest there be any remaining doubt about bold new ECB plans, Mr. Draghi went further by reminding those in attendance that the ECB cannot purchase sovereign bonds directly and he ruled out more extreme measures like granting the ESM a banking license. The ECB President also brushed off the market rally that followed the comments he made in London by saying that he cannot be held responsible for the actions of market speculators.

Talk about an anti-climax.

What Mr. Draghi really said was that the ECB has no new magic bullets. There were some tweaks to existing policies, but while material, they were nothing close to the new bazookas that investors had been fantasizing about. What we really got was just more confirmation that the ECB still has a very limited set of options for counteracting the depth and breadth of the euro zone’s financial crisis.

The perplexing part was that after an initially negative market reaction drove Italian and Spanish bond yields sharply higher, both yields fell right back down again on Friday. At the same time, instead of clamouring for the safety of Canadian bonds as they usually do in such circumstances, investors sold off GoC bonds and pushed our five-year yield eight basis points higher on Friday.

Given Mr. Draghi’s proverbial egg laying, why didn’t investors run for cover? I can think of three possible reasons:

- The U.S. jobs report came in higher than expected on Friday at 163,000 and world markets rallied on the news. While the report was a welcome surprise, the details in the report showed that hours worked were flat, average earnings barely moved (+.1%), and while the headline number came in higher than expected it was still nowhere close to what we should be seeing in the third year of a typical U.S. economic recovery. As such, any rally based on the headline number in that report should be short lived.

- Large-scale investors who were shorting European assets were suitably spooked by Mr. Draghi’s initial comments and were still selling safe assets (like GoC bonds) and using those funds to cover their European short positions. If this is the reason, the short-term negative impact on GoC bonds will be temporary.

- There is a sub-group of investors who know something the rest of us don’t. This is always a possibility, but I’m having a hard time imagining what they could know that would make the picture of the euro zone look materially different.

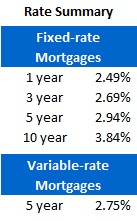

Five-year GoC bond yields were flat for the week, despite significant volatility. After drifting down nine basis points from Monday to Thursday, the five-year yield snapped all the way back on Friday to finish where it started at 1.34%. Five-year fixed-mortgage rates are holding at about 3%, with sub-3% rates still on offer for well qualified borrowers who know where to look.

Variable-mortgage rates were unchanged for the week and I continue to believe that borrowers who are attracted to the short end of the interest-rate curve are better served with one- or two-year fixed-rate options.

The bottom line: The events over the past couple of weeks have really just been a continuation of the cat-and-mouse game between euro-zone leaders and bond-market speculators. While I was surprised that GoC bond yields did not finish the week sharply lower after Mr. Draghi’s flaccid press-conference statements, I still think we’re headed in that direction. As such, barring any major new developments, I’ll be very surprised if GoC bond-yields aren’t lower by end of business this Friday.

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave