David Larock in Mortgages and Finance, Home Buying, Toronto Real Estate News

We started last week just hoping to dodge a German constitutional bullet but by

the time it was over, markets everywhere were surging after U.S. Fed Chairman

Ben Bernanke (or Ben BernanQE as he is now more cleverly known) backed his

liquidity truck up to the American low-rate punch bowl and filled it to the

rim.

On Wednesday,Germany’s constitutional court ruled that its government does in

fact have the legal authority to participate in the European Stability Mechanism

(ESM) and to join the European Union’s fiscal compact.

Whew. While investors expected a favourable ruling on both fronts, if the

court had ruled the other way, Europe’s bailout programs would have been turned

on their heads and financial markets everywhere would have descended into chaos.

Bullet dodged.

Then on Thursday, Ben Bernanke spoke the words that investors had been

waiting for, and then some.

First, he said the U.S. Fed would now embark on a third round of quantitative

easing whereby it will effectively print new money to purchase $40 billion in

mortgage-backed securities each month, while also continuing Operation Twist

until the end of the year. (Reminder: Operation Twist is a Fed program that

sells short-term Treasuries and uses the proceeds to buy long-term Treasuries in

an effort to drive down long-term borrowing costs). In total, the Fed will

purchase $85 billion worth of assets each month for the remainder of this

year.

Second, just to make sure that the animal spirits of investors would be

sufficiently whipped up, Mr. Bernanke also extended the Fed’s timeline for

raising its near 0% policy rate from late 2014 to mid-2015.

Here were the key points made by the experts I read following the Fed

announcement:

- The Fed’s commitment to buy $40 billion/month in mortgage-backed securities

was open-ended, which means there is no timetable or limit on the potential size

of QE3. Mr. Bernanke made it clear that the Fed would leave its economic

stimulus programs in place “for a considerable time after economic activity

strengthens.” This carefully worded phrase was designed to reassure Americans in

the midst of building personal or business budgets that cheap rates will be

around for the foreseeable future. To anyone reading between the lines, it also

means that the Fed expects the U.S.economy to continue to struggle in the years

ahead. - The Fed has a dual mandate – to promote price stability and to help the

economy reach full employment. Mr. Bernanke emphasized that it will take a

“substantial” improvement in the employment situation before the Fed will change

course, even at the expense of higher inflation.

But in spite of the Fed’s willingness to fight until it fires its last

bullet, will these initiatives work as intended? I have my doubts. Here’s

why:

- QE3 injects more liquidity into the U.S.economy but U.S.banks are already

holding nearly $1.5 trillion in reserves and U.S. businesses currently have

about $2 trillion in cash on their balance sheets. The U.S. economy doesn’t have

a liquidity problem. It has a demand and growth problem because people don’t

want to borrow to spend anymore. Printing money in that environment has about as

much impact as pushing on a string. - The Fed is hoping that QE3 will stimulate job creation but there is very

little evidence that the former will cause the latter. Some experts argue that

the rise in U.S. unemployment was not caused by cyclical changes in the economy

but was instead triggered by structural changes in the economy that created a

mismatch between skills and jobs (which would be more permanent in nature). If

that is true, this type of stimulus won’t have much impact. - More quantitative easing is actually a double whammy for U.S. consumers

because it drives up commodity prices (like food and fuel) and drives down the

U.S. dollar (making all imports more expensive). If U.S. consumers have to spend

more on basic necessities they will have less to spend on discretionary

purchases and that reduced demand will dampen economic growth. (Remember that

U.S. consumer spending accounts for roughly 70% of total U.S. GDP.) - Cheaper borrowing rates do nothing to help the millions of U.S. homeowners

who are currently underwater and can’t refinance their mortgages no matter how

low rates go. - When investors sober up from their QE induced risk-on bender, the continuing

steady-stream of downbeat economic reports will remind them soon enough that the

U.S. economy, like so many others, has plenty of tough sledding ahead.

More to the point for my readers, what does this mean for Canadian mortgage

rates?

For fixed-rate borrowers, we may see bond yields rise over the short term as

investors shift out of safe-haven assets like GoC bonds and move to riskier

assets like equities to catch the QE3 rally wave. If the momentum is sustained

then we will see an increase in fixed-mortgage rates (since they are based on

GoC bond yields) but if past is prologue, any effects on yields will be

short-term in nature.

For variable-rate borrowers, I think today’s announcement makes it even more

difficult for Bank of Canada (BoC) Governor Mark Carney to raise the overnight

rate (on which variable-mortgage rates are based) for the foreseeable future.

The Canadian dollar is already above par and if the gap between U.S. and

Canadian interest rates widens further, the Loonie will continue to appreciate

against the Greenback. That would hammer the already struggling Ontario and

Quebec economies, which both have huge manufacturing sectors that depend heavily

on exporting to U.S. markets.

(Dave’s Populist Rant: Excess liquidity and ultra-low borrowing rates

fueled the U.S. credit crisis. While the profits ‘earned’ during the run-up were

privatized, when the credit bubble burst the losses were socialized. The ensuing

housing-market crash destroyed a huge swath of middle-class wealth and put

millions of Americans underwater on their mortgages or forced them out of house

and home altogether. The resulting low rates also reduced and in some cases

eliminated the incomes of retirees who had saved diligently to provide for their

future.

Now, when the Fed uses quantitative easing (money printing by another

name) to push borrowing rates to even lower levels, this disproportionately

benefits the rich who can still qualify for mortgage financing. Wealthy

Americans are now using this almost free money to buy up foreclosed houses and

rent them back to their previous owners while earning a handsome return in the

process. Of course, with so much new demand for rental accommodation, average

U.S. rents are up 9% on a year-over-year basis. Anybody else think the Willy

Lomans of America are getting a raw deal in all of this?)

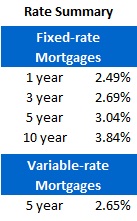

Government of Canada five-year bond yields were 6 basis points higher for the

Government of Canada five-year bond yields were 6 basis points higher for the

week, closing at 1.48% on Friday and five-year fixed rates can still be found in

the 3% range.

Variable-rate mortgages may increase in popularity now that it seems more

likely that the overnight rate will remain low for years to come. But they are

still being offered in the prime minus .35% range (2.65% using today’s prime

rate) and as such, I think a one-year fixed rate at 2.49% is a better way to

take advantage of the savings offered at the short end of the yield curve.

The bottom line: While I think any spike in GoC bond yields that is

caused by Ben Bernanke’s latest announcement will be short lived, anyone in the

market for a fixed-rate mortgage should lock in a pre-approval ASAP. Better safe

than sorry.

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave