David Larock in Mortgages and Finance, Home Buying, Toronto Real Estate News

Market bulls hoped that when U.S. Fed Chairman Ben Bernanke finally gave

investors the quantitative easing juice they had long been waiting for it would

ignite a furious equity-market rally that would reinvigorate the U.S. economy.

At the same time, investment capital was expected to flee the safety of low-risk

sovereign debt, like Government of Canada (GoC) bonds, and flow into riskier

assets as investors sought out higher yields.

That was the theory anyway. Reality has so far proven much different. Instead

of triggering the next bull market run, the ensuing rally was more of the

blink-and-you’ll-miss-it variety.

Today’s key question then is why? Here are five possible explanations:

- The market had already priced in the Fed’s next intervention. There is an

old adage that the market buys on the rumour and sells on the news and in this

case, that’s pretty much what has happened. - Many of the tailwinds that were helping the U.S. economy during QE1 and/or

QE2 have now reversed into headwinds at the outset of QE3. Specifically,

European import demand levels, Chinese growth rates, food and energy price

momentum and unseasonably mild winter weather that converted into the worst

drought conditions we have seen in fifty years are all economic forces that are

now acting against U.S. economic momentum. - U.S. stock market indices had been defying gravity and had not adjusted to

reflect the deteriorating U.S. macro-economic backdrop, primarily because all of

this rampant Fed stimulus has been distorting market fundamentals. But it looks

like a steady string of negative earnings releases have finally caught up with

investors and that has left bonds as the prettiest horses in the glue factory.

This reminds me of the famous old saw from Benjamin Graham where he says that

in the short term, the stock market acts like a voting machine but in the long

term, it acts like a weighing machine. Fed stimulus excitement aside, the

majority of bell weather U.S. public companies are coming up light on the

earnings weigh scale while also downgrading their forecasts to boot. - The U.S. Fed has made it clear that QE3 is an attempt to stimulate

employment, even at the expense of above-target inflation rates. While the Fed’s

guidance was designed to reassure companies and investors that they can count on

QE3 to continue, the unprecedented nature of this open-ended commitment raises

more questions than it answers and companies don’t hire when faced with

uncertainty. - Any future U.S. economic recovery must be underpinned by increased domestic

consumption and this isn’t going to happen while the average American is

(rightly from his/her personal point of view) trying to reduce debt. While the

Fed hopes that QE3 will eventually increase employment rates and average

incomes, this is a long-term goal. In the here-and-now, injecting more liquidity

into the U.S. economy will drive up the cost of basic commodities, like food and

fuel, and that will lower the purchasing power of the average

American.

A theory about what the U.S. Fed might really be up to. America suffers

from political gridlock at a time when urgent action is needed. While Grover

Norquist’s Tax-pledge Republicans will fight to their last bullet to prevent any

taxes increases, it’s hard to imagine how the U.S. can address its long term

funding challenges without them. While letting the higher-inflation Genie out of

the bottle is fraught with risks, if Mr. Bernanke can push inflation higher he

will give the economy much needed help in several areas, specifically, by

driving down the value of the Greenback (making U.S. exports more competitive)

and by increasing nominal government revenues while U.S. debt levels remain

fixed (making U.S. debt relatively less expensive). Higher inflation is just a

tax by any other name and given the fact that it touches almost every part of

the U.S. economy isn’t using higher inflation as a policy tool really just

another way to create the mother-of-all-consumption taxes?

To be clear, I don’t think rampant inflation is around the corner because

the excess liquidity that is created by quantitative easing has its strongest

impact on inflation when economies are operating at full capacity, not when they

have huge amounts of excess capacity (as the U.S. economy does now). But central

bankers are known for taking the long-term view and if Mr. Bernanke believes

that the current U.S. political gridlock is firmly entrenched then might he see

higher inflation as a non-political revenue solution to America’s most pressing

problem?

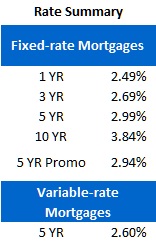

Five-year GoC Canada bond yields fell 9 basis points last week, closing at

Five-year GoC Canada bond yields fell 9 basis points last week, closing at

1.29% on Friday. Lenders continue to drop rates and as such, a market five-year

fixed-rate mortgage can readily be found at or below 3%.

My best five-year variable-rate mortgage is now available at prime minus .40%

(2.60%) which is the lowest it has been for some time. While this rate looks

tempting at first glance, Bank of Canada (BoC) Governor Mark Carney still

considers household borrowing rates to be the greatest domestic threat to our

economy. Given that, I expect him to remain staunchly opposed to lowering the

BoC’s overnight rate any further. With that in mind, I still think a diligently

managed strategy of rolling over a one-year fixed rate (my best one-year is

currently at 2.49%) will probably prove a cheaper option for anyone looking to

save on interest cost at the short end of the yield curve.

The bottom line: The post-Q3 market reaction confirms what many have

long believed - that there is no magic stimulus bullet that will turn the U.S.

economy around in short order. Instead, we are in the middle innings of a

grinding game of deleveraging. Against that backdrop, government bonds in

fiscally prudent countries like Canada will continue to be in demand and that

should continue to keep GoC bond yields, and by association our mortgage rates,

at ultra-low levels for the foreseeable future.

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave