David Larock in Mortgages and Finance, Home Buying, Toronto Real Estate News

Last week was a slow one for new economic data so in today’s Update I’m taking a

step back and offering a general overview of how the world looks from my

desk:

The U.S.

The beauty (or lack thereof) of the U.S. economic recovery is still in the

eye of each beholder. Some experts are touting the start of a jobs-led recovery

and are writing about signs of housing market recovery. Others believe that U.S.

consumers, long serving as engines of global growth, are waking from their

spending slumbers just in time for the holiday shopping season.

- I see the recent pick-up in U.S. economic activity as an inventory-building

bet by businesses on the future, and a risky one at that. - I see new jobs that are part time, which makes them transitory in nature,

and average incomes that aren’t keeping pace with inflation. - I see a housing market devoid of first-time buyers and approximately 30% of

all U.S. home owners with mortgages who are still underwater. - I see the weakest economic recovery in U.S. history, which has been

engineered by record levels of stimulus and $1 trillion+ deficits, hurtling

toward a fiscal cliff while political gridlock reigns in Washington. - I see unprecedented U.S. Fed policy that borders on financial alchemy

distorting market fundamentals and fueling past (dot com), present (real estate)

and future (student debt) asset bubbles.

In short, I think the U.S. economy is a very long way from a meaningful and

sustainable recovery and that deflation, not inflation, remains its primary risk

(rising food and fuel prices notwithstanding).

Europe

The euro-zone experiment continues to lurch from one disaster to another:

- Greece hasn’t met the terms and conditions tied to its bailout.

That shouldn’t surprise anyone who has studied history because Greece has been

in default roughly 50% of the time over the past 179 years. - Spanish Prime Minister Rajoy continues to insist that his country will not

need another bailout, something that will be true until it isn’t (see Greek

reassurances along the exact same lines two years ago).

But these sovereign default threats are mere appetizers compared to France’s

coming denouement:

- French public debt levels have just passed 90% of GDP at the same time that

the country has either entered, or is about to enter, another recession. That

debt-to-GDP level is considered by many of the experts I read to be an critical

point beyond which incremental debt acts as a significant drag on overall

economic growth. - French Prime Minster Hollande won election on an anti-austerity platform and

has stayed true to form so far – lowering the retirement age from 62 back to 60,

increasing taxes on the rich (who still have passports and are using them to

predictable effect) and generally continuing on as if his country’s finances

were well in order.

This begs the question: What happens when the second most important country

in the euro-zone experiment goes from bailor to bailee? How does a monetary

union that is fundamentally defined by a Franco-German partnership hold together

if/when France is staring default in the face? If waves upon waves of austerity

programs have turned peaceful Spanish protests into violent ones, what will

French protests look like? Will the guillotine make a comeback?

(China and its rapidly decelerating growth rates are also on my worry list

but that topic will have to wait for another day.)

Canada

Canada has fared as well as any country since the start of the Great

Recession. But this is in large part because our economic growth has been fueled

by rising consumer debt, which has now reached the point where Bank of Canada

(BoC) Governor Mark Carney is calling it the biggest single threat to our

domestic economy.

- Canada’s relatively clean federal government balance sheet has been a mixed

blessing. While demand for the safety of Government of Canada (GoC) bonds has

pushed yields down to ultra-low levels, the Loonie has appreciated against other

currencies and hurts our exporters, particularly in Ontario and Quebec. - While our federal debt and deficit levels are manageable, it’s a different

story at the provincial level. Ontario and Quebec in particular are going to

need to substantially reduce their public spending in the near future and that

will put additional strain on each province’s economic momentum. - Some regional housing markets are probably at or near their peaks and most

people believe that some sort of price correction is overdue. That said, you’ll

get lots of spirited debate about the size and scope of potential corrections.

While I’m nowhere near the ‘sky is falling’ crowd, I do think that our long-term

fundamentals are out-of-whack at the moment and that they will revert back to

the mean over time.

While a small, open economy like Canada’s will always be vulnerable to a

slowing global economic landscape we have several strong points in our favour.

Specifically:

- We have an abundant supply of four things the world cannot live without –

food, fuel, forests and fresh water. - We have a well-regulated financial sector that is widely seen as the most

stable in the world. It is not perfect by any means, but our problems (criticism

of CMHC’s emili automated valuation system the most recent example) are

relatively minor when compared to those in the U.S. and many countries in

Europe. - We are a tolerant and safe country that is attracting immigrants from around

the world in record numbers. High levels of immigration are a boon to our

economy and Canada benefits from being a very desirable place to live.

Before I get to the silver lining in all of this doom-and-gloom in The

Bottom Line below, let’s take a look at what happened with mortgage rates

late week:

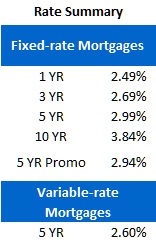

Five-year GoC bond yields were up 4 basis points for the week, closing at

1.37% on Friday. Five-year fixed-mortgage rates are available in the 3% range

and smaller lenders who offer far better contract terms and conditions than the

far better contract terms and conditions than the

Big Five are now very competitive. That’s good news for informed borrowers who

are willing to think beyond their branch.

Variable-rate mortgages are still not compelling in my opinion (my best

variable is still prime minus 0.4%, which is 2.60% using today’s prime rate). It

would probably take Mars hitting Earth for Governor Carney to lower the BoC’s

overnight rate any further, which means that variable rates come with more risk

of increasing than potential for decreasing at this point. As such, I continue

to advise borrowers who are looking to save money at the short end of the yield

curve to consider a one-year fixed rate as an alternative. (My best one-year

fixed rate is 2.49% today and I am recommending it as my Mortgage

Deal of the Week.)

The bottom line: GoC bond yields are at ultra-low levels because

investors still believe that our government bonds offer safety at a time of

great uncertainty. For many of the reasons listed above, I believe the global

uncertainty theme has plenty of room left to run, and since our mortgage rates

are priced off of GoC bond yields, that should keep them at rock-bottom levels

for the foreseeable future.

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave