David Larock in Mortgages and Finance, Home Buying, Toronto Real Estate News

Statistics Canada recently changed the way it calculates key economic data to

bring its methods into line with agreed upon international accounting standards.

As a result, the debt-to-income ratio for the average Canadian household shot up

11%, literally overnight, to 163% (a record high).

This has inspired lots of foreboding talk about how our “soaring” household

debt-to-income levels are now higher than U.S debt-to-income ratios were at the

peak of their housing bubble. That may be technically true, but it is also

totally misleading.

That’s because the standard method for calculating this ratio uses after-tax

income which isn’t a fair comparison because Canadian personal income taxes

cover health care costs and American personal income taxes don’t. (To put this

difference in perspective, according to my initial research the average American

spends anywhere from 10% to 20% of their after-tax income on health-care related

costs.)

While it has become fashionable to predict that Canada is headed for a U.S.

style housing crash, most economists still think that is unlikely and they use

plenty of data to support their position. (Here is a post I wrote last year

called How

the US Lent Its Way to a Housing Bubble and Why It Didn’t Happen Here if you

are interested in my detailed take on this question.)

To be clear, I readily agree that our household debt levels are too high and

that’s why I have consistently supported the federal government’s attempts to

reign in borrowing by changing the lending policies and regulations used by CMHC

and OSFI. But that’s a far cry from believing that our debt levels are about to

cause our houses to start spontaneously combusting. (Did I just give MacLean’s

an idea for their next apocalyptic magazine cover … or have they used that one

already?)

Before you start loading up on canned soup and fire extinguishers, consider

this sampling of recent comments from the experts I read:

- A report done by BMO economists in January 2012, first pointed out the flaw

in using after-tax income to compare Canadian and U.S. debt-to-income ratio

levels. Instead, they argued that using a debt-to-gross income ratio would

provide a better apples-to-apples comparison. Using this revised methodology,

BMO economist Sal Guatieri reported last week that Canada’s debt-to-gross income

ratio (121%) is still well below both the current (146%) and peak (166%) U.S.

levels. That presents a very different comparison from the popular one being

bandied about in much of the mainstream media. - David Rosenberg, a well-known Canadian economist, wrote last week that our

ratio of housing starts to the civilian population is “not far off the average

of the last ten years, whereas as in the U.S. back in the 2006-07 peak, that

ratio was 25% above the long-run norm.” In other words, Canada has not seen the

kind of short-term spike in speculative real-estate investing/borrowing that we

saw in the U.S. during the latter stages of their housing bubble. - Mr. Rosenberg also notes that Canadian policy makers and regulators have

been pro-active in responding to our rising household debt levels while their

U.S counterparts were basically asleep at the switch until it was too late

(hyperbole mine). - Further to that last point, Benjamin Tal, an economist with CIBC, recently

noted in this video

interview with Rob Carrick that overall Canadian household debt is now

rising at its slowest pace in ten years, while consumer debt levels are actually

falling for the first time in twenty years. That kind of momentum makes for a

trend in the right direction. - In a separate report, Tal notes that the crash in U.S. house prices was far

more extreme in cities with above average levels of sub-prime lending, where

prices corrected by an average of 40%. This is more than double the average

decline seen in U.S. cities with below average levels of subprime loans.

“Eradicate subprime from the U.S. housing market and, instead of the most severe

house price meltdown since the great depression, you get a soft landing.” By

comparison, Canadian subprime loans account for about 7% of our total mortgage

debt outstanding while U.S. subprime loans peaked at a little under 25% of their

total mortgage debt outstanding before their housing crash.

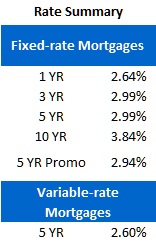

Five-year Government of Canada (GoC) bond yields fell seven basis points for

Five-year Government of Canada (GoC) bond yields fell seven basis points for

the week, closing at 1.32% on Friday, and five-year fixed rates are still

available in the 3% range. Effective November 1, all OSFI regulated lenders will

now use the Bank of Canada’s Mortgage

Qualifying Rate (MQR), which is 5.24% today, to qualify borrowers who are

applying for fixed-rate terms of less than five years. That said, those who know

where to look can still find well-established lenders who are not subject to

these new, more restrictive OSFI guidelines.

Variable-rate mortgages can still be found at discounts as low as prime minus

0.40% (which works out to 2.60% using today’s prime rate). Also effective

November 1, variable-rate borrowers who are putting down 20% or more are also

now subject to the MQR at OSFI regulated lenders. (Previously, only high-ratio

variable-rate borrowers were subject to the MQR.)

The bottom line: Like any informed observer who can see beyond his

own short-term self interest to what is best for the whole economy over the long

term, I am concerned about how ultra-low interest rates have pushed our

household debt levels to record highs. But I reject the implication that we have

driven over the debt cliff to financial ruin and are now in free fall just

waiting to hit the ground.

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave

November 5, 2012

Mortgage |