Dave Larock in Monday Interest Rate Update, Mortgages and Finance, Home Buying, Toronto Real Estate News

Editor's Note: Dave's Monday Morning Interest Rate Update appears

on Move Smartly weekly. Check back weekly for analysis that is always

ahead of the pack.

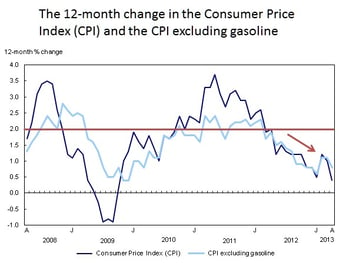

Anyone keeping an eye on Canadian mortgage rates should pay close

attention to the Consumer Price Index (CPI) which is released monthly by

Statistics Canada. The CPI tells us whether average prices have

increased or decreased over the past twelve months, and over time,

changes in the CPI influence Bank of Canada (BoC) monetary policy more

than any other economic measurement.

Before looking at the details

in the latest CPI (released last Friday), let’s highlight a few phrases

from the BoC’s oft repeated inflation-control strategy, which it

includes at the front of each Monetary Policy Report (MPR).

- At

the heart of its inflation-control strategy, the BoC believes that

“that the best way to foster confidence in the value of money and to

contribute to sustained economic growth, employment gains and improved

living standards is by keeping inflation low, stable and predictable”. - Further

to that point, the BoC’s inflation-targeting approach is symmetric,

meaning “that the Bank is equally concerned about inflation rising above

or falling below the 2 per cent target”.

As you will see in

a moment, that last phrase is critical in the current context. If the

BoC’s monetary policy actions are primarily governed by the goal of

steering inflation towards 2% over time, then current CPI trends clearly

imply that the BoC’s next move in its overnight rate should be a

decrease, rather than the increase it has repeatedly warned us about.

The latest CPI data

show that average prices rose by a paltry 0.4% over the most recent

twelve months ending in April (down from 1% in March). The largest

contributor to this drop was falling gas prices but even with the change

in gas prices stripped out, overall CPI would still only have risen by

0.8% - a far cry from t he BoC’s 2% target. As the chart by Stats Can on

he BoC’s 2% target. As the chart by Stats Can on

the

right shows, our CPI has now been below the BoC’s

target rate of 2% for

over a year and much of our supporting economic data, such as GDP

growth and unemployment rates, are more consistent with continued

disinflation and even deflation, not inflation.

In its most recent MPR the Bank of

Canada forecasted that inflation would return to its 2% target in

mid-2015 but as with so many of the BoC’s predictions of late, that one

is also now ripe for some downward revision. In fact, we seem so far

away from returning to that target rate that I think it’s time to

suggest that the BoC may need to give us a little help to get back

there.

As unlikely as it may sound to Canadians who have grown

accustomed to former BoC Governor Carney’s warnings about imminent rate

increases, at some point the BoC may have no choice but to lower its

overnight rate. Our economy is dangerously close to stall speed and if

you want a look at just how far central bankers are willing to go to

stave off the threat of deflation and/or recession, look no further than

U.S. Fed Chairman Ben Bernanke and his ever-whirring printing presses. A

little drop in our overnight rate hardly seems radical by comparison.

The

BoC’s main reason for not dropping rates has long been our record

household debt levels, which it has called “the biggest threat to our

domestic economy”. But the increase in our household borrowing rates has

slowed dramatically of late and as strange is it may sound, there may

come a day when lowering rates in an attempt to stimulate a little more

household borrowing will seem like a price worth paying if it keeps our

economy afloat.

To be clear, I don’t believe that a rate cut is

imminent and my best guess is that rates aren’t likely to go up or down

significantly for the foreseeable future. In fact, even if the data

continue to indicate that the BoC should cut its overnight rate, the

Bank may still question whether a marginal decrease would have any

material impact on consumer spending in our already well-entrenched,

ultra-low rate environment. But if we’re going by the BoC’s official

inflation-control strategy, I think the recent data continue to lend

support to the rate-decrease option.

Government of Canada (GoC)

five-year bond yields were two basis points higher for the week, closing

at 1.36% on Friday. Not all lenders have raised rates in response to

the recent bond-yield run up and as such, five-year fixed rates are

still available in the sub-3% range.

Five-year variable-rate

mortgages are available in the prime minus 0.45% range, which works out

to 2.55% using today’s prime rate.

The Bottom Line: The

latest CPI from Statistics Canada shows that average prices have barely

risen over the most recent twelve months. These data bolster my

long-held belief that fixed- and variable-mortgage rates aren’t likely

to rise for the foreseeable future and lends support to the argument, at

least in theory, that the BoC’s next change to its overnight rate is

still most likely to be a decrease.

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave