Dave Larock in Monday Interest Rate Update, Mortgages and Finance, Home Buying, Toronto Real Estate News

Editor's Note: Dave's Monday Morning Interest Rate Update appears

on Move Smartly weekly. Check back weekly for analysis that is always

ahead of the pack.

Last week borrowers saw five-year fixed-mortgage rates rise, and then

rise again, ending the era of sub-3% five-year fixed rates ... at least

for the time being.

Lenders raised their rates in reaction to

surging Government of Canada (GoC) five-year bond yields, which have now

increased by 66 basis points over the last seven weeks.

As a

first step toward understanding what all this means for our mortgage

rates over the short and medium term, let’s start by taking a look at

how we got to this point.

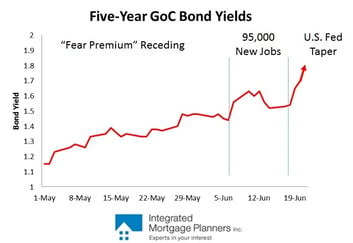

The run-up in five-year GoC bond yields

has occurred in three distinct phases which were fueled by separate but

mutually reinforcing factors:

- A

reduction in the “fear premium” that investors were willing to pay for

the safety of GoC bonds. During this phase, from May 1, 2013 to June 6,

2013, the GoC five-year bond yield rose from 1.15% to 1.44%. In a post,

written three weeks ago, I predicted that renewed fears of tail-risk

events, like more euro-zone instability and/or a Japanese bond-market

shock, would eventually re-inflate this premium.

- A

near-record spike in the Canadian employment data showed 95,000 new

jobs created in the month of May. This report was released by Statistics

Canada on June 7, 2013 and bond yields surged 19 basis points over the

next two trading days. In a post,

written two weeks ago, I predicted that any impact from our May

employment report would be minimal and highlighted several concerns with

the details in the report that were obscured by the banner headline.

Interestingly, bond yields fell back 9 basis points and were in retreat

until … - An announcement last Wednesday by the U.S. Federal

Reserve that later this year it would begin tapering its massive $85

billion per month program to purchase U.S. treasuries and

mortgage-backed securities. The Fed also outlined a more optimistic

economic forecast in support of this plan.

While the first

two factors weren’t enough to change my long-held view that five-year

fixed rates would not materially rise for the foreseeable future, the

U.S. Fed’s latest announcement is a potential game changer. We live in

strange times where the role of central banks has shifted from

influencing markets with an invisible hand to being an active, direct

and leading, market participant. As such, when the Fed softens its

open-ended commitment to be the marginal, and largest, buyer of U.S.

Treasuries, you can bet that U.S. Treasury yields will rise in the

aftermath. Against this back drop, higher Canadian fixed-mortgage rates

are inevitable because GoC bond yields have had a 98% correlation with

U.S. Treasury yields over the past five years (thanks to BMO economist

Doug Porter for that statistic).

But will the U.S. Fed follow

through and taper its quantitative easing programs within the timetable

it now prescribes? The Fed carefully qualified its schedule with caveats

about the economy, jobs, and (implicitly) equity markets, performing as

expected. As such, if equity markets continue to weaken, and/or

business investment and employment growth slow, these developments could

easily cause the Fed to delay its tapering plans. This is a very

realistic possibility. The experts I read have long said that starting

quantitative easing (QE) is as easy as squeezing toothpaste from a tube

and ending it is about as complicated as trying to put that toothpaste

back again (and we’re talking about the multi-coloured kind of

toothpaste in this analogy).

The Fed’s QE programs have created

massive market distortions that won’t right themselves without sending

shock waves through an economy that is still on a fragile footing.

Consider the following:

- The U.S. Fed is counting on the

continued recovery of the U.S. housing market but the rise their latest

comments have triggered in Treasury yields has already pushed U.S.

mortgage rates 0.50% higher, before any actual QE tapering has even

begun. The U.S. housing recovery has thus far been primarily fueled by

well-heeled private and corporate investors, not the all-important

first-time buyers whose increased participation will be critical to any

sustainable momentum in the housing market. First-time buyers are highly

sensitive to these now rising mortgage-borrowing costs, especially

since many of them are already awash in record levels of student debt.

If the Fed’s tapering plans push Treasury yields significantly higher,

this will create a powerful headwind for the U.S housing recovery. - Average

price-to-earnings (P/E) ratios for equities are above their long-term

averages and this latest bull-market run has recently had much more to

do with the Fed’s ultra-loose monetary policy distorting prices than

with actual improvements in corporate earnings. If equity markets

continue to decline as the Fed begins to taper, this will undo the

wealth effect that the Fed worked so hard to create in the first place

and could easily force the Fed to slow the timing of its QE withdrawal. - The

Fed revised its 2013 GDP growth forecasts for the U.S. economy down

into the 2.3% to 2.6% range, but now calls for U.S. GDP growth to

rebound to 3.25% in 2014, based largely on a recovery in export demand.

Given the fragile state of the world economy, this forecast is far from

assured. (Side note: I’ve noticed that central banks have a habit of

raising their medium-term forecasts when lowering their short-term

forecasts, only to then revise them gradually back down as they move

closer to the present. The Fed appears to be following this well-worn

playbook and as such, I am instinctively skeptical about the upward

revision to its 2014 GDP growth forecast which got the markets so riled

up last week. Interestingly the IMF reduced its forecast for U.S. GDP

growth in 2014 from 3% to 2.7% last Friday.) - Before they

became modern-day rock stars who determine market winners and losers,

central bankers were charged with the boring old task of keeping

inflation stable. The U.S. Fed’s target for inflation is 2.5% but it

came in at 1.4% in May and in its latest commentary, the Fed

acknowledged that inflation might drop below 1% this year. In Canada,

our target inflation rate is 2%, and last Friday Statistics Canada

confirmed that our latest Consumer Price Index

(CPI) for May came in at a meager 0.7%, up from 0.4% in April. Both

inflation rates are well under target and this implies the need for

looser, not tighter monetary policy.

Although we ignore the

Fed’s warnings at our peril, I can’t help wondering whether the Fed’s

change in tone was really just a trial balloon to see how the market

will react when the day of reckoning, or in this case, the day of

tapering, actually arrives. The Fed certainly left itself plenty of room

to alter its timing if circumstances warrant. In the words of Ben

Bernanke: “Our policies are going to depend on this [improved] scenario

coming true. If it doesn’t come true, we’ll adjust our policies.”

In

the meantime, investors will carefully inspect every piece of new data

with a fine tooth comb in an attempt to pinpoint when the Fed will

actually begin to taper. This guessing game should incite more

volatility in bond yields, and markets in general, in the months to

come.

Five-year GoC bond yields were up 29 basis points last week,

closing at 1.81% on Friday. Five-year fixed rates are now offered in

the 3.25% range while ten-year fixed rates are still available in the

3.64% range. If you value the stability of fixed rates and believe in

the strength and sustainability of the U.S. recovery, paying a small

premium (0.40%) to lock-in a rate for an additional five years of

protection seems like an easy call. If rates start to rise in a major

way, the second five years could be a lot more important than the first

five. (Most people don’t know that breaking a ten-year fixed-rate

mortgage after the fifth year only costs you a penalty of three months’

interest. For more details, here is my post on the ten-year fixed rate, which I took many years ago as my first mortgage.)

Five-year

variable-rate mortgages are available in the prime minus 0.50% range

(which works out to 2.50% using today’s prime rate). Even if the Fed’s

tapering plans come off without any major hitches the removal of its QE

programs will still provide a headwind for the U.S. economy. This should

push out the timing of any change to the Fed’s policy rate, and by

close association, the Bank of Canada’s overnight rate (on which our

variable rates are based). In fact, at their latest meeting, fifteen of

the nineteen members who sit on the committee that sets the U.S. Fed’s

policy rate forecasted that it would not be increased until 2015 or

later.

The Bottom Line: We are now at an inflection point

with mortgage rates and there are two evolving views of where we are

headed. If you believe that the U.S Fed QE taper will not cause serious

damage to the U.S. economy, with five and ten-year fixed rates so

closely aligned, I think the ten-year fixed rate is worth the 0.40%

premium you pay for the five extra years of rate certainty. If you

believe that volatility and fear will remain the watchwords of central

bankers and investors for the foreseeable future, then I think the

five-year variable rate is a far more compelling option than the

five-year fixed rate, especially given the 0.75% gap that now exists

between them.

David Larock is an independent mortgage planner and industry insider specializing in helping clients purchase, refinance or renew their mortgages. David's posts appear weekly on this blog (movesmartly.com) and on his own blog integratedmortgageplanners.com/blog). Email Dave