John Pasalis in Toronto Real Estate News

There have been no shortage of media headlines about Toronto’s real estate market this year. The majority have focused on the future of Toronto’s condo market along with the overall slowdown we are seeing in the real estate market both locally and nationally.

Today I’m going to take a detailed look at the statistics behind Toronto’s real estate market half way through 2013.

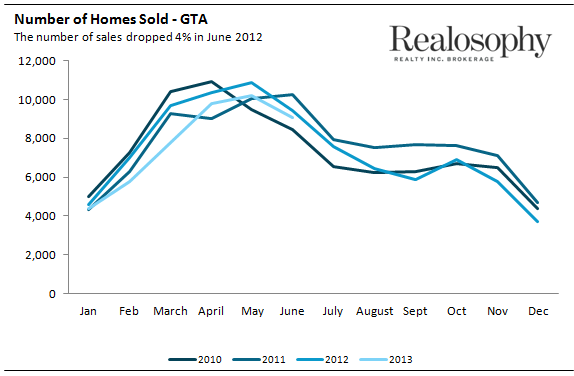

The first half of 2013 saw 46,953 house and condo sales, a 10% decline over the previous year and the lowest sales volume over the past 4 years. Many have attributed this decline in sales to changes to Canada’s mortgage rules which were introduced a year ago.

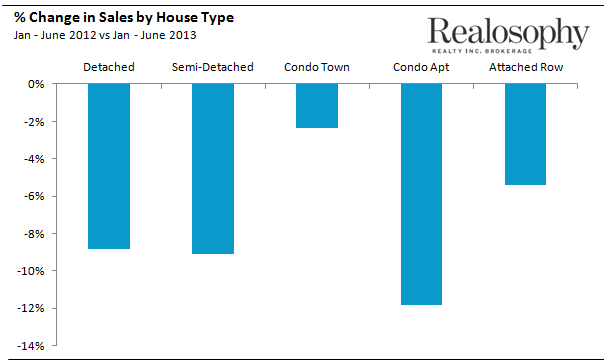

The condo segment led the decline in sales showing a 12%

year over year drop compared to 9% for detached and semi-detached houses

followed by a 5% drop for attached row houses and a 2% decline for condo

townhomes.

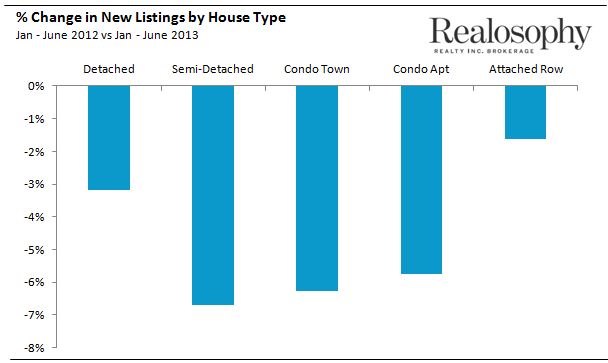

The volume of new listings coming on the market dropped by roughly

4% compared to the first half of 2012. This decline in the number of homes coming

on the market for sale helped to soften the impact caused by the 10% drop in

sales this year.

When we look at the decline in new listings by house type

it’s interesting to see a 6% decline in the number of condominium listings

coming on the market in the first half of this year. This is noteworthy for a couple of

reasons. Firstly, one of the biggest

fears that most industry watchers have about Toronto’s condo market is that we

are overbuilding and we’ll start to see a significant increase in the supply of

condominiums coming on the market for sale eventually driving prices

down.

While we are only looking at 2 quarters worth of data it is

still interesting to see the supply of condos decrease when most people are

expecting the supply of resale condos to be on the rise.

This decline in supply is also a great reminder of the

delicate balance between supply and demand and the impact it can have on prices. Condo prices in Toronto have remained

relatively balanced because the decline in sales was met with a decline in

supply. Had the supply of condos for

sale increased or even remained the same as last year we would probably have

seen some downward pressure on prices.

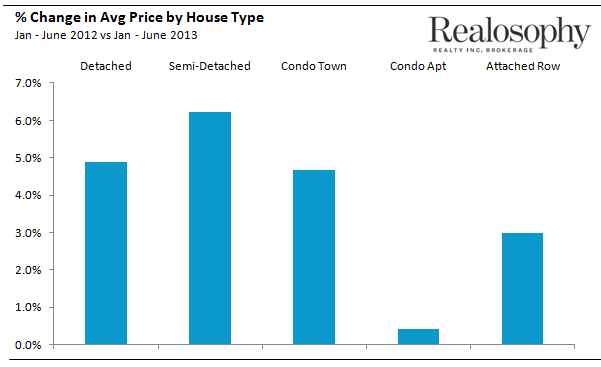

During the first half of 2013 average prices were up across

the board with Semi-Detached houses leading the way with a 6.2% increase. Condo apartments showed the slowest rate of

appreciation at just 0.4%.

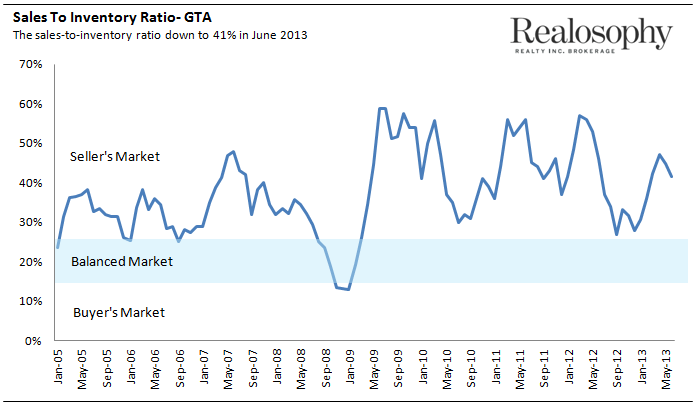

When comparing the first half of 2013 to the first half of

2012 the overall trend is a slight softening in the market. The sales-to-inventory ratio is a good way to

keep an eye on the balance between supply and demand. During the first half of 2012 the

sales-to-inventory ratio started at 41% in January and peaked at 57% in

March. In 2013 the sales-to-inventory

ratio started at 31% in January and peaked at 47% in May.

Why does this matter?

When the sales-to-inventory drops it means we are seeing fewer houses

selling relative to the number homes available for sale. Put another way, in

January 2013 we saw 3 houses sell for every 10 available for sale (a 31%

sales-to-inventory ratio) a drop from the 4 sales for every 10 homes available

in January 2012 (a 41% sales-to-inventory ratio).

While the market is softening in Toronto we are still deep

in seller’s market territory which explains why so many buyers are still

competing in bidding wars. But the drop

in the sales-to-inventory ratio means that we are seeing slightly fewer bidding

wars compared to last year.

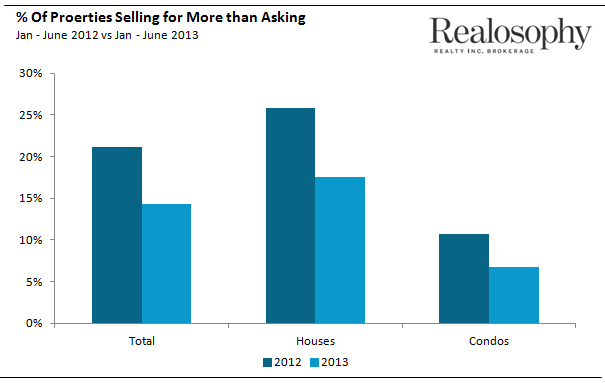

We can see this in the following chart which shows the

percentage of properties that sold for more than asking, a good proxy for the

number of bidding wars since most buyers are not going to pay more than a

seller’s asking price unless they are competing.

The softening we are seeing in Toronto’s real estate market

is definitely welcome given that the market has been heavily skewed in the

seller’s favour for several years. I

expect to see this softening trend to continue into the second half of 2013.

John Pasalis is the President and Broker of Realosophy

Realty Inc. Brokerage in Toronto. A leader in real estate analytics and

pro-consumer advice, Realosophy helps clients buy or sell a home the

right way. Email John

July 19, 2013

Market |