John Pasalis in Toronto Real Estate News

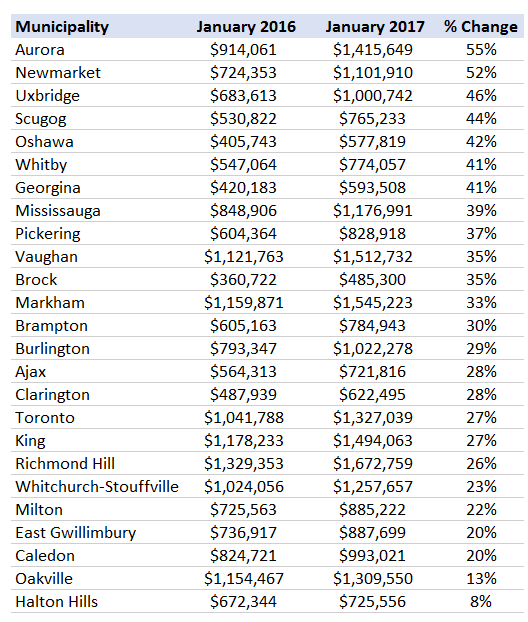

The Greater Toronto Area's real estate market is off to a very hot start in 2017. The table below shows the average price for a detached house in January 2016 vs 2017 for every municipality in the GTA.

Aurora tops the list as the hottest neighbourhood where prices increased 55% from $914,061K in January 2016 to $1,415,649 last month. Newmarket saw a 52% increase in the price for a detached home and five other municipalities saw prices climb over 40%.

It's worth noting that some of the averages might be skewed by the few number of sales in January. But when we look at the market as a whole, the average price for a detached home in the entire GTA (a very large sample of sales) is still up 28% over last year.

What is behind the rapid increase in house prices across the GTA?

The most common answer you're going to hear - usually from industry insiders - is that the real problem with Toronto's real estate market is the lack of supply of new homes. Specifically, that municipal and provincial restrictions are preventing builders from building enough homes to keep up with demand.

This is a great story and for the most part is a relatively accurate one. Land use restrictions have been partly responsible for the boom in house prices in the GTA over the past 15 years. A boom that has been pushing the average price for a home up roughly 7-10% per year.

But in 2016, things changed. We went from seeing house prices climb 7-10% per year to over 25% per year. This sudden surge in house prices had nothing to do with supply constraints - this increase was the result of a sudden increase in the demand for homes. Demand that I believe is the result of a significant increase in the number of investors/speculators, both foreign and domestic. A view shared by others in the real estate industry.

The federal government's mortgage rule changes announced in the fall of 2016 have done little to cool the market.

A 27% annual increase in house prices is not normal, not sustainable and if left alone to run its course will eventually end badly for all. Our market can't cool down by addressing the supply side of the real estate market - these changes take years to materialize. The only way to cool down Toronto's real estate market is through a policy change that curbs the demand for homes. And more specifically a policy that targets demand from foreign and domestic investors vs individual home buyers.

John Pasalis is the President and Broker of Realosophy Realty Inc. Brokerage in Toronto. A leader in real estate analytics and pro-consumer advice, Realosophy helps clients buy or sell a home the right way. Email John

February 1, 2017

Market |