Toronto has spent the past few years prioritizing multiplex housing. I wanted to see what’s actually happening, so I analyzed every City of Toronto building permit issued from 2023 to Q3 2025 for 3 to 6-unit buildings, either through a conversion or a new build. I then matched those properties to MLS sales and rental data to understand what these projects look like once they hit the market.

Multiplex construction is happening, mostly through conversions

- 779 multiplex permits issued since 2023

- 73% are renovations of existing homes

- 27% are ground-up new builds

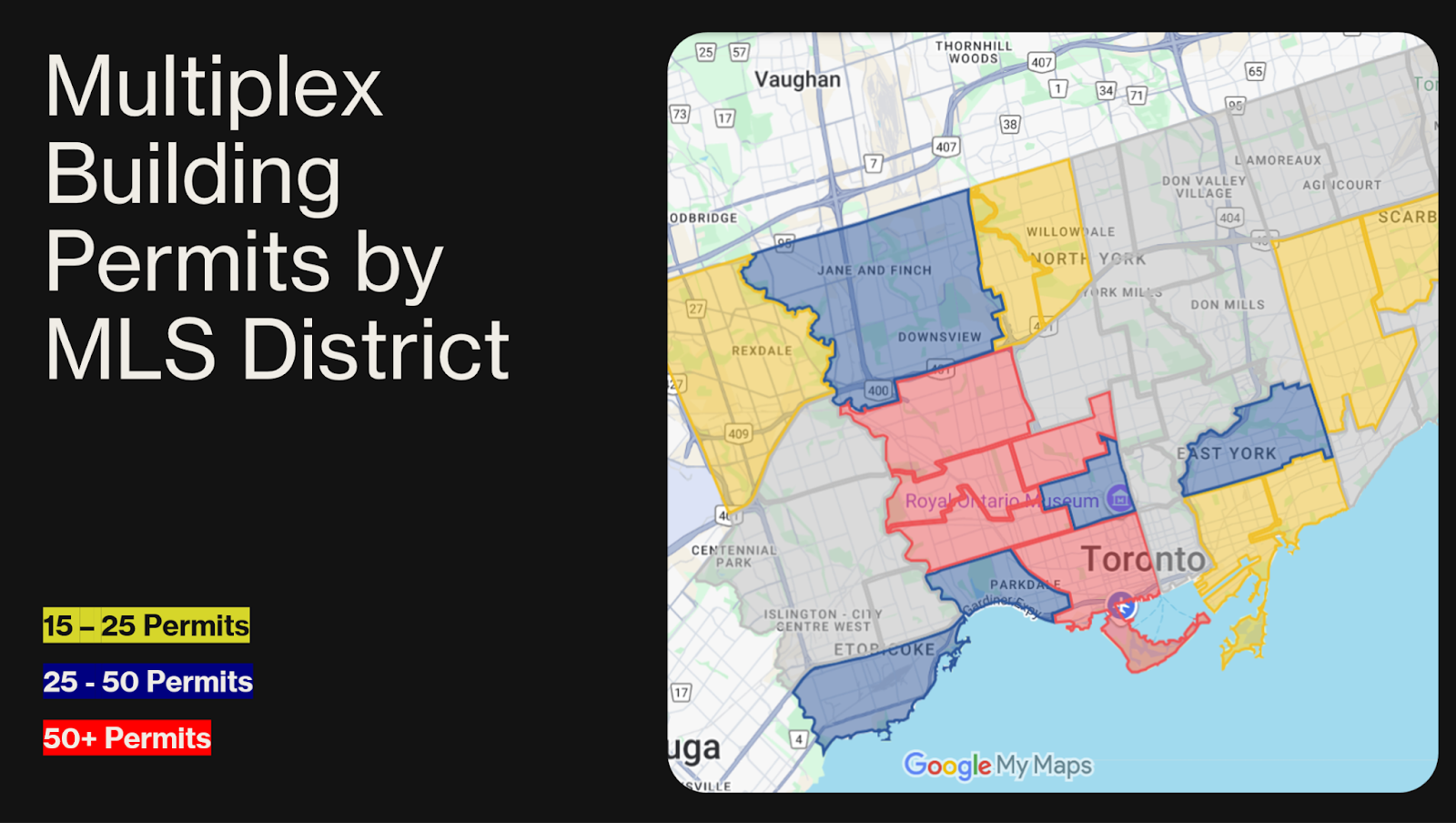

- 76% of permits are west of Yonge Street (see heatmap below)

Side note:

At the Foremost Financial housing conference last month, an HST expert made a point that caught a lot of people off guard. A brand-new multiplex typically qualifies for a full HST rental rebate. A substantial renovation of an existing home often does not, even if the finished building ends up with the exact same number of units. That can make renovations far less tax-efficient than building new.

What are people buying?

Of the total permits, 370 properties were purchased after 2021.

- 75% were detached homes

- 16% were semis

- Detached homes averaged about $1.27M

- Semis averaged about $1.33M since more of them were in the core

Land values show how different the economics are across the city. Detached lots downtown averaged around $600 per square foot of land. In Scarborough and north Etobicoke that dropped to around $170 to $180 per square foot. The same type of project can make sense in one area and be impossible in another.

What kind of housing is being created?

Out of all the multiplex properties I tracked, 164 had rental transactions.

- 55% of leased units were two bedrooms

- 23% were three bedrooms

These are relatively spacious homes compared to the micro-condos that dominated the market over the past decade.

- Rents varied by location.

A two-bedroom apartment downtown rented for roughly $3,350 per month - In the inner suburbs a similar two-bedroom rented for around $2,700

That’s about a 20 percent difference in price. When you account for unit size, the difference is closer to 30 percent because the units outside the core tend to be larger.

One interesting finding is that laneway suites often rented for the highest price on a per-unit basis. The additional privacy that comes from living in a detached home appears to command a premium.

Why this matters

For years, Toronto has largely built small apartments in tall towers. Homes designed to maximize investor returns rather than to support long-term living. Multiplexes are starting to give us something we haven’t been building nearly enough of: larger apartments in low-rise neighbourhoods where people actually want space and backyards.

They are not trying to compete with small condo units, they are filling a gap that has been ignored for a long time.

John Pasalis is President of Realosophy Realty. A specialist in real estate data analysis, John’s research focuses on unlocking micro trends in the Greater Toronto Area real estate market. His research has been utilized by the Bank of Canada, the Canadian Mortgage and Housing Corporation (CMHC) and the International Monetary Fund (IMF).

Have questions about your own moves in the Toronto area as a buyer, seller, investor or renter? Book a no-obligation consult with John and his team at a Realosophy here: https://www.movesmartly.com/meetjohn

December 10, 2025

Market |