John Pasalis in Toronto Real Estate News

Last year I wrote about a trend I had been noticing in the Toronto area real estate market - whether at our office or at dinner parties, we were hearing from a greater number of investors looking to buy single family homes. This was not unusual. What was unusual is that unlike regular investors many of them were not particularly concerned about the rental income they could generate and were even willing to buy a property that didn't earn enough to cover all expenses. These investors were buying because of their belief that house prices would only continue to appreciate.

Readers of this blog will know I'm a follower of Nobel Prize winning economist Robert Schiller and Karl Case's assertion that this type of attitude shift is in itself a sign of a market bubble. When we began to see investors act on the assumption that the price of houses will continue to rise indefinitely, we start shifting from a market driven by an investor's mindset to a speculator’s mindset.

Toronto's real estate market is already at a critical point. While we have seen an average growth rate of 7% annually over the last twenty years, we now see detached house prices appreciating at a rate of over 30% year over year.

I wanted to see if there was any quantitative evidence that would confirm our anecdotal observations about investor demand for single family homes in the Greater Toronto Area (GTA) and assess the role this might be playing in the rapid price appreciation we are seeing. What I found was interesting - and worrying. The full report can be downloaded here

It is notoriously hard to find data that drills down into specific activities in the real estate market (and the lack of such data from our governments on things like percentage of foreign buyers in Toronto is frustrating as presumably they need this data to inform the policy changes they are making and asking us to approve us of).

However, looking more closely and carefully at real estate listing data, like the data contained in the Toronto Real Estate Board (TREB) Multiple Listing Service (MLS) database) which is used by real estate agents and brokers to list all properties being bought and sold in the GTA, can still tell us a lot.

I had to innovate a reasonable way to get a look at the investors I was interested in so to quantify this investor demand, I looked at every freehold house (detached, semi and rowhouse house as opposed to condo) that has sold over the past five years and then checked to see what percentage of buyers listed their property for rent shortly after taking possession.

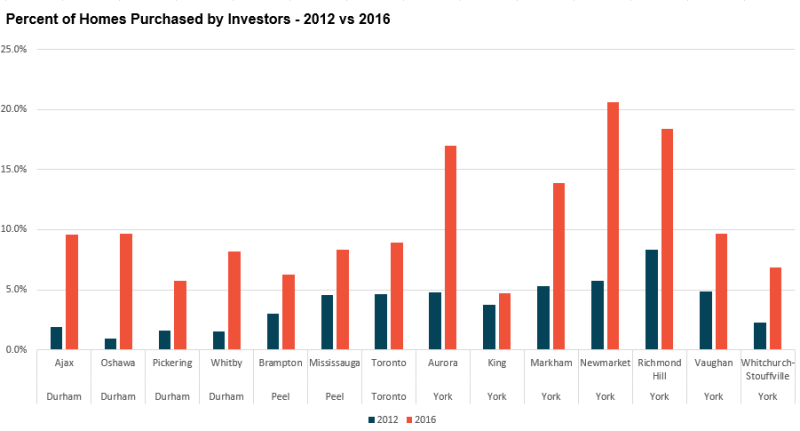

What I found was that these investors are responsible for 17-21% of all sales in Aurora, Newmarket and Richmond Hill and 36-39% of all sales in some of the GTA’s hottest neighbourhoods.

Whitby, Ajax and Oshawa all saw the steepest increase in sales to investors of over 400% in just 4 years.

There were signs of rising investor activity across the GTA - and zeroing in showing that some areas and neighbourhoods were showing sharper increases than others.

Source: Realosophy; Toronto Real Estate Board MLS

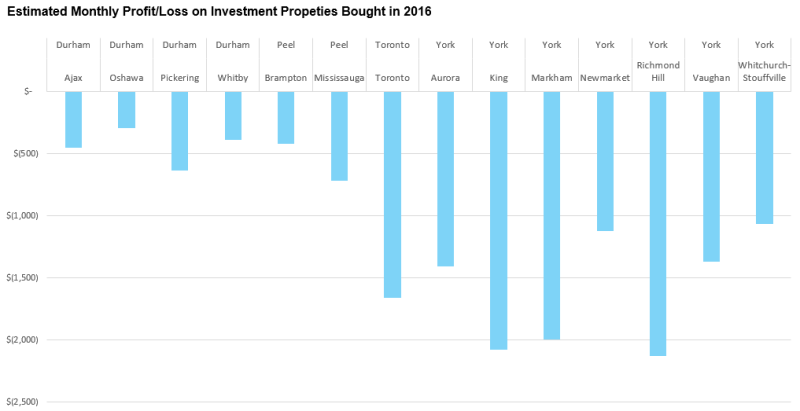

By looking at actual sales and rental data, I was also able to estimate the monthly profit or losses that these single family home investments were generating. In doing this, I had to make the assumption of a 35% down payment with typical mortgage terms (I discussed my methodology in more detail in my full report).

Based on this, I estimated that 95% of the investment properties purchased in 2016 in the GTA would be losing money every month (meaning these owners would have to personally cover the carrying costs of the property because the rent alone is not sufficient to cover expenses).

The average monthly loss per property in 2016 was $1,121.

Again, the variations by area and neighbourhoods across the GTA were important to see, with York Region municipalities of Richmond Hill and Markham showing the greatest signs of this kind of investment activity.

Not all buyers will be equally exposed in the event that their belief in rapidly rising house prices sputters out; anecdotally, it is estimated that many foreign investors are buying with far more cash than domestic investors. But we have heard first-hand from some buying with little cash, using their principal residence mortgage to finance investment purposes and in some cases, rationalizing why it makes sense to use your credit card to cover any shortfalls in the carrying costs of investment properties – who cares if you have to pay 25% interest on the $1,200 you need to borrow each month if you’re earning 25% on the $800,000 purchase price of a property? For many, it seems to be a no-brainer.

And yet no-brainers are where most market bubbles - and bursts - begin.

That's why we believe our governments need to coordinate and implement the right measures to address the problems suggested by the data. Most notably, lenders currently underwrite mortgages for residential investment properties as if they are owner occupied homes, resulting in a loophole that allows buyers to finance money losing investment properties largely with debt; these loopholes should be closed by tightening lending practices.

If public policy makers want to prevent damage to our housing market, they need to act now.

While some might be judgmental about buyers who speculate in real estate, we are concerned that some consumers, buoyed by the perennially sunny attitudes of the residential real estate industry and offshoot industries that promote residential real estate investment schemes, are not being sufficiently advised as to the downside risks of their activity.

And right now more than ever, it's critical for regular buyers and sellers to be aware of whether there is speculative activity in a particular neighbourhood - see our full report to take a closer look at this trend area by area across the GTA.

(And for those needing even closer drill downs particular to their situation, learn more about how Realosophy agents use data and get in touch with us).

John Pasalis is the President and Broker of Realosophy Realty Inc. Brokerage in Toronto. Buying a house or condo this spring? A leader in real estate analytics and pro-consumer advice, Realosophy helps clients buy or sell a home the right way. Email John

March 21, 2017

Market |