We're in for a tough winter but there's hope. Forecasters expect our economy to rebound robustly and inflation to surge, as consumers spend the cash they saved during the lockdown.

Today, mainstream economic forecasts fall within a fairly narrow band.

The narrative, in simple form, acknowledges that we’re in for a tough winter but predicts that we’ll be on our way back to normal not long after the snow melts, thanks to widespread vaccinations. After that, most forecasters expect our economy to rebound robustly and inflation to surge, as consumers unleash the cash they saved up during the lockdown.

In recent posts I have challenged several of the assumptions on which this view is built. Here is a summary of my key counter-arguments:

- Even in a best-case scenario, the pandemic won’t end to the sound of trumpets. It’s more likely to peter out gradually, and that will slow the rate at which people return to their normal activities (and increase their spending).

- Vaccine distribution is already taking longer than expected, and vaccine hesitancy may also slow the take-up rate needed to achieve the end goal of herd immunity.

- Our economy will need time to adjust to the world after COVID. For example, some of the changes in our spending habits will likely be permanent. And the longer the lockdown lasts, the more businesses will close their doors, and the more time it will take for new ones to absorb that slack when the economy reopens.

- Governments, businesses, and many consumers have all taken on more debt during this crisis, and the cost to service that incremental debt will reduce the amount of capital that is available for more productive investments.

- Spending on services will increase due to pent-up demand, but spending on many goods is likely to decrease. Relatedly, some lower-income workers will have less disposable income once they return to work because the emergency benefits they received paid them more than they had previously earned through employment.

Every forecast pays homage to the virus, conceding that its path will determine the fate of all else, but only before assuming that it will be brought to heel in short order.

What if it isn’t? What if things take a turn for the worse?

While that risk doesn’t warrant much analysis, we’re not talking about a low probability event. Infection rates are rising across Canada, and our hospitals and their ICUs are already filling up. That is happening even without any discernible impact from the much more infectious COVID strain that is currently spreading like wildfire across Europe. If it reaches the Great White North, those mainstream economic forecasts will be out the window.

This recent newsletter from Lacy Hunt offers a grim look at a potential worst-case scenario.

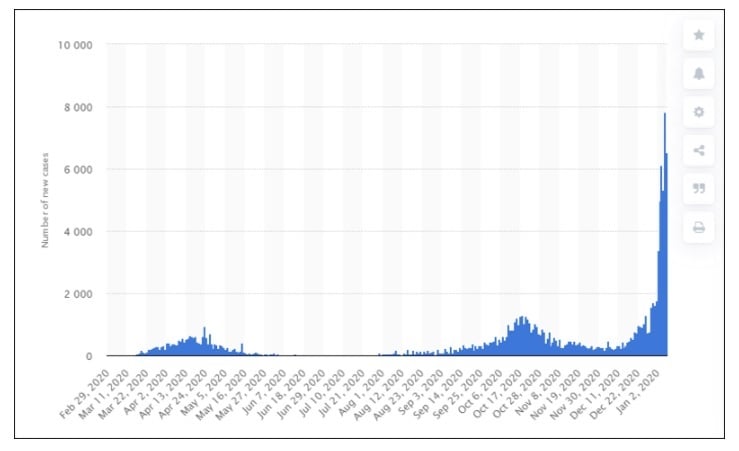

It opens with a chart of the reported daily new COVID cases in Ireland where the new faster-spreading variant is now established. The chart illustrates the infection spike that has occurred there since late December.

Here are the highlights from Hunt’s recent piece:

- Ireland has experienced a 30x spike in infections. It went from “a few hundred new Covid cases every day to more than six thousand cases every day.”

- A spike like this in a major metro area will require “draconian economic shutdowns.”

- “This new infection rate would far outpace [US] current vaccine distribution capacity and policy.” (Note: Canada has a lower vaccine distribution capacity than the US at this point.)

- “The overall burden of severe outcomes (death, long-term health consequences) would shift to younger demographics.”

- What’s happening in Ireland is “driven by both the more virulent UK-strain AND a deterioration in social distancing behaviors.” (Any fair assessment of Canadian behaviour would concede that as a whole, our respect for masking and social distancing protocols has deteriorated.)

Hunt’s research is both compelling and alarming. He reminds us that when the pandemic began, what happened in Europe was a pre-curser to what followed in North America. If past is prologue, today’s lockdown restrictions might be a light touch when compared to what comes next.

Here are my thoughts on how mortgage borrowers can minimize their risk of an Ireland-like spike:

- Most borrowers who are buying one property and selling another have focused on buying first, because that has been the harder step to complete. If the pandemic worsens, the demand side of the market may temporarily dry up, as it did briefly during the first wave. Borrowers who have bought but not yet sold should list their properties as soon as possible.

- Any borrower who has been conditionally approved for a mortgage should submit their documents and, if an appraisal is required, have it completed ASAP. Most lenders and appraisers are already swamped, and if staffing is impacted by the virus, turnaround times will slow further.

- The same is true for anyone considering a refinance. Your access to credit is fully available now – but that could change quickly if infection rates spike.

- While a worst-case outcome would likely put downward pressure on mortgage rates over time, if lenders become concerned about a surge in defaults, they could reapply COVID risk premiums to their rates (as they did during the first wave). Borrowers can lock in a pre-approval rate now to guard against that risk.

I didn’t write this post to alarm anyone. I wrote it because most forecasts don’t provide sufficient warning about the risk of dramatically worse pandemic outcomes. Forewarned is forearmed.

The Bottom Line: Fixed and variable rates held steady last week. The Bank of Canada meets this Wednesday, and there is an outside chance that it will enact a micro rate cut of 0.10% to .15%. (I explain why in this post.) If that happens, our variable mortgage rates should fall by the same amount, and the Government of Canada bond yields that our fixed-mortgage rates are priced on would likely drop as well.

Image credit: iStock/Getty Images

David Larock is an independent full-time mortgage broker and industry insider who works with Canadian borrowers from coast to coast. David's posts appear on Mondays on this blog, Move Smartly, and on his blog, Integrated Mortgage Planners/blog.

January 18, 2021

Mortgage |

.jpg?width=687&name=Rate%20Table%20(January%2018,%202021).jpg)