I look into the data to understand why Toronto area condo rents have been falling over the last 5 months.

The average rent for a condominium in the Greater Toronto Area has declined from a record high of $2,986/m in August 2023 to $2,780 in January 2024, a 7% drop in just 5 months.

While it is typical for rents to dip slightly during the winter months when demand is typically the lowest for new rentals, the decline we have seen this year is greater than what we would expect from seasonal factors.

The biggest driver of the decline in condominium rentals is a surge in new rental listings, which was caused by an above-average number of condominiums being completed during the second half of 2023.

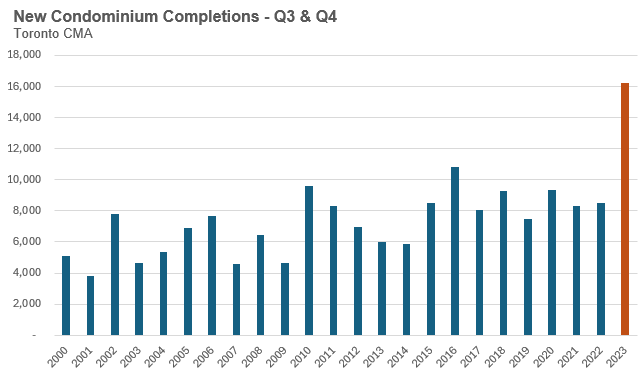

The chart below shows the number of condominium completions in the Toronto area during the third and fourth quarters of each year. The Toronto area typically has just over 8,000 new condo completions during the second half of the year. In 2023, the number of completions was double that at 16,242.

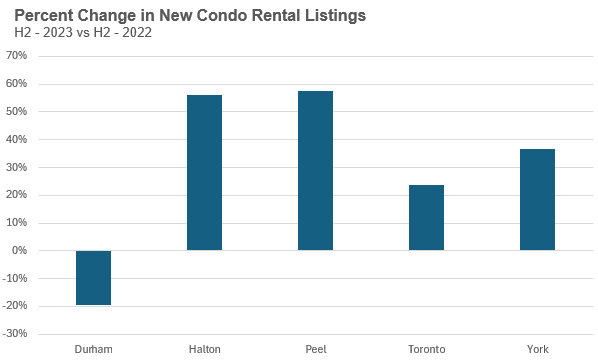

Since the majority of new condominium units are purchased by investors, this lead to a surge in the number of units listed for lease. The chart below compares the change in the number of new rental listings during the second half of 2023 against the second half of 2022.

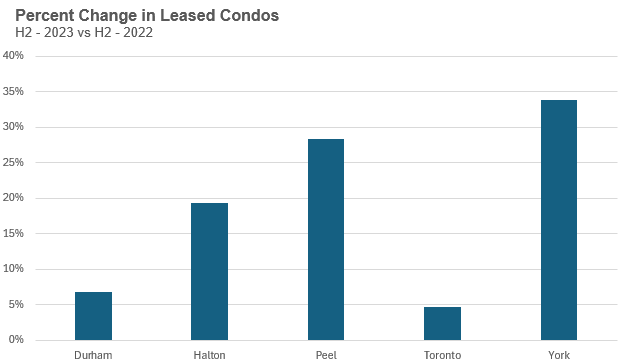

In all regions, the number of condominium units that were leased during the second half of 2023 was up compared to the same period in 2022. But even though the demand for rentals is up, the volume of rental listings exceeded it.

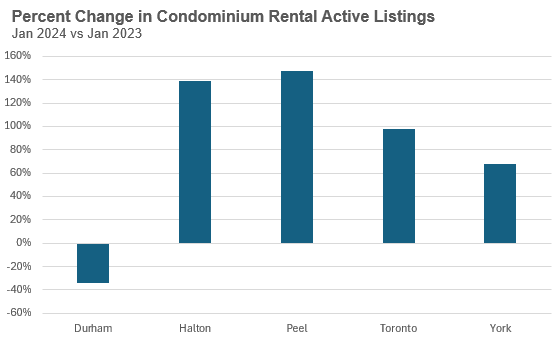

When we compare the number of active condo rental listings in January 2024 vs January 2023, we can see that the numbers have doubled in Halton and Peel and nearly doubled in Toronto.

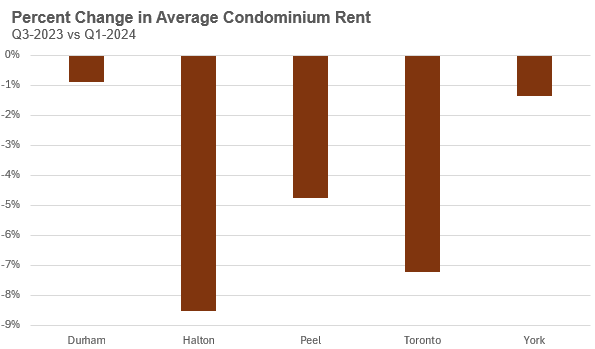

Not surprisingly, the regions with the biggest increase in active listings have also seen the biggest decline in average prices. The chart below compares the change in average price at the start of the third quarter of 2023 (July) against January 2024.

On a year-over-year basis, average rents are relatively similar to the same time last year, but a year-over-year comparison misses the fact that rents are down from their peak last summer.

And the supply shock we are seeing in the condo rental market will likely get worse in 2024 since a record 17,918 units are scheduled to be completed during the first six months of the year according to condo research firm Urbanation.

Where prices will go with depend on how long it takes the market to absorb all of this additional supply.

John Pasalis is President of Realosophy Realty. A specialist in real estate data analysis, John’s research focuses on unlocking micro trends in the Greater Toronto Area real estate market. His research has been utilized by the Bank of Canada, the Canadian Mortgage and Housing Corporation (CMHC) and the International Monetary Fund (IMF).

February 20, 2024

Market |