Author John Pasalis is the President of Realosophy Realty, a Toronto real estate brokerage which uses data analysis to advise residential real estate buyers, sellers and investors. He is a top contributor at Move Smartly, a frequent commentator in the media and researcher cited by the Bank of Canada and others.

Rise in Demand Outpaces New Listings

LIVE MARKET UPDATE: WATCH REPORT HIGHLIGHTS & Q/A - THURSDAY FEBRUARY 15th 12PM ET

.jpg?width=600&height=337&name=Public%20Webinar%20Social%20%E2%80%93%20Dec%202023_YouTube%20(1).jpg)

Join John Pasalis, report author, market analyst and President of Realosophy Realty, in a free monthly webinar as he discusses key highlights from this report, with added timely observations about new emerging issues, and answers your questions. A must see for well-informed Toronto area real estate consumers.

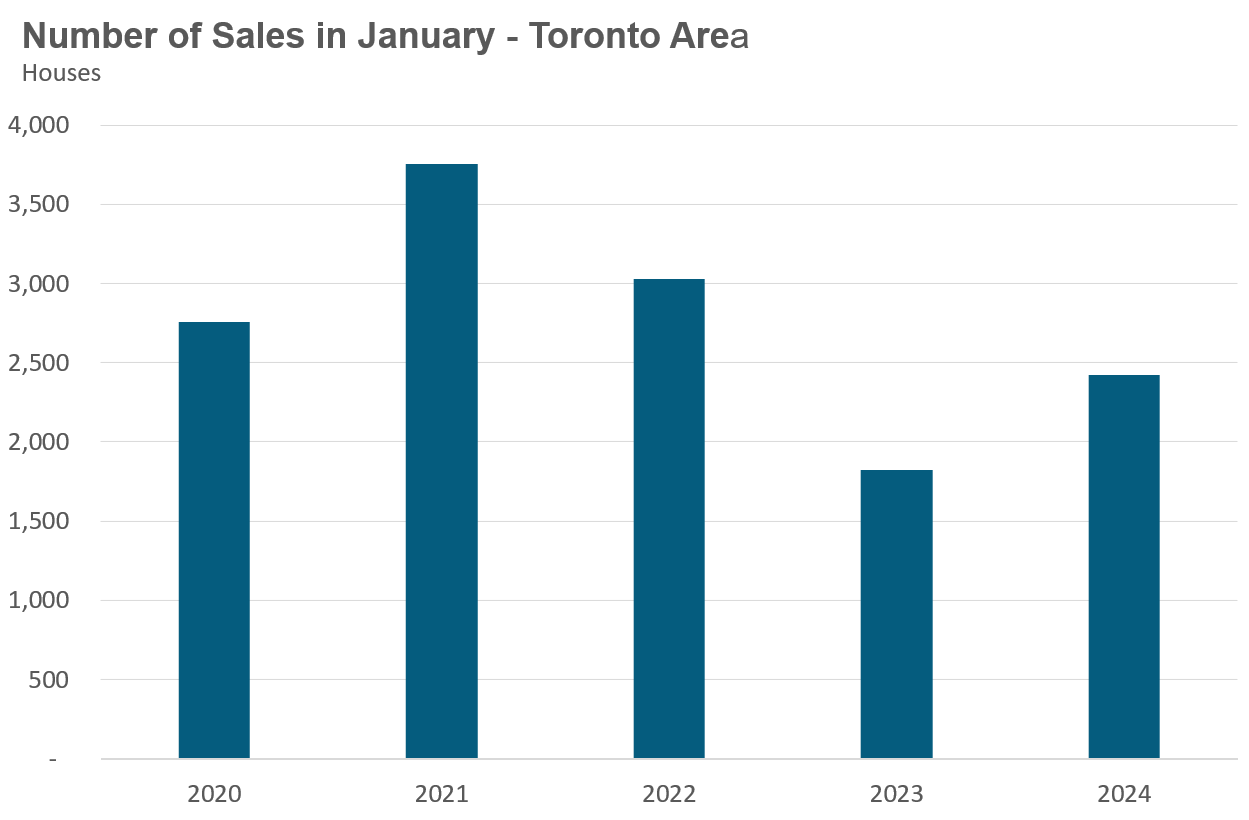

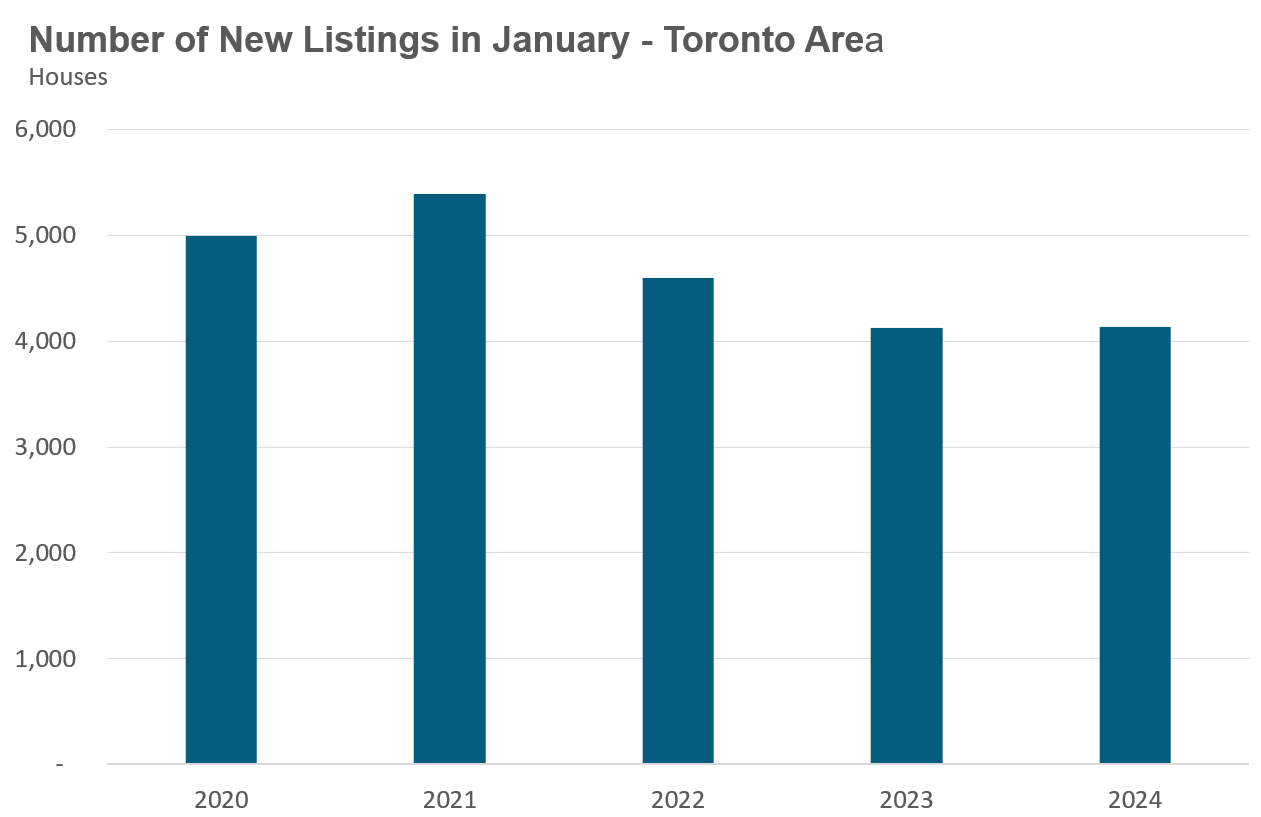

The housing market in the Toronto area became far more competitive in January thanks to a rapid increase in the number of sales and moderate to no growth in the number of new listings.

WATCH NOW: John talks about the latest monthly numbers

In early December, when the housing market was still sluggish and the words “bidding war” were rarely heard, I highlighted some early signs that Toronto’s housing market might be turning a corner. At the time, it was too early to tell if the trends I was seeing were short-term dynamics or a real shift in the market, but two months later, it is looking a lot clearer that Toronto’s market did turn a corner.

A decline in fixed mortgage rates since the summer, coupled with expectations that the Bank of Canada is done raising interest rates, has pushed many buyers back into the housing market, hoping to get a head start before any change in the Bank of Canada’s policy rate.

The housing market in the Toronto area became far more competitive in January thanks to a rapid increase in the number of sales (houses up 33% and condos up 40%) and moderate to no growth in the number of new listings (houses flat and condos up 17%).

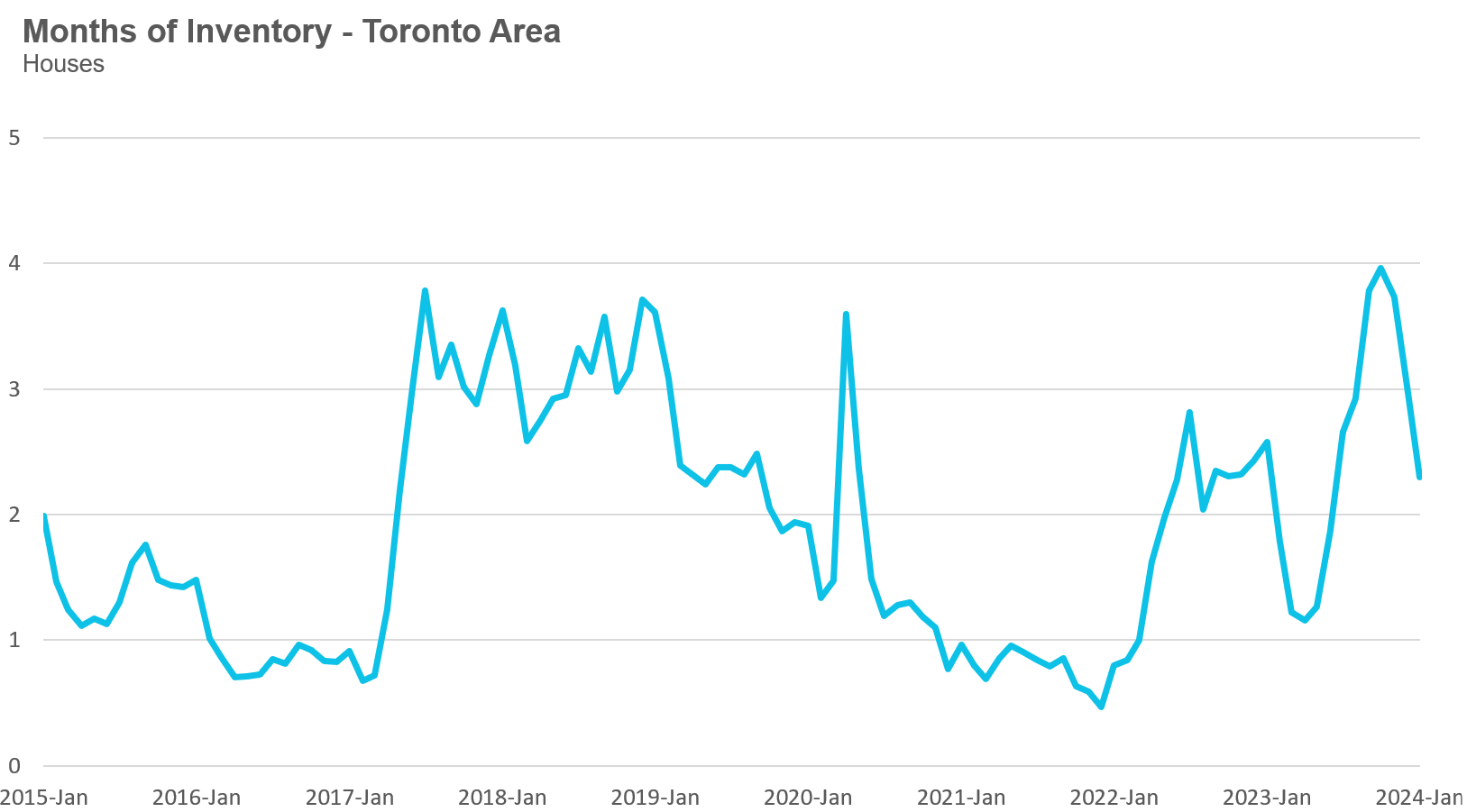

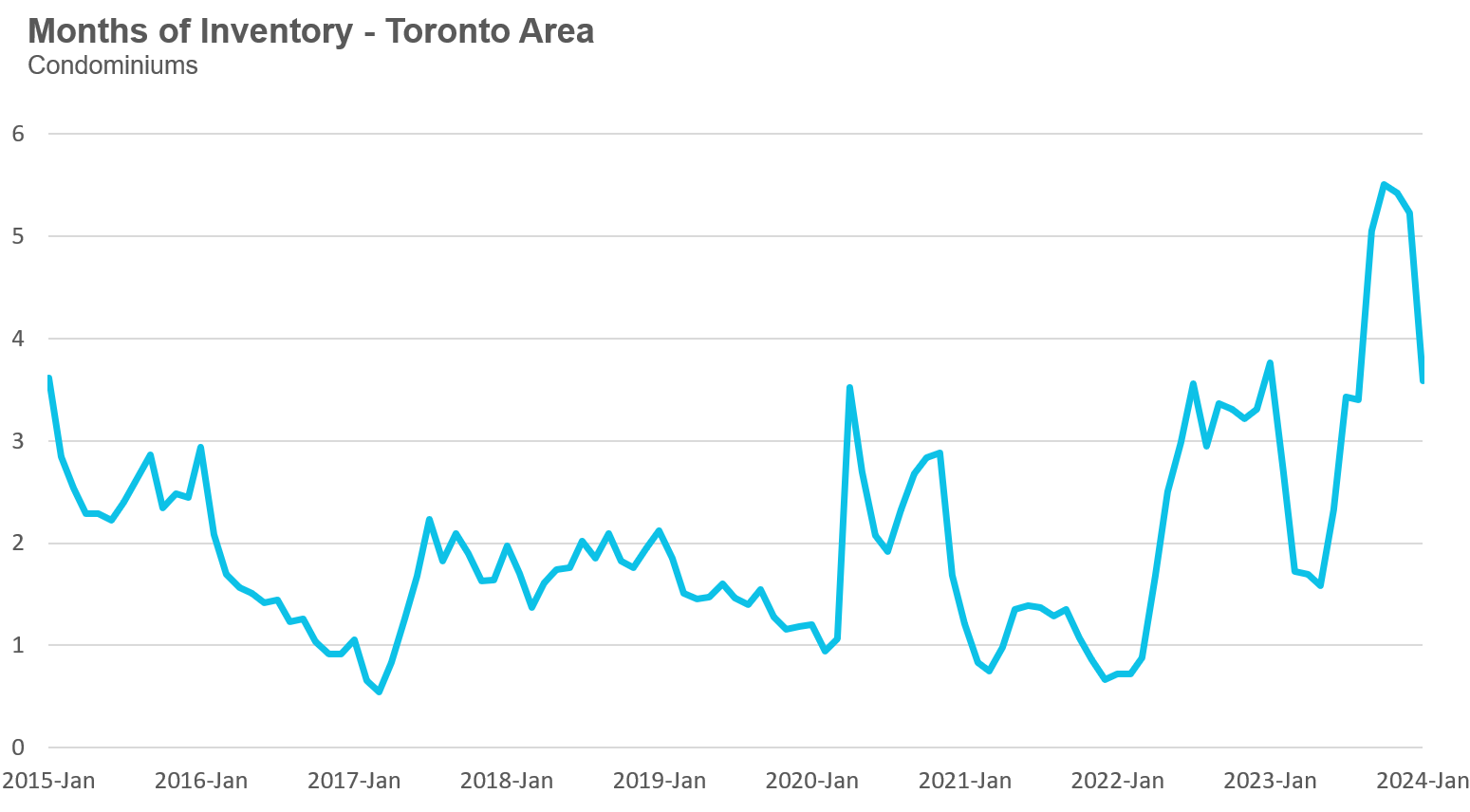

The Months of Inventory for houses has declined from a high of 4MOI in October to 2.3MOI in January. Between September and December, the condominium market had more than 5 months of inventory, but inventory levels declined to 3.6 in January.

So far, this increase in demand has not translated into higher prices (average or median), but if demand from home buyers continues to outpace new listings, we may see prices start to trend up.

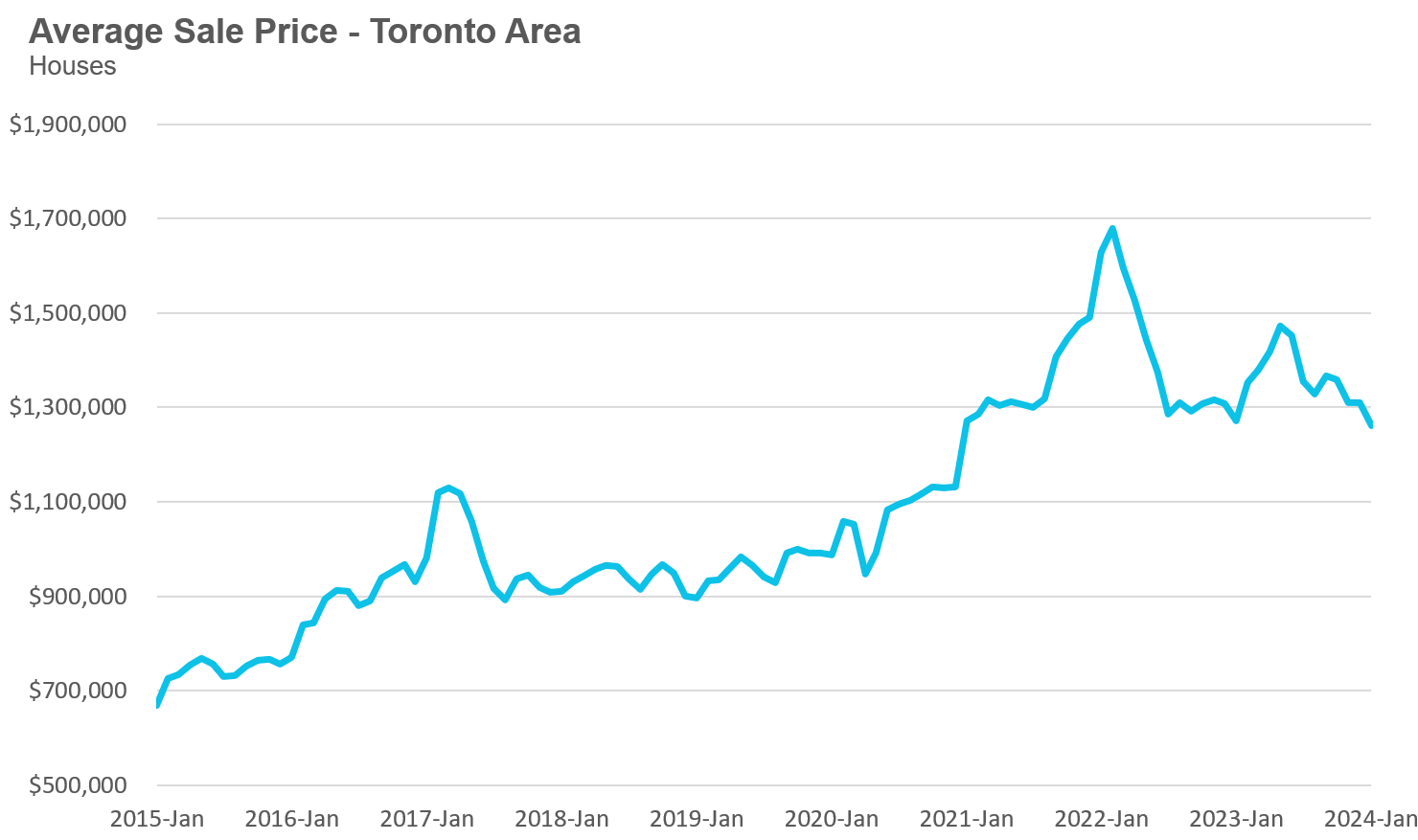

The average price for a house in the Toronto area was $1,260,727 in January, down 1% over the same month last year. Last month's median house price was $1,100,000, also down 1% over last year.

House sales in January were up 33% over last year, while new house listings were unchanged.

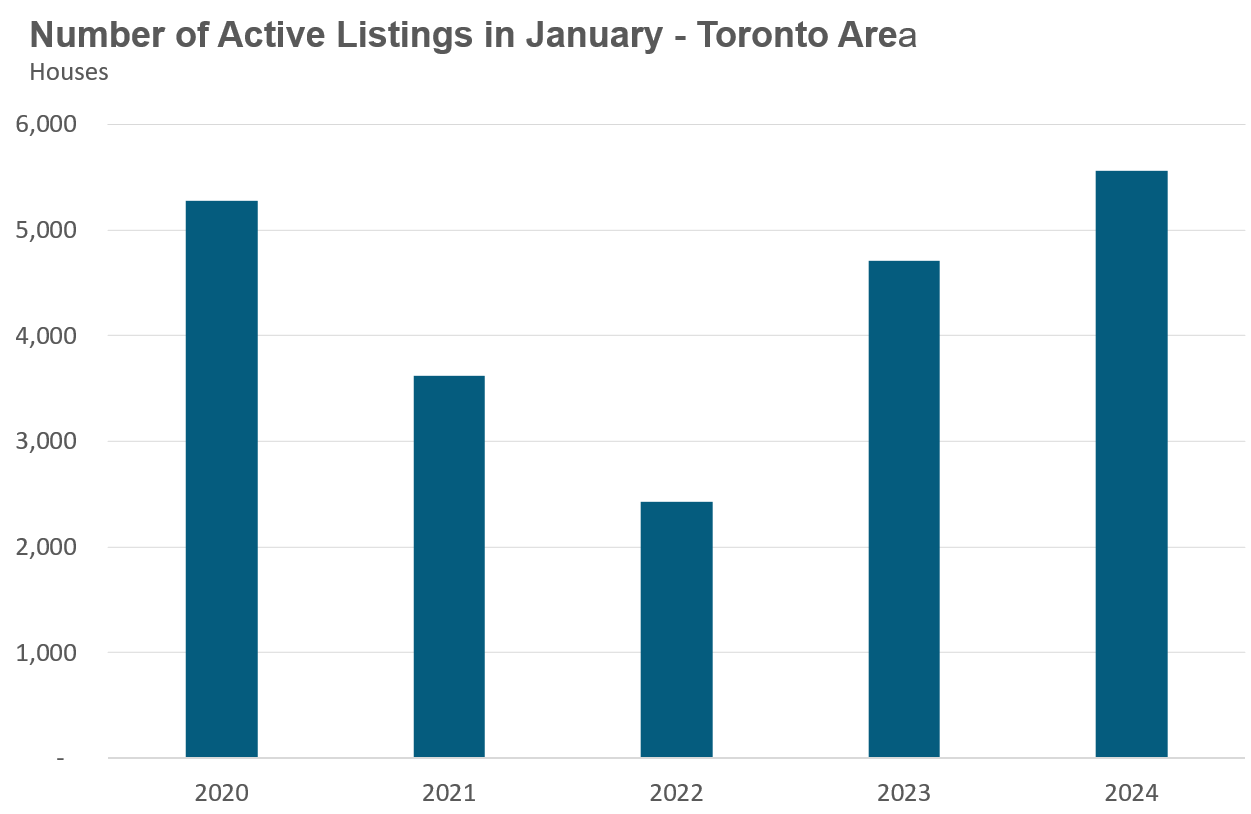

The number of houses available for sale at the end of the month, or active listings, was up 18% over last year.

The current balance between supply and demand is reflected in the MOI, which is a measure of inventory relative to the number of sales each month.

In January, the MOI for houses fell to 2.3.

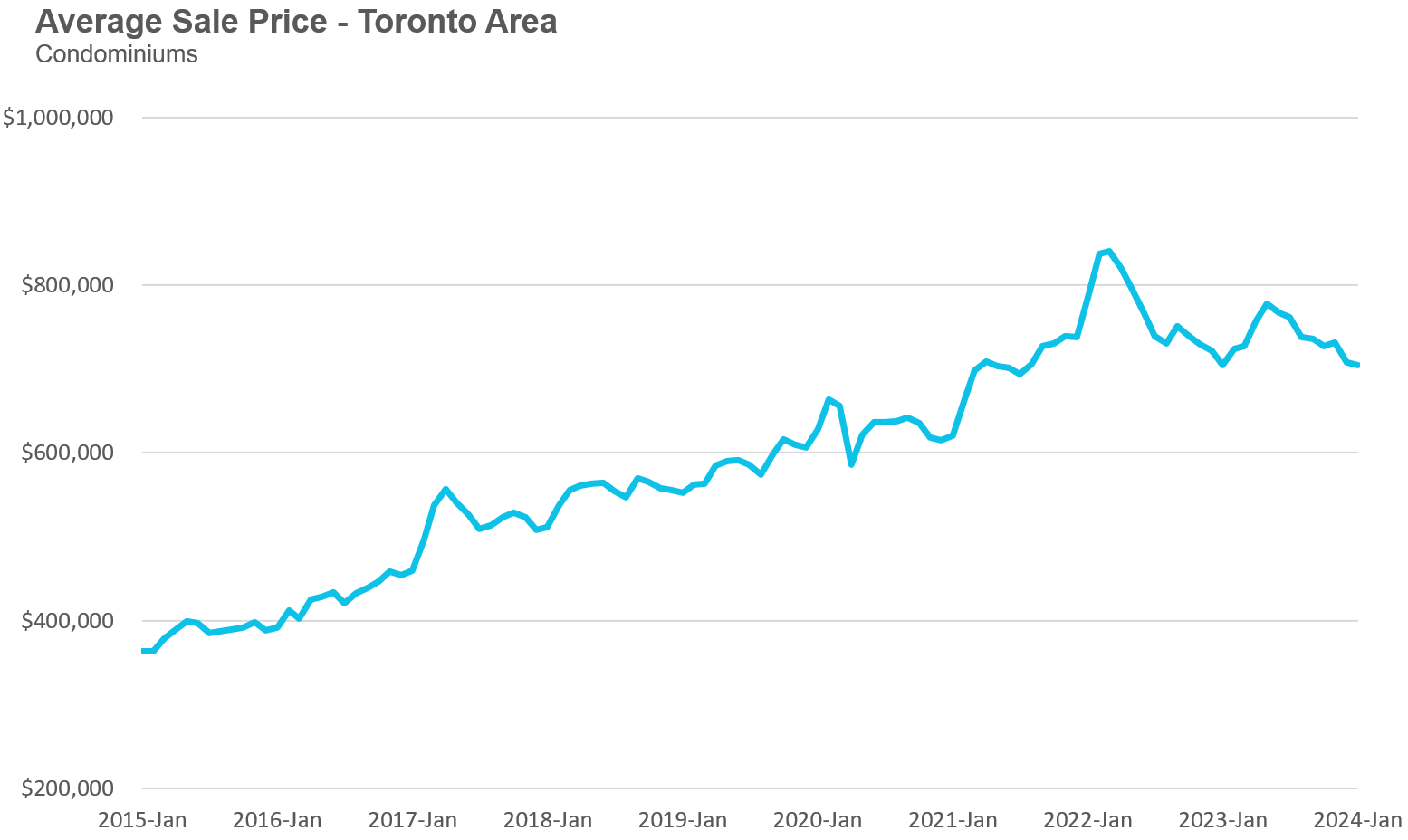

The average price for a condo in the Toronto Area was $704,982 in January, which is unchanged over last year. The median price for a condo in January was $633,000, also unchanged over last year.

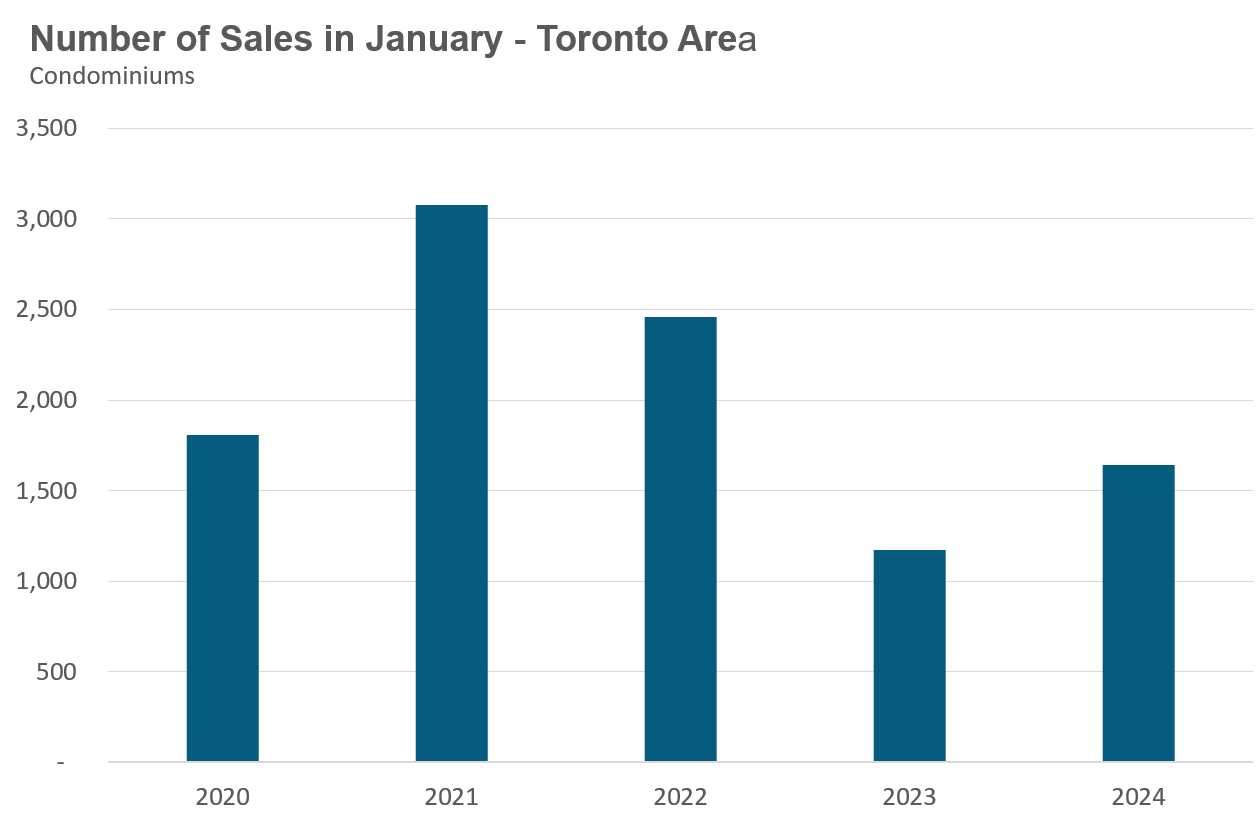

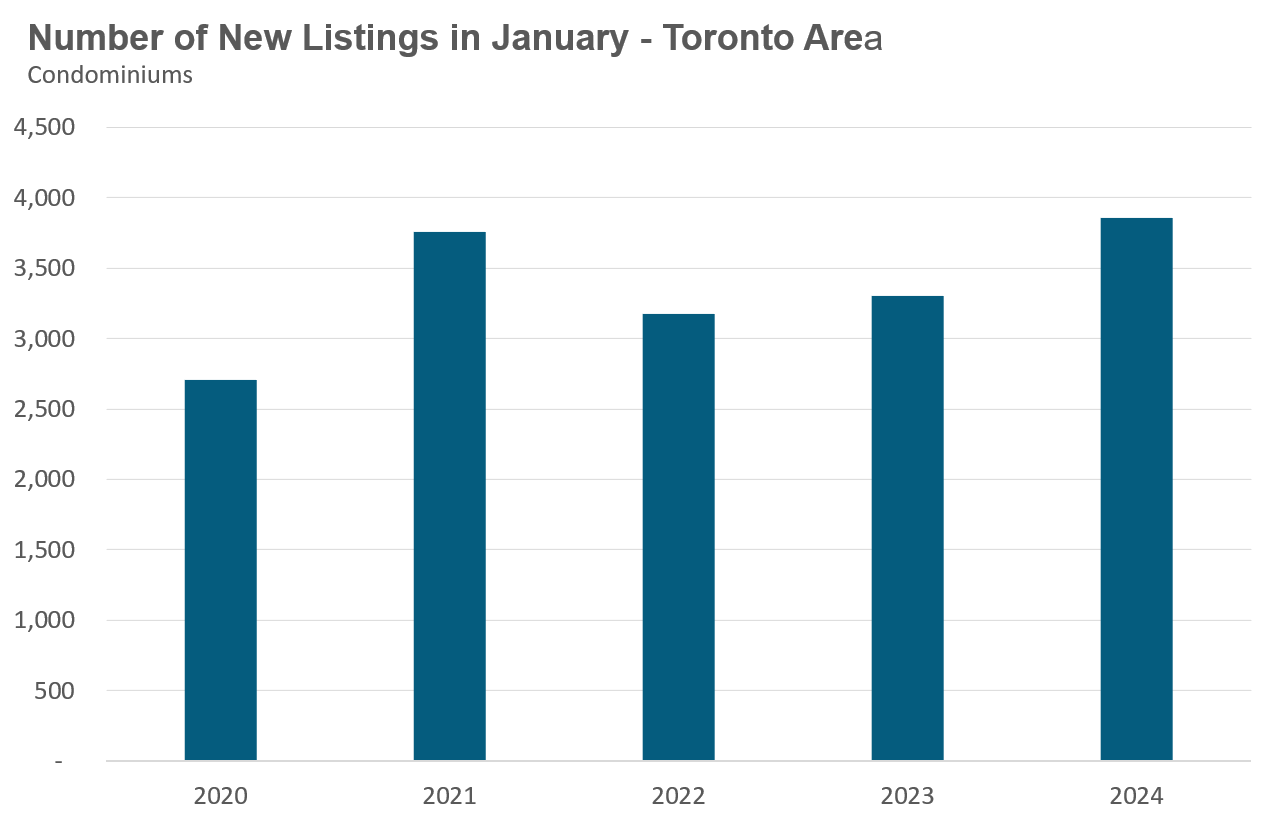

Condo sales in January were up 40% over last year, and new condo listings were up 17% over last year. The number of active condo listings was up 33% over last year. The MOI decreased slightly to 3.6.

Browse detailed monthly statistics for January 2023 for the entire Toronto area market, including house, condo and regional breakdowns below.

How Will Scramble to Curb Student Visas Impact Housing Market?

The federal government is now scrambling to reign in Canada's spiking foreign student numbers - how will this impact the housing market?

WATCH NOW: John talks about the impact of student visa restrictions on housing

As I've written about previously, the rapid increase in international students in Canada has been a big driver of Canada’s population boom, which has raised concerns about the impact this boom is having on housing and healthcare. There are currently over one million international students in Canada.

In response to these concerns, the federal Liberal government has just announced a cap on the number of international student visas issued in Canada for 2024. The cap of 360,000 is a 35% decrease from 2023 levels, and the cap will be weighted by each province’s population. The provincial weighting will result in a 50% decline in Ontario, which will see the number of new international student visas drop by over 100,000 in 2024 compared to the previous year.

So how will this cap impact the housing market in the Greater Toronto Area and Southern Ontario?

Provincial governments never felt it necessary to consider international students' housing needs when they allowed post-secondary institutions to rapidly increase the number of international students they were admitting.

As a result, the private sector filled the gap as many mom-and-pop investors bought single-family homes and converted them to rooming houses, some illegal, to house international students.

Renting to students has been a profitable business because investors can cram 15 to 20 students in a single home, and their total monthly rent would significantly exceed the rent that could be earned if the home was rented to a single family. It’s worth noting that many of these rooming houses offered very poor and, in some cases, unsafe living conditions for students.

How will the cap on international student admissions impact these investors?

The first thing worth noting is that the federal government’s measures should not be interpreted as a cut in the number of international students, but as an attempt to prevent further growth in international student enrollment.

The important number that we need to consider is not the decline in the number of students admitted compared to last year, but the difference between the number of students finishing their studies and the number of new students.

For example, suppose the 50% decline in new international student admissions for Ontario means that Ontario will issue 150,000 new student visas in 2024. If Ontario also sees 150,000 international students finish their studies at the end of this academic year, then there will be no change in the total number of international students. The number of international students ending their studies will equal the number of new students.

The number of international student visas that Canada approves has been increasing each year over the past five years. This means that the number of international students who began their studies 2 to 4 years ago and will be finishing their studies this year will be much smaller than the cohort that began their studies in 2023, the cohort that the federal government is basing their 35% off of.

While I have not seen any accurate estimates of the number of international students finishing their studies in Ontario this year, it is reasonable to assume that the number will be much lower than last year’s intake and closer to Ontario’s new annual international student cap, resulting in very little change in the total number of international students studying in Canada.

That being said, the effects of the cap may not be felt equally across regions in Ontario. Some schools that had an outsized increase in international student admissions recently may see their numbers fall more dramatically. If you own a home or are considering buying one in regions with schools that might see their admissions cut more than others, there are a couple of things worth keeping in mind.

Investors who own a single-family home that they are currently renting to international students will want to consider if they can afford to keep the home if they need to rent to a single family rather than students if student demand is softer later this year.

Suppose you can’t make the numbers work and are concerned that the demand for student housing will be much lower next year. In that case, you may want to get ahead of the market by selling your investment property as soon as your existing student tenants finish their studies rather than waiting for Fall 2024.

I don't expect to see any material impact on the housing market in the near term. Investors tend to be very optimistic about the market, so we are unlikely to see a surge in new listings this spring/summer caused by investors rushing to sell their properties.

However, if the cap on international students dramatically cools the demand for student rentals in certain areas, we may see some investors try to sell their properties this fall if they can’t afford to hold their property with the lower rents earned from a single tenant.

Whether this impacts home prices would depend on the volume of new listings coming on the market and any change in the demand for housing in the fall. Even if listings do increase in some areas, if interest rates are lower in the fall, the increase in demand caused by lower rates may help the market absorb the increase in new listings.

We’ll better understand how the market is adjusting to the international student cap in the second half of this year.

Surprising Number of Consumers Unaware of Key Considerations

There are many things home buyers and sellers need to know if they are considering buying or selling a tenanted property in Ontario.

WATCH NOW: John explains what you need to know about tenanted properties

Today, I will touch on some common misconceptions and the different scenarios that buyers and sellers might encounter when dealing with tenanted properties.

Let's start by clarifying a misconception many landlords have.

Many landlords I speak with believe they can give their tenants notice to vacate if they want to sell their property. Selling a property does not grant a landlord the right to evict a tenant, and sellers who try this are starting off their sale process on the wrong foot.

For sellers who would like their tenant to move out as part of their sale process, there are two approaches they can take.

The first approach is to list their property for sale while it's tenanted and then provide the tenant notice to vacate if the Buyer wants to move into the home for their use. In this situation, the seller would serve their tenant with a form called an N12 Form- Notice to End your Tenancy Because the Landlord, a Purchaser or a Family Member Requires the Rental Unit.

In Ontario, a tenant can be evicted if the owner of the home or the buyer of a home wants to move into the property for their or their use. But it's worth noting that this only applies to month-to-month tenancies. If the tenant is currently within the term of a lease, the seller would have to wait for the lease to end and for the tenancy to roll over to a month-to-month tenancy.

The other approach is for sellers to negotiate with their tenants to mutually agree to end the tenancy by signing an N11 Form - Agreement to End the Tenancy. For a landlord to persuade the tenant to sign an N11, they typically need to compensate the tenant - something often referred to as Cash for Keys.

Now that we have the basic rules figured out, I will walk you through both scenarios in more detail and discuss the pros and cons of each scenario from buyers' and sellers' perspectives.

Before COVID, most landlords who had a tenanted property would typically list their property for sale with the tenant still occupying it.

When buyers make an offer, they include a clause in the agreement of purchase and sale that requires the seller to give the tenant the N12 notice so the buyer can move into the home for their use. The buyer would also typically sign a declaration that confirms they intend to move into the property for their use.

The seller must give the tenant at least two full months' notice and needs to compensate the tenant one month's rent.

One important thing about N12 notices is that the tenant has the right to dispute the notice with the Landlord Tenant Board if they disagree with the notice.

For this reason, when an N12 notice clause is included in an agreement of purchase and sale for the sale of a home, it is common to include a clause that says that if the tenant does not move out by the time that the Buyer is scheduled to take possession - the Buyer agrees to assume the tenant.

Before COVID, Buyers rarely had any concerns with these clauses because it was rare for a tenant not to move out when given the proper notice. But a lot has changed over the past four years.

During COVID, some tenants felt more empowered and refused to move out in these situations. They effectively decided to squat and dispute the notices with the Landlord and Tenant board, knowing it could take many months for their case to be heard because of the backlog at the LTB. Which means it would take months before they are forced to move out.

The other factor that led more tenants to refuse to vacate is the rapid increase in rents in the Toronto area. Tenants paying below-market rents would have difficulty finding another apartment in the same price range.

So, in this situation, if the tenant does not move out by the closing date, the Buyer would be responsible for having the tenant evicted through the Landlord and Tenant Board.

Now, let's go through some of the pros and cons of the N12 process from both sellers' and buyers' perspectives.

The seller's property can remain fully tenanted throughout the sale process, and the seller does not need to worry about negotiating a cash-for-keys deal with the tenant to sign an N11.

On the flip side, tenanted properties usually sell for less than untenanted properties for several reasons. Tenanted homes typically don't present as well as homes that have been staged and styled to be as attractive as possible to the average Buyer. Tenanted properties are often more challenging for buyers to view if the tenant is not cooperating with showings. Finally, for some buyers, a tenanted home isn't even an option because of the risk that the tenant may not move out on closing.

It's worth noting that in some cases, the Buyer may ask to be compensated on closing if the tenant refuses to move out.

One advantage for buyers is that they can often get more value when buying a tenanted property. This might be a good option for someone currently renting who can wait to see if the tenant has moved out before giving notice to vacate their rental.

The downside is that if the tenant does not move out, you must go through the eviction process at the Landlord Tenant Board. Buyers can ask for a reduction in the sale price if the tenant refuses to move out. Hiring a good paralegal can help speed up the eviction process.

Unlike the N12 process just discussed, which is a notice that the tenant can dispute. The N11 is an agreement between the tenant and the landlord to end the tenant's tenancy.

When I'm representing sellers, I always advise them to try to negotiate the terms to an N11 with their tenant upfront before they list their property for sale because this issue will likely come up, so it's better to be proactive about it.

There are one of two approaches to negotiating an N11 agreement with your tenant.

The first approach is to sign an N11 so the tenant can move out of the unit before a seller lists their property for sale. Under such a scenario, we would typically make some improvements to the property, including painting it, and the property would be fully staged to maximize the sale price.

The other option is to negotiate the basic terms of the N11, including the compensation to the tenant and how much notice the tenant will receive should the purchaser request a signed N11. I should mention that many of today's buyers who intend to move into the home for their use request a signed N11 rather than relying on an N12 notice because the Buyer is more confident that the tenant will move out with a signed N11.

Under this scenario, the tenant remains in the unit during the sale process and would only sign an N11 with the previously agreed-upon terms if the Buyer requires it. If the Buyer wants to assume the tenant, then the N11 will not be signed, and the tenant will continue to occupy their unit.

But negotiating an N11 agreement is sometimes easier said than done. Sellers often feel like they shouldn't have to compensate the tenant anything. In contrast, the tenants are faced with the prospect of paying a lot more for a smaller unit, so it is understandable to ask for more money than the landlord is often willing to pay.

The right amount of compensation often depends on several factors, including the length of the tenant's tenancy and their current rent relative to market rents.

But if the tenant refuses to sign an N11 agreement, the Seller would have to list the property with the tenant and would market the home to a buyer who is willing to accept the tenant, or is comfortable with an N12 notice. In this scenario, may even compensate the Buyer should the tenant refuse to move out on closing.

Now, let's go through some of the pros and cons of the N11 process from both sellers' and buyers' perspectives.

Suppose you can achieve a higher sale price by painting and staging your property. In that case, it's in your interest to negotiate an N11 agreement with your tenant and have them vacate before you begin marketing the property for sale. In most cases, a vacant property will sell for more than a tenanted property.

Even if you don't want the tenant to move out immediately, agreeing to the basic terms of an N11 will ensure your sale process is much smoother because most buyers today are asking for a signed N11 rather than an N12 notice.

The downside is that you'll have to spend some money to compensate your tenant.

You can be far more confident that the tenant will move out by the closing date if they have signed an N11.

There is still a slim chance that the tenant will not move out, but this is less common when tenants sign an N11. You can try to include a clause requiring the Seller to compensate you if the tenant fails to move out on closing.

House sales (low-rise freehold detached, semi-detached, townhouse, etc.) in the Greater Toronto Area (GTA) in January 2023 were up 33% compared to the same month last year.

New house listings in January were unchanged compared to last year.

The number of houses available for sale (“active listings”) was up 18% in January compared to the same month last year.

The Months of Inventory ratio (MOI) looks at the number of homes available for sale in a given month divided by the number of homes sold in that month. It answers the following question: If no more homes came on the market for sale, how long would it take for all the existing homes on the market to sell, given the current level of demand? The higher the MOI, the cooler the market is. A balanced market (a market where prices are neither rising nor falling) is one where MOI is between four to six months. The lower the MOI, the more rapidly we would expect prices to rise.

While the current level of MOI gives us clues into how competitive the market is on-the-ground today, the direction it is moving in also gives us some clues into where the market may be heading.

The MOI for houses dipped to 2.3 in January, down from 4 MOI in October.

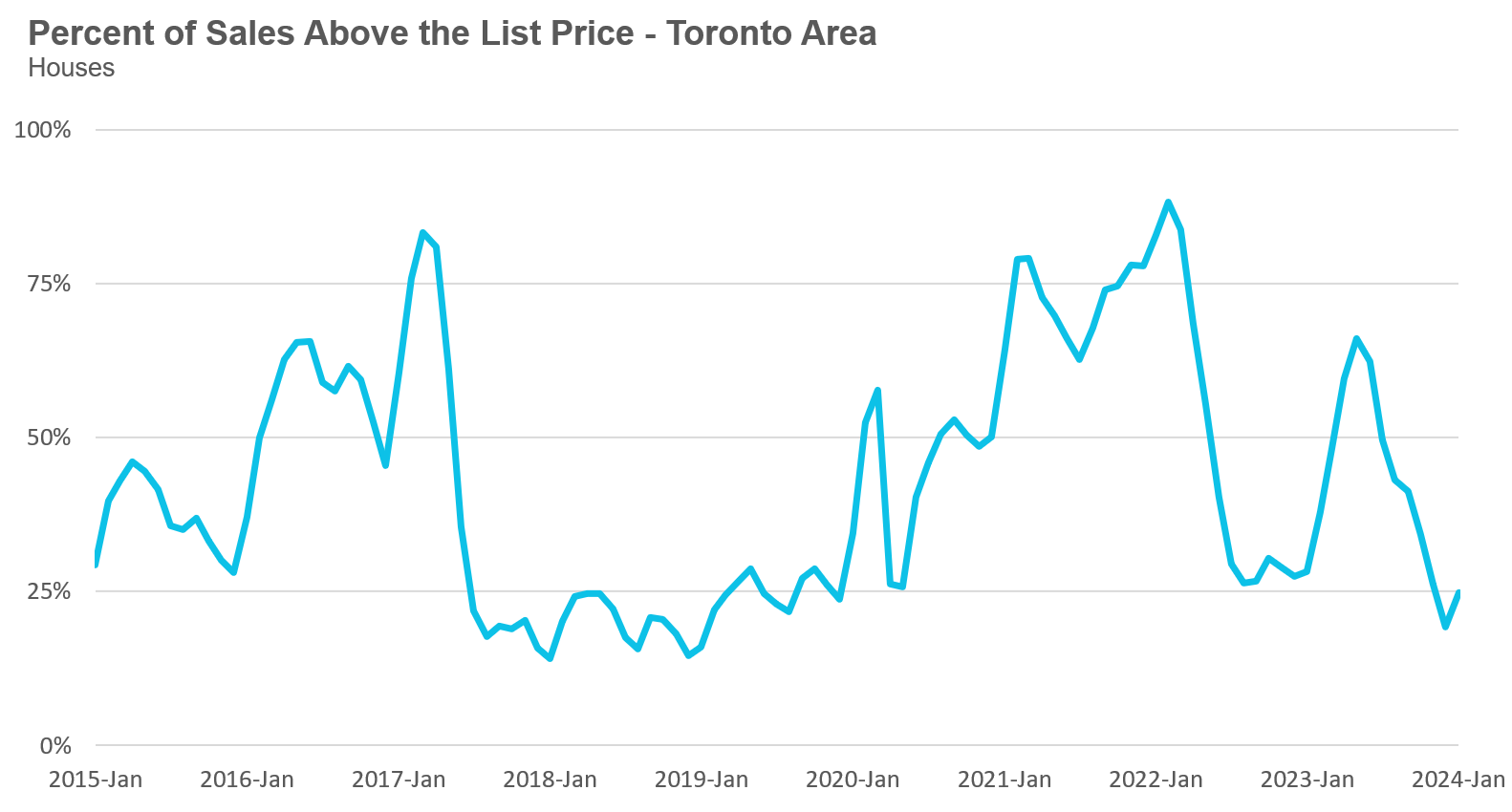

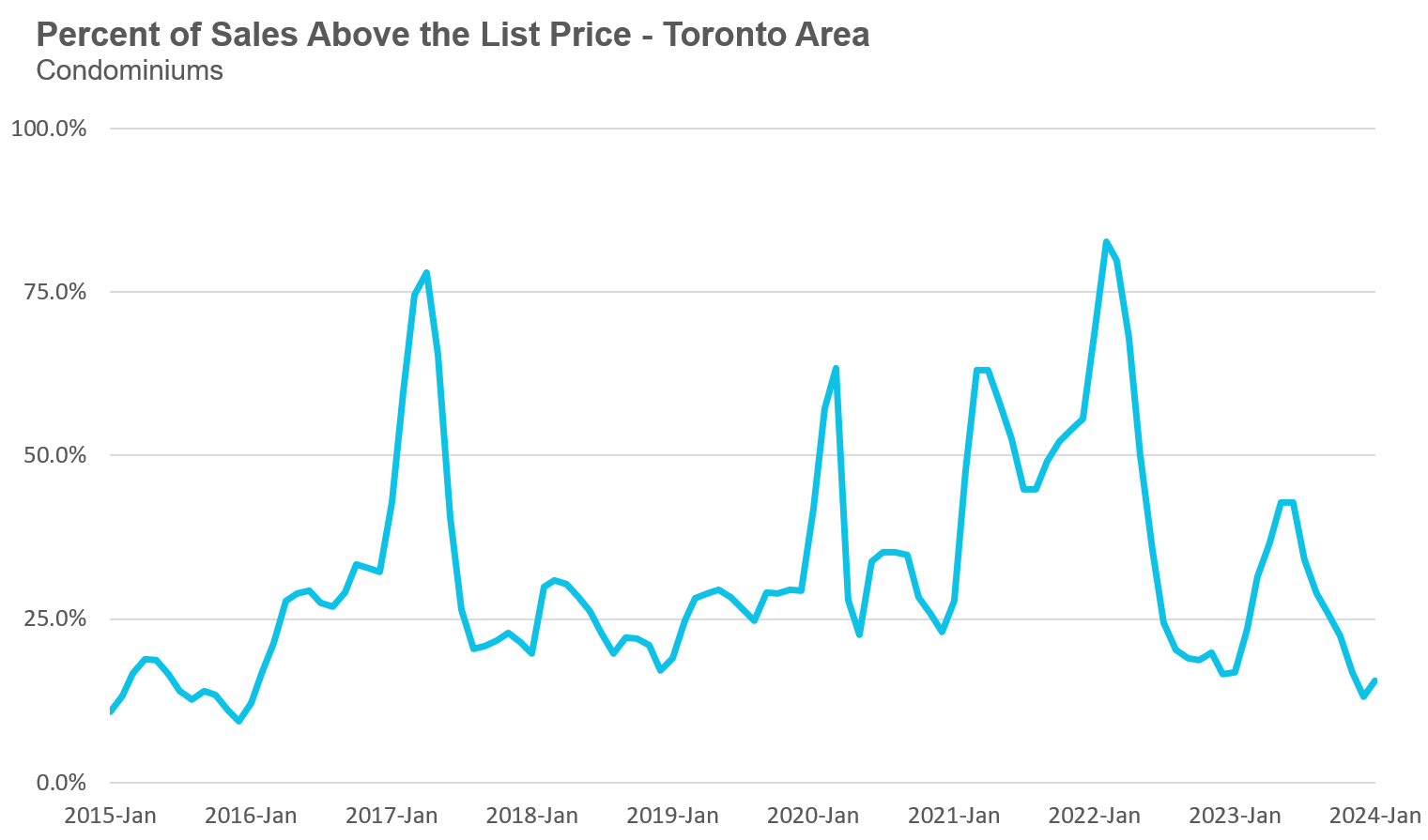

The share of houses selling for more than the owner’s list price increased to 25% in January.

The average price for a house in January was $1,260,727 in January 2024, down 1% compared to the same month last year.

The median house price in January was $1,100,000, down 1% over last year.

The median is calculated by ordering all the sale prices in a given month and then selecting the price that is at the midpoint of that list such that half of all home sales are above that price and half are below that price. Economists often prefer the median price over the average because it is less sensitive to big increases in the sale of high-end or low-end homes in a given month, which can skew the average price.

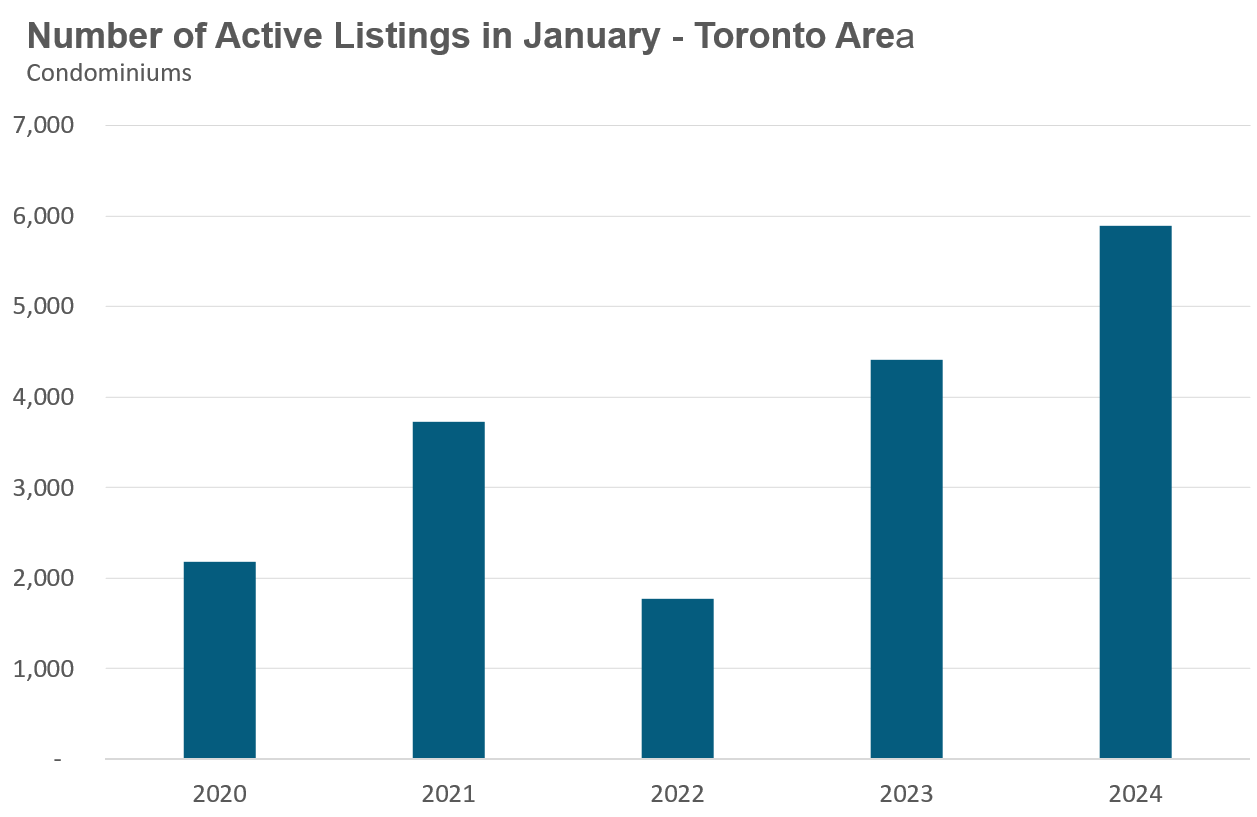

Condo (condominiums, including condo apartments, condo townhouses, etc.) sales in the Toronto area in January 2023 were up 40% over the same month last year.

New condo listings were up 17% in January over last year.

The number of condos available for sale at the end of the month, or active listings, was up 33% over last year.

Condo months of inventory decreased slightly to 3.6 MOI in January.

The share of condos selling for over the asking price increased to 16% in January.

The average price for a condo in January was $704,982, unchanged over last year. The median price for a condo in January was $633,000, down 1% over last year.

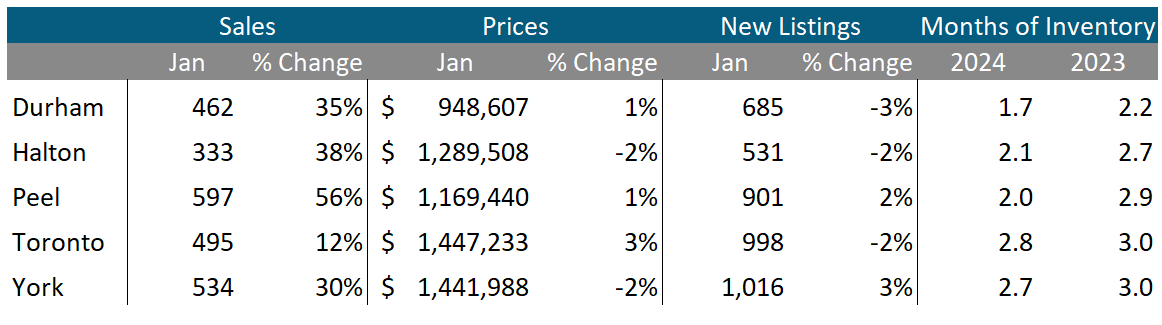

All five regions saw sales increases in January over last year. Peel saw the biggest increase in sales, up 56% over last year, while Toronto saw just a 12% increase. Three of the five regions saw new listings decline in January, while the MOI was down in all five regions over last year.

Average house prices were up in Durham, Peel and Toronto and down in York and Halton regions.

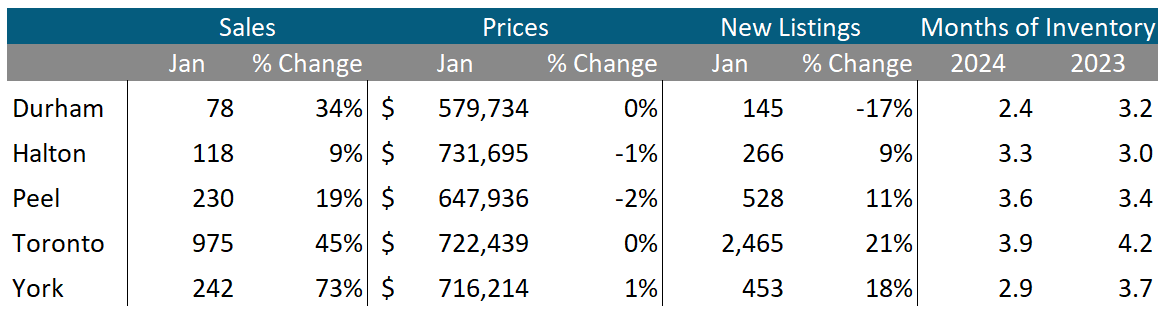

Condo sales were up in all five regions in January, with York seeing the biggest increase, up 73% over last year. Average prices were down in Halton and Pell, unchanged in Durham and Toronto and up slightly in York. The MOI is below last year’s level in Durham, Halton and York and up slightly in Halton and Peel.

Have more specific questions about your own real estate decisions? Book a no-obligation consultation

Learn more at https://www.movesmartly.com/meetjohn