Author John Pasalis is the President of Realosophy Realty, a Toronto real estate brokerage which uses data analysis to advise residential real estate buyers, sellers and investors. He is a top contributor at Move Smartly, a frequent commentator in the media and researcher cited by the Bank of Canada and others.

LIVE MARKET UPDATE: WATCH REPORT HIGHLIGHTS & Q/A

.jpg?width=600&height=337&name=Public%20Webinar%20Social%20%E2%80%93%20Dec%202023_YouTube%20(1).jpg)

Join John Pasalis, report author, market analyst and President of Realosophy Realty, in a free monthly webinar as he discusses key highlights from this report, with added timely observations about new emerging issues, and answers your questions. A must see for well-informed Toronto area real estate consumers.

In my Move Smartly report for last month, I discussed some early signs that Toronto’s housing may be turning a corner, and the latest statistics for December did reveal some signs of improvement over previous months.

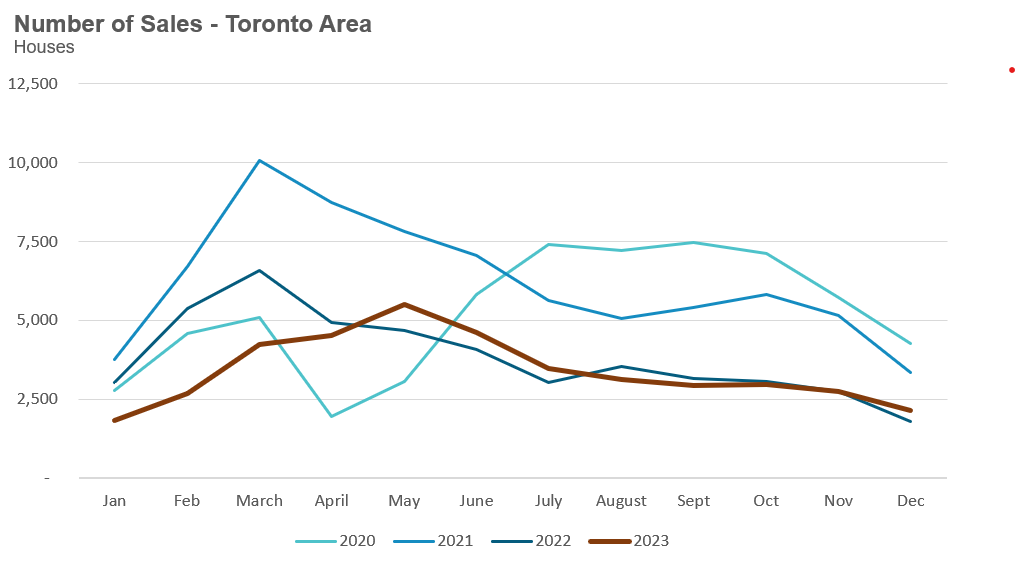

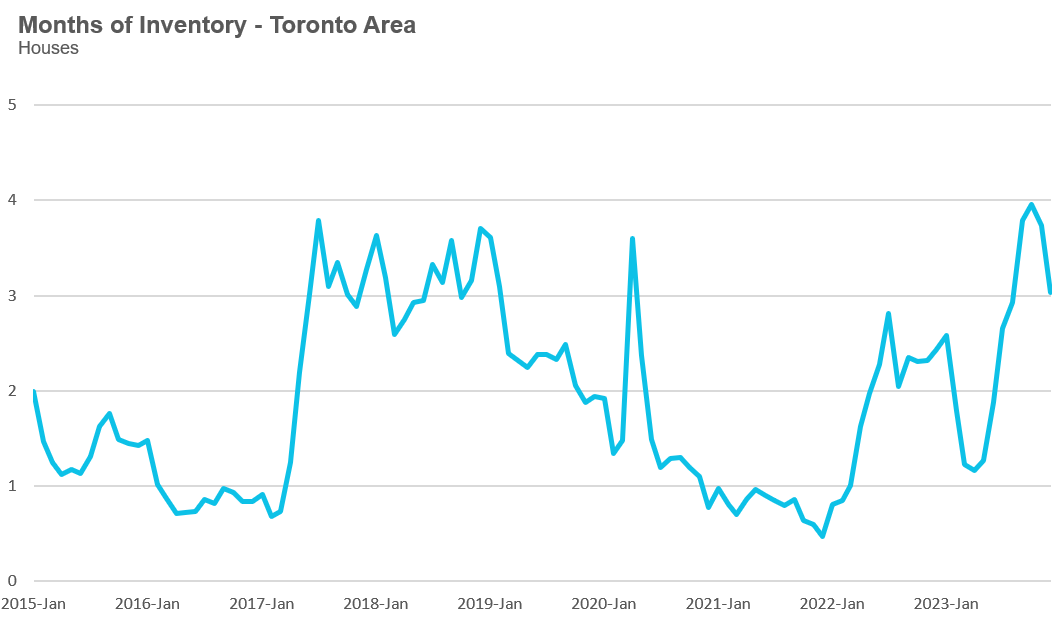

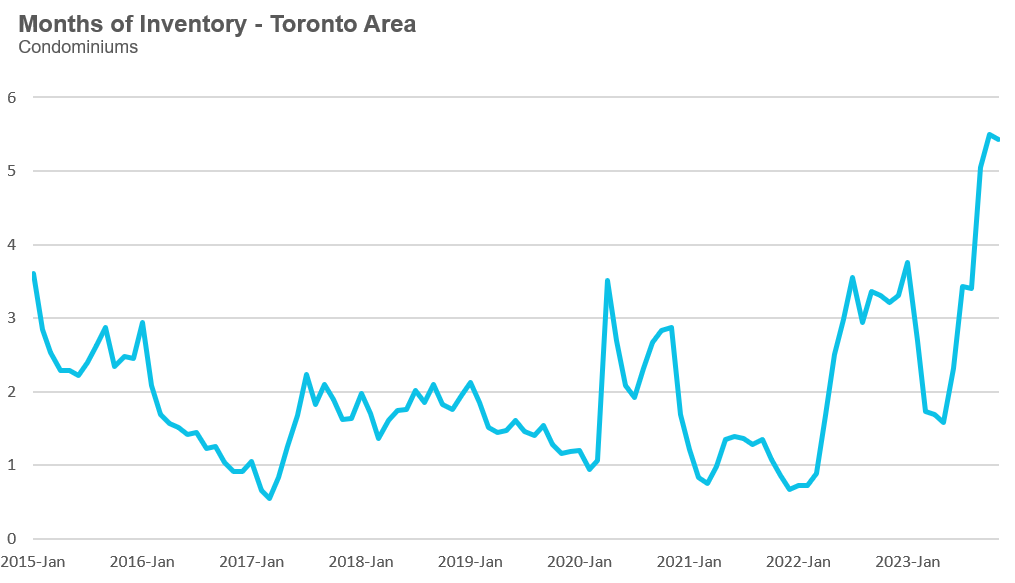

House sales were up 20% over the previous year, and the Months of Inventory (MOI), declined to 3 in December. The condo market did not see much of a rebound, with sales down slightly over last year and MOI relatively flat.

A full breakdown of the monthly statistics for December 2023 can be found below.

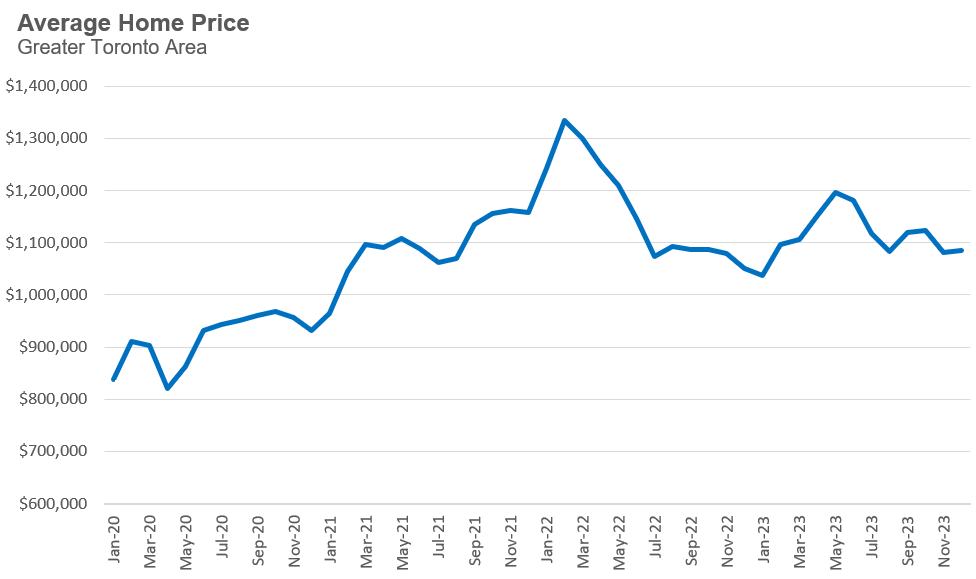

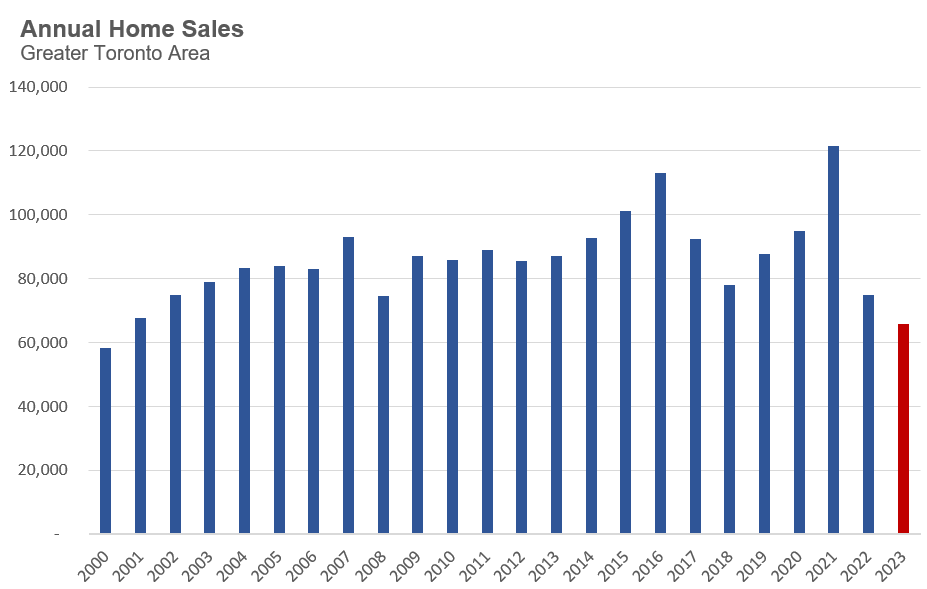

Overall, the Greater Toronto Area (GTA’s) housing market experienced a rollercoaster market in 2023. This time last year, most housing analysts (including this one) expected Toronto’s housing market in 2023 to be challenging due to the spike in interest rates over the previous twelve months.

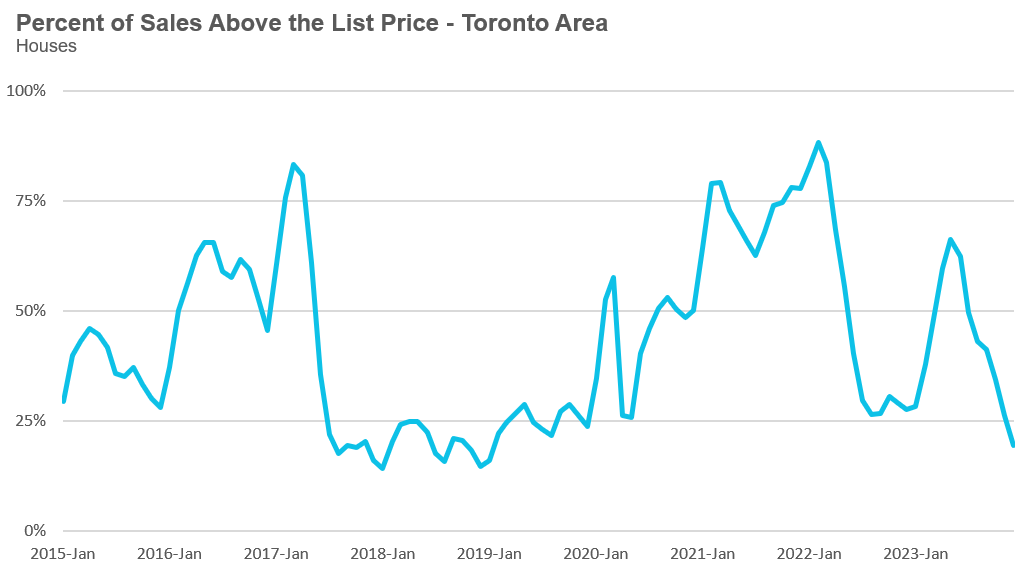

But Toronto’s housing market surprised everyone when the first half of the year saw an increase in the number of homes receiving multiple offers and average home prices. This surge in demand during the first half of 2023 was partly due to the Bank of Canada signalling in January that they may be done raising interest rates. A signal that subsequently proved to be poorly timed and incorrect.

This signal, combined with a decline in fixed mortgage rates due to the collapse of Silicon Valley Bank in the US, pushed more buyers back into the market.

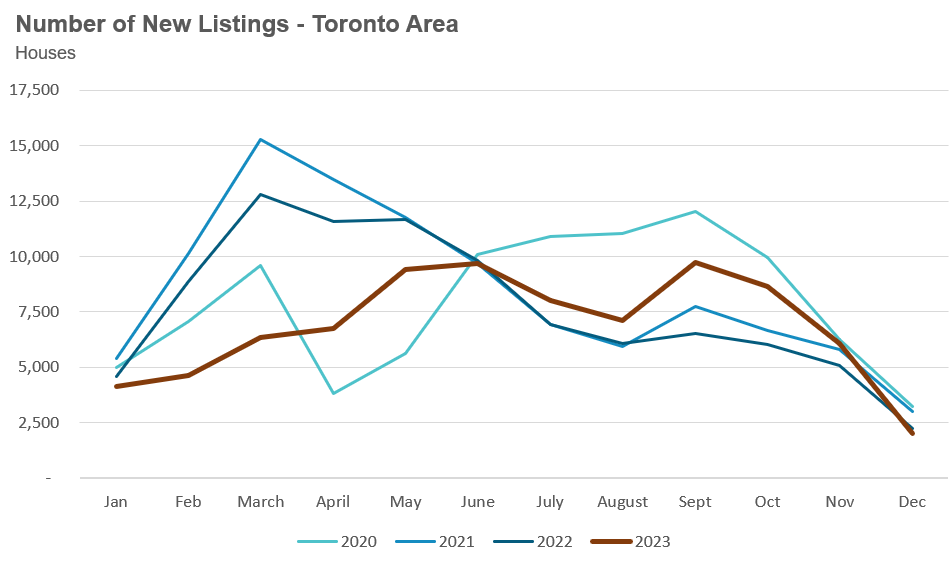

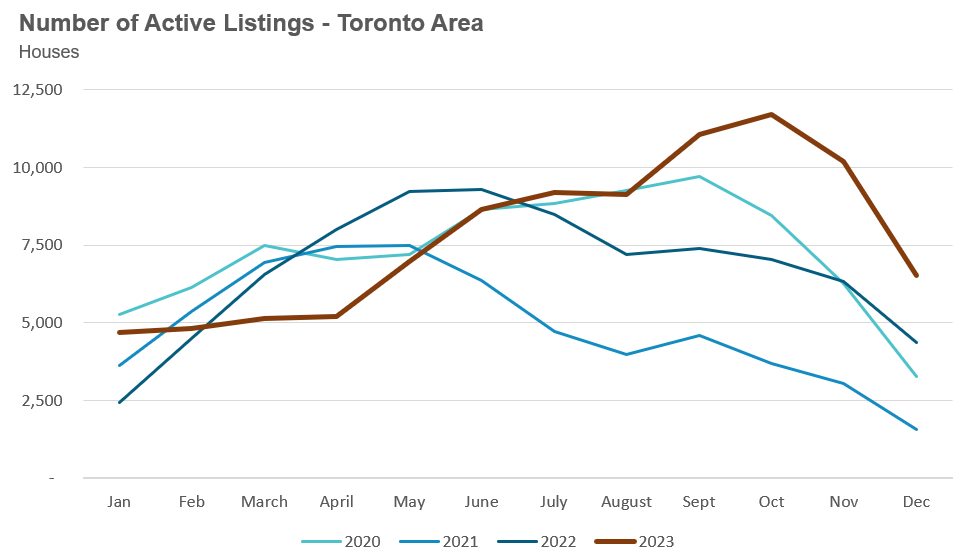

But as buyers rushed back into the market, home sellers decided to move to the sidelines.

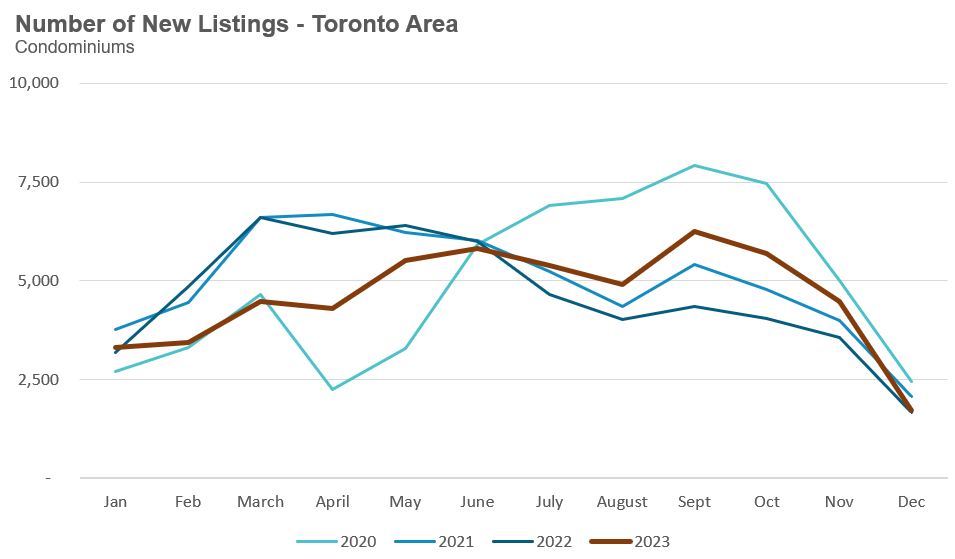

For much of the first half of 2023, new listings were approaching 20-year lows. The dearth of new listings contributed to the tight market conditions that saw home prices rise during the first half of 2023.

But in June, the Bank of Canada decided to increase their policy rate again, signalling to buyers that rates are likely to stay higher for longer. This helped push fixed mortgage rates into the mid to high 6% range, which pushed many buyers back to the sidelines. The housing market went from fiercely competitive to a ghost town in just a few weeks.

Buyers disappeared.

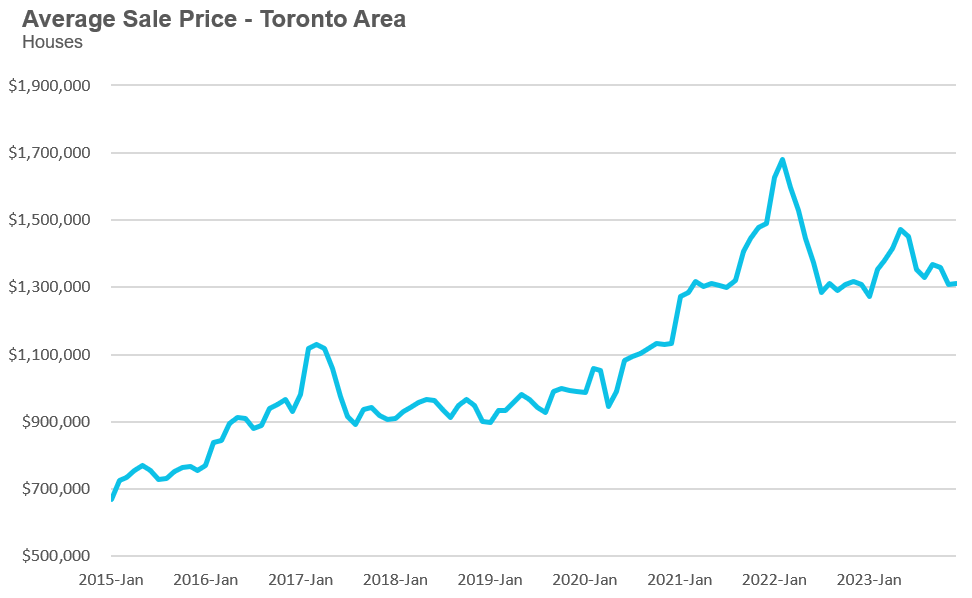

This decline in the demand for homes pushed average home prices back down in the second half of 2023, erasing the gains from the year's first half.

The GTA’s housing market ended the year with the lowest number of home sales in over 20 years.

The average price for a house in the Toronto area was $1,310,068 in December, unchanged over the same month last year. Last month's median house price was $1,101,000, also unchanged over last year.

House sales in December were up 20% over last year, while new house listings were down 10%.

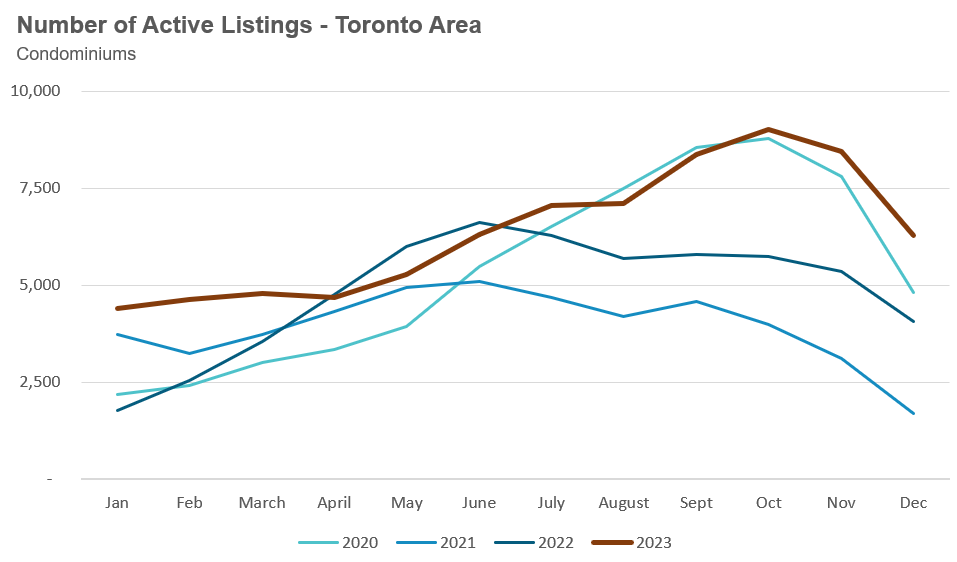

The number of houses available for sale at the end of the month, or active listings, was up 49% over last year.

The current balance between supply and demand is reflected in the Months of Inventory (MOI), which is a measure of inventory relative to the number of sales each month. In December, the MOI for houses fell to 3.

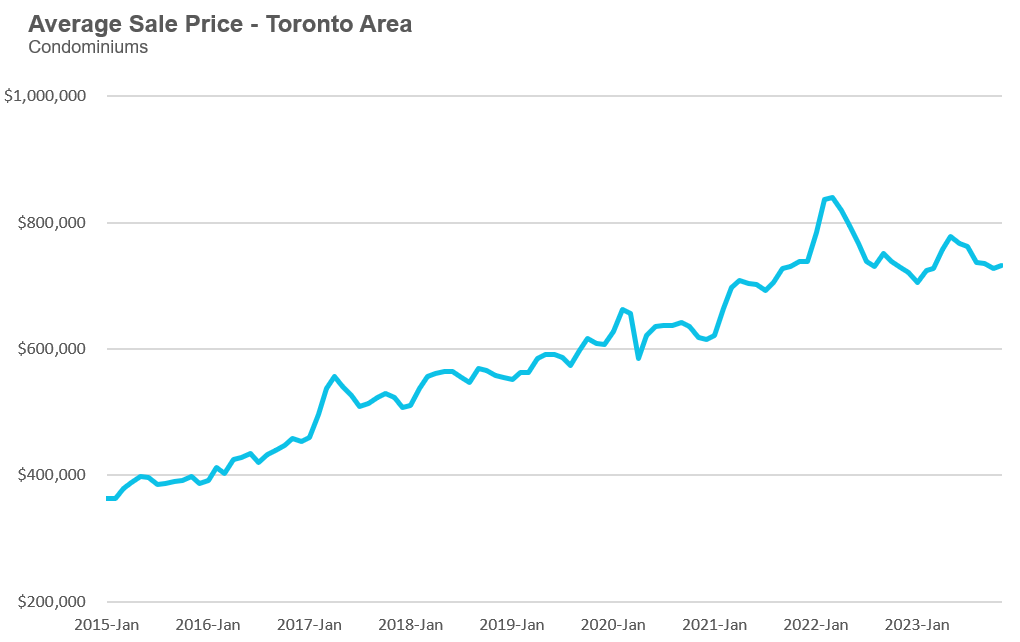

The average price for a condo in the Toronto Area was $708,109 in December, which is unchanged over last year. The median price for a condo in December was $640,000, also unchanged over last year.

Condo sales in December were down 3% over last year, and new condo listings were up 3% over last year. The number of active condo listings was up 54% over last year. The MOI decreased slightly to 5.2.

Browse detailed monthly statistics for December 2023 for the entire Toronto area market, including house, condo and regional breakdowns below.

Why did our federal government ignore the warnings if the impact of Canada’s high population growth on housing was so obvious?

A report by the Canadian Press revealed that federal public servants warned the federal government two years ago that population growth has exceeded the growth in available housing and was putting pressure on healthcare and affordable housing.

Since that time, Canada’s population has surged from just over 400K people per year to just under 1.2 million people per year, and as expected, housing costs have surged.

So why did our federal government ignore the warnings if the impact of Canada’s high population growth on housing was so obvious?

If one looks back at the reports and op-eds from leading housing and bank economists at that time, one will find that the impact of high immigration on housing was not so obvious.

Most housing economists at that time observed Canada’s booming population, but concluded that this wasn’t the key driver of rising home prices.

The key driver of rapidly rising home prices, according to the experts, was a “lack of supply” driven by municipal inefficiencies and zoning restrictions. This incidentally continues to be the argument Canada’s federal government and Conservative Party leader Pierre Poilievre continue to put forward in his "Housing Hell" video which he released back in December.

I suspect that one of the reasons Canadian housing economists have been arguing that high housing costs are driven by a lack of supply is that this is the dominant academic theory today.

The theory is that high home prices are not caused by high levels of demand, but by municipal zoning restrictions that restrict the supply of new housing. And if cities allowed builders to build more homes – house prices would only rise at the rate of construction costs.

Last year, I wrote about some of the misguided academic theories that have been dominating the housing discourse in Canada and why I believe that Canada’s population boom was the primary driver of rapidly rising home prices.

The one big takeaway from the above Canadian Press article is that the arguments put forward by economists regarding our country’s leading economic issues really matters.

Had housing economists correctly argued years ago that Canada’s housing supply cannot and will not keep up with our government’s booming population growth targets and that housing costs were going to surge – citizens could have held our government to account as the problem grew - not now, when the damage has been done.

Now that most economists, including supply-centric housing economists, are slowly starting to argue that the demand for housing actually matters and that this crisis cannot be solved with a singular focus on supply – our politicians are not listening.

As long as the institutions that we rely on to hold governments to account - including academia, business and economic institutions, and the media - fail to accurately criticize the government's impossible solutions for our housing affordability crisis, expect the crisis to continue - and grow.

House sales (low-rise freehold detached, semi-detached, townhouse, etc.) in the Greater Toronto Area (GTA) in December 2023 were up 20% compared to the same month last year.

New house listings in December were down 10% over last year.

The number of houses available for sale (“active listings”) was up 49% in December compared to the same month last year.

The Months of Inventory ratio (MOI) looks at the number of homes available for sale in a given month divided by the number of homes sold in that month. It answers the following question: If no more homes came on the market for sale, how long would it take for all the existing homes on the market to sell, given the current level of demand? The higher the MOI, the cooler the market is. A balanced market (a market where prices are neither rising nor falling) is one where MOI is between four to six months. The lower the MOI, the more rapidly we would expect prices to rise.

While the current level of MOI gives us clues into how competitive the market is on-the-ground today, the direction it is moving in also gives us some clues into where the market may be heading.

The MOI for houses dipped to 3 in December, down from 4 MOI in October.

The share of houses selling for more than the owner’s list price decreased to 19% in December.

The average price for a house in December was $1,310,068 in December 2023, unchanged compared to the same month last year.

The median house price in December was $1,101,000, unchanged over last year.

The median is calculated by ordering all the sale prices in a given month and then selecting the price that is at the midpoint of that list such that half of all home sales are above that price and half are below that price. Economists often prefer the median price over the average because it is less sensitive to big increases in the sale of high-end or low-end homes in a given month which can skew the average price.

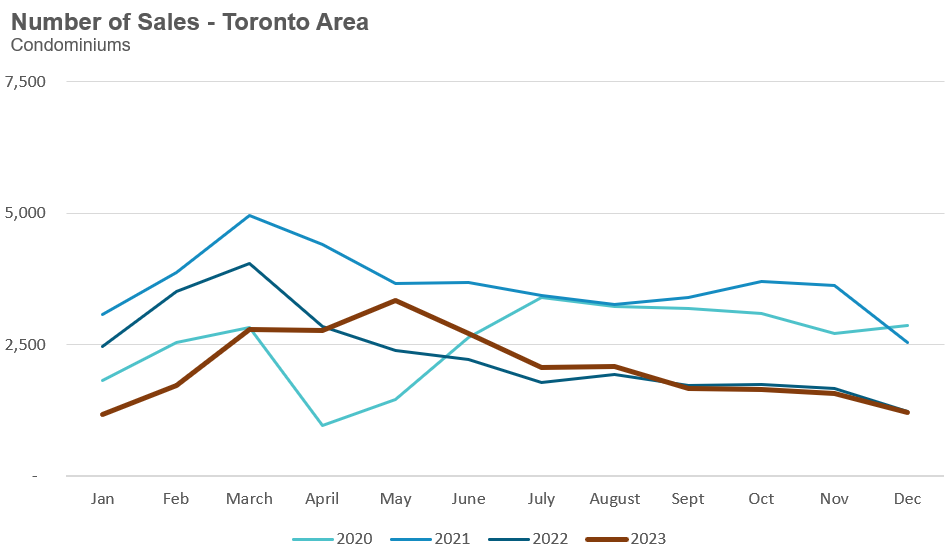

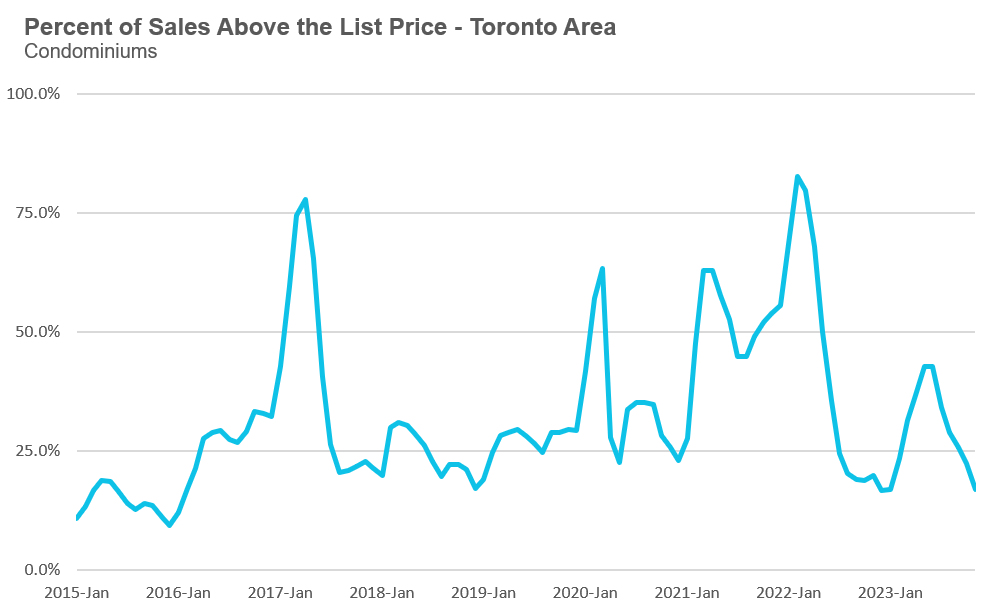

Condo (condominiums, including condo apartments, condo townhouses, etc.) sales in the Toronto area in December 2023 were down 3% over the same month last year.

New condo listings were up 3% in December over last year.

The number of condos available for sale at the end of the month, or active listings, was up 54% over last year.

Condo months of inventory decreased slightly to 5.2 MOI in December.

The share of condos selling for over the asking price declined to 13% in December.

The average price for a condo in December was $708,109, down 2% over last year. The median price for a condo in December was $640,000, down 1% over last year.

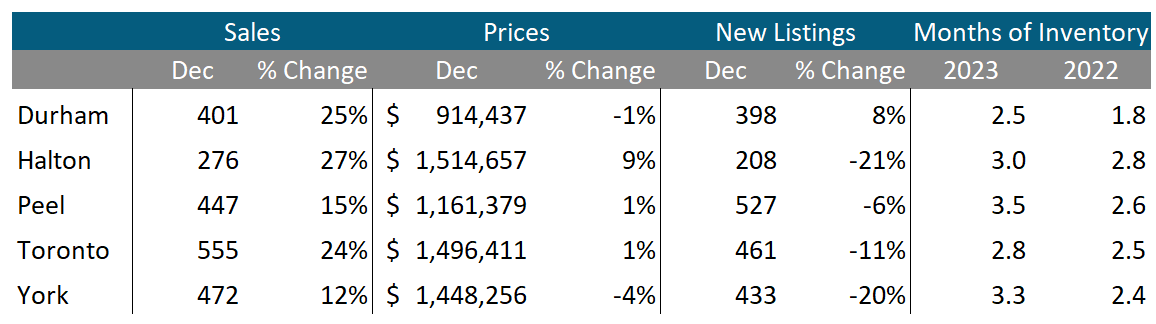

All five regions saw sales increases in December over last year. Four of the five regions saw a new listings decline in December while the MOI was up in all five regions over last year.

Average house prices were up in Halton, Peel and Toronto and down in York and Durham regions.

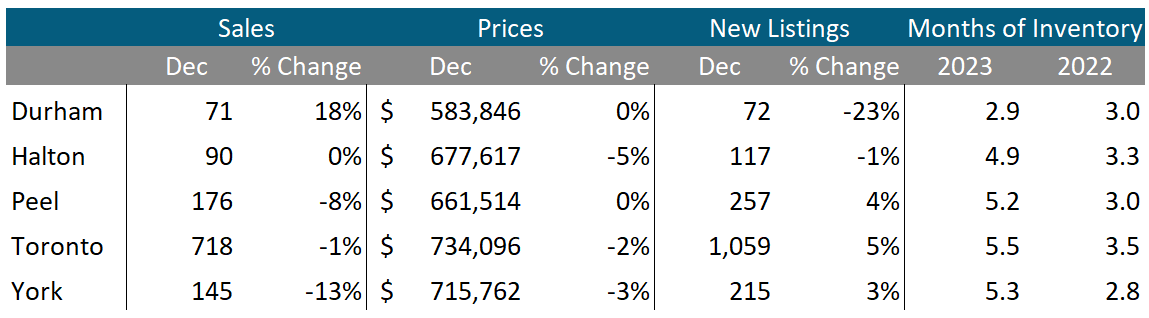

Condo sales were down in Peel, Toronto and York, while Durham saw sales increase over last year. Average prices were down in York, Toronto and Halton and flat in Peel and Durham. The MOI is above last year’s level, indicating a cooler market for condos this year.

Have more specific questions about your own real estate decisions? Book a no-obligation consultation

Learn more at https://www.movesmartly.com/meetjohn