Author John Pasalis is the President of Realosophy Realty, a Toronto real estate brokerage which uses data analysis to advise residential real estate buyers, sellers and investors. He is a top contributor at Move Smartly, a frequent commentator in the media and researcher cited by the Bank of Canada and others.

Sales numbers remain extremely low, but are matched by low listing levels, resulting in prices holding month-to-month, though down from peak.

With the change in sales outpacing the change in new listings by a margin of 2:1, competition is strong.

The impact of high interest rates is being off-set by allowing mortgage amortizations to be extended and even become negative.

House prices in the Greater Toronto Area peaked in February 2022 - here's where they are at one year later.

Sales numbers remain extremely low, but are matched by low listing levels, resulting in prices holding month-to-month, though down from peak.

FREE PUBLIC WEBINAR: WATCH REPORT HIGHLIGHTS & Q/A - Thursday March 16th 12PM ET

Join John Pasalis, report author, market analyst and President of Realosophy Realty, in a free monthly webinar as he discusses key highlights from this report, with added timely observations about new emerging issues, and answers your questions. A must see for well-informed Toronto area real estate consumers.

The Market Now

Toronto’s housing market has started 2023 far more competitive than most people in the real estate industry were expecting. (I discuss some of these latest trends in more detail in this month’s Data Dive section below.)

Looking at the most recent monthly statistics for the Greater Toronto Area (GTA) market available, for the month ending February 2023, we’re seeing that even as sales numbers remain extremely low, the volume of new listings coming onto the market is even lower, resulting in a market where the demand for housing is actually outpacing the supply of new listings.

The average price for a house was $1,352,275 in February, down 19% from the peak in February 2022. The median house price last month was $1,179,000, down 21% from $1,485,000 in February.

It’s worth noting that the average sale price in February was up 6% over the previous month and reached its highest point since June 2022.

House sales in February were down 50% over last year while new house listings were down 48% compared to last year. The number of houses available for sale at the end of the month, or active listings, was up 7% over last year.

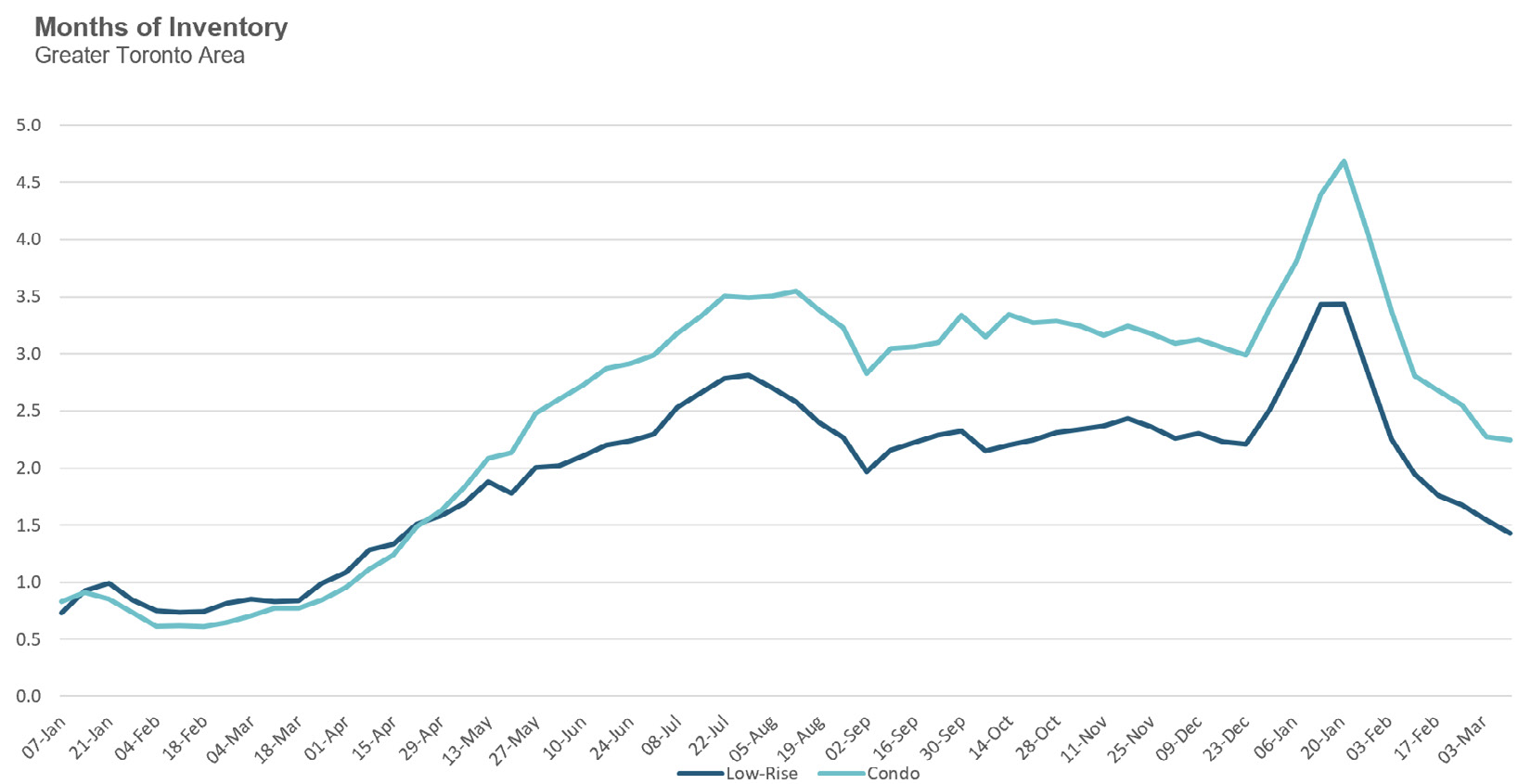

The Months of Inventory (MOI) which is a measure of inventory relative to the number of sales each month (for a more detailed explanation of this measure, see Monthly Statistics section later in this report) moved down to 1.8 MOI in February, indicating tight supply conditions.

The average price for a condominium (condo) was $723,659 in February, down 14% over last year. The median price for a condo in February was $650,000, down 16% over last year.

Condo sales in February were down 51% over last year while new condo listings were down 29% over last year. The number of active condo listings was up 83% over last year. The MOI decreased to 2.7 MOI in February, indicating that supply is slightly less constrained for condos than for houses.

For detailed monthly statistics for the entire Toronto Area, including house, condo and regional breakdowns, see the final section of this report.

With the change in sales outpacing the change in new listings by a margin of 2:1, competition is strong.

In last month’s report, I discussed the early signs I was seeing that the housing market in the Toronto area was starting the year hot. One month later, my very early interpretation of the latest data and trends appears to have been correct.

After the Bank of Canada raised its interest rate a record 425 basis points starting in March of last year, one would expect this winter’s housing market to remain soft and even see prices trend down further as the market adjusts to today’s much higher interest rates. But Toronto’s housing market is defying all expectations and is starting the year more competitive than anyone expected.

While sales remained at near 20 year lows for the month of February, new listings were at a 20-year low and the imbalance between supply and demand kept the market competitive. The month of February saw just over 1,400 more homes sell when compared to the previous month, but new listings over the same period were up by only 668.

In other words, the change in sales outpaced the change in new listings by a margin of 2:1.

Looking at a weekly measure of MOI for houses and condos, it’s been trending down rapidly to start the year and inventory levels for houses during the second week of March were at their lowest level since April 2022, and, for condos, at their lowest level since May 2022.

On the ground, we are seeing a significant increase in the number of showing requests homes are receiving once they come on the market for sale and an increase in the number of homes receiving multiple offers. During the second week of March, 44% of houses sold for more than the seller’s list price, the highest level since June 2022. The condo market is less competitive with 29% of condos selling for more than the list price.

While the vast majority of homes receiving multiple offers are selling for their market value, I have been seeing more and more homes sell for prices that are well above their market value. If this trend continues, we’ll likely see some upward pressure on prices as we move towards the spring market.

The impact of high interest rates is being off-set by allowing mortgage amortizations to be extended and even become negative.

Ever since the Bank of Canada began their aggressive rate hikes in 2022, one of the biggest concerns in the housing market was understanding how home-owning households, in particular those with variable rate mortgages, would adjust to rapidly rising interest rates.

Most Canadian banks that offer variable rate mortgages offer their mortgages with fixed payments which means the payment doesn’t change as interest rates change. The only thing that changes is the share of the payment that goes towards interest as opposed to the principal.

But eventually, if interest rates increase too rapidly, homeowners with variable rate mortgages will hit their “trigger rate”, the rate at which their mortgage payment doesn’t even cover the entire interest owed on their mortgage each month. If the homeowner doesn’t increase their mortgage payment, then the difference between the interest they owe each month and their mortgage payment gets added to their mortgage balance. This means that rather than paying down their mortgage, their mortgage balance is actually increasing each month, a scenario referred to as negative amortization.

Earlier this month, the CIBC disclosed that 20% of their mortgage borrowers are seeing their mortgage balances grow each month because their mortgage payment isn’t high enough to cover their interest owed. TD and the Bank of Montreal also allow their mortgage holders to have negative amortization mortgages, but they have not disclosed the share of mortgage holders in this scenario.

Royal Bank does not allow negative amortization mortgages and Scotiabank's variable rate mortgages have floating payments where the payment increases with every change in interest rates.

Some borrowers are increasing their mortgage payments to both cover the interest they owe each month and to pay down their principal, but they are not increasing their payments enough to maintain their original amortization schedule. When this happens, the amortization period on their mortgage, or put another way, the amount of time it would theoretically take them to pay off their mortgage given their current payment and interest rate gets longer.

The maximum amortization period on any new uninsured mortgage is 30 years, but banks are seeing a significant increase in the share of their mortgage portfolio that have amortization periods greater than 30 years.

The share of mortgage borrowers with an amortization period greater than 30 years was 32% at the Bank of Montreal, 30% at CIBC, 29% at TD and 25% at Royal Bank.

Banks allowing negative amortization on mortgages and extending amortization periods beyond 30 years has helped to soften the impact that higher rates would have otherwise have had on households and is likely one of the reasons why we are not seeing much financial distress leading to an increase in the number of listings coming onto the market for sale.

While we are of course still early in this rate hiking cycle and we will likely see more distress in the future, it’s important to remember that a homeowner or investor is typically going to try to sell their property well before they default on their mortgage. If that holds true during this cycle, then we would expect to see listings volumes gradually increase over time as distressed households and investors look to exit the market.

But we have yet to see any significant sign of that happening. And as long as banks continue to do everything they can to ensure homeowners keep their homes and avoid a default on their mortgage, the ‘distressed sellers’ category will likely be limited to the most overleveraged owners and investors.

House prices in the Greater Toronto Area peaked in February 2022 - here's where they are at one year later.

Home prices in the Greater Toronto Area peaked in February 2022. One year later, here’s how average house prices have changed by municipality.

Note: Because condo sales are concentrated in a handful of municipalities in the Toronto area, a regional comparison was less relevant and omitted from this survey.

Early trends suggest signs of renewed competition for Toronto area real estate is relatively broad-based, across types and regions.

In this month’s Data Dive, I wanted to take a closer look at how changes in the number of sales, listings and prices differ across regions and house types in the GTA during the first two months of 2023.

I’ll start by looking at trends for houses first and will follow that up with a look at the condo market.

Houses

As mentioned earlier, one of the biggest factors contributing to the competition in Toronto’s housing market is that the demand for homes right now is outpacing the supply of new listings coming on the market. We can see this by comparing how the number of sales and new listings changed from January to February.

February saw 864 more houses sell when compared to January, but new listings over the same period were up by just 520.

The chart below shows the change in the number of house sales and new listings between February and January for all five regions. Durham and Pell saw house sales eclipse new listings by more than 3 times.

The chart below shows how the Months of Inventory (MOI) for houses changed from January to February 2023 across all five regions. All five regions had less than 2 MOI in February.

All five regions saw average sale prices edge up from January to February (a typical seasonal trend) with Toronto seeing the biggest increase, up 14% in a single month. The change in the median sale price for the City of Toronto was 7%.

Condos

The condo market saw sales increase by 544 between February and January while new listings only increased by 148 units, which means that sales increased nearly 4 times as fast as the change in new listings.

The City of Toronto saw the biggest increase in sales and new listings while new listings actually declined slightly in Durham and Peel regions.

The MOI fell for all five regions in February and ended the month below 3 MOI.

Average sale prices edged up across all five regions with Halton seeing the biggest increase over January up 9% and the median price up 6%.

These early trends suggest that the signs of renewed competition for Toronto area real estate is relatively broad-based, impacting all home types and all regions in the Toronto area.

Houses - Condos - Regional Trends

House sales (low-rise freehold detached, semi-detached, townhouse, etc.) in the Greater Toronto Area (GTA) in February 2023 were down 50% over the same month last year and well below historic sales volumes for the month of February.

New house listings in February were down 48% over last year and well below historic sales volumes for the month of February.

The number of houses available for sale (“active listings”) was up 7% when compared to the same month last year, but still well below pre-Covid levels for the month of February.

The Months of Inventory ratio (MOI) looks at the number of homes available for sale in a given month divided by the number of homes that sold in that month. It answers the following question: If no more homes came on the market for sale, how long would it take for all the existing homes on the market to sell given the current level of demand?

The higher the MOI, the cooler the market is. A balanced market (a market where prices are neither rising nor falling) is one where MOI is between four to six months. The lower the MOI, the more rapidly we would expect prices to rise.

While the current level of MOI gives us clues into how competitive the market is on-the-ground today, the direction it is moving in also gives us some clues into where the market may be heading.

The MOI for houses dropped to 1.8 MOI in February.

The share of houses selling for more than the owner’s asking price increased to 38% in February.

The average price for a house in February was $1,352,275 in February 2023, well below the peak of $1,679,429 reached in February and down 19% when compared to the same month last year. It’s worth noting that the average sale price did increase over the previous month and was at its highest level since June 2022.

The median house price in February was $1,179,000, down 21% over last year, and below the peak of $1,485,000 reached in February.

The median is calculated by ordering all the sale prices in a given month and then selecting the price that is in the midpoint of that list such that half of all home sales were above that price and half are below that price. Economists often prefer the median price over the average because it is less sensitive to big increases in the sale of high-end or low-end homes in a given month which can skew the average price.

Condo (condominiums, including condo apartments, condo townhouses, etc.) sales in the Toronto area in February 2023 were down 51% over last year and well below pre-COVID sales volumes for the month of February.

New condo listings were down 29% in February over last year.

The number of condos available for sale at the end of the month, or active listings, was up 83% over last year.

Condo months of inventory levels decreased to 2.7 MOI in February.

The share of condos selling for over the asking price remained unchanged at 23% in February.

The average price for a condo in February was $723,659, down from the peak of $840,444 in March, and down 14% over last year. The median price for a condo in February was $650,000, down 16% over last year, and down from the March peak of $777,000.

Houses

This month, we are comparing sales and price trends against the peak in February 2022 and we can see that Durham region saw the biggest drop in average price, down 28% while average prices in Toronto are down by just 15%. Sales were down significantly across all regions and inventory levels were well ahead of last year’s level.

Condos

Average condo prices saw the biggest year-over-year decline in Durham region with Halton showing a decline of just 8% compared to last year. Sales were down significantly across all regions and inventory levels were well ahead of last year’s level.

See Market Performance by Neighbourhood Map, All Toronto and the GTA

Greater Toronto Area Market Trends