John Pasalis in Toronto Real Estate News and Condo Buying

If you’re a condo buyer in Toronto it’s certainly tough to make sense of what’s really happening in the market. In the same day one can read a story about the condo market being on solid ground thanks largely to the strong demand for condo rentals followed by a story about the condo boom coming apart at the seams.

I thought it would be worthwhile to expand on a post I wrote last month on the condo market, this time taking a closer look at actual numbers to give readers a better picture of what has actually been happening in Toronto’s condo market over the past year.

While most mainstream media outlets focus on reporting changes in sales and average prices there’s actually a more important metric that gives us a more accurate picture of how balanced the market is. The sales-to-inventory ratio is one of the key metrics we use when analyzing the market because it takes both supply and demand into account giving us a more accurate picture of how balanced the market is.

To see how this works, imagine that 500 condos sold in April and at the end of the month there were 1,000 condos available for sale. In this case the ratio of sales (500) to inventory (1000) would be 50%. This level of balance between supply and demand is roughly what we are seeing in Toronto’s freehold market. There are not enough homes coming on the market for sale to meet the demand from buyers. This is why we are still seeing a lot of bidding wars for Toronto houses.

Now imagine in May sales dropped to 100 and there were still 1000 condos available for sale at the end of the month. In this scenario the ratio of sales (100) to inventory (1000) would be 10%. This level of balance between supply and demand is similar to what we are seeing in many US cities. Weak demand relative to the number of properties available for sale.

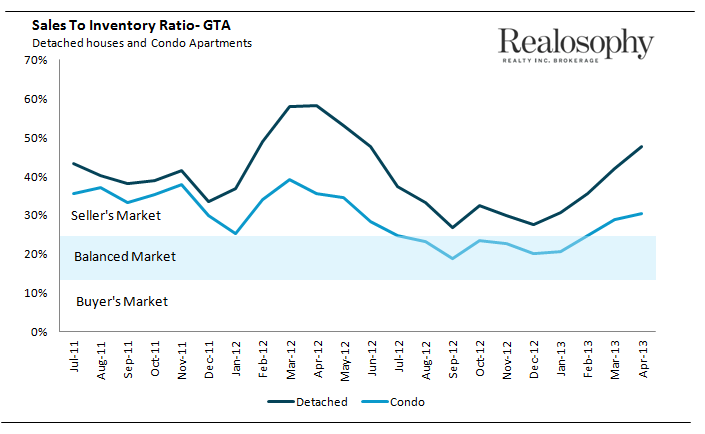

The market is considered to be balanced when the sales-to-inventory ratio is between 15%-25%. Anything above 25% favours sellers and below 15% is a buyer’s market.

The chart below shows the sales-to-inventory ratio for detached houses and condo apartments in the Greater Toronto Area.

We can see that 2012 started off strong but by April the market started to slow down pretty rapidly. In September 2012 condo sales were down 29% and the sales-to-inventory ratio hit 19%. More importantly, since then we can see that the sales-to-inventory ratio for both housing types has been trending up.

This is important because if a market is in a state of decline, if there are way too many condos coming on the market for sale relative to demand, we would expect the sales-to-inventory ratio to trend down towards buyer’s market territory not up into seller’s market territory. While we did see a downward trend in 2012, much of that was driven by changes to Canada's mortgage rules which came into effect that summer pushing many buyer's out of the market temporarily.

In late 2012 when condo sales were down nearly 30% for several months, there were a fair number of headlines about the start of the decline in Toronto’s condo market. It’s encouraging to see the market swing back into seller’s market territory so quickly showing that the market for condos in Toronto remains balanced.

While the condo market as a whole appears to be doing well in Toronto, I can’t say that all neighbourhoods are performing equally well.

One of the things we do at Realosophy is look at sales metrics like the sales-to-inventory ratio at the neighbourhood level to help our clients understand how balanced the resale market is in each area. If the resale market is already pretty competitive and there are relatively few new condos under construction then you’re probably making a good investment buying in that area. On the flipside, if the resale market in a particular neighbourhood is currently in buyer’s market territory and there are thousands of units currently under construction nearby, you may want to avoid that area.

It’s fine to look at market statistics at the city level if you want a good overall feel for how the market is performing but if you’re actually looking at buying a condo and you want to make an informed decision you need to look at the market statistics for the neighbourhood and condo you’re buying in.

John Pasalis is the President and Broker of Realosophy

Realty Inc. Brokerage in Toronto. A leader in real estate analytics and

pro-consumer advice, Realosophy helps clients buy or sell a home the

right way. Email John

Related article

Toronto's Condo Market - Bubble or Balanced?

Why Flaherty's policies are hurting Toronto's condo market

New Realosophy Workshop Alert!

Since I started writing about Toronto’s real estate market from a

consumer’s perspective nearly six years ago, I have heard from many

buyers who have run into problems with their home purchase.

Unfortunately, many buyers contact me when things have already gone

wrong, but I have done my best to advise them on how to best manage

their situation.

I’ve consolidated all of these "lessons learned" into a list of Top 10

Pitfalls that Every Home Buyer Should Know. We’ll be running our first

workshop in a couple of weeks to share the Top Ten Pitfalls and answer

your specific questions. Sign up below to reserve a spot or learn more.