In spite of three months of economic free fall due to COVID-19, the Toronto real estate market seems to be returning to its pre-pandemic vigour.

Click on the video below to watch my update this - recap follows below. As always, I welcome your questions and comments at askjohn@movesmartly.com

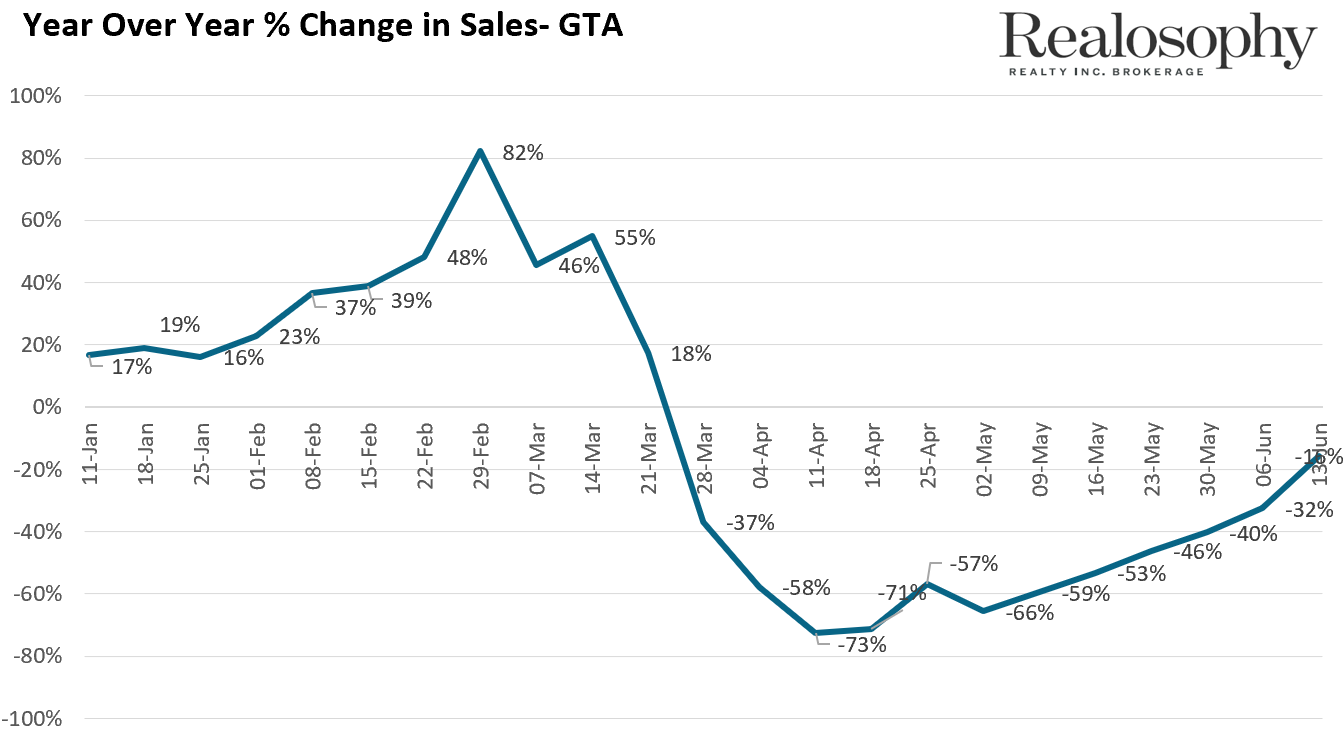

Sales are down 16% compared to last year but you can see from the chart below that every week they keep improving and are getting close to last year’s volumes.

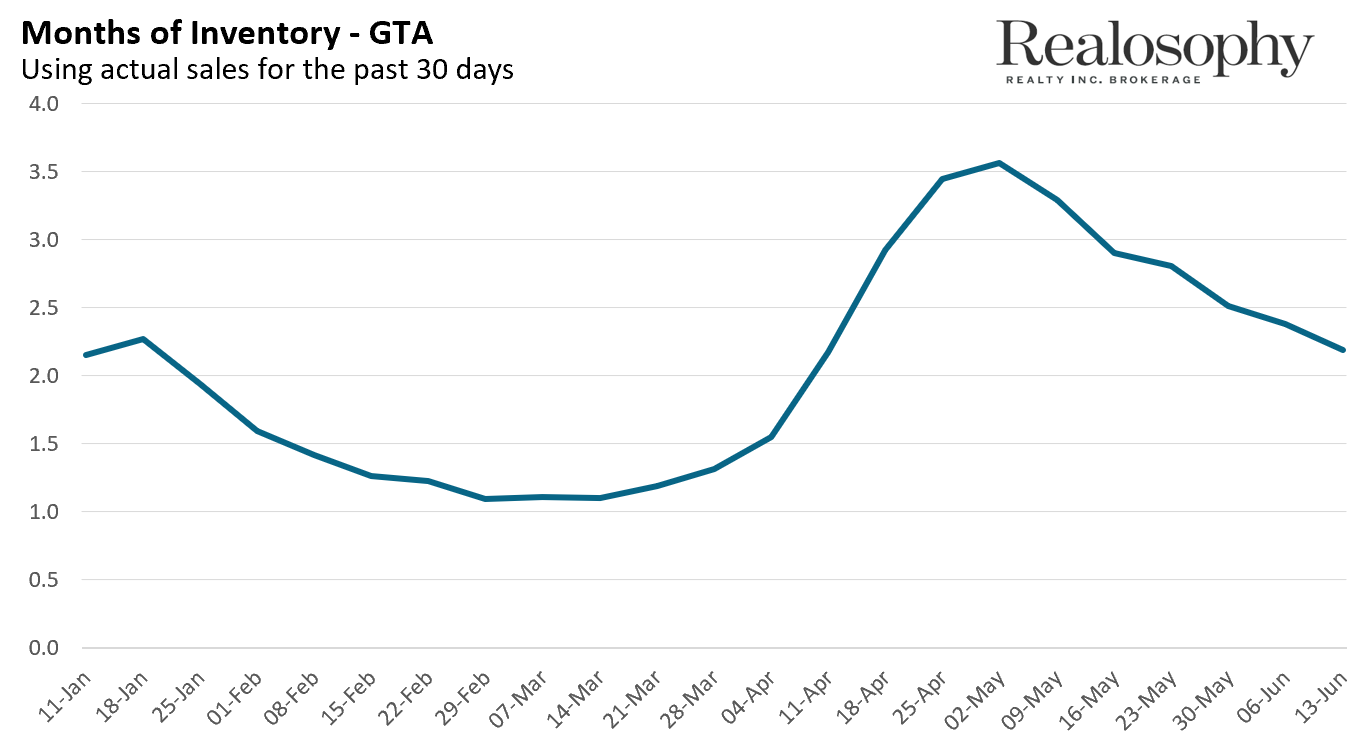

The Months of Inventory (MOI) which measures the number of homes on the market relative to the number of sales also keeps falling - which means every week that passes the number of available homes for buyers to choose from is declining.

See latest Greater Toronto Area market stats at Realosophy.com

What does this look like on the ground? More bidding wars, homes selling faster and with far more competition.

This of course does not mean every home is getting 10 offers and selling in 3 days. As always, there are some segments of the market that are slower than others. But as a whole the market is quite competitive.

Which of course raises an important question, why is the real estate market booming when the unemployment rate is at 14%?

History has shown us that housing markets usually cool down when the unemployment rate increases. This makes sense. With an increase in the number of people losing their jobs fewer buyers can afford to buy homes and more owners usually need to sell their homes when they can no longer afford their mortgage after a prolonged period of unemployment.

So why is the opposite happening?

Some people are pointing to the very low interest rates - around 2% for a 5 year mortgage - as the cause for this surge in demand. But low rates don’t create demand. If you lost your job over the past 2 months you’re not going to suddenly jump back into the market and buy a home because rates are lower - you can’t get a mortgage without a job.

The more likely explanation is that the vast majority of jobs that have been lost in Canada were in lower paying front line service jobs. Many of the buyers our agents are working with have not been impacted by the recent job losses. They are primarily in jobs where working from home is an option so have not seen a loss to their income.

So how will the housing market progress from here?

I expect the summer to remain very competitive and the only thing that might help cool the competition is a spike in new listings.

As for the fall market, there are still two main risks on the horizon. Firstly, when all the government support for businesses and individuals who lost their jobs comes to an end, only then will we know how many households are impacted and have permanently lost their income as a result of this crisis.

Secondly, households who have deferred their mortgage payments are going to see their deferrals come to an end this fall.

But while I was very concerned about the fall market about a month ago, I’m a bit less concerned today for a couple of reasons. As businesses open up, I expect household spending to increase and more and more businesses to start making money again. I don’t think things will be back to normal, but I do not think they will be worse than they were a month ago. The economy will start to recover which means it’s unlikely for demand to be lower tomorrow than there is today.

There may be some tenants and homeowners who are unable to pay their rent or mortgage after all the government support comes to an end, but I'm not convinced that this alone is enough to put downward pressure on home prices. Anecdotally, I'm hearing that many of the households deferring their mortgages today are doing this to be cautious, not because they can't afford their mortgage payments.

The one big unknown of course is if we see a second COVID-19 wave that is worse than the first, which would be additional stress on an already stressed healthcare system and economy. It’s hard to imagine what things will look like if that does happen. The best we can do for now it to monitor developments closely - stay tuned.

Follow John's latest updates on Twitter, YouTube, Facebook or Instagram

John Pasalis is President of Realosophy Realty, a Toronto real estate brokerage which uses data analysis to advise residential real estate buyers, sellers and investors.

A specialist in real estate data analysis, John’s research focuses on unlocking micro trends in the Greater Toronto Area real estate market. His research has been utilized by the Bank of Canada, the Canadian Mortgage and Housing Corporation (CMHC) and the International Monetary Fund (IMF).