Why a change who's behind the demand for homes makes all the difference.

With home prices continuing to surge across the country, many are starting to wonder if the rational explanation we’ve been hearing for Canada’s housing boom — an urban exodus and surge of end-users buying homes due to the Covid-19 pandemic —- no longer applies.

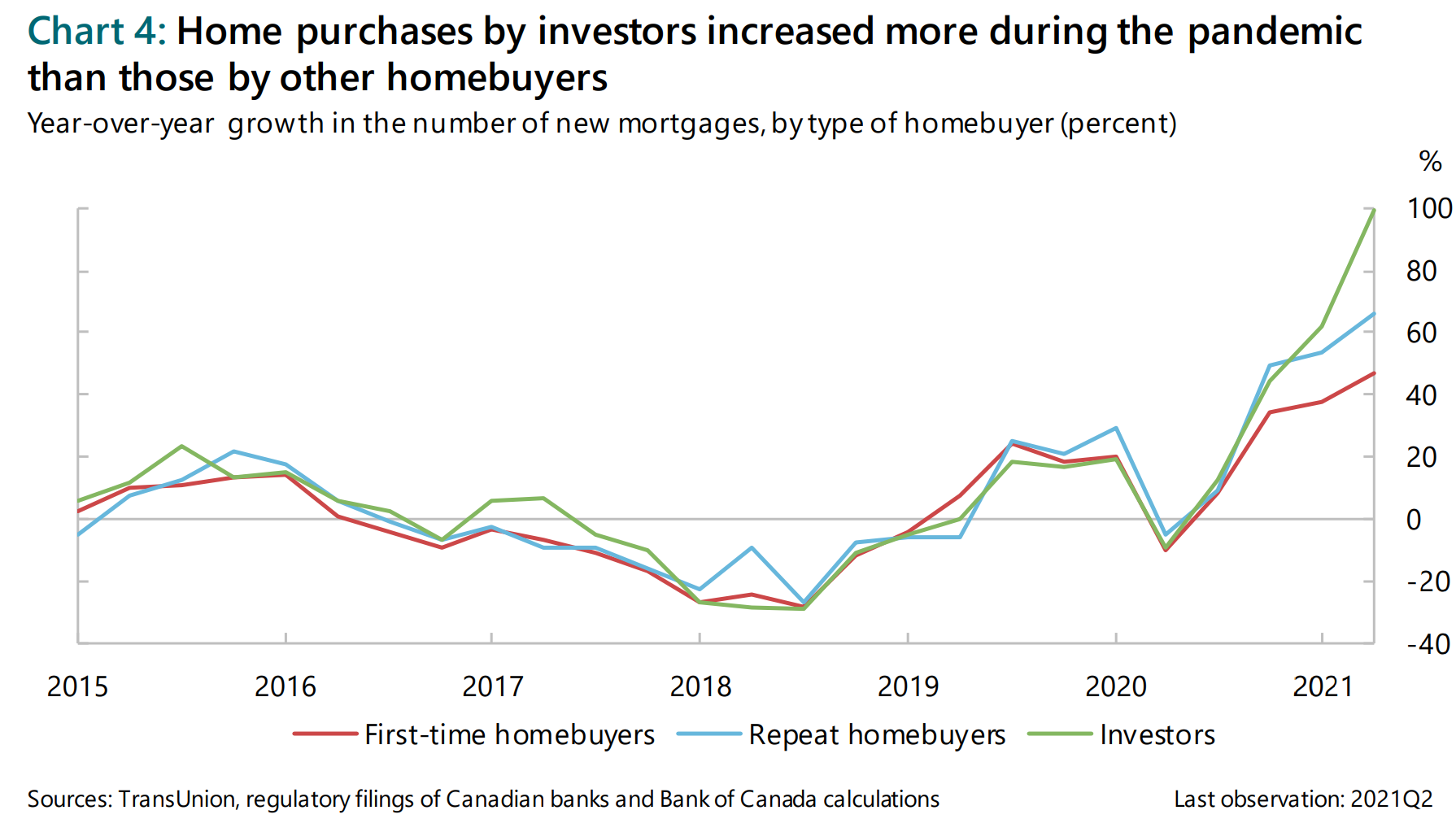

In last month’s report, I discussed how the housing market on the ground in the Toronto area appears to have turned; while much of the demand in 2020 was driven by end users rushing into the market post-Covid lockdowns, 2021 has seen a surge in demand from investors looking to capitalize on rapidly rising home prices.

My observations turned out to be prescient as later that same month the Bank of Canada’s Deputy Governor Paul Beaudry highlighted many of the same risks in his speech titled, “Financial stability through the pandemic and beyond.”

Here are a few notable comments:

A particularly worrisome development is that price expectations in some areas may have become extrapolative. This happens when people think house prices will be even higher in the future, and it can lead them to rush into the market to buy.

At the same time, our analysis finds that many Canadians are buying homes as investment properties—that is, in addition to their principal residence—and the importance of this phenomenon has grown. Expectations of a capital gain can make homes a very attractive asset for investors.

A sudden influx of investors in the housing market likely contributed to the rapid price increases we saw earlier this year. In such a case, expectations of future price increases can become self-fulfilling, at least for a while. That can expose the market to a higher chance of a correction. And, if one occurs, the damage can spread far beyond the investors. That’s because, for many households, their wealth and access to low-cost credit are tied to the value of their home.

The Bank of Canada’s research found that home purchases by investors outpaced demand from first-time and repeat home buyers.

While Beaudry didn’t refer to Canada’s housing market as a bubble, central bankers rarely do, his description of Canada’s housing market was pretty much the definition of a bubble.

A surge in demand driven by the extrapolative expectations of investors echoes Joseph Stiglitz’s definition of a bubble:

“[i]f the reason that the price is high today is only because investors believe that the selling price will be high tomorrow—when "fundamental" factors do not seem to justify such a price—then a bubble exists…”

- Joseph Stiglitz

In the case of a housing bubble more specifically (as compared to other asset bubbles), a disproportionate increase in demand from investors vs end user home buyers is a defining characteristic, according to Robert Shiller and Karl Case:

“That is what a bubble is all about: buying for the future price increases rather than simply for the pleasure of occupying the home. And it is this motive that is thought to lend instability to bubbles, a tendency to crash when the investment motive weakens.”

- Shiller and Case

But not everyone agrees with these risks.

While the Bank of Canada is indirectly cautioning us about an investor-driven housing bubble in Canada, former CEO of CMHC Evan Siddall had this to say about a potential housing bubble in Canada:

“I don’t think we’re in a bubble, I really don’t think we’re in a bubble. If demand is going up and supply is not, prices will go up, that’s not a bubble.”

This argument, that lack of supply is the real problem, is a common one put forward by home builders and real estate agents.

The problem with this argument is that every single housing bubble in history has seen demand outpace supply. This is in fact a characteristic of a housing bubble and it doesn’t matter if the particular city has an elastic (easy to increase) or inelastic (hard to increase) supply of housing. If demand was not outpacing supply, prices would not rise rapidly — and without rapid price acceleration, there is no bubble.

But the difference between a housing boom and a bubble (as demand exceeds supply in both cases) is the question of who is driving the demand. When the demand for homes from investors is outpacing demand from end users, this is typically the difference between a bubble and a boom.

So how can the federal government take some heat out of the housing market and mitigate the financial and economic risks associated with a bubble that were highlighted by the Bank of Canada?

Economist David Rosenberg outlined what I see as the correct approach in this recent interview where he noted that "[h]ousing has become not just a place to live in Canada, it's become like an asset class, and probably too much of an asset class".

The solution is to tighten credit on investors looking to buy houses.

This would not only take some of the excess demand out of the market and cool the acceleration in home prices for average buyers, but it would also help mitigate the negative side effects of an investor-driven housing bubble.

But once again, not everyone agrees with this view.

In a recent interview, the Superintendent of Canada’s banking regulator OSFI, Peter Routledge had this to say about the strong investor demand for housing in Canada:

“The investors are making an investment to generate a return, that’s a free market economy, more power to them.”

- Peter Routledge

What does Routledge think needs to be done to cool an investor driven housing boom?

Build more homes.

This is a rather odd suggestion for a couple of reasons. Firstly, I’m not aware of any investor-driven housing boom that successfully built their way out of a bubble. In fact, a number of cities that experienced investor driven housing booms in the early 2000s that had a relatively elastic supply of homes (e.g., Phoenix, Las Vegas, Dubai, etc.) and were able to sell and build enough houses to accommodate investor demand saw massive price corrections when their bubbles’ burst.

But more importantly, this proposed solution is not something the federal government can control and has been talked about as a solution for over a decade with little to no progress. More housing supply is no doubt an important long-term solution to introducing more housing affordability in Canada, but it’s not an immediate solution to short-term problems — like a surge in investor demand.

If the only solution we continue to hear from policymakers for an investor-driven housing boom is “build more homes,” we expect a bumpy ride for our housing market ahead.

Read our full monthly Move Smartly market report for Dec 2021 here

John Pasalis is President of Realosophy Realty, a Toronto real estate brokerage which uses data analysis to advise residential real estate buyers, sellers and investors.

A specialist in real estate data analysis, John’s research focuses on unlocking micro trends in the Greater Toronto Area real estate market. His research has been utilized by the Bank of Canada, the Canadian Mortgage and Housing Corporation (CMHC) and the International Monetary Fund (IMF).

Follow John on Twitter @johnpasalis

Email John