Author John Pasalis is the President of Realosophy Realty, a Toronto real estate brokerage which uses data analysis to advise residential real estate buyers, sellers and investors. He is a top contributor at Move Smartly, a frequent commentator in the media and researcher cited by the Bank of Canada and others.

Market Stays Strong, Median Now $1.3M for Houses, $660K for Condos

FREE PUBLIC WEBINAR: WATCH REPORT HIGHLIGHTS

Join John Pasalis, report author, market analyst and President of Realosophy Realty, in a free monthly webinar as he discusses key highlights from this report, with added timely observations about new emerging issues, and answers your questions. A must see for well-informed Toronto area real estate consumers.

The Market Now

Those hoping for a slow-down in the Toronto area’s housing market will need to wait a bit longer — all indicators from the past month’s data for October 2021 are showing a market that is actually heating up rather than cooling down.

But the strong demand we are seeing today is very different from the demand we were seeing a year ago. This time last year, the strong demand was largely driven by a surge in home buyers entering the market. This year, the surge in demand is coming from investors rather than end users. In this month’s Data Dive section (see in this report, below), I discuss the irrational exuberance that I’m seeing from Toronto area real estate investors.

House sales were down 18% on a year-over-year basis in October, but well above pre-Covid 19 pandemic levels for October in 2018 and 2019.

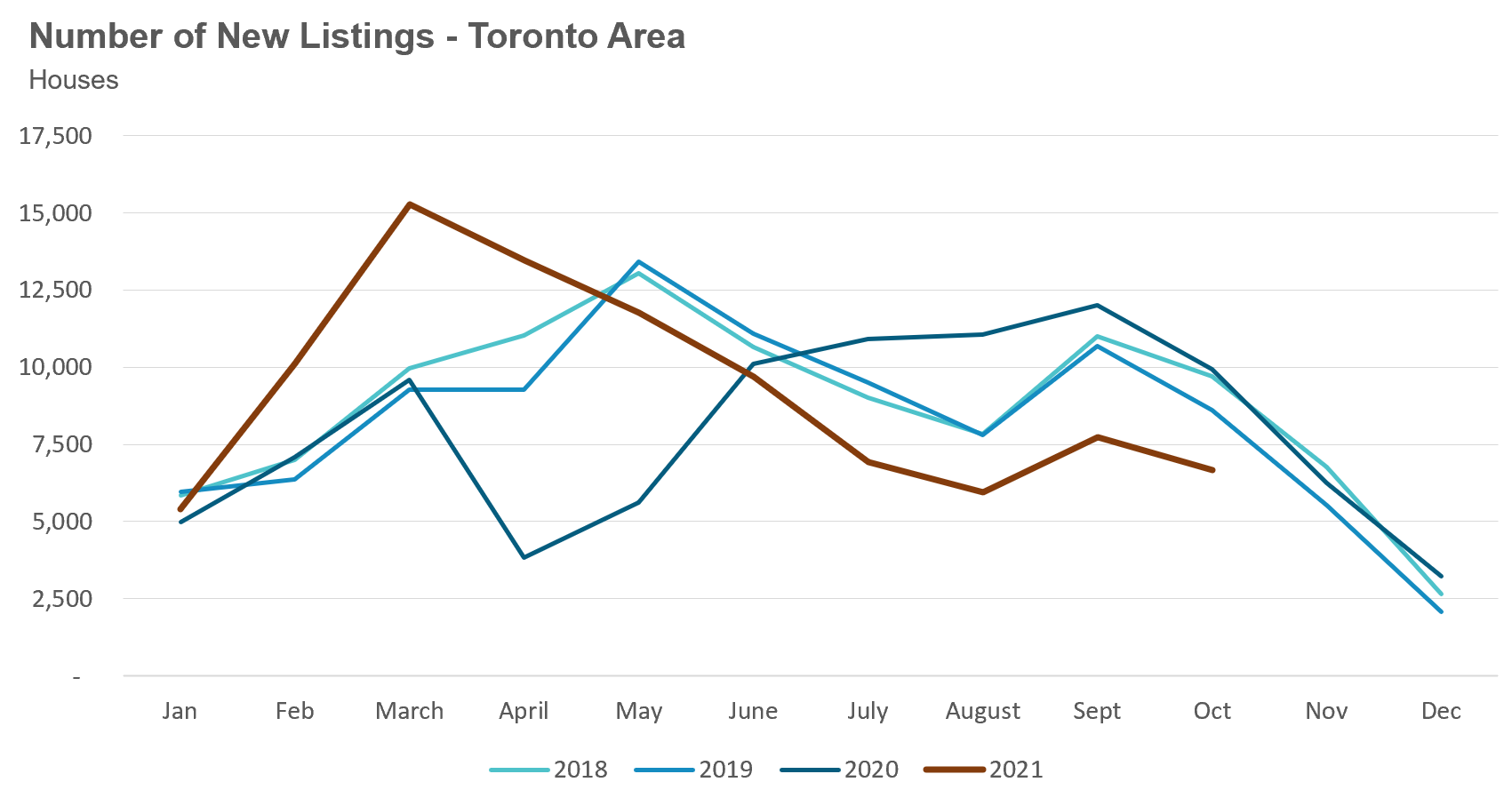

New listings in October were down 33% over last year and well below pre-Covid levels in 2018 and 2019.

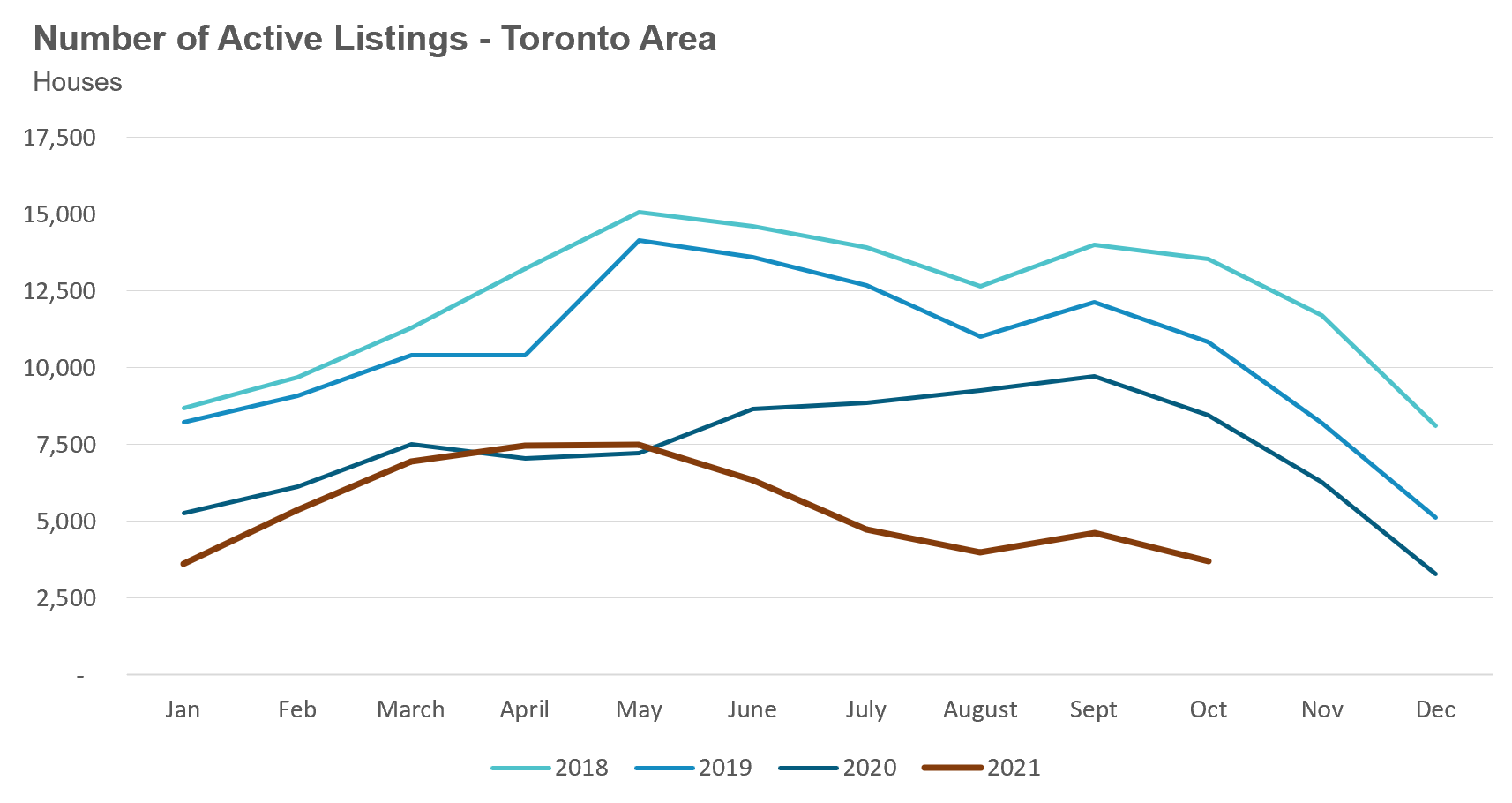

At the end of October, the Toronto area had only 3,687 houses available for sale, a 56% decline from inventory levels last year and well below the roughly 12,000 active house listings that are more typical for the month of October.

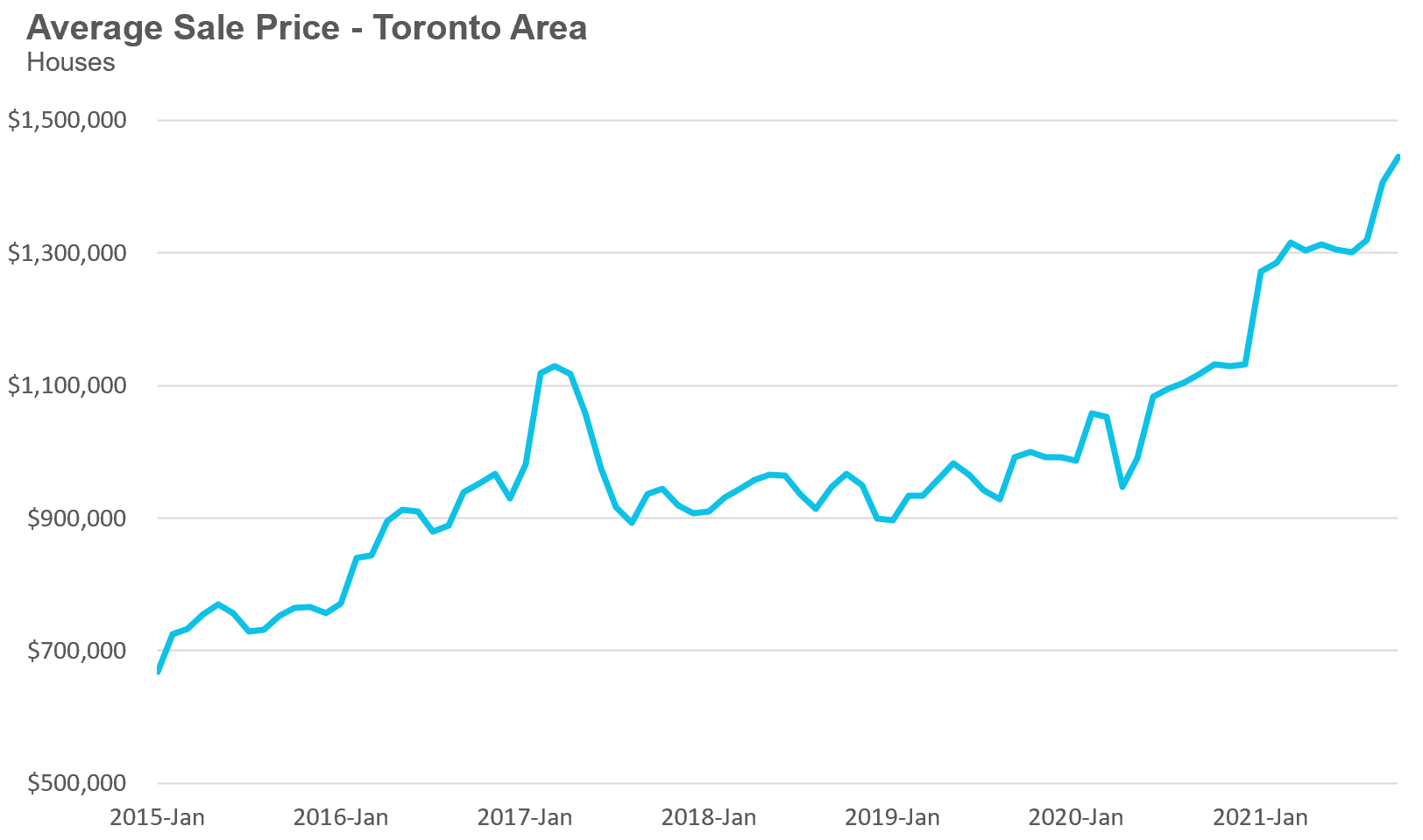

The average price for a house in October was $1,445,088, up 28% over last year; the median house price in October was $1,265,000, up 33% over last year.

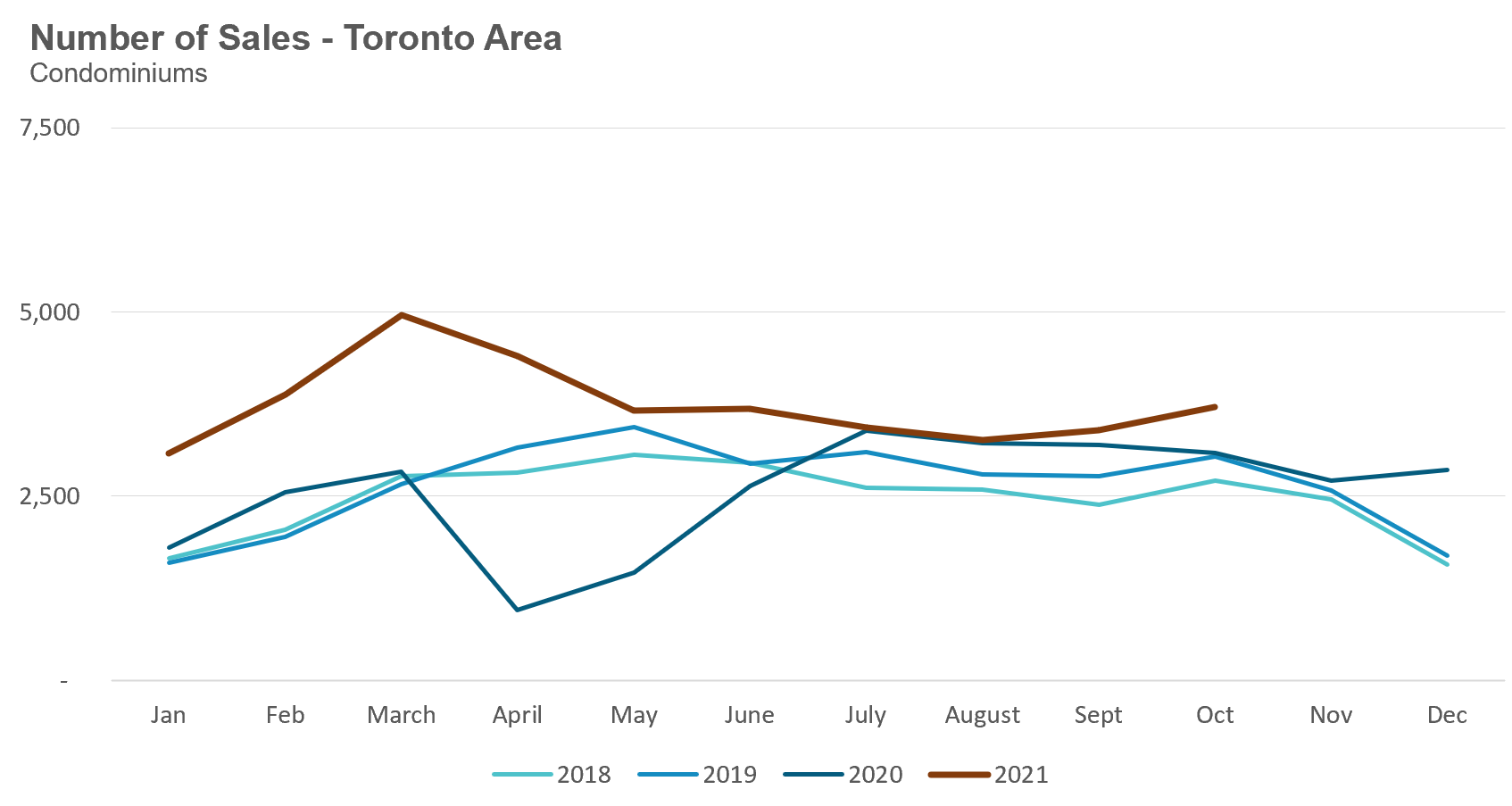

Condominium (condo) sales in October were up 20% over last year and above the pre-Covid 19 levels for the same month in 2018 and 2019.

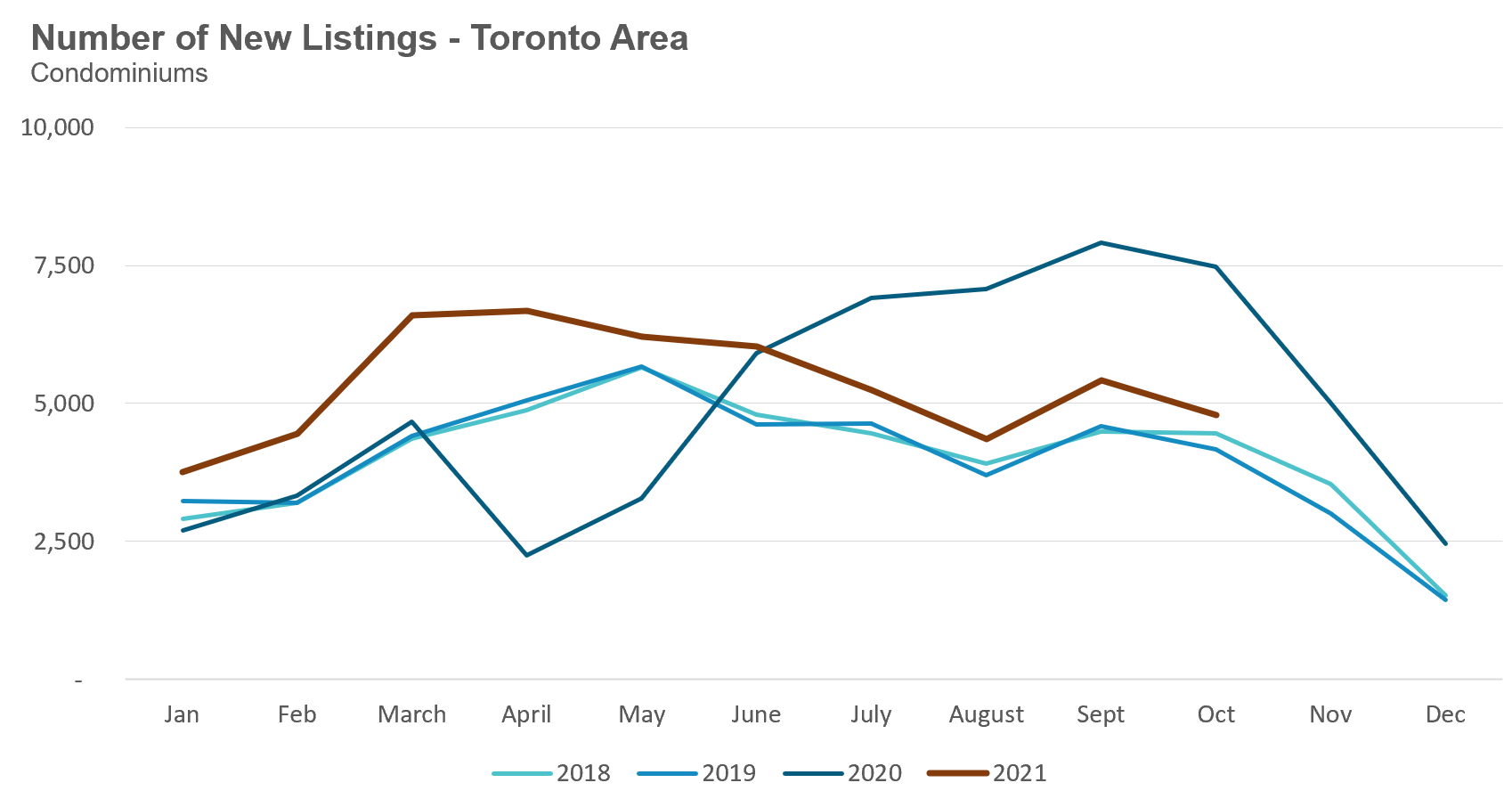

New condo listings were down by 36% in October 2021 over last year, but above the volumes in 2018 and 2019. The number of condos available for sale at the end of the month, or active listings, was down 54% over last year.

The average price for a condo in October reached $730,726, up 15% over last year; the median price for a condo in October was $660,000 up 15% over last year.

(For all monthly statistics for the Toronto Area, including house, condo and regional breakdowns, see the final section of this report.)

Bank of Canada Indicates Rate Hikes Likely Soon

Over the past year, economists have disagreed on the future path for inflation (a general increase in prices for goods) with some arguing that any increase in inflation is likely due to Covid-19 related problems, such as delays in global supply chains for producing and delivering goods, that are short-term and transitory, and others arguing that this inflation will be more persistent.

Last month, the Bank of Canada was very clear about which side of the debate the Bank is on.

“The main forces pushing up prices — higher energy prices and pandemic-related supply bottlenecks — now appear to be stronger and more persistent than expected.”

- Bank of Canada Governor Tiff Macklem

The Bank of Canada ended their aggressive form of monetary policy referred to as ‘Quantitative Easing’ (QE) (purchasing particular securities such as bonds in order to expand money supply to encourage economic activity), which pushes down the interest rates that fixed rate mortgage rates are based on.

In addition, the Bank indicated that they will be raising their policy rate, which variable rate mortgage interest rates are based on, much earlier than they originally planned, with many expecting the first rate hike to come in April. CIBC’s Benjamin Tal noted that the bond market has priced in no less than 6 rate hikes in 2022.

Given this news, I’ve heard from a number of home buyers who are worried that an increase in rates might lead to a “correction” (read: a drop) in home prices as it would reduce what buyers and owners could afford.

I see this as a very unlikely outcome (at least in the short-term) for a number of reasons.

Firstly, most homeowners in Canada have five-year fixed rate mortgages so most homeowners are unlikely to feel the impact of higher interest rates next year.

Secondly, home buyers in Canada over the past five years have been qualifying for their mortgage at a ‘stress test’ interest rate, which is much higher than what they are paying. These tests were introduced by our authorities precisely for this situation of rising interest rates; home owners who qualify under these tests should be able to handle the costs associated with a higher interest rate on their mortgage when they do need to renew.

But even those households that might have a hard time with these extra costs, perhaps due to high balances on their home equity lines of credit which are directly impacted by the Bank of Canada’s rate increases, we are still unlikely to to see any widespread ‘distressed selling’ (when home owners have to sell their homes due to their inability to pay their mortgage), which can pull down home prices, any time soon. Before a homeowner defaults on their mortgage, they will typically cut other expenses, take on more debt or get help from others to help in the short-term or sell and downsize first.

However, there are two more likely effects that higher rates might have on the housing market in the coming year.

The first is that it will likely take some demand out of the housing market, from both investors and end users. Variable interest rates in the 1% range have been a key driver of demand from real estate investors and it’s this segment that will likely see a disproportionate decline in demand should we see multiple rate hikes in 2022.

Higher interest rates could also have an impact on investor outlook and confidence. If investors start becoming less optimistic about the future growth in homes prices, thinking that double-digit home price growth is behind us in the wake of higher rates, this may lead to more investors selling their properties.

But are either of these factors going to lead to a decline in house prices in 2022?

I think that’s very unlikely.

Toronto’s housing market continues to be a market where demand significantly exceeds the supply of homes coming on the market for sale, particularly given our immigration policies (see my previous months reports for more than this issue).

As I’ve said before, it’s like our housing market is going 200km/h on the highway — before it can reverse, it needs to slow down considerably first. If we see a lot of demand come out of the market and more homes listed for sale, our market will start to slow down, but will continue to remain in seller’s market territory, with prices growing at a more modest rate than we are seeing now.

Why is the Market Bubbling Up Again?

During an interview earlier this month, I was asked the perennial question:

Is Toronto in the middle of a housing market bubble?”

My answer was probably not.

Much of the growth in home prices over the past 18 months since the start of the Covid-19 pandemic was largely driven by strong demand from end users (home buyers intending to live in the property), not investors (looking to rent out or just ‘hold onto’ properties given the expectation that prices will keep going up).

In most bubbles, optimistic (or as they’ve been dubbed, “irrationally exuberant”) investors have played a key role in driving up home prices to unsustainable levels that eventually ‘burst’.

But while end-users were the primary driver of the Toronto area’s housing boom in 2020, that trend appears to be changing in 2021, leading me to wonder if we are moving closer to a market where the extrapolative expectations of real estate investors are once again driving home prices.

So what does “irrational exuberance” look like in the real estate market?

When a key driver of home price appreciation is no longer fundamental factors (such as population growth, low interest rates, etc.), but rather the optimistic beliefs of investors who believe home prices will keep going up forever at a rapid rate. This is when you hear about more and more people looking to invest in real estate themselves, after hearing about how well family and friends have been doing with their own properties.

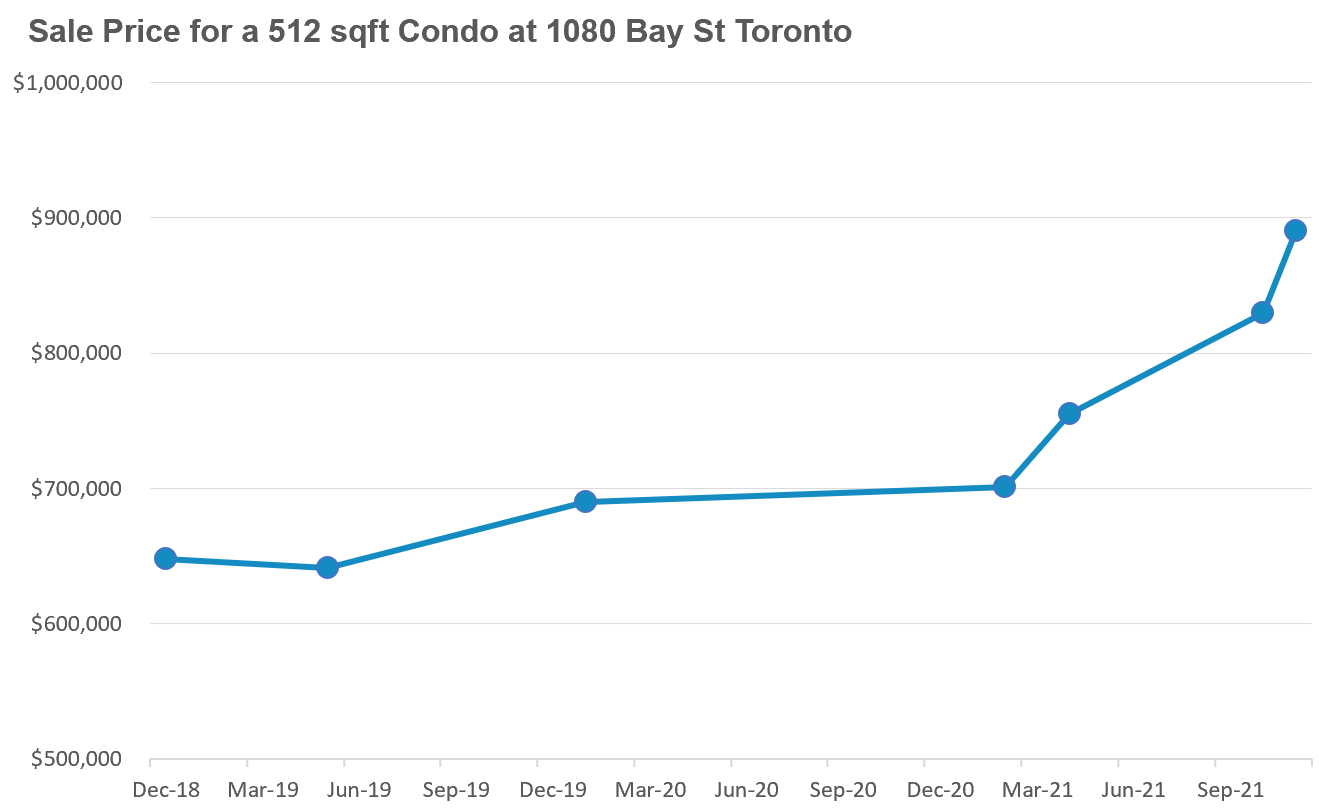

Let’s take a look at what this looks like on the ground by looking at sales prices for identical 512 square foot units (floor level aside) at a condo at 1080 Bay Street in downtown Toronto.

Since December 2018, seven of these units have sold and their sale prices tell an interesting story. The unit that sold in December 2018 achieved a sale price of $648,000; the price growth remained very balanced up until February 2021 when a unit sold for $700,888.

But since then, prices have started to take off.

Only two months later in April 2021, a unit sold for $755,000. Six months after that in October 2021, a unit sold for $830K and a month later in November, the same sized unit sold for $890K.

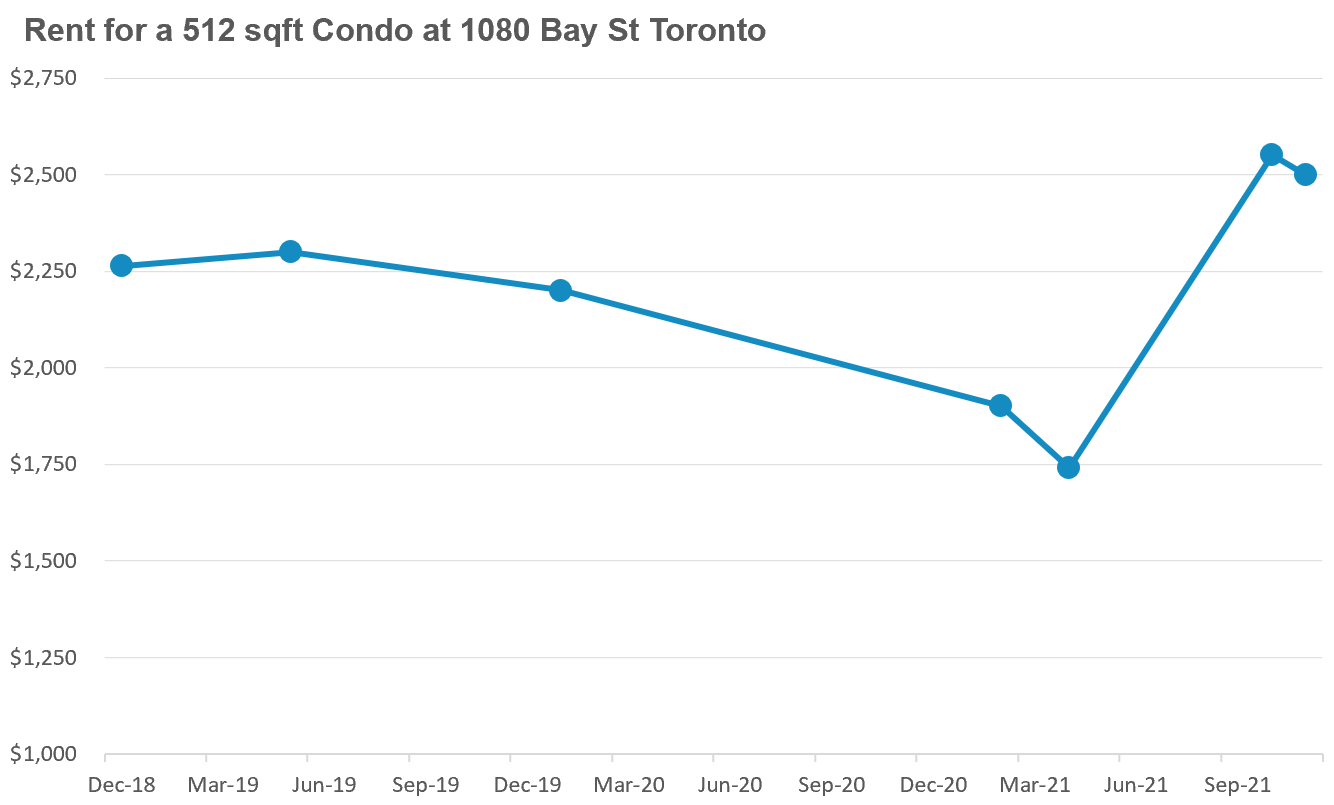

So what’s driving this explosive growth? Have rents surged in Toronto unexpectedly in the same time period?

In March 2021, the market rent for one of these units had fallen to $1,740, down 23% from $2,263 in December 2018.

Since then, rents have rebounded, thanks in large part to a surge in demand in the summer of 2021 from students returning to university after the Covid-19 shutdown.

But current rents are not that far above rents seen in 2018, up just $239 or 10%, while prices have surged $240,000 or 37% over the same period.

And there are some signs that not all renters will be back any time soon, at least in the Toronto downtown core, given the ongoing decrease in retail and restaurant activity in the area.

At the most recent sale price of $890,000 at 1080 Bay Street, the monthly carrying costs (mortgage, maintenance fee and property tax) for an investor with a 20% down payment and a 30-year mortgage would be $3,500 — $1,000 more than the monthly rental income being generated.

So why are investors eager to buy a property where they’ll have to pay $1,000 per month out of pocket to cover the carrying costs?

The primary reason is that investors expect their investments to be worth significantly more a year from now. They don’t care if they are paying $1,000 out of pocket because they expect that their unit is going to be worth $100K more a year from now.

This is very reminiscent of the trends I saw on the ground in 2015/16 when Toronto experienced a suburban housing bubble in 2015-16.

The pre-construction unit that sold in November achieved a price of $1,738 per square foot, which is also notably high given that downtown resale condos are selling for just over $1,000 per square foot on average.

It’s no surprise that some real estate agents are promoting this sale as a “new normal” and using this single sale to argue that paying $1,500 per square foot for a pre-construction condo downtown is “very reasonable”.

I don’t really agree with this conclusion — at $1,400 to $1,500 per square foot, I’m finding pre-construction condos to be a very risky investment given current rents and resale prices.

This leads me to believe that the price trends we are seeing in parts of the resale condo market and the pre-construction condo market are a symptom of irrationally exuberant investors.

And it’s worth noting that this exuberance is not just limited to the condo market, it’s happening everywhere in the Toronto area and beyond.

The rapid acceleration in home prices over the past year has, not surprisingly, made everyone want to become a real estate investor. Our brokerage, Realosophy Realty, is getting more phone calls from investors than end-users looking to buy a home.

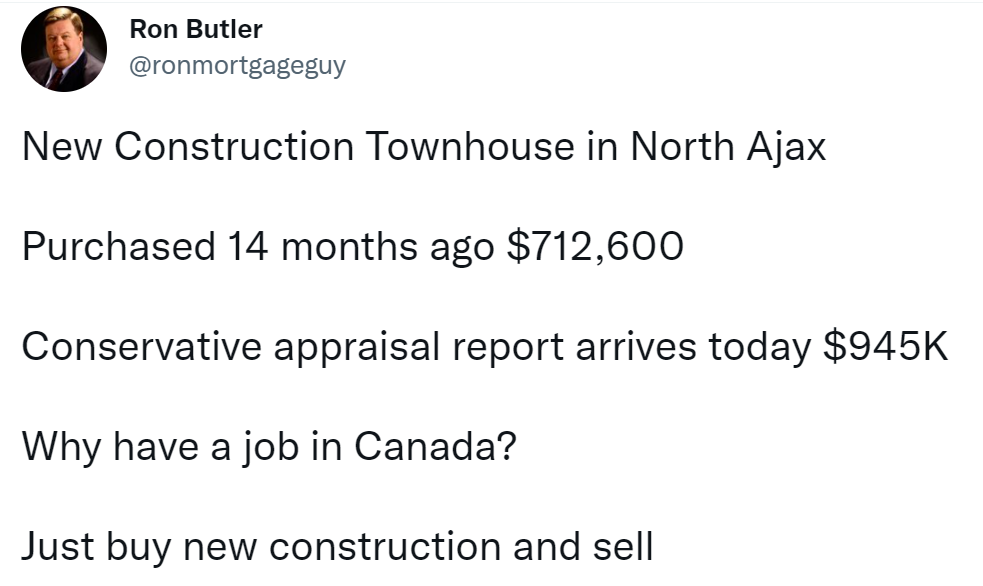

This post from prominent mortgage broker Ron Butler highlights what many recent home buyers are experiencing in terms of the price appreciation on their homes which is driving the investor enthusiasm we are seeing in the market today.

Earlier this year, I spoke to students in the real estate management program at Ryerson University. The discussion ended with a brief Q&A and the most popular question students submitted was “What advice do you have for potential residential real estate investors now?”

I was taken aback as I thought that their primary concern would be related to the challenges that young first-time home buyers face trying to buy a home today. But when young university students are more concerned about buying real estate as an investment rather than as a place to live, we should be concerned about the speculative mood that has taken over our housing market.

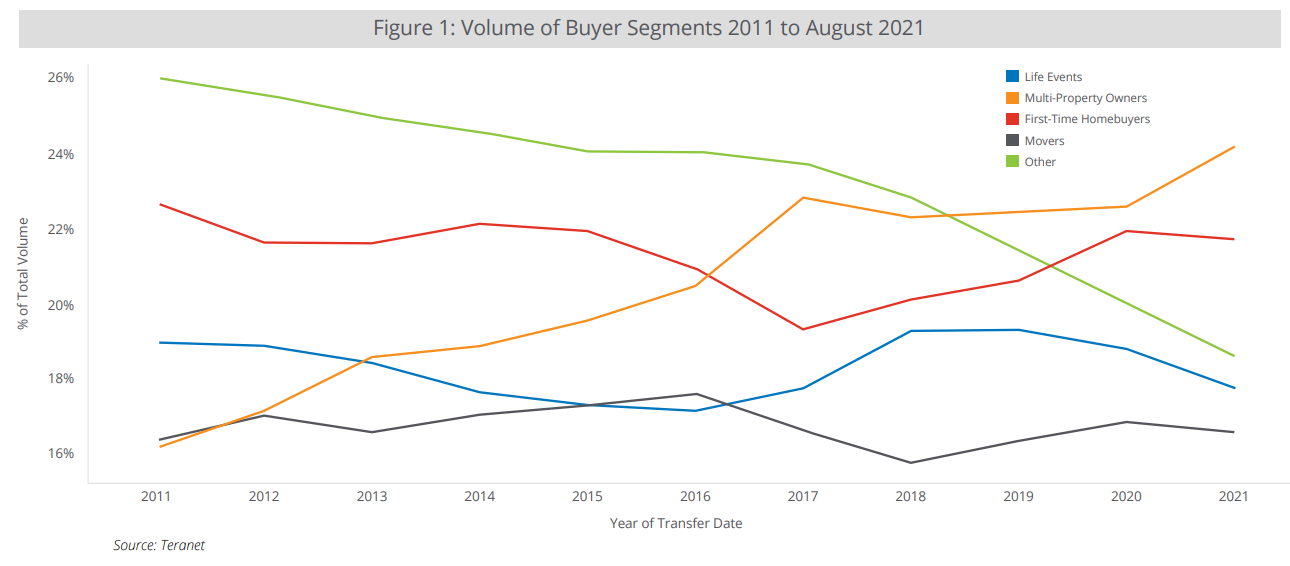

These on the ground observations line up with recent data published by Teranet. Teranet divided buyers of residential homes into segments including first time buyers, movers, and investors (multi-property owners). They found that not only are investors the biggest buyer segment in 2021 (they were the smallest segment in 2011), they are the only segment that actually saw their share of transactions increase in 2021.

Every other type of buyer, including first-time buyers are buying proportionally fewer homes in 2021.

There are two things I think we all need to consider when thinking about these trends.

Firstly, anyone arguing that the rapid acceleration in home prices is justified because of a “lack of supply” is not being entirely honest with you.

This is a common argument among realtors, and the wider real estate industry, including self-described “real estate investment coaches”, which is intended to reassure investors about paying ever increasing prices since prices can ‘never fall’ because ‘there’s not enough supply.’

The fact that some bank economists, likely cognizant of how important real estate is to Canada’s economy, reinforce this narrative is even more troubling.

The fact is that when the dominant buyers of homes are investors, no amount of supply can ever keep up with the appetite and lofty expectations of real estate investors.

To see this in action, we only need to look at cities like Phoenix, Las Vegas and Dubai that have a relatively elastic (not constrained by land or zoning restrictions, etc.) supply of new homes.

Leading up to the 2008 global financial crisis, investors were a key driver of skyrocketing home prices in those cities and having a very elastic supply of housing did not stop them from experiencing a housing bubble which was followed by a deep crash in home prices.

Many economists also argue that it makes no difference if a home is purchased by an investor vs. an end-user, as long as the investor rents the home out. This again is not entirely accurate.

When investors are the dominant buyers in a market they push home prices much higher than they otherwise would be — preventing some end-users from buying homes for themselves. By financing the new construction of homes, such investors may help keep renting more affordable but they make owning far less affordable.

Additionally, having a larger share of investors in our housing market makes our housing economy (and thus our entire economy) far more vulnerable in the event of a sudden investor exit from the market. In my July 2021 report, I unpacked in more detail how investors particularly impact home prices (both on the way up and on the way down).

Now, I should repeat that while the trends I’m seeing on the ground — rapid price acceleration driven largely by strong investor demand — are troubling from a bubble-watching perspective, I don’t expect any dramatic change in the housing market and home prices anytime soon (as I discussed earlier in this report).

This type of investor-led rapid home price acceleration can go on for far longer than you might expect. As long as there is another optimistic investor around the corner willing to pay even more — prices will keep rising.

What is unlikely to rise as rapidly are rents, because unlike home prices, rents are truly constrained by household income. Home prices are a financial asset that when purchased by end-users may be constrained by income, but when purchased by cash-rich investors — the income constraint on prices no longer matters.

So this pronounced investor demand will continue until investors find that the gap between the carrying costs for their investment property and the rental income they may generate from it is too large. If that happens, then the optimistic investor may suddenly turn very pessimistic, much like they did during the initial onset of the Covid-19 pandemic when investors rushing to sell their downtown condos caused prices to suddenly fall.

Given this, it is important for consumers of real estate to be aware of potential issues, particularly in some segments of the housing market, in light of these troubling signs.

October 2021

House sales (detached, semi-detached, townhouse, etc.) in the Toronto area in October 2021 were down 18% over the same month last year.

Sales will likely continue to be negative on a year-over-year basis until at least the first quarter of 2022 since we’ll be comparing against a period that saw a sudden shock in demand for houses following the initial Covid-19 lockdowns. But it’s worth noting that sales in September were above levels for the same month in pre-Covid 2018 and 2019.

New listings in October were down 33% over last year. But unlike sales volumes which were strong compared to pre-Covid levels, new listings in October were well below the listings volumes seen in 2018 and 2019.

The number of houses available for sale (“active listings”) was down 56% when compared to the same month last year and 66% below the inventory levels seen in pre-Covid 2019.

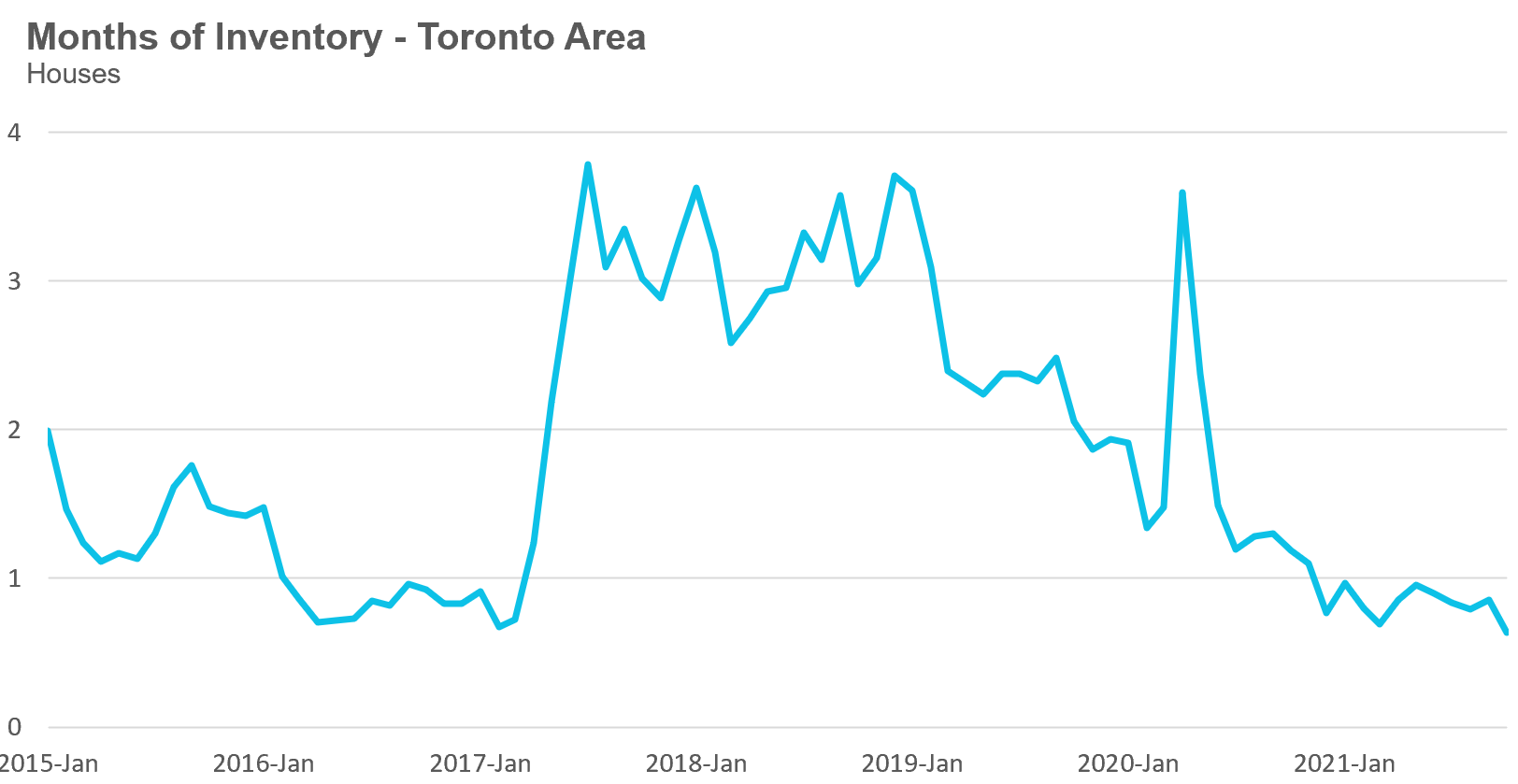

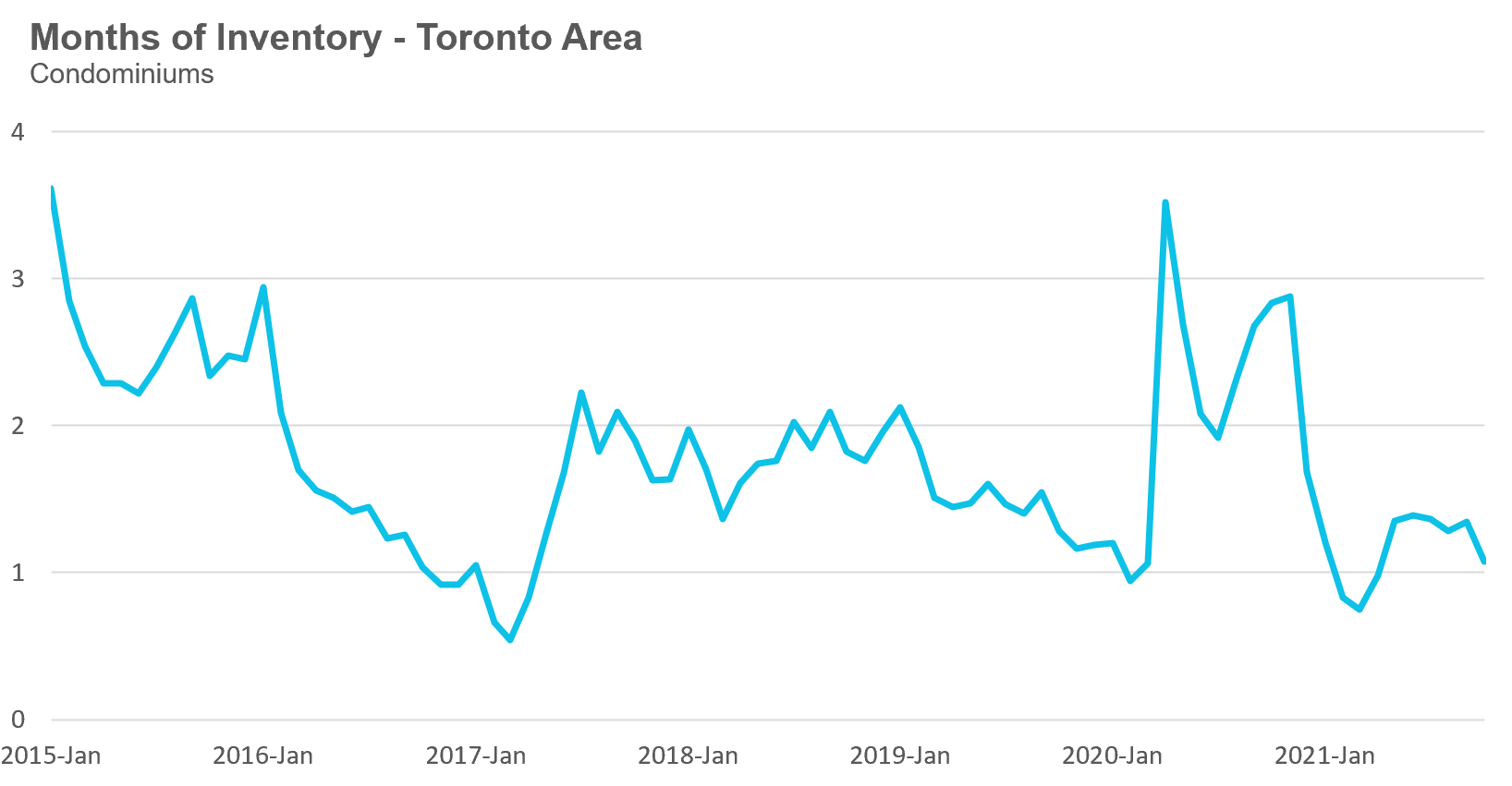

The Months of Inventory ratio (MOI) looks at the number of homes available for sale in a given month divided by the number of homes that sold in that month. It answers the following question: If no more homes came on the market for sale, how long would it take for all the existing homes on the market to sell given the current level of demand?

The higher the MOI, the cooler the market is. A balanced market (a market where prices are neither rising nor falling) is one where MOI is between four to six months. The lower the MOI, the more rapidly we would expect prices to rise.

This October, the market remained very competitive with the MOI trending down to 0.6 months.

While the current level of MOI gives us clues into how competitive the market is on-the-ground today, the direction it is moving in also gives us some clues into where the market may be heading. The MOI has remained relatively stable at or below a very competitive 1 MOI for the past twelve months.

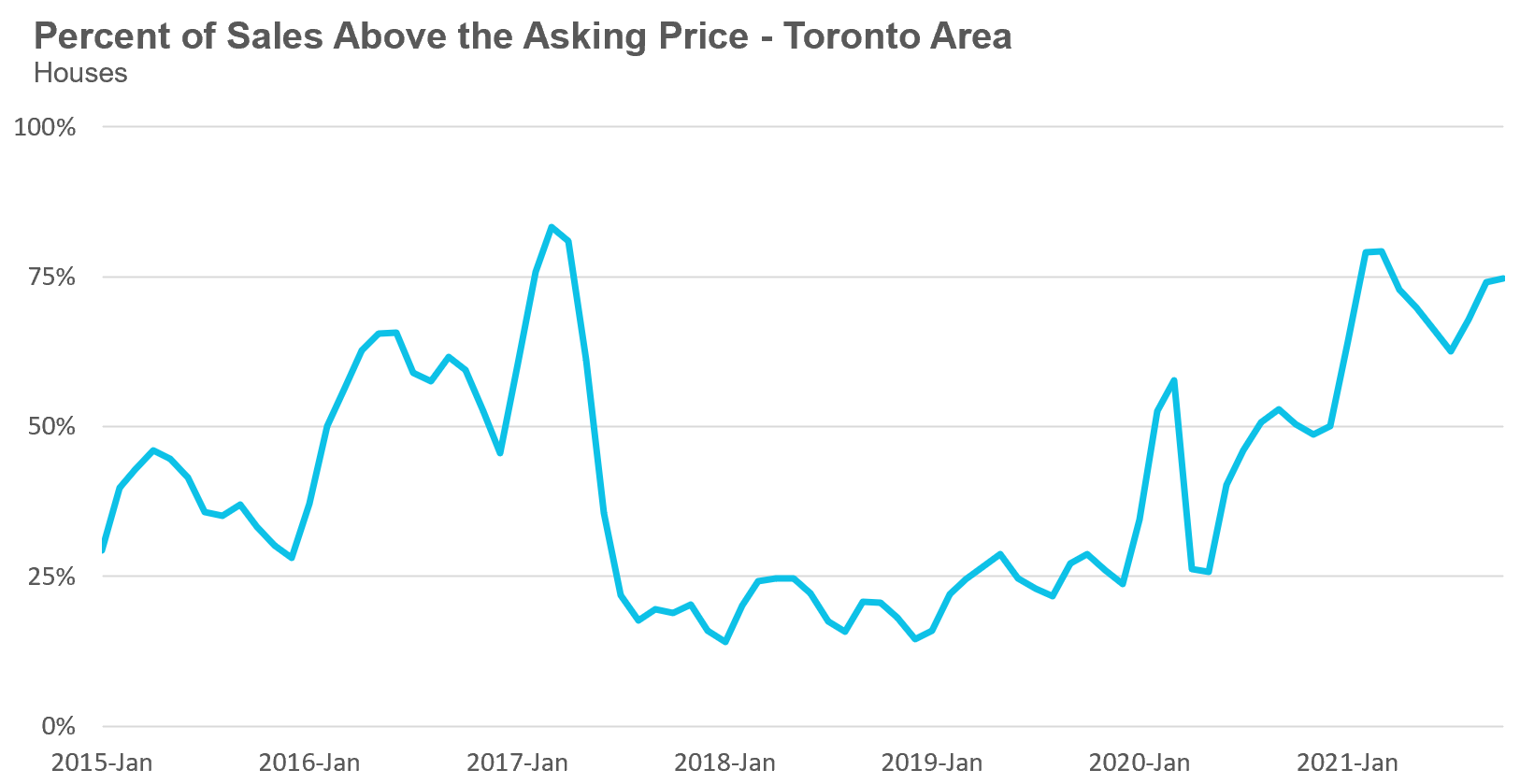

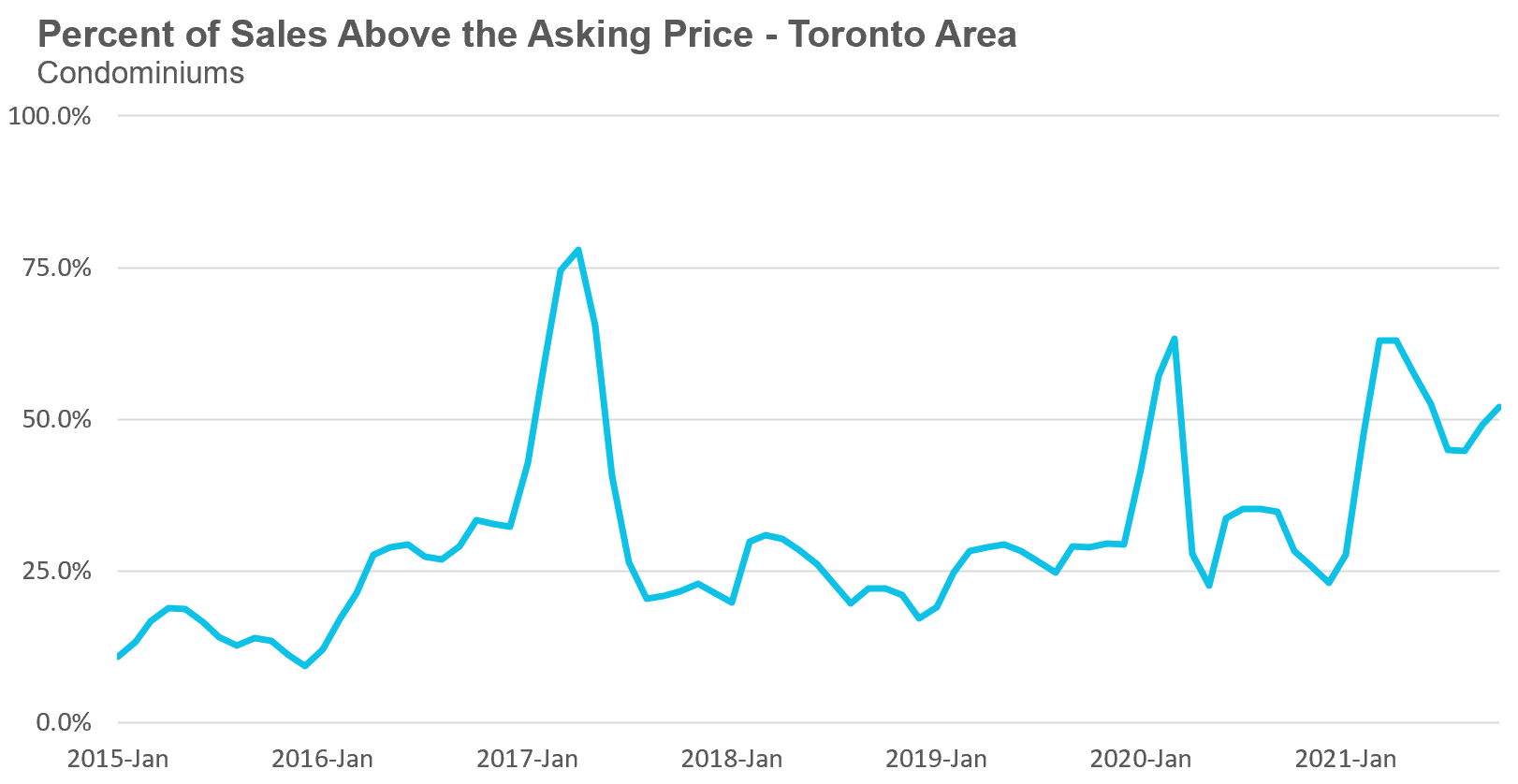

The share of houses selling for more than the owner’s asking price climbed from 68% in August to 75% in October.

Average house prices had plateaued in 2021, remaining relatively constant in the $1.3M range since the start of the year, but that trend ended this September when average prices surged above $1.4M and average prices continued to climb in October to $1,445,088, up 28% over last year.

The median house price in October was $1,265,000, up 33% over last year.

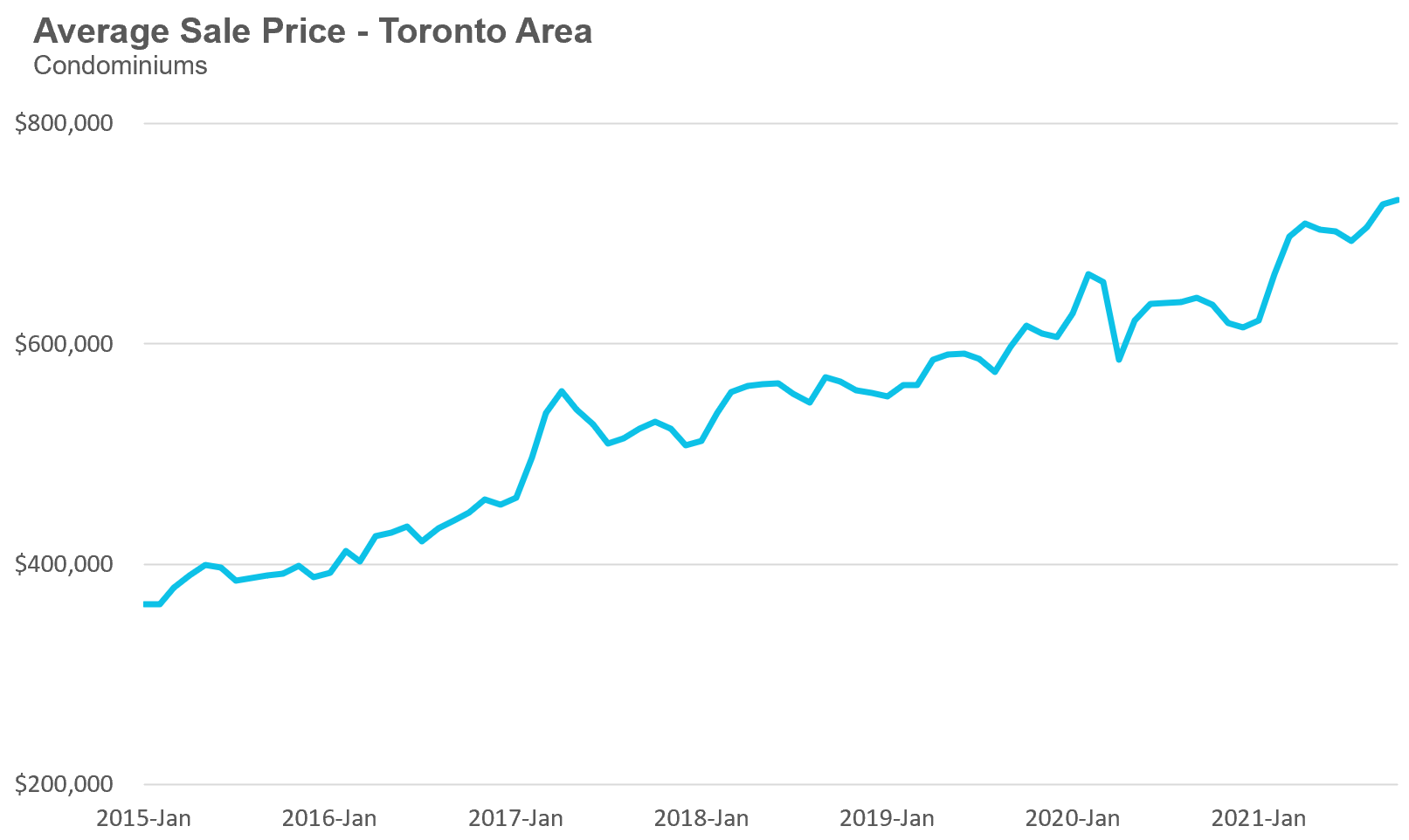

Condo (condominiums, including condo apartments, condo townhouses, etc.) sales in the Toronto area in October were up by 20% over last year and up 22% compared to pre-Covid 2019.

New condo listings were down by 36% in October 2021 over last year, but well above the volumes in 2018 and 2019.

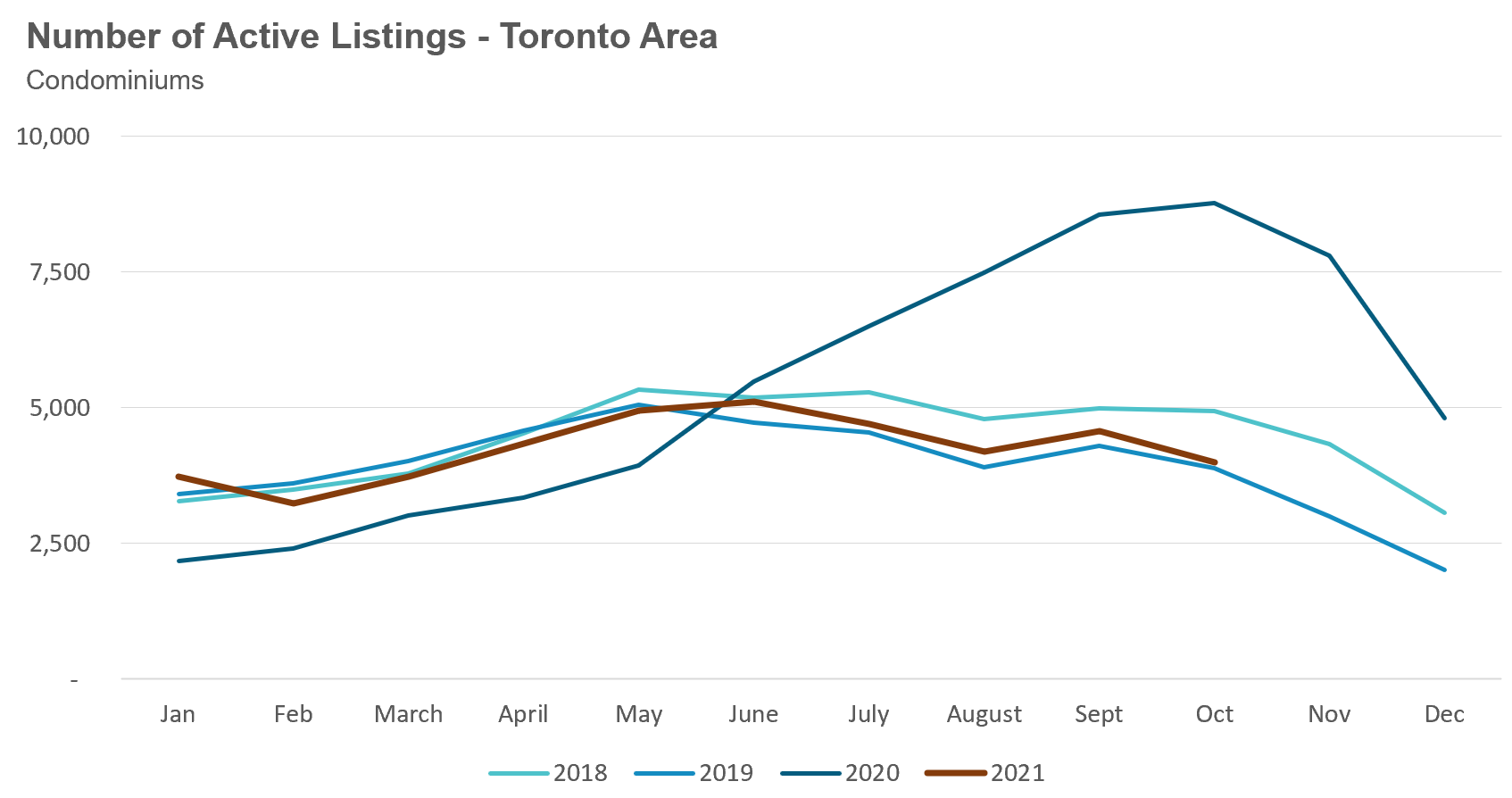

The number of condos available for sale at the end of the month, or active listings, was down 54% over last year, a period that saw a surge in condo listings due to declining prices, falling rents and rising vacancy rates.

The relatively strong demand of new listings (supply) helped push the MOI down to just over 1 MOI for the month of October.

The competition for condos picked up very slightly with the share of condos selling for over the asking price rising from 45% in August to 52% in October.

Average condo prices plateaued at approximately $700K for most of 2021, but increases have started to resume over the past two months. The average price for a condo in October reached $730,726, up 15% over last year. The median price for a condo in October was $660,000 up 15% over last year.

Houses

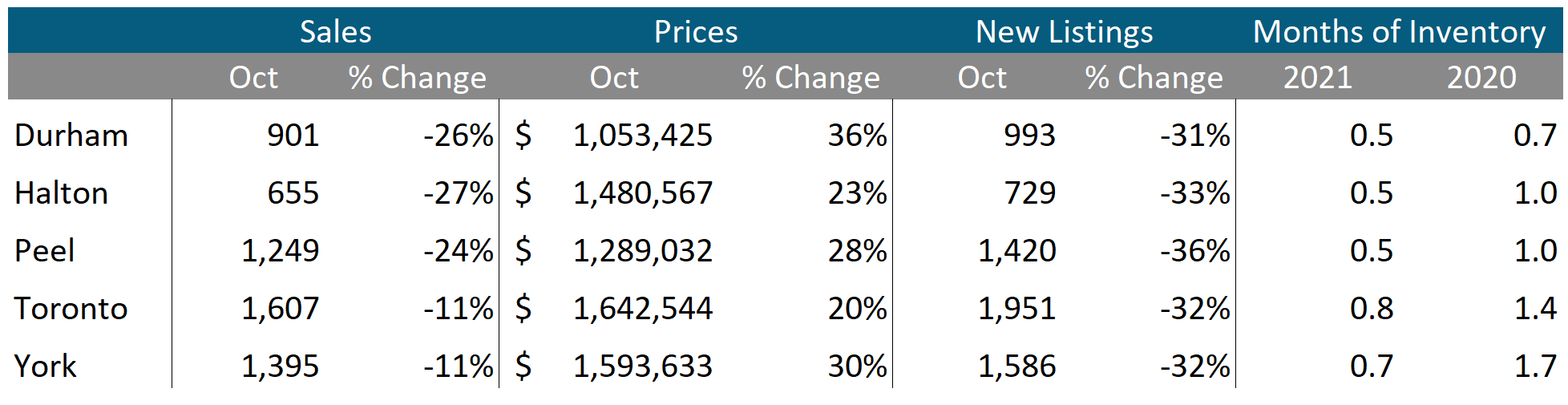

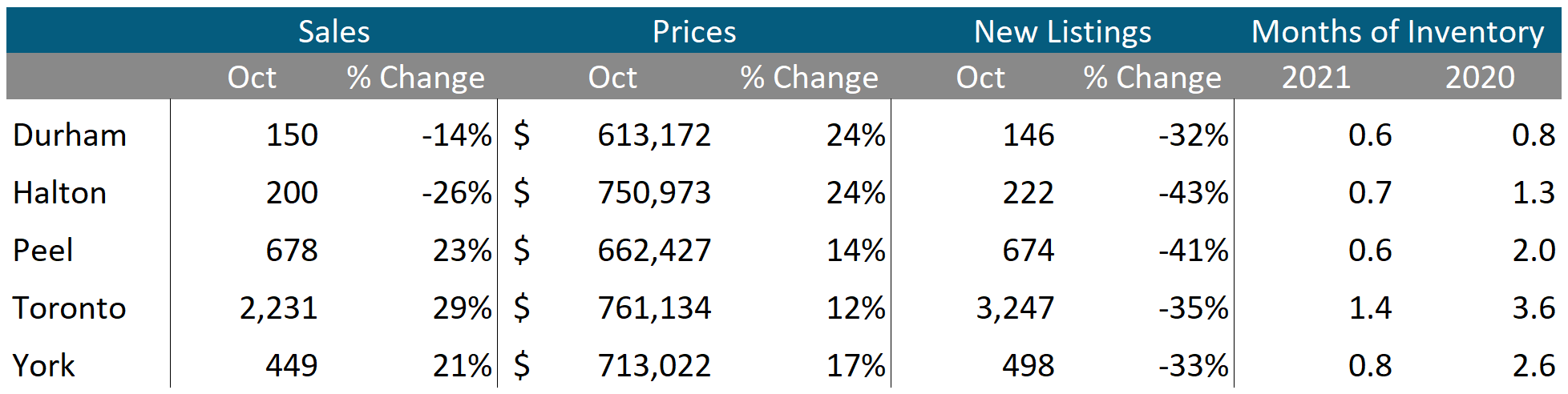

Sales across all five regions in the GTA were down in October while average prices were up on a year-over-year basis. The decline in new listings helped keep the market competitive with MOI below 1 across the entire GTA, indicating a strong seller’s market.

Condos

Toronto, York and Peel saw condo sales up on a year-over-year basis while the other regions saw a decline in sales. Average prices were up double digits across the Toronto area. Also indicative of strong market conditions, current MOI levels are below 1 in the suburbs and just 1.4 in the City of Toronto.

See Market Performance by Neighbourhood Map, All Toronto and the GTA

Greater Toronto Area Market Trends