Have questions about this unpredictable market? John is hosting a monthly webinar for past and present clients of Realosophy Realty. Hear key takeaways from this month's report and get answers to your questions.

The Market Now

Every month that passes we seem to be breaking yet another record in Toronto’s real estate market and March 2021 was no exception.

March saw the highest number of home sales in a single month ever — a total of 15,262 sold last month, a 90% increase over last year.

Home prices also hit a record at $1,107,942 up 22% over last year.

Inventory levels are down to just 0.7 Months of Inventory (MOI) for houses and 0.8 for condos. As a reminder, this means that if no other new homes or condos were listed for sale in just three weeks there would be no homes left for sale in the entire Toronto area.

Many real estate agents and brokers have been reporting some early signs of cooling, but we still need to take these with a grain of salt — at this point, the “cooling market” means homes that were getting 25 offers two months ago are only getting 8-10 offers today.

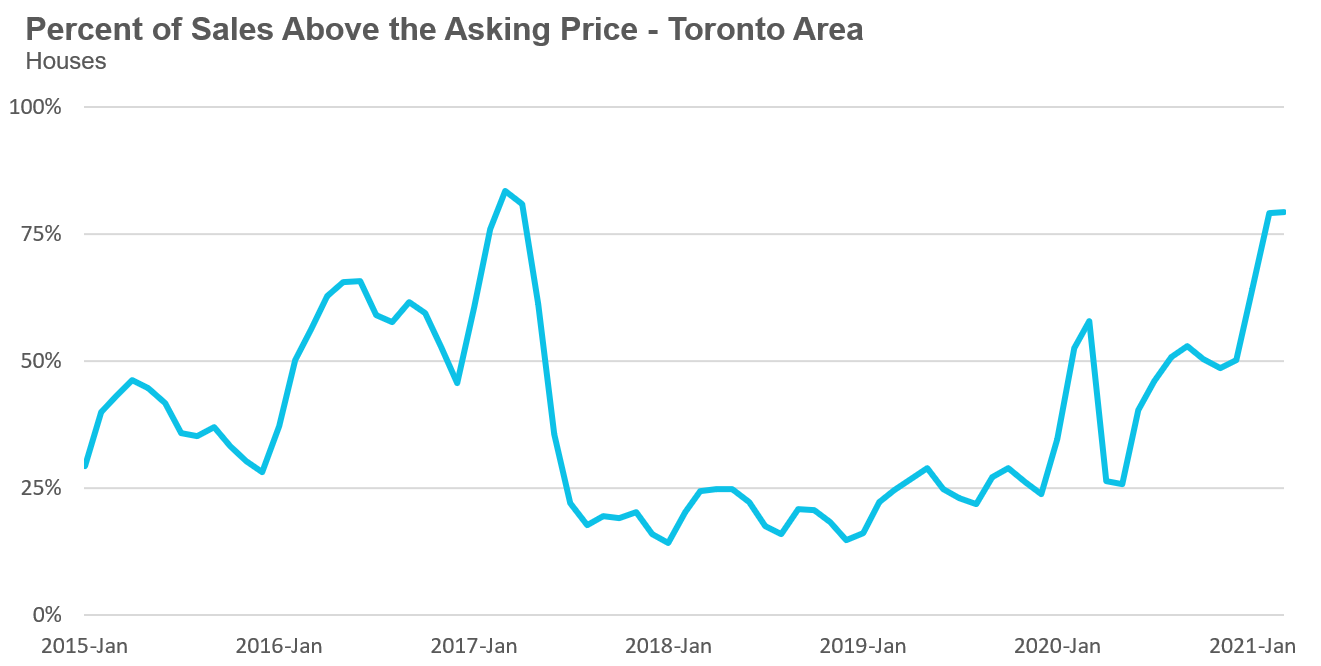

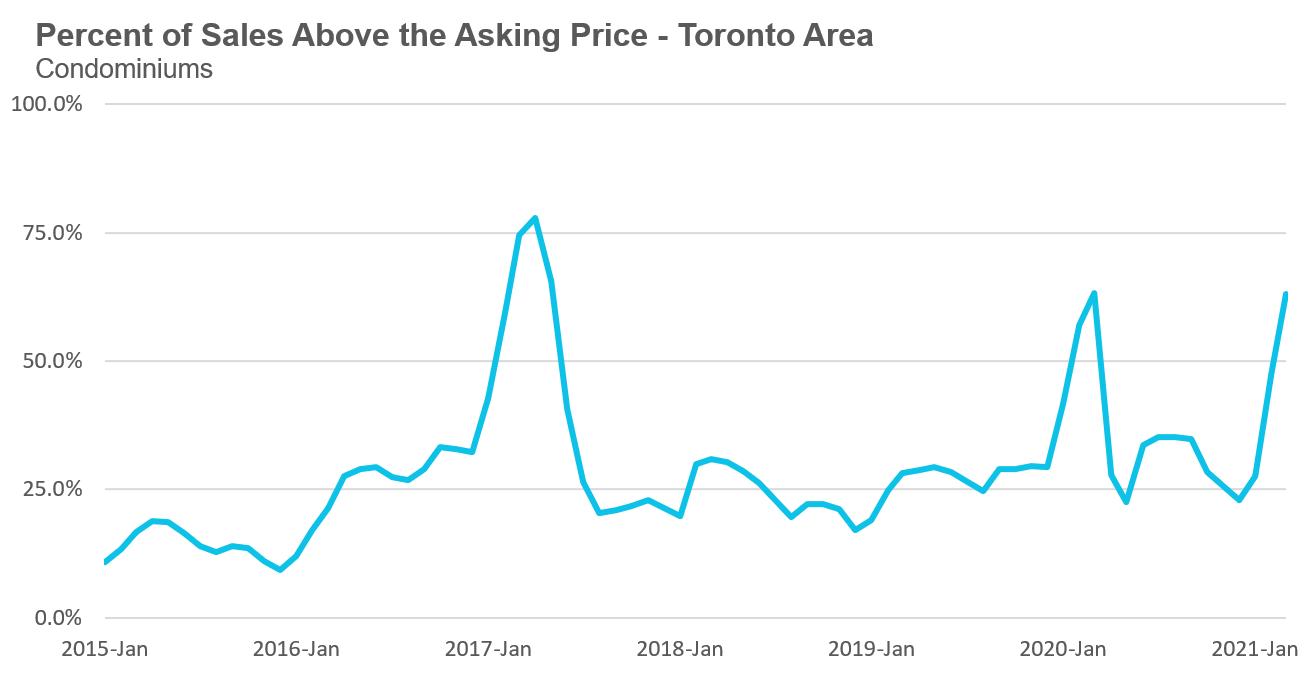

By the end of March, 79% of all houses are still selling for over the asking price (the same as last month). In the condo market 63% of condos are selling for more than the owner’s asking price, up from 23% in December.

To all of our everyday Toronto area home and condo buying and selling clients at Realosophy Realty and my readers at Move Smartly and my various social platforms who are feeling confused about this current state of affairs, I can only say that I am with you — you are not wrong to be confused.

Given this, there are still many things you can do as a home or condo buyer or seller in an uncertain market to ensure that you and your family benefit from any potential upside while being as protected against any downside as best as possible. That is what my research and my practice as a real estate practitioner, and that of my team at Realosophy Realty, has always been about — and you will find more information in this report speaking to this aim.

And while I, and all of my colleagues, will always be bullish on Canada, and more particularly the Toronto & Greater Toronto Area, as being one of the most diverse and dynamic social and economic regions in the world on the strength of its residents — I do have some strong concerns about what our policymakers are doing to keep this strength strong. More on that too, in this report.

Back in December, policymakers were still arguing that the biggest risk to Toronto’s housing market was rising unemployment and homeowners defaulting on their mortgage payments.

In my December 2020 report, I outlined why I disagreed with policymakers and why I believed that the biggest risk facing Toronto’s market “is the risk that the bubble-like appreciation we were seeing in the first quarter of 2020 pre-Covid is re-inflating.”

Three months later there is general consensus that the biggest risk facing our housing market today is overheating and a rapid acceleration in home prices. Bay street economists are sounding the alarms and our overheated housing market has made international headlines in the Financial Times, Bloomberg and the Wall Street Journal.

Policymakers have also started to raise more red flags with the Bank of Canada raising concerns about more flipping in the housing market and mounting debt as Canadians stretch to chase rising home prices.

Even the Canadian Mortgage and Housing Corporation (CMHC) has come out to warn that rapidly rising prices have left markets like Toronto highly vulnerable to a correction.

But these warnings from policymakers are a lot like having a smoke detector that only warns about a fire only once a house is already engulfed in flames.

Several years ago, after Toronto’s 2016/17 bubble, I spoke at a housing conference and argued that Canada needs an early warning system to caution policymakers about risks of future housing bubbles, much like a smoke detector that goes off at the first signs of risk.

These past few months have shown us how far away we are from that.

When I first warned that Toronto’s suburbs were moving towards a bubble in December 2020, suburban house prices were rising by under 20% in three out of four of the Toronto and Greater Toronto Area suburban (GTA)’s regions — Durham was the only region with prices rising by over 20%.

It was obvious that the market was hot, but on the surface it wasn’t obvious that we were moving towards a bubble.

Yet all the data I was looking at in December made me confident that the probability that the market was moving in this direction was high enough for me, a dedicated academic real estate estate researcher but also the owner of a real estate brokerage in this very industry, to warn about a bubble — months before our policymakers raised any red flags.

I find this troubling.

It’s clear that whatever methods economists in Ottawa and Queen’s Park are using are not quite up to the task of warning of early signs of risk in the housing market. We don’t need our policymakers to tell us the obvious after the fact, that our housing market is overheating and “highly vulnerable,” when prices are already rising by over 30% per year. We needed them to warn us in October or November that the probability that we would end up with a wildly overheating housing market in several months’ time was high.

To be fair, it would be very unreasonable to expect anyone to predict the unpredictable. For example, it would have been impossible to predict in February 2020 that a red-hot housing market would be frozen on a dime two months later due to the unprecedented global pandemic that is Covid-19.

Nobody can predict the unpredictable (cue the Black Swans).

But the fact is that the path our housing market is on today is just a continuation of the path we were on back in November and December 2020 so we actually do have some information to work with: Predicting this path is a lot like trying to predict where a car will be 30 seconds from now when you know its velocity and the rate at which it’s accelerating.

This, of course, is a trivial exercise for an engineer.

But when it comes to the housing market, which moves far slower than a car, economists can’t make heads or tale of where the market will be just two months from now even when they know both the velocity and rate of acceleration in the market today, which is a problem.

I’m hopeful that CMHC and the Bank of Canada will prioritize using new methods to analyze the housing market to develop an early “smoke detector” of exuberance in the housing market. This would allow our policymakers to be more proactive with their messaging and when considering future policy changes to cool the market, which is far better than simply reacting after prices are rising by over 30% per year.

For what it’s worth, I think the main barrier for this type of analysis has been that research into housing markets continues to be the realm of the macroeconomist; however, housing bubbles are not a macroeconomic phenomenon.

The macro approach is a lot like trying to determine if there is a bubble in the equities market when the only thing you can analyze is the aggregate index without knowing any information about the underlying stocks that make up the index.

I’m confident that developing a better understanding of future housing bubbles requires analyzing multiple high frequency time series that have been disaggregated spatially and by housing type that captures both fundamental factors along with estimates of behavioural factors that may be skewing property prices. Only then can one get a clearer picture of the underlying price dynamics in a given metropolitan area.

This, a possibility that underpins my latest work as a doctoral candidate at the University of Toronto Rotman and the University of Reading (UK), really motivates me as to the powerful applications it would have in advising real estate consumers, along with the media and the industry authorities I’ve been privileged to be in conversation with.

Stay tuned.

I get a lot of emails and questions from home buyers and sellers in the GTA who are trying to make sense of this overheated housing market, but of all the questions I receive, one in particular really stuck with me.

Below is the question I received from Christina:

Hi John! I love reading about all your real estate takes. I am a first time home buyer in Toronto, with 20% down for a 700,000 home. And have a middle class family income. I’m finding it infuriating to say the least, that it appears this isn’t even enough to live a comfortable life, or break into a market where value intersects with price.

Even homes outside of the GTA, are soaring. And when you factor in commute expenses, your potential housing savings are lost in commute. Plus your opportunity cost lost in a 90 min commute, one way.

Getting pretty anxious, that I may be completely priced out of the market. For 30 somethings looking to start a family, it seems financially impossible.

Would love to know your thoughts on waiting to get in, and will and if we see a cool?

In looking at this question, I see that Christina has managed to save $140,000 as a down payment and has a household income in the low $100K range (above the median income in the GTA), both of which are incredibly diligent achievements which denote her financial dedication and viability as a mortgage holder/home owner.

These numbers would make her maximum home buying budget $700,000.

So just how hard is it for Christina to buy a family home for no more than $700K in the Toronto Area?

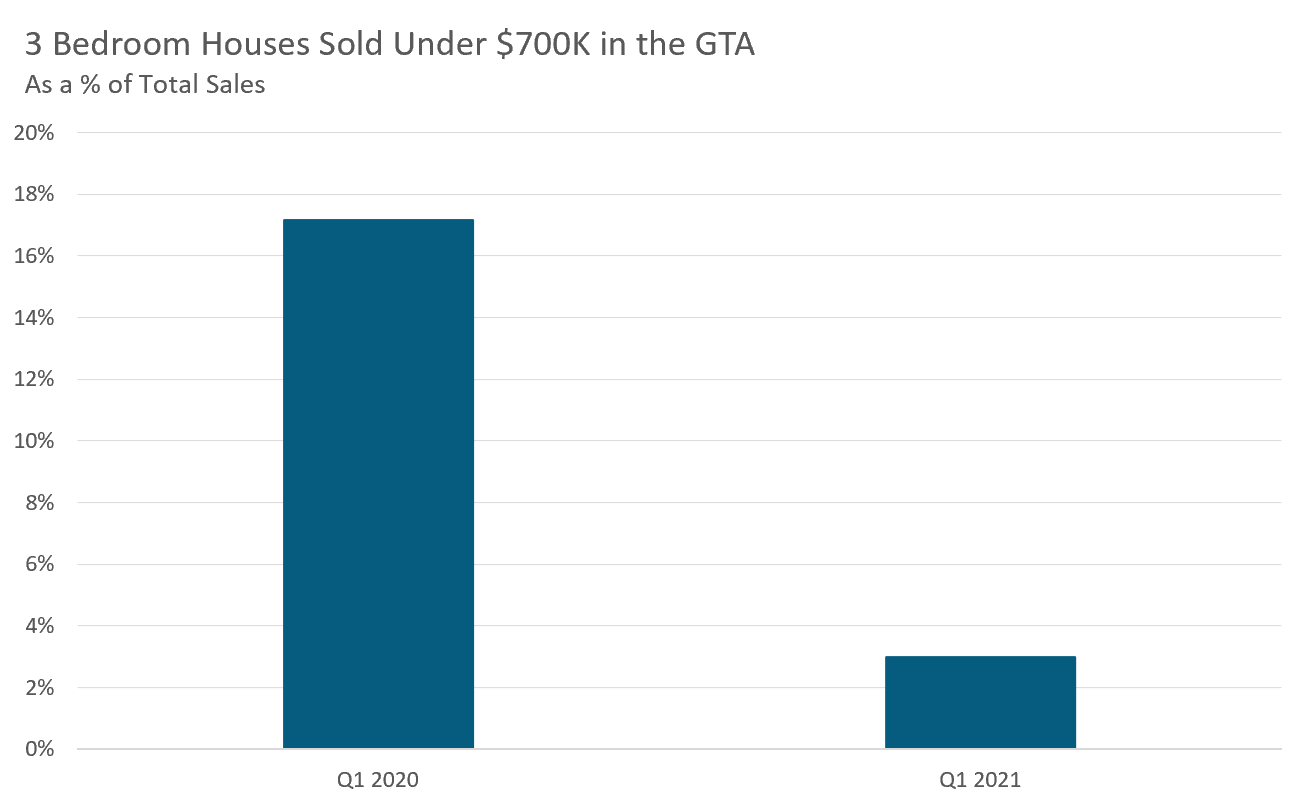

If Christina was buying a home last year, it would have been tough, but she still would have had plenty of options. Just over 17% of all the 3-bedroom houses that sold during the first quarter of 2020 sold for a price that was at or below $700K.

When we fast forward to the first quarter of 2021, only 3% of all the 3-bedroom homes that sold had a sale price at or below $700K. Most of these were, as Christina noted, a 90-minute commute to downtown Toronto or were in need of significant renovations.

When a family that has saved $140,000 as a down payment and earns a household income that is well above the median finds they have very slim odds of buying a home anywhere in the entire Greater Toronto Area - an area that stretches as far east as Clarington, west to Burlington and north to lake Simcoe - this is a sign that policymakers have failed Christina and thousands of other young households like hers.

The thing that many of the potential home buyers like Christina find the most disheartening is that housing affordability does not appear to be a priority for federal policymakers, and in fact, rapidly rising house prices has been a desired outcome of policy measures - as Bank of Canada Governor Tiff Macklem said “we need the support, we need the growth we can get”.

What Should Christina Do?

Let me return to Christina’s real life question about buying a home now or waiting to get into the market in the event that it cools.

If I was a first time buyer today, there are a lot of things I would personally be prepared to compromise on to buy a home because I have a strong bias for owning. I wouldn’t care too much about the condition the home is in, what it looks like on the inside or the outside. All of these can be changed over time, through slow investment and my own manual labour as funds allowed. I wouldn’t care if the home is very small, provided it is big enough for my needs today and for the next five to ten years. I would be fine buying a home on a busy street if the lower price helps me get into the right neighbourhood for me.

If I could afford to buy a home that would be big enough for me over the longer term and is in a neighbourhood I want to live in, then I personally would buy a home. Not because I think this is the best time and not because I don’t believe prices will fall in the future as I believe they will, as they always do. What we don’t know is when and by how much — and this is why I advise others to not attempt to time the market. While it’s normal to be worried, the danger that so many experience in reality is that this delay in action equates to many years of living your life waiting rather than doing — and benefitting from — your ‘doing’.

If prices fell six months after I bought, it would sting a bit (who likes to see their stocks or RRSP returns dip?), but I am always clear in my mind that I’m buying for the long-term so what matters is where prices are in ten years from now, not six to twelve months from now.

The rare exception is the need to be very cautious as a home buyer when we are seeing a rapid turn in the market that leads us to believe prices may be lower in the near future potentially affecting our ability to manage financially in the very short-term. In this video I walk through how we approached this in 2017.

Having said all this, if my maximum budget was $700K like Christine’s and those of many highly impressive first-time buyers today, I personally wouldn’t be in a position to buy. For me, where I live has a material impact on my happiness and I know I wouldn’t be able to afford a home that fits my needs and that is also in an urban part of Toronto for under $700K. And as much as I would prefer to own my home, moving to an area in the far reaches of Toronto’s suburban (or ‘905’ region) such as Clarington or Georgina would not be an option for me.

I wouldn’t be happy about renting, but I also wouldn’t be down about it either — because this situation would be out of my control and in no way a reflection of my commitment to buying a home because it takes a financially disciplined person to save a $140,000 down payment.

When you’re a first time buyer on a $700K budget today, your fight to get into the market is not with your peers, other first-time buyers trying to do the same, but with the Bank of Canada and our federal government who are deliberately trying to inflate home prices to improve our economy over the short term.

That’s a fight that no first time buyer can win.

So in the meantime, I would tell Christina that if the fundamental needs for your life - a place for you and your family to gather in a place that you have the satisfaction of owning - could be met in a home in the outer reaches of the 905, do it - no matter what you peers think about moving that far out and how much the 'opportunity cost' of your commute would be, consider that a beneficial compromise for the quality of your life.

But if a move that far out would exceed the day-to-day satisfaction of your life, what is enough to keep you at the hard work of your life, don't feel pressured to buy. Rent where you want to live, perhaps in an older building or house to minimize that outlay and invest as much of your income as you can in savings.

Bank economists including the Royal Bank of Canada (RBC)’s Robert Hogue and the Bank of Montreal (BMO)’s Robert Kavcic and Benjamin Reitzes have raised the alarm about Canada’s overheating housing market and have made a number of recommendations for federal policymakers to cool the market.

Kavcic and Reitzes offered nine possible policies to cool the market while Hogue suggested that “policymakers should put everything on the table, including sacred cows like the principal residence exemption from capital gains tax.”

The challenge that policymakers face now is that the right time for them to panic about our housing market was three to six 6 months before a crisis. Now that we are in a crisis, panicking and introducing too many measures to cool the housing market may end up doing more harm than good.

I don’t think policymakers should introduce any policies that aim to address problems in the housing market today. I think it’s better to consider what we want our housing market to look like over the next five years and to shape our policies to get us to that end goal.

I think the overarching goal that should shape housing policy over the next five years is that single family houses should primarily be bought by people who intend to live in them rather than by domestic and international investors and speculators who are simply using houses as a financial investment.

The first step in achieving this goal is making single family houses a less desirable asset to invest in.

This can be achieved in many ways.

The easiest and most immediate is to tighten lending requirements for investment properties by either increasing down payment requirements and/or ensuring a debt coverage ratio similar to what banks would require when financing a multi-unit residential property.

The Canadian federal Liberal government has also proposed a foreign buyer tax that may be modeled after BC’s speculation and vacancy tax. Such a policy would encourage domestic and foreign investors to rent out their investment properties rather than leave them empty.

For clarity, I am not referring to investors who build new infill housing where a much smaller single family home exists today. This type of investment into new housing construction should be encouraged.

Targeting investors rather than end-users serves what I believe are a number of short-term and long-term goals.

In the short-term, demand from end-users will naturally unwind so there is no need for any blunt policies that would make it harder for first-time buyers to buy a home.

But demand from investors is starting to pick up steam and will carry this housing boom well into next year — especially in the condominium (condo) market.

Why is demand from investors accelerating? Because policymakers have anchored investors’ expectations that residential real estate is the best investment in Canada.

Investors aren’t expecting 30% price gains per year to continue, but even at a more “modest” 10% price growth, investors can buy a property with a 20% down payment and due to the fact that any housing appreciation accrues to the entire value of the home, not just the down payment, a phenomenon referred to as “leveraging”, they are able to double their investment in three years, net of transaction costs. You just can’t do that with investments in machinery and you can’t do that with investments in R&D.

All of this might explain, as BMO’s Sal Guatieri noted, why Canadians are investing a lot more in residential real estate than on machines, factories and artificial intelligence (AI) which are all aimed at furthering the impact and reach of the work we actually do — because sitting around in our homes (or simply owning vacant ones) financially eclipses anything those work efforts could achieve.

Over the longer term, policies that promote single family homes as a place for people to live in rather than a financial asset that may or may not be rented out by investors will move us to a more affordable housing market for tomorrow’s first time buyers and an economy that is not as dependent on the real estate sector to drive Canada’s overall Gross Domestic Product (GDP) growth — an economy that would better incentivize and deliver on the incredible potential and skillset of the uniquely diversified people that make up modern Canada.

How Does Canada’s Housing Market Compare Internationally?

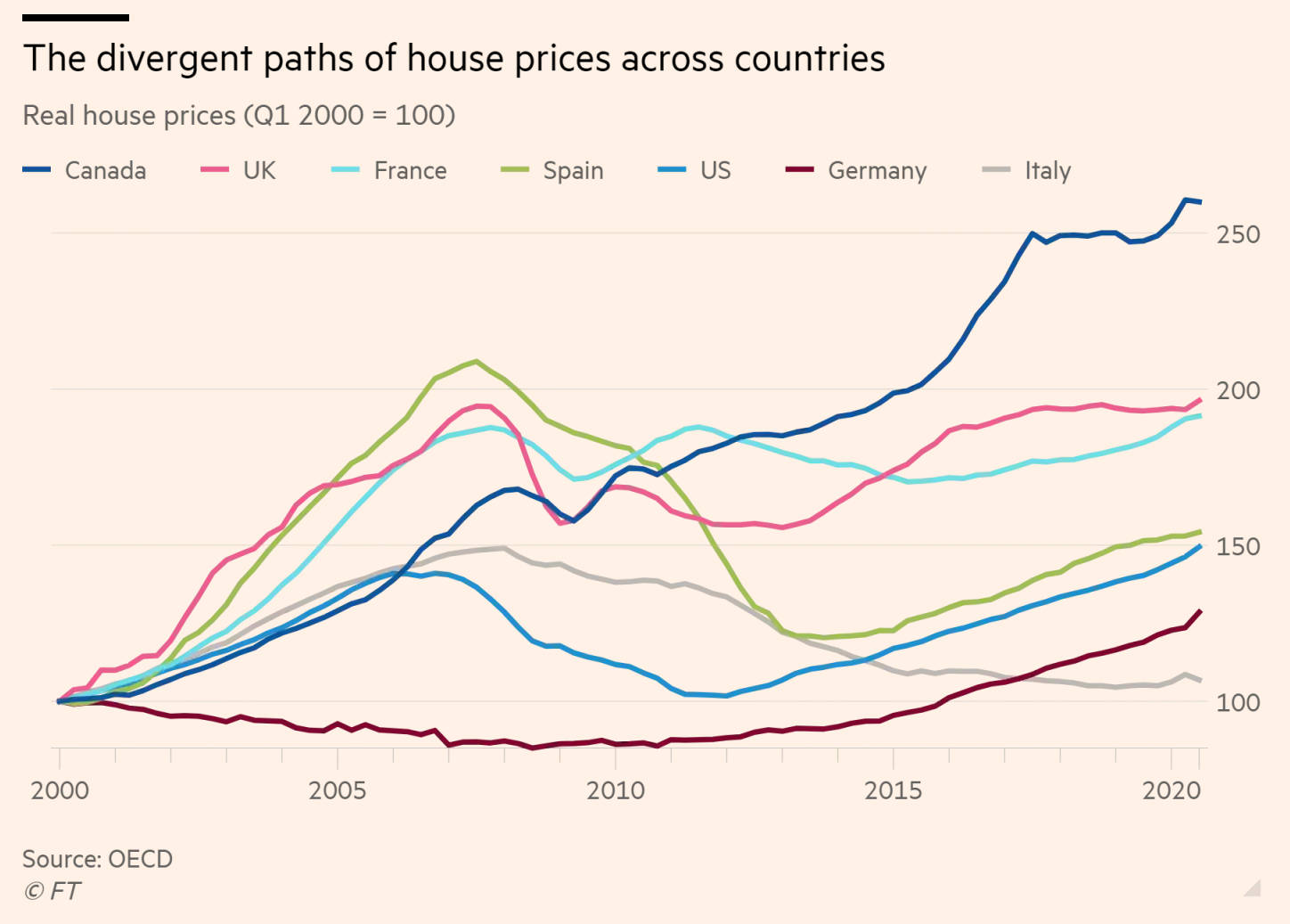

Martin Wolf’s Financial Times column last month looked at how housing supply constraints in the UK contributed to high house prices.

The column also included this interesting chart that compares house price appreciation across a number of developed countries - including Canada.

It is quite clear that the rapid acceleration we are seeing in Canada’s housing market is not new.

Canada’s house price growth was well ahead of other countries before the pandemic and we are outpacing the rest of the G7 since the pandemic.

Most discussions about investor behaviour in Toronto’s condo market focus on the number of investors entering the market at any given point in time. We rarely see any commentary or analysis on the number of investors exiting the market by selling their units and how that might change from one year to the next.

During one of my weekly meetings with our sales team, Realosophy agent Mei Chan mentioned that one of her rental listings received a high number of offers from tenants and every single applicant was moving because their current landlord was selling their unit. This prompted me to see if in fact condo investors were exiting the market at a higher rate this year.

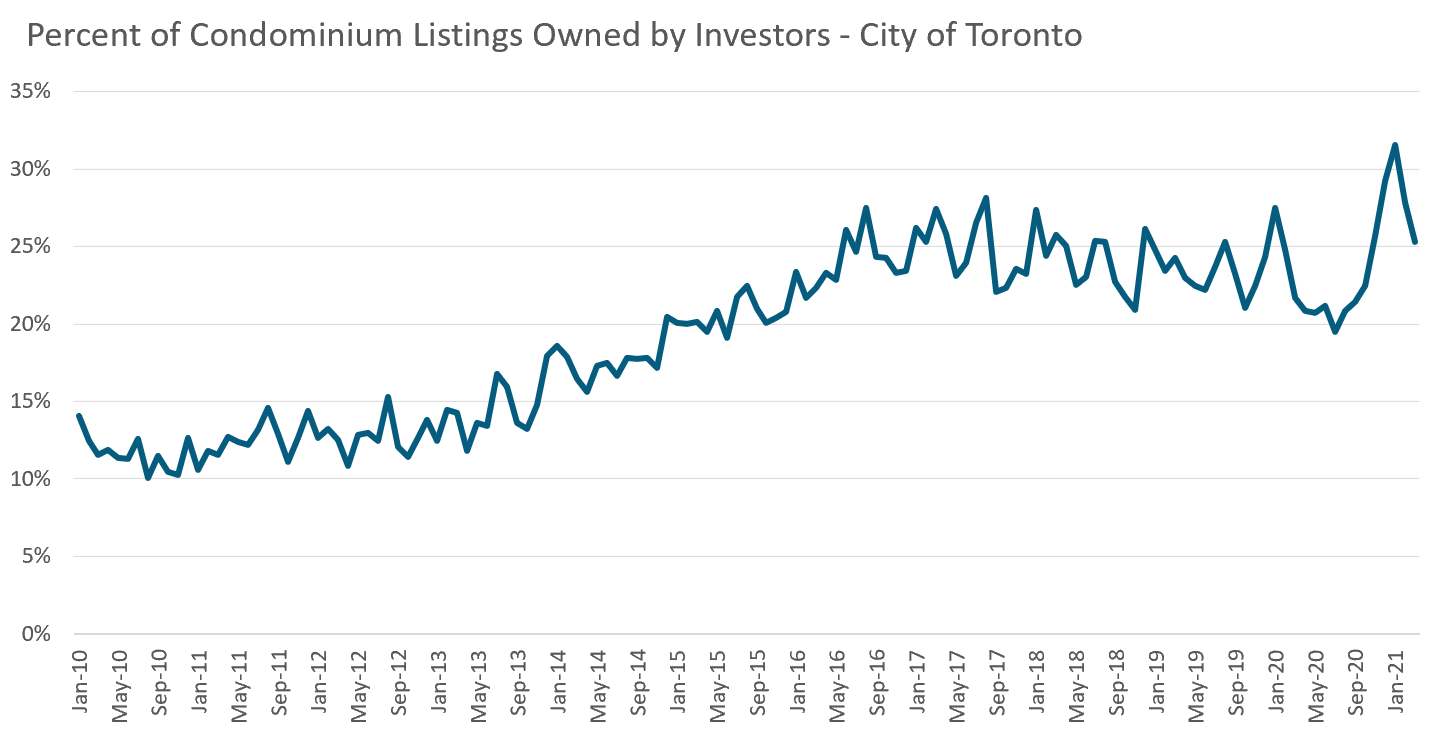

What I found is that over the past two quarters (Q4-2020 and Q1-2021), Toronto saw a significant increase in the share of new condo listings owned by investors.

To determine whether a condo was owned by an investor or an owner-occupier, we looked back in time to see what the last completed transaction was on the Toronto Regional Real Estate Board (TRREB)’s Multiple Listing System (MLS) system, where virtually all homes for sale in the Toronto area are advertised. If the last transaction was a lease, we classified the property as investor-owned. If the last transaction was a sale or purchase, then we classified the property as owner occupied.

Unfortunately this approach will undercount the total volume of investor owned units because many condominiums are advertised for rent on private websites like rentals.ca rather than on the MLS system. This means that a property that was bought by an investor and only listed for rent on private websites will be classified as owner-occupied when it is actually an investor-owned unit.

But for the purposes of this mini-analysis, we are more concerned about the change in the number of properties listed by owners and investors this year over last year. Since nothing materially has changed in the rental market that would lead to more or fewer investors renting their units on the MLS vs private websites, any undercounting should have a similar impact on volumes in both periods.

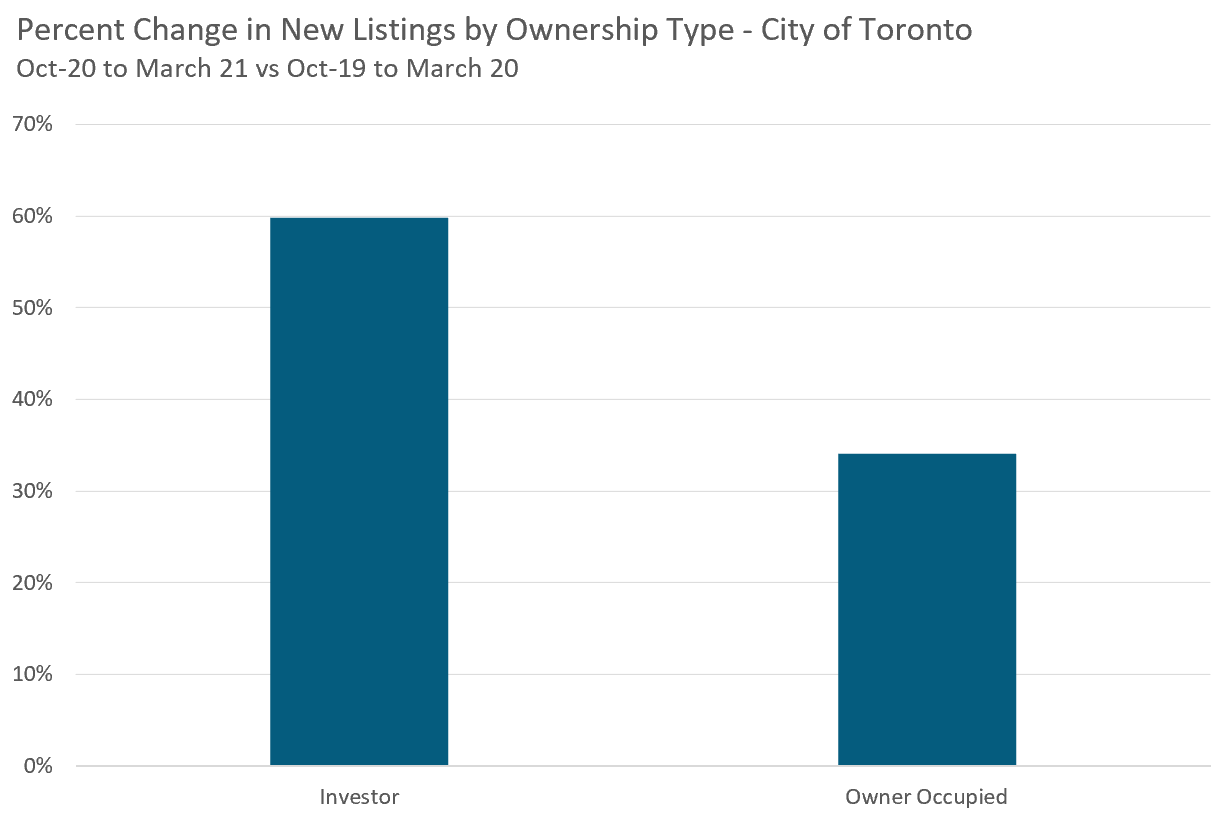

When looking at the total number of condo units that were listed for sale over the past two quarters (Oct-20 to March-21) compared to the same period last year we saw a much bigger increase in the number of units listed by investors compared to owner-occupiers.

New listings from investors were up 60% compared to just 34% for owner occupiers.

This surge in new listings from investors over the past two quarters was likely in response to a sluggish rental and resale market in the third quarter.

New listings owned by investors accounted for 27% of all condominium listings in the City of Toronto during the previous two quarters.

Over the past three months, we have seen a surge in demand for resale condos that has helped push condo prices up. The condo rental market is also showing signs of strength with inventory levels trending down and rental prices halting their downward trend.

The strength in the rental market along with rising resale prices has left investors feeling more optimistic about the future direction of condo prices and rents. This optimism has slowed the share of investor listings over the past two months.

We can see below that the share of investor-owned new listings peaked in January at 32%, but it has been trending down since then.

As condo prices continue to accelerate expect the share of investor-owned new listings to decline (tightening supply) and the share of properties bought by investors to increase in the months ahead.

In an upcoming report we’ll offer a detailed breakdown of investor behaviour on the demand side including the share of units bought by investors, the average purchase price of their units, average rents and an estimate of their monthly cash flow. Stay tuned.

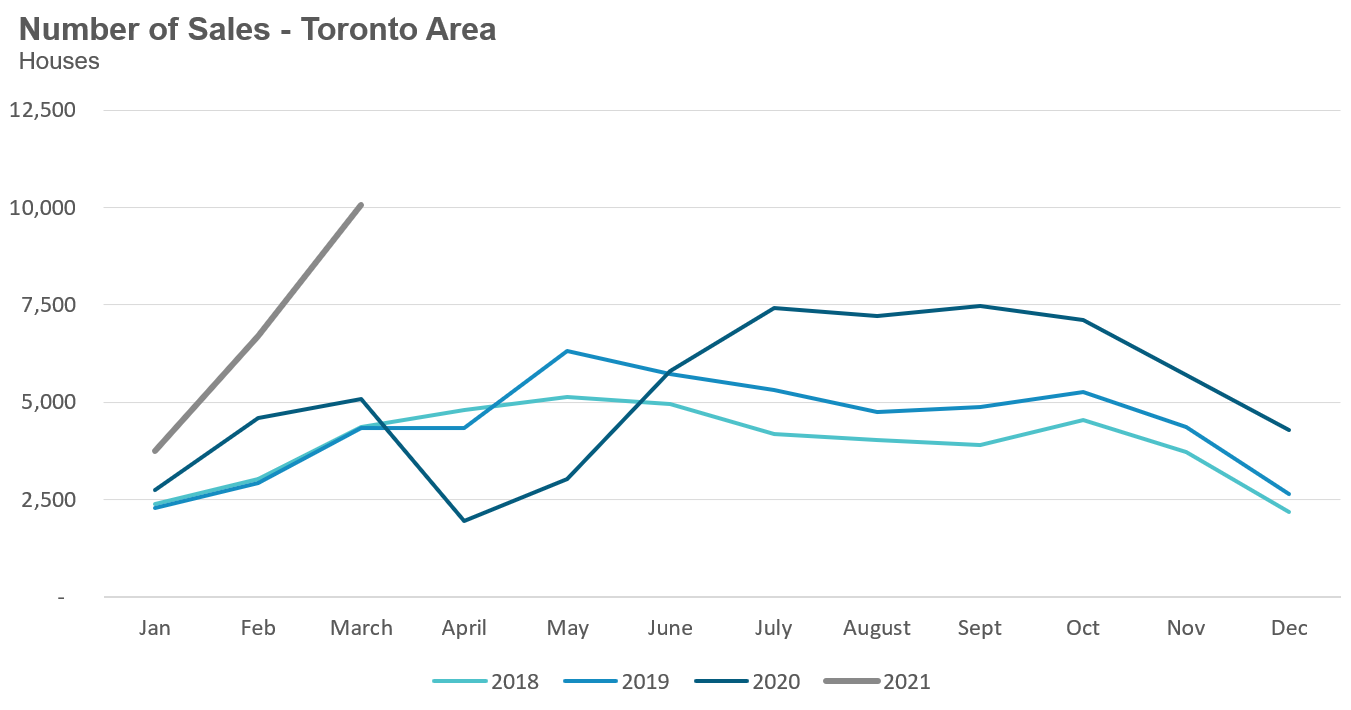

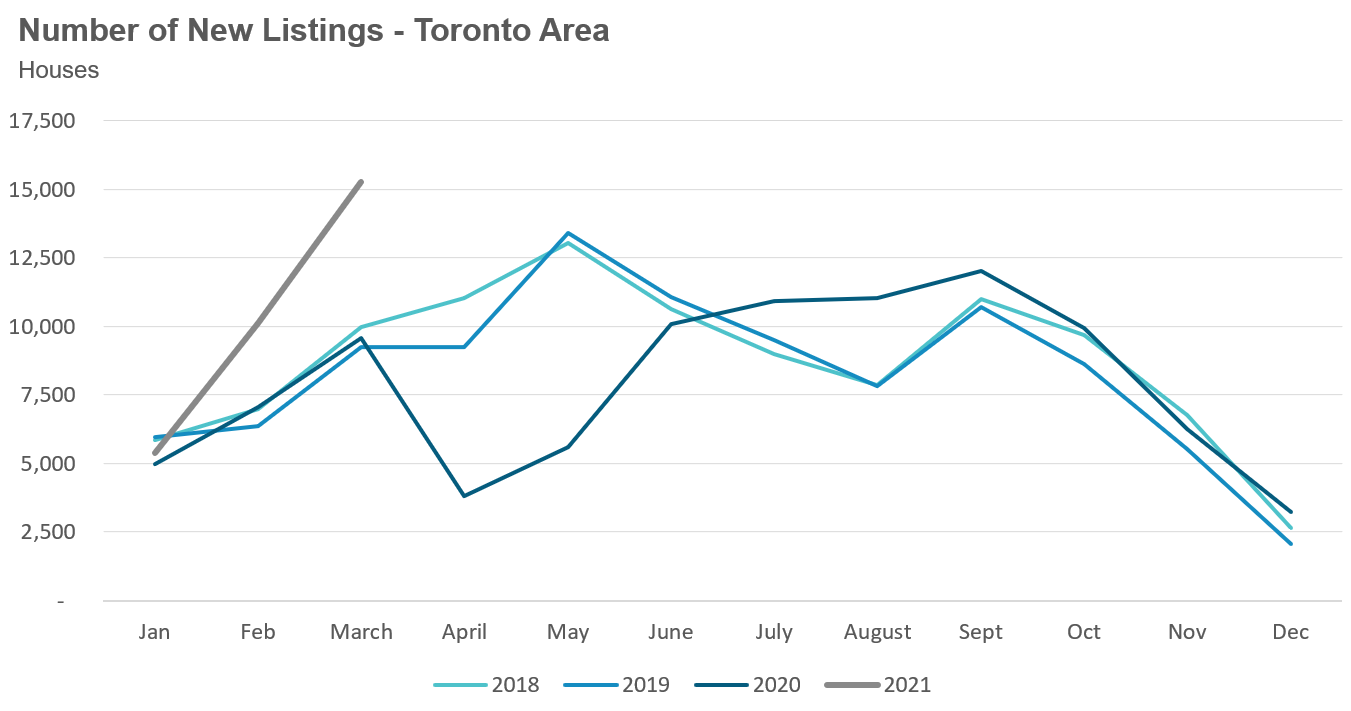

House sales (detached, semi-detached, townhouse, etc.) in the Toronto area in March 2021 were up 98% over the same month last year. The 10,068 sales last month was the highest number of sales ever for Toronto’s housing market.

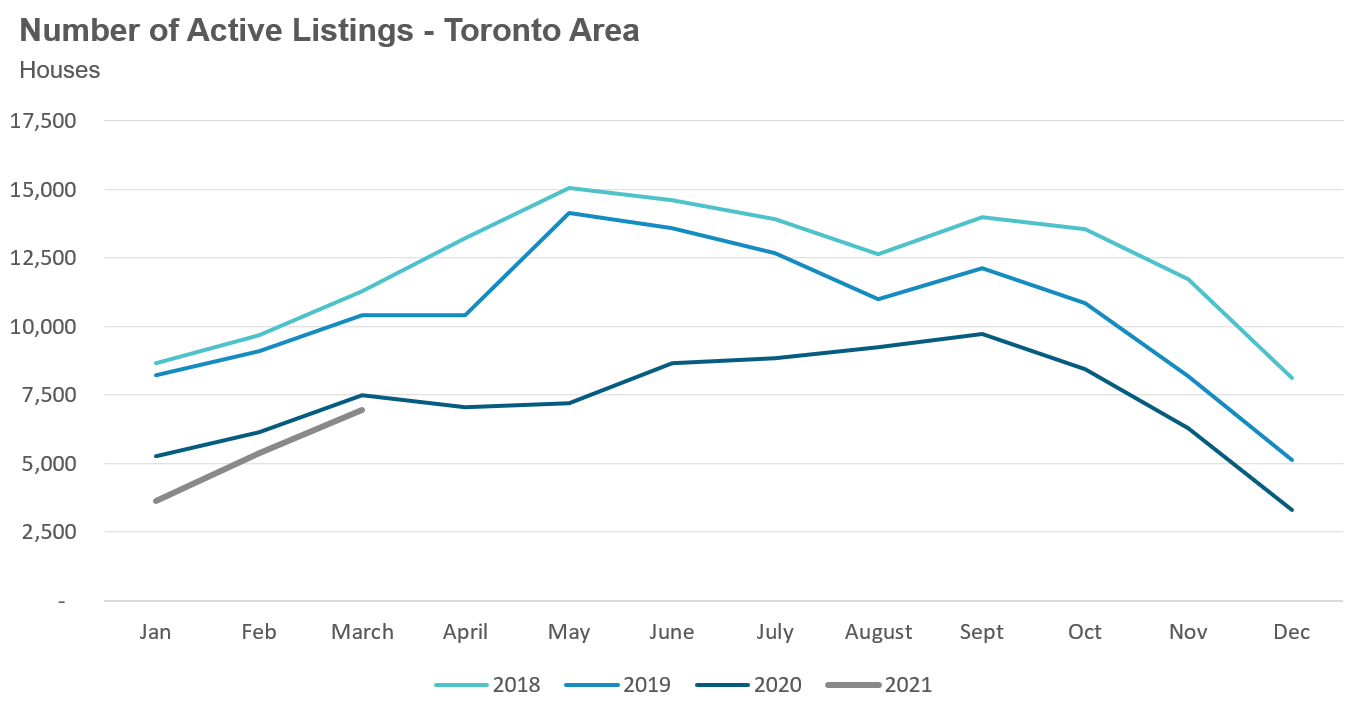

New listings in March were up 59% over last year while the number of homes available for sale (“active listings”) was down 7% when compared to the same month last year.

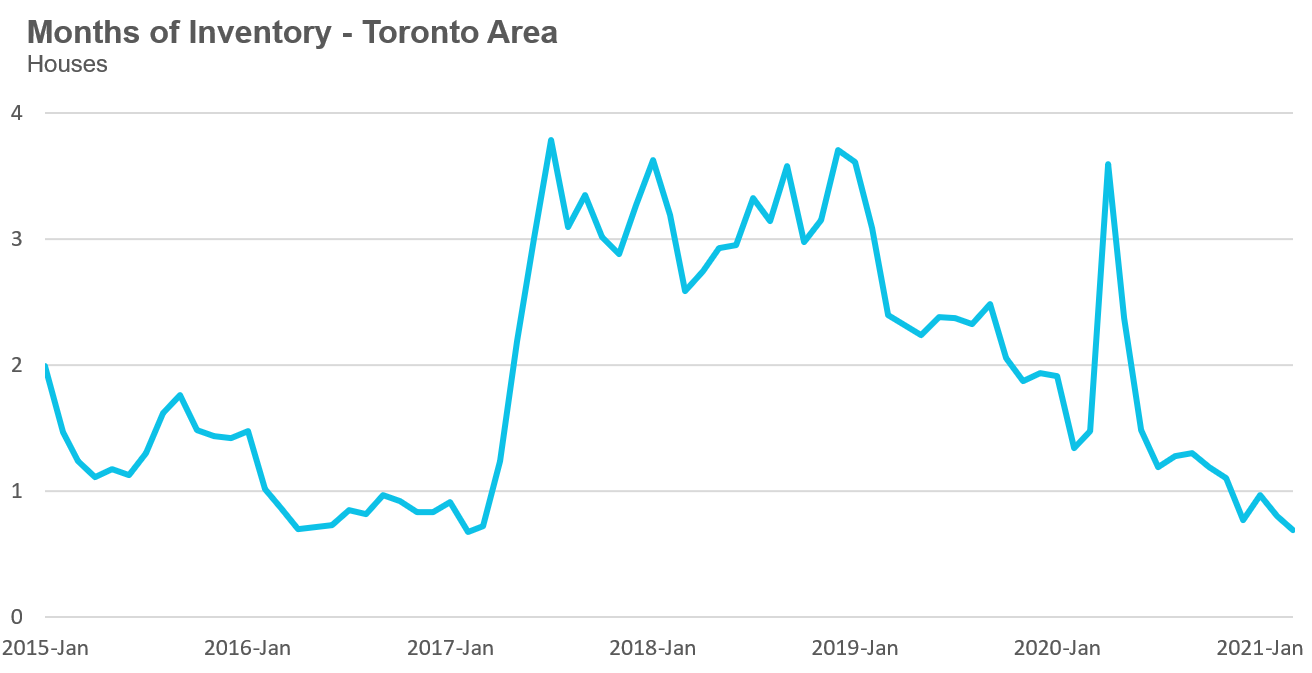

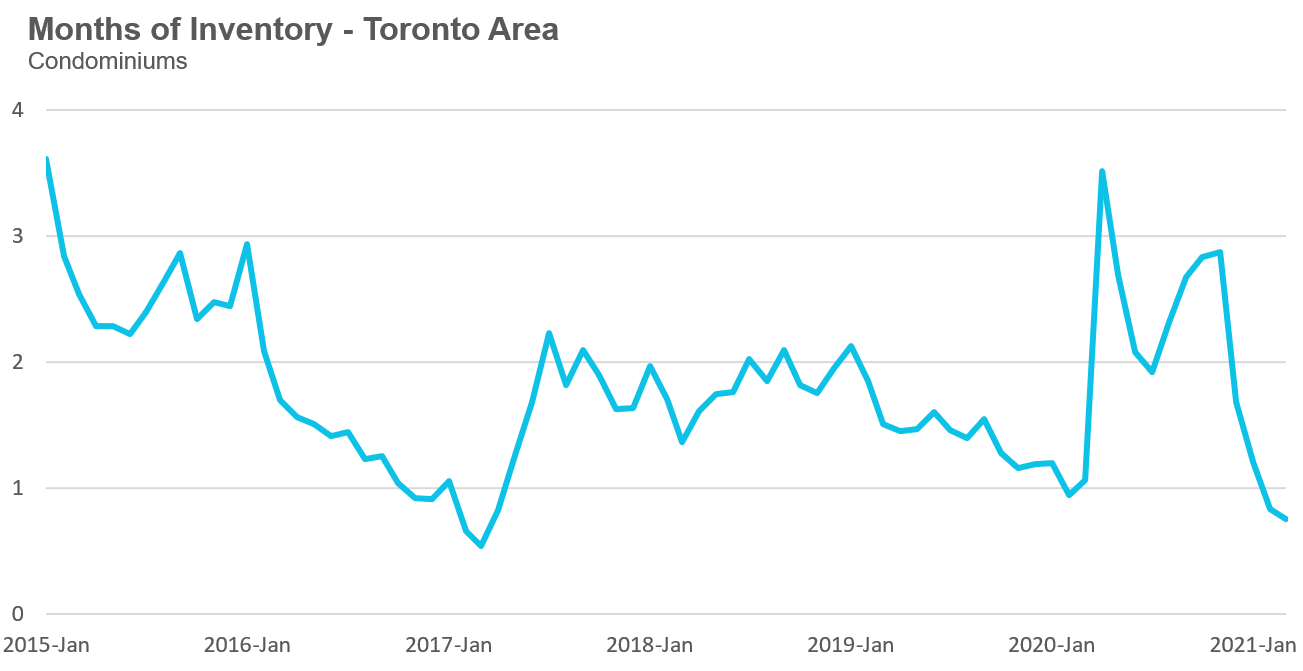

The Months of Inventory ratio (MOI) looks at the number of homes available for sale in a given month divided by the number homes that sold in that month. It answers the following question: If no more homes came on the market for sale, how long would it take for all the existing homes on the market to sell given the current level of demand?

The higher the MOI, the cooler the market is. A balanced market (a market where prices are neither rising nor falling) is one where MOI is between four to six months. The lower the MOI, the more rapidly we would expect prices to rise.

The market remained very competitive in March with an MOI of just 0.7 months.

While the current level of the MOI gives us clues into how competitive the market is on the ground today, the direction it is moving in also gives us some clues into where the market may be heading. The MOI has remained relatively stable at or below 1 MOI for the past four months.

The competition for houses has picked up considerably since December when 50% of houses were selling for more than the owner’s asking price. For the second month in a row, 79% of houses sold for more than the owner’s asking price.

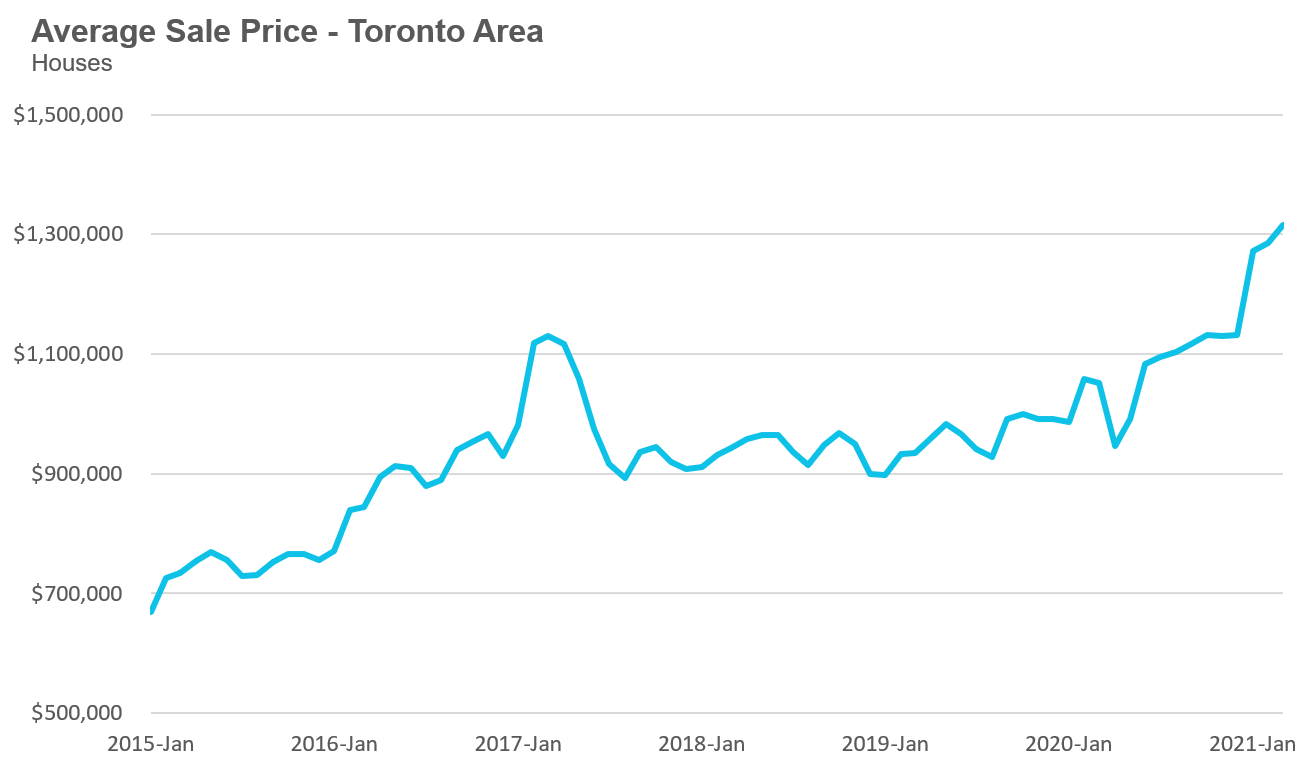

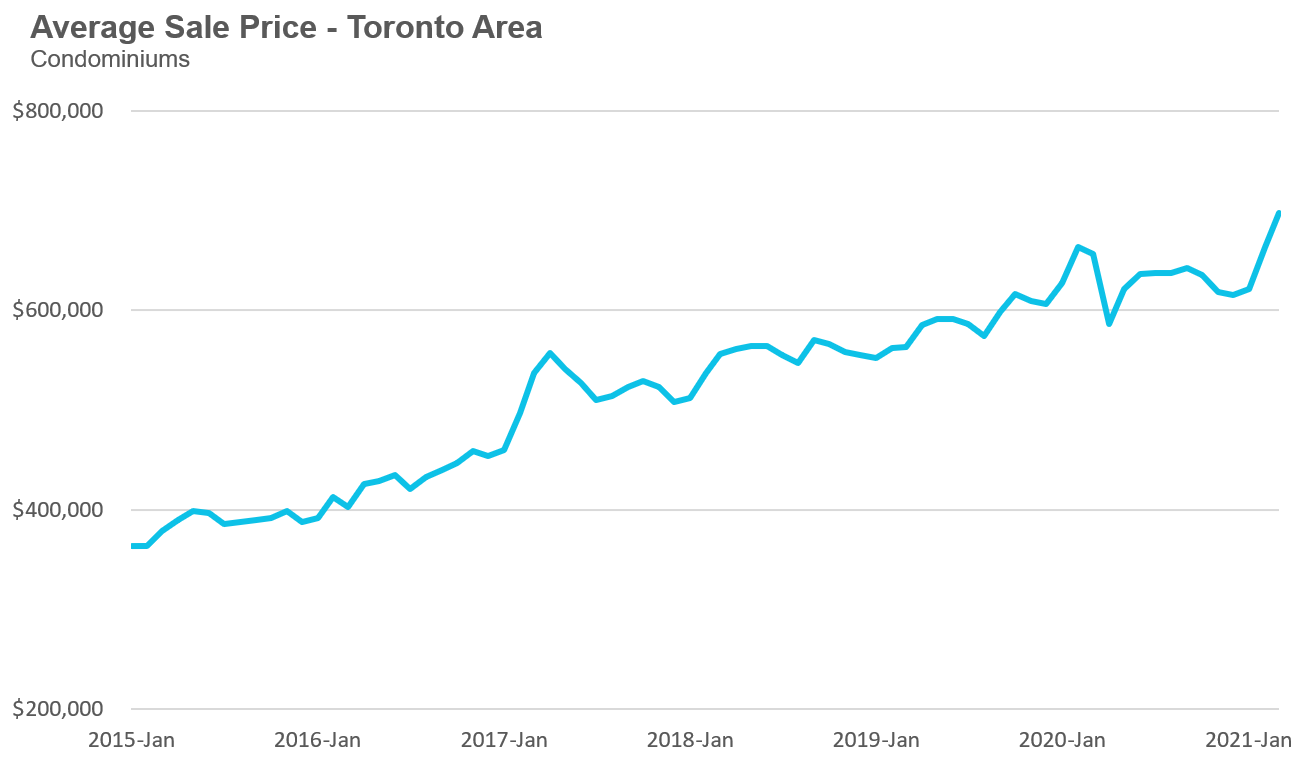

Strong demand coupled with very low inventory levels helped push average house prices up to another record high of $1.316M and up 25% over last year.

Median house prices are up by 28% over last year.

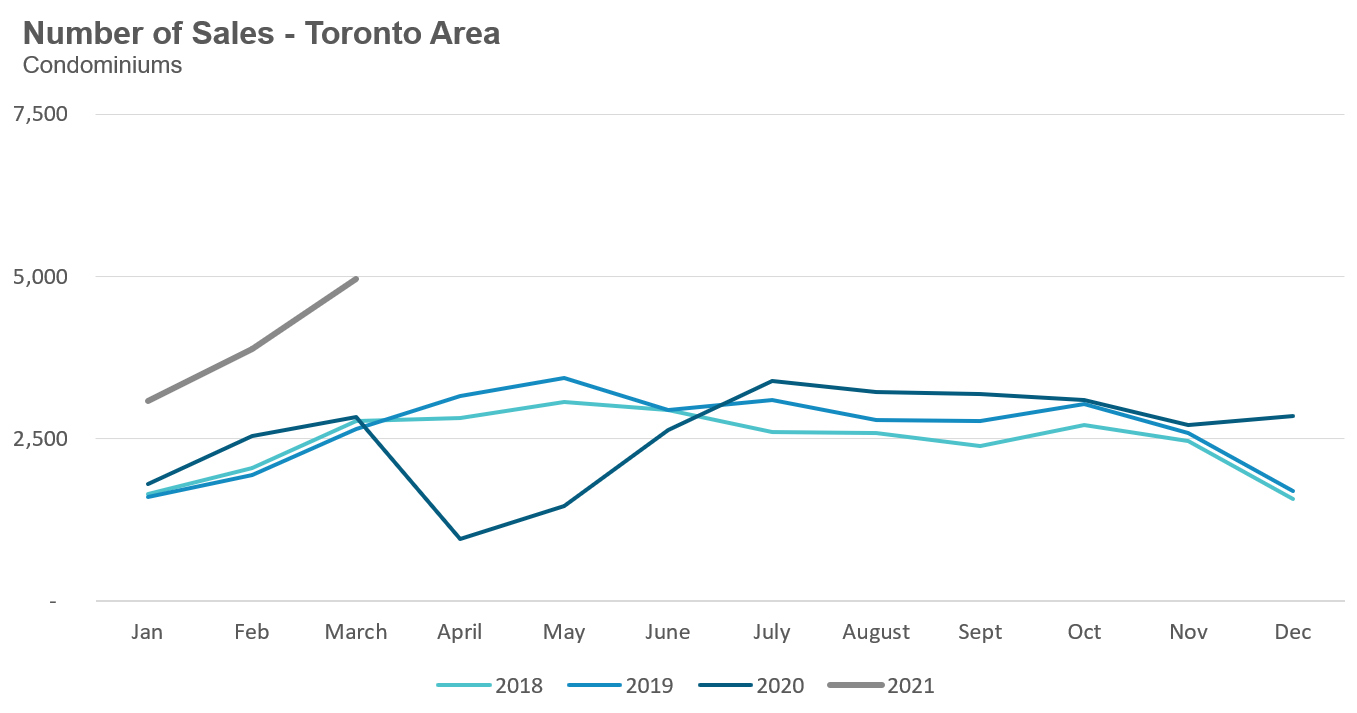

Condominium (condo) sales (condo apartments, condo townhouses, etc.) in March were up by 75% over last year.

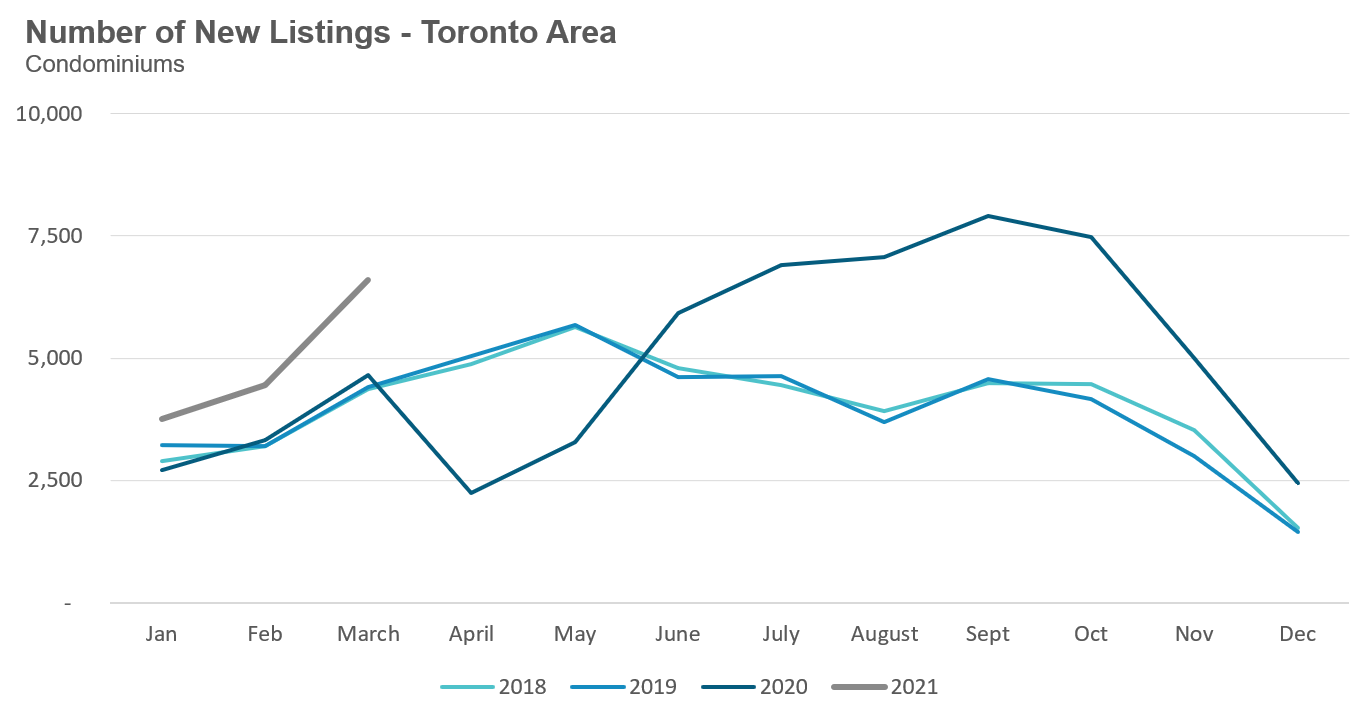

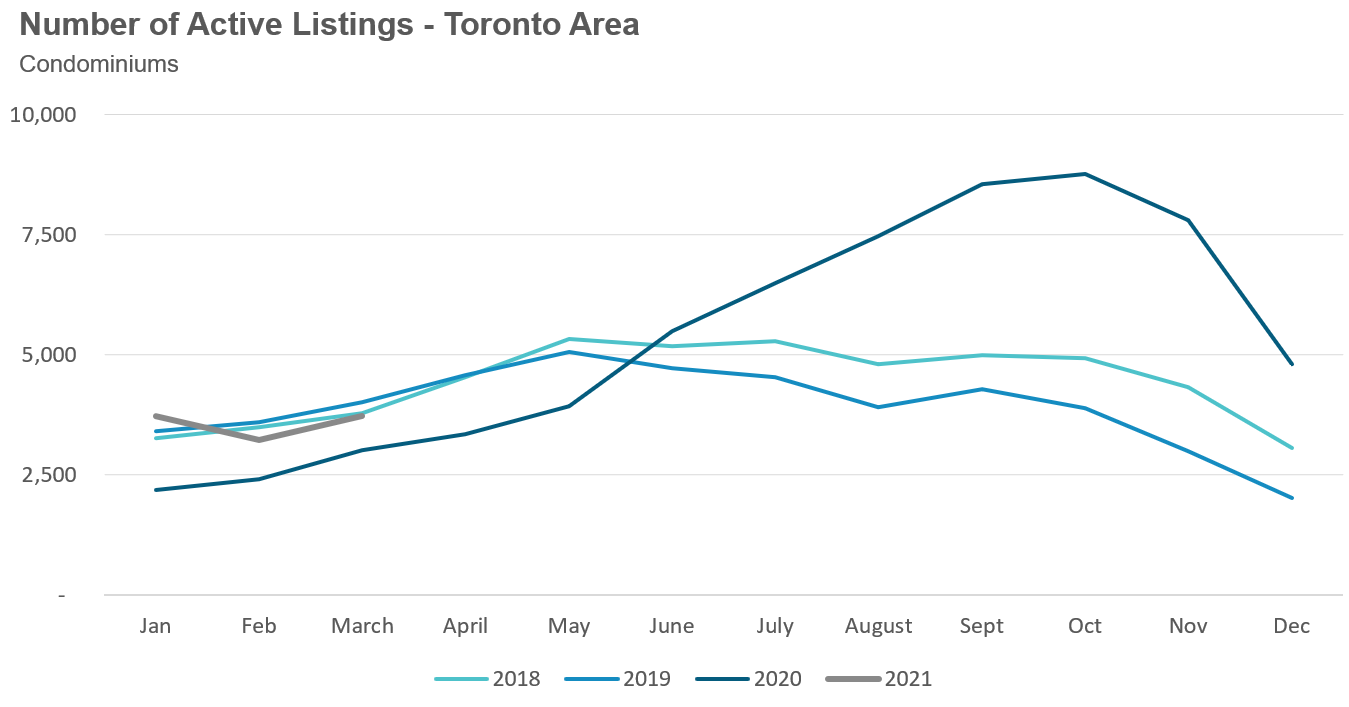

New condo listings were up by 42% in March 2021 over last year while active listings were also up 24% over last year.

Active listings were up on a month over month basis for the first time since October when active condo listings peaked at 8,772.

But the strong growth in sales is leading to a more competitive condo market with the MOI decreasing from just under 2.9 months in November to 0.8 in March.

The competition for condos has picked up considerably since December when 23% of condos were selling for more than the owner’s asking price. In March 2021 63% of condos sold for more than the owner’s asking price.

Toronto area condo prices are up 6% over last year. The increase was led by the suburbs where condo prices are up by more than 10% while prices in the City of Toronto are up just 1% over last year.

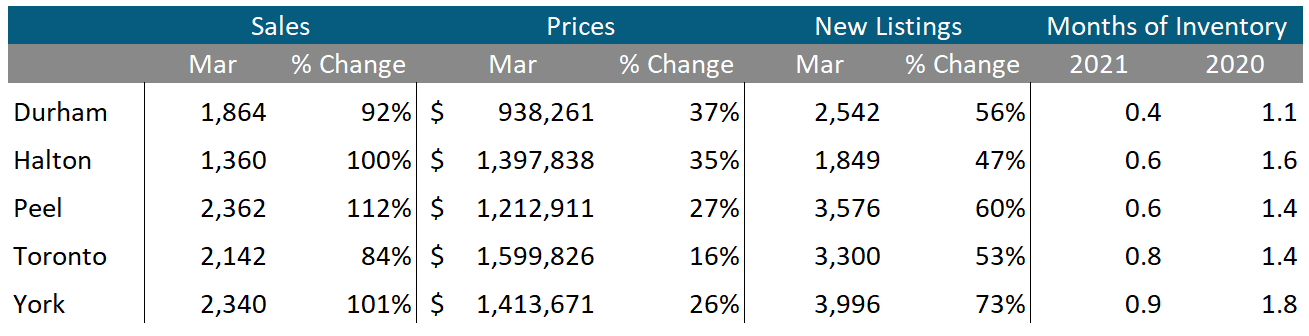

Sales across all five regions in the GTA were up significantly in March. Average prices were up 26%-37% in the suburbs while prices in the City of Toronto were up 16%. Despite the increase in new listings inventory levels are at or below 1 month across the entire GTA.

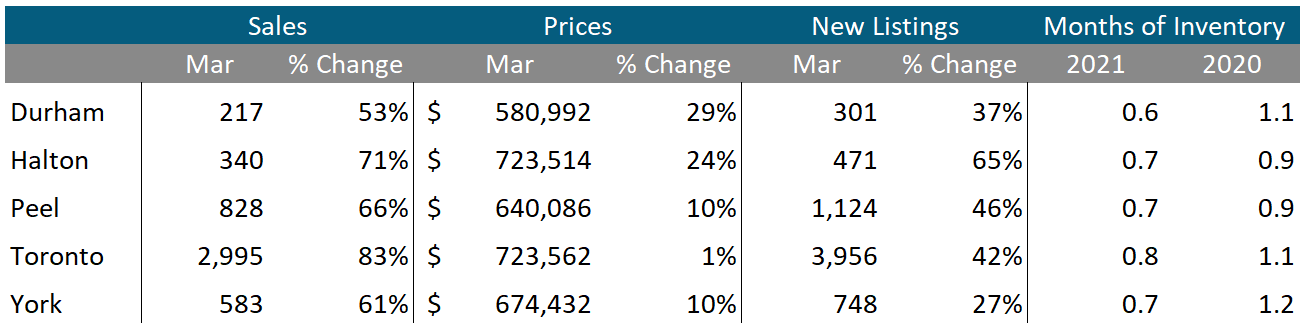

The surge in condominium sales continued in March across the entire GTA. Average prices were up across the suburban regions with the City of Toronto recording a slight increase over last year.

Inventory levels are below last year’s levels for all five regions.

Greater Toronto Area Market Trends

Market Performance by Neighbourhood Map, Toronto and the GTA

More Data for Realosophy Clients

Realosophy clients can access the same information above plus additional information on every home for sale, including building permit history, environmental alerts and more. Visit Realosophy.com/buy or contact your Realosophy agent for more details.