With the Toronto condo market cooling, this month's Move Smartly report investigates which condos are to watch - and which to avoid.

As Featured in the Move Smartly Report:

While Toronto's condo market is showing signs of cooling, some units are performing better than others. But which units are performing well and which are a tougher sell in today's market?

While Toronto's condo market is showing signs of cooling, some units are performing better than others. But which units are performing well and which are a tougher sell in today's market?

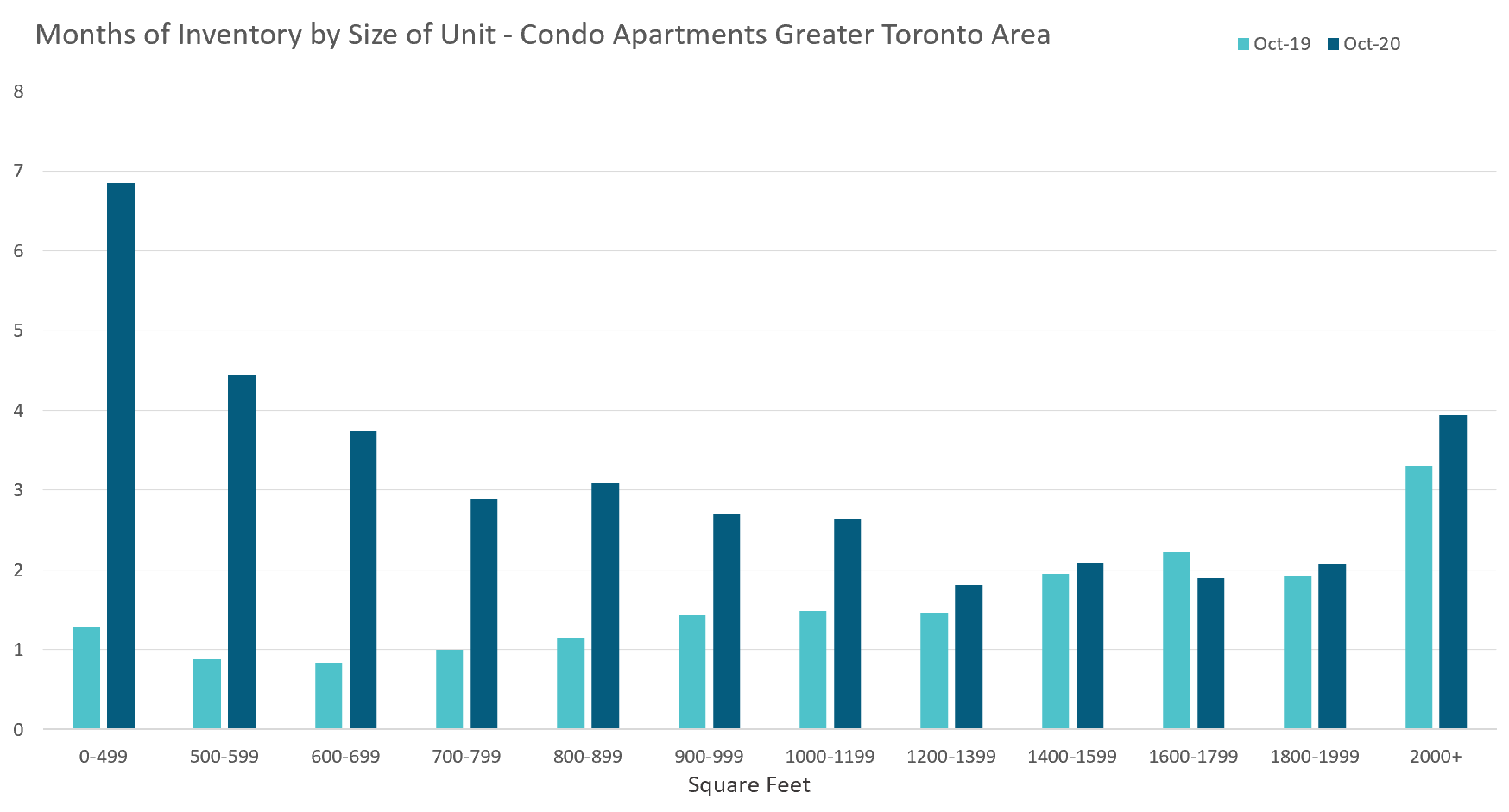

One way to measure this Is to compare the current number of properties for sale against the number of homes that sold over the past month which gives us a metric called the Months of Inventory (MOI). The higher the MOI the more inventory there is relative to current demand suggesting a cooler market while a lower MOI suggests that properties are selling relatively quickly and demand remains strong.

Realtor Scott Ingram of Century 21 had the clever idea of analyzing the MOI in the condo market by unit size to see if there are differences in how over or undersupplied the condo market is by condo unit size. Scott's results were for the City of Toronto; I extended this analysis to the GTA and added last year's MOI results as well as a point of reference.

The light blue shows the MOI by unit size in October 2019. We can see that smaller units generally had the lowest level of inventory and inventory levels gradually increased as units got larger – a common trend since larger units also tend to be more expensive.

We see a very different pattern in 2020. The most oversupplied units in the condo market today are units that are smaller than 600 sq. ft. In fact, these units are more oversupplied and harder to sell than units that are over 2,000 sq. ft in size which tend to be in the luxury segment.

We also see a U-shaped pattern in the MOI by unit size. Inventory levels decline as units get larger, reaching their lowest level in the 1,200-1,399 sq. ft range before gradually increasing again as units get larger.

On the ground, this means that if you're a buyer looking for a 1,200-1,399 sq. ft unit you're likely to find the market tightly supplied with units selling relatively quickly. If you're looking to buy a condo that is smaller than 500 sq. ft, the supply of units significantly exceeds demand today.

This shift away from micro condos is likely due to a desire for larger living spaces as more people are working from home due to COVID restrictions.

These trends are noteworthy for a couple of reasons.

Firstly, there is historically a very close link between MOI and changes in price - the higher the MOI the more likely we are to see downward pressure on prices. If this trend continues into the future it suggests that we may end up seeing more downward pressure on very small condos while larger units may end up performing better.

The other reason this trend is noteworthy is because small condos make up a significant portion of the new condo supply that is coming on the market. More inventory of small condos from new condo completions could put even more downward pressure on prices.

A key trend to track.

Read my full analysis on this and other key trends in the November 2020 Move Smartly Report

Follow John's latest updates on Twitter, YouTube, Facebook or Instagram

John Pasalis is President of Realosophy Realty, a Toronto real estate brokerage which uses data analysis to advise residential real estate buyers, sellers and investors.

A specialist in real estate data analysis, John’s research focuses on unlocking micro trends in the Greater Toronto Area real estate market. His research has been utilized by the Bank of Canada, the Canadian Mortgage and Housing Corporation (CMHC) and the International Monetary Fund (IMF).

November 26, 2020

Condos |