Since February 2022, condo sales and prices are declining far more rapidly in the suburbs than in the City of Toronto.

As featured in our monthly Move Smartly Report - watch full story video above, read brief recap of story below and click on report cover below to read all stories for the month

FREE PUBLIC WEBINAR: The Market Now with John Pasalis

Join John Pasalis, report author, leading market analyst and Move Smartly contributor, and President of Realosophy Realty, and in a free monthly webinar as he discusses key highlights from this report, with added timely observations about new emerging issues, and answers your questions. A must see for well-informed Toronto area real estate consumers.

Over the past two years, the low-rise suburban housing market has seen a lot of media attention due to skyrocketing demand and prices driven by the “urban exodus” triggered by the COVID-19 pandemic.

The suburban condo market has been largely overlooked because it makes up a relatively small share of total sales each month. But drilling down into some of the trends in the suburban condo prices reveals some interesting — and overlooked — trends.

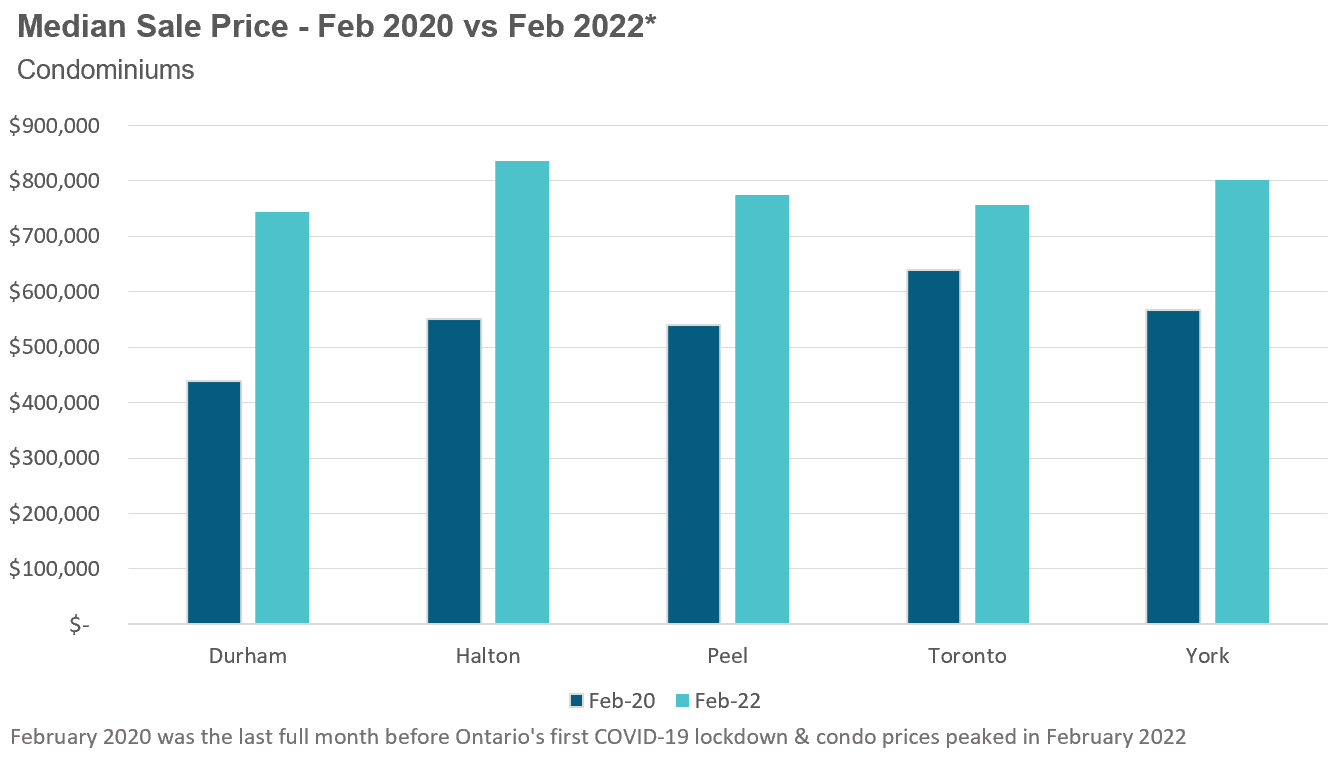

This first chart compares the median sale price for condominiums (apartments and condo townhomes) for February 2020 (the last month before the COVID-19 lockdowns) and February 2022, the approximate peak for this cycle.

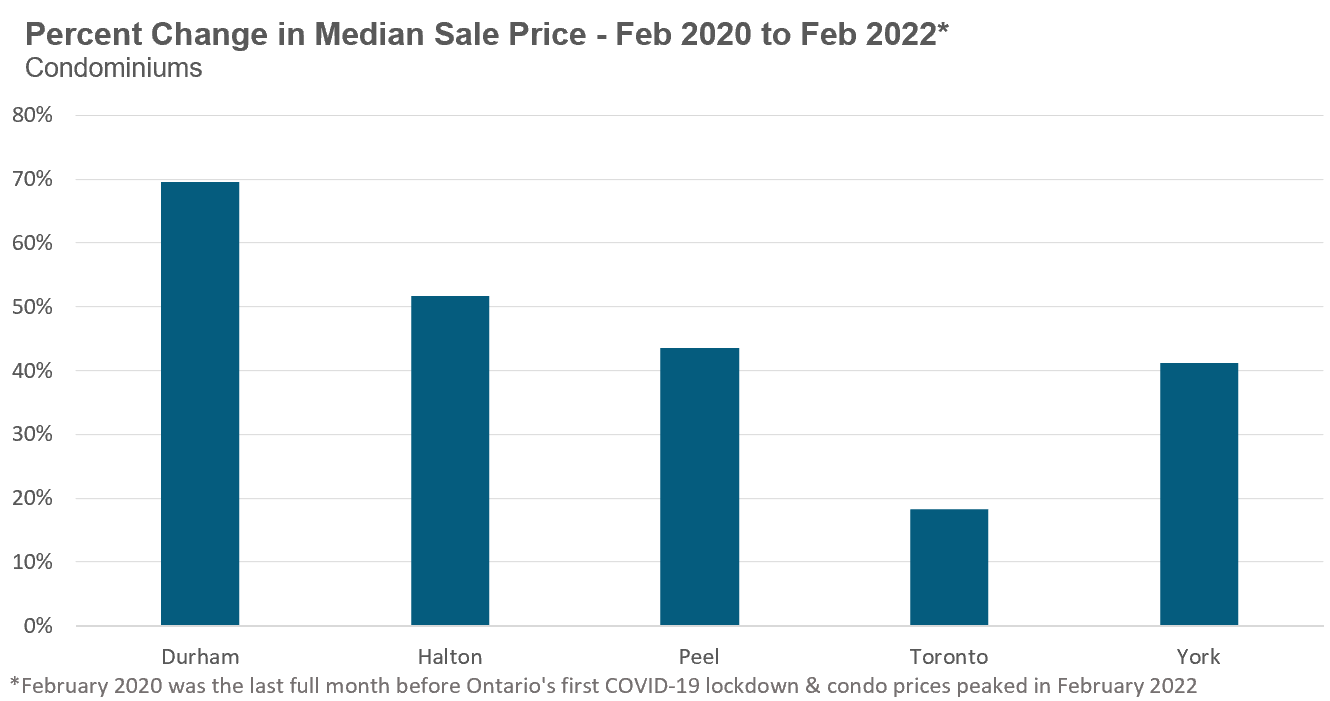

The first thing that stands out is that condo prices in the City of Toronto were higher than the other four regions in 2020, but since then, median condo prices in Halton, Peel and York have surpassed Toronto while Durham prices are just behind Toronto.

Condo prices surged by more than 40% over the past two years in York and Peel, more than 50% in Halton and were up 69% in Durham. In comparison, the City of Toronto saw condo prices rise by 18% over this two year period.

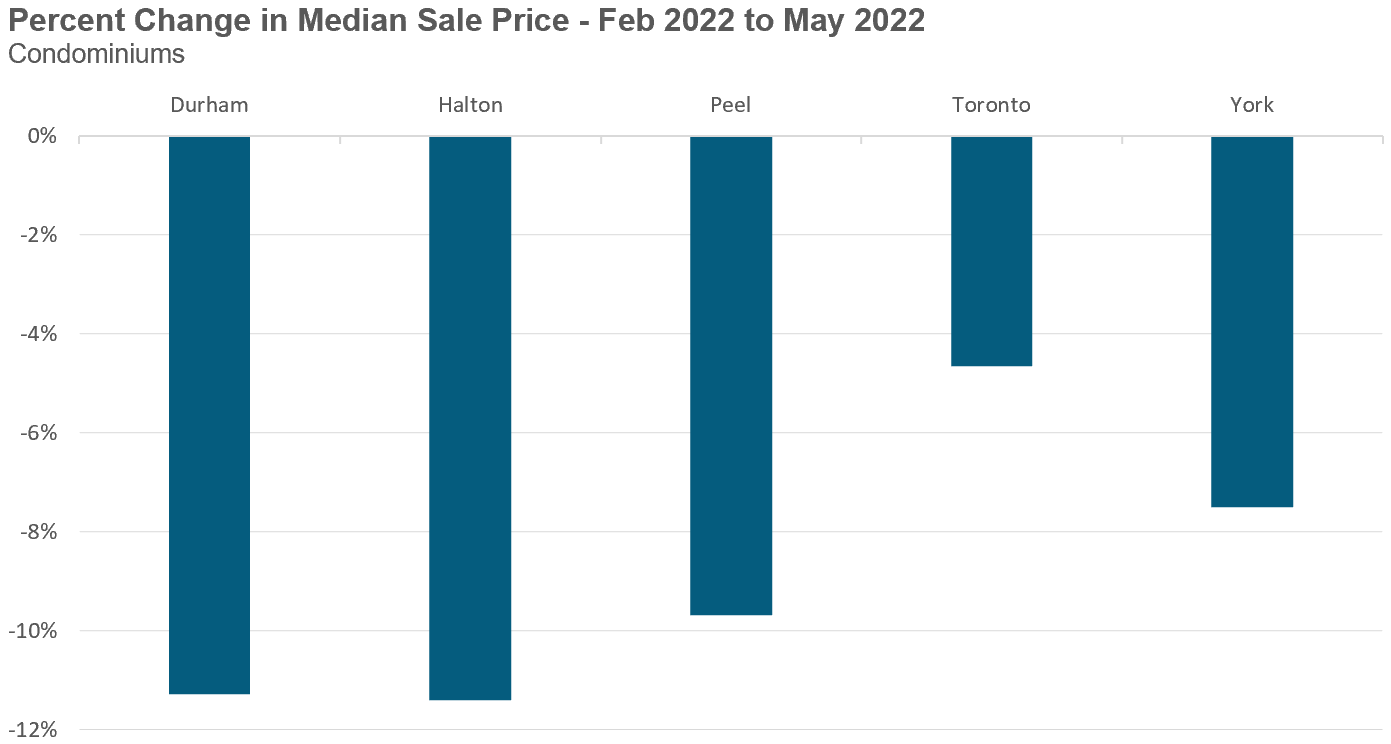

Since February 2022, the condo market has experienced very similar dynamics to the ones we are seeing in the low-rise market. Sales and prices are declining far more rapidly in the suburbs than in the City of Toronto. The chart below shows the change in the median sale price between February and May of this year.

While we typically don’t compare median price changes on a month-over-month basis if they have not been adjusted to account for seasonal differences, it’s worth noting that median prices don’t typically decline as we move into the spring market.

The decline we are seeing in condo prices is likely due to the same factors driving the decline in house prices. Rising interest rates have pulled many buyers out of the market while current sellers who have purchased a house and now need to sell their current condo find themselves selling in a slower market and are more willing to accept a lower price for their condo to ensure they can close on the property they just purchased, a trend I discussed in last month’s report.

In the months ahead, it will be critical to keep a close eye on the changing dynamics of the Toronto area housing market by house type and geographic location because regional and house type trends may diverge over time.

The Move Smartly monthly report is powered Realosophy Realty Inc. Brokerage, an innovative residential real estate brokerage in Toronto. A leader in real estate analytics, Realosophy educates consumers at Realosophy.com and MoveSmartly.com and helps clients make better decisions when buying and selling a home.