Author John Pasalis is the President of Realosophy Realty, a Toronto real estate brokerage which uses data analysis to advise residential real estate buyers, sellers and investors. He is a top contributor at Move Smartly, a frequent commentator in the media and researcher cited by the Bank of Canada and others.

Toronto Area Market Cooling Down in a Notable Shift

FREE PUBLIC WEBINAR: WATCH REPORT HIGHLIGHTS

Join John Pasalis, report author, market analyst and President of Realosophy Realty, in a free monthly webinar as he discusses key highlights from this report, with added timely observations about new emerging issues, and answers your questions. A must see for well-informed Toronto area real estate consumers.

The Market Now

In my past two monthly reports, I have discussed early signs that Toronto’s housing market is beginning to cool. This is the first month we are seeing this cooldown reflected in the monthly statistics.

And the changes are significant.

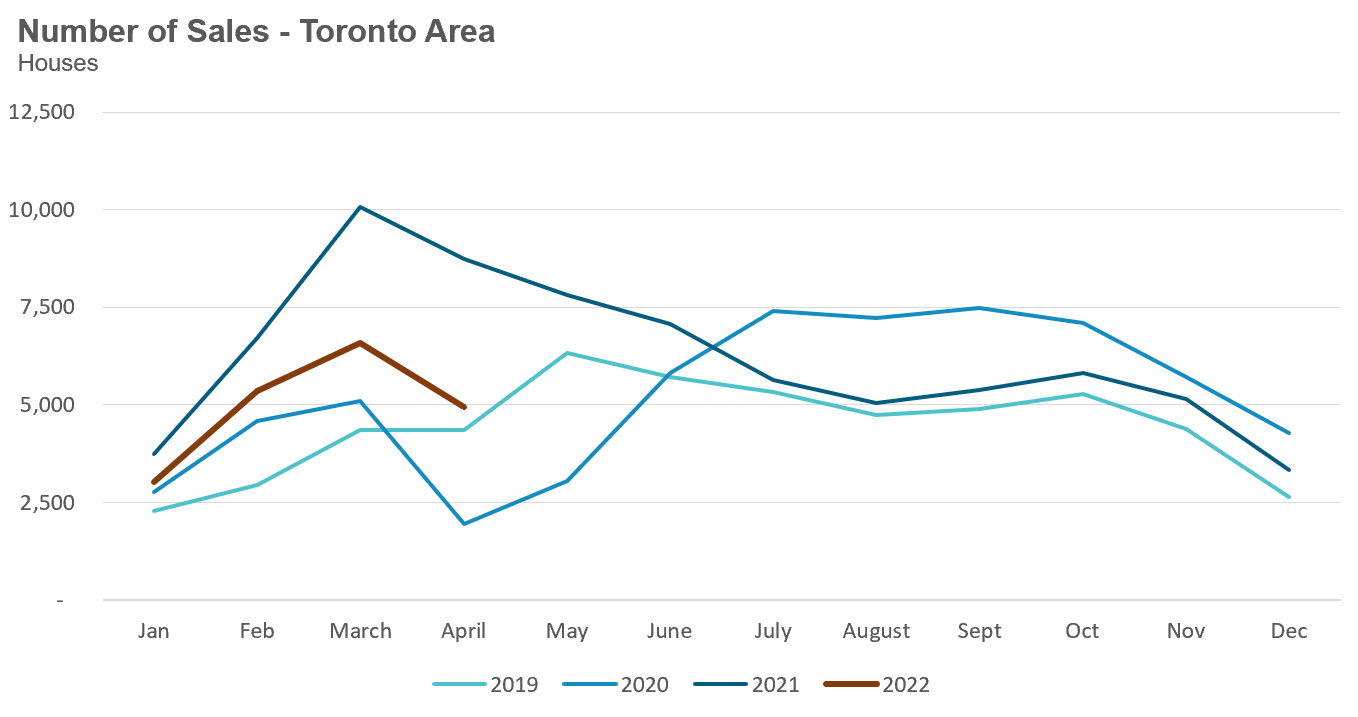

House sales in April are down 26% over March, a period in which sales are usually trending up, and average prices for low-rise suburban houses have been declining over the past two months. House sales were down 44% on a year-over-year basis.

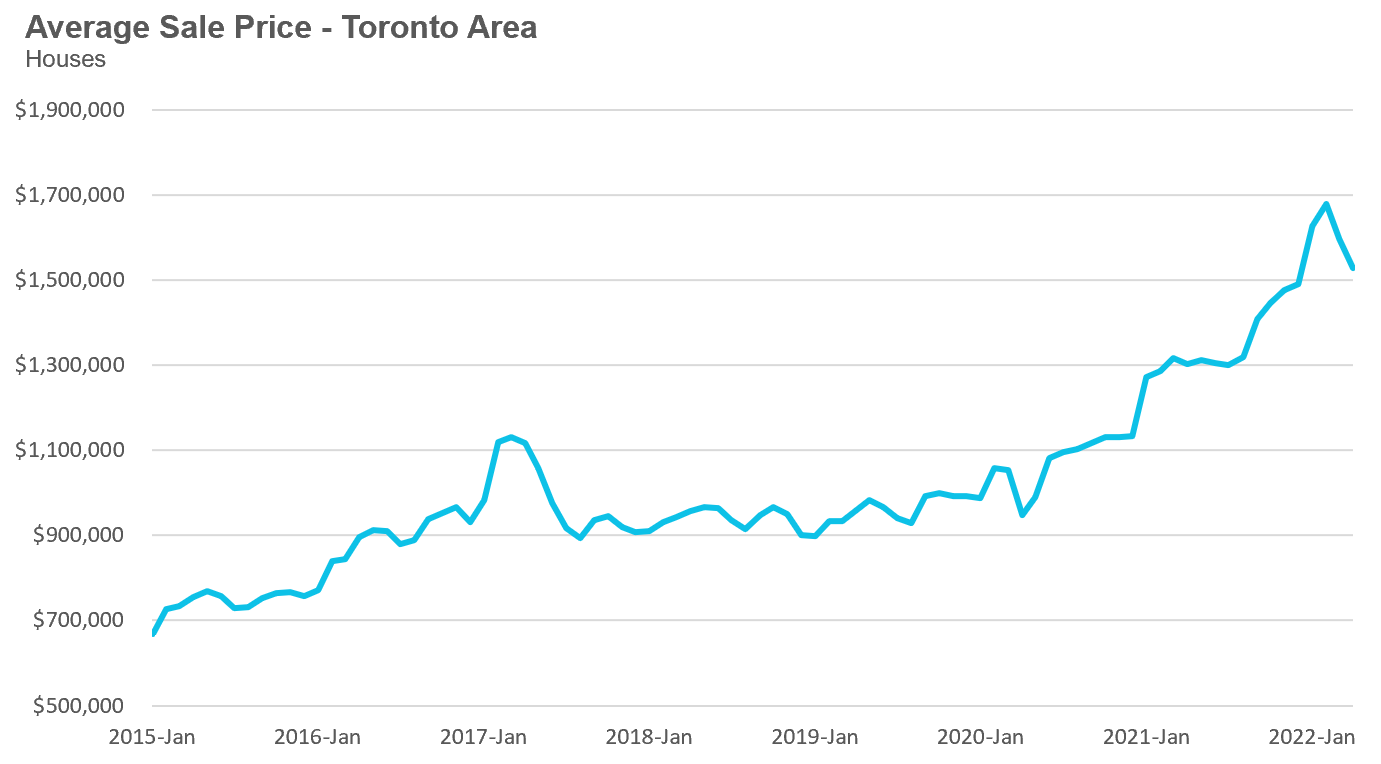

The average price for a house in April was $1,527,743 down from $1,679,429 in February, but up 17% over last year; the median house price in April was $1,348,94, down from $1,485,000 in February, but up 18% over last year.

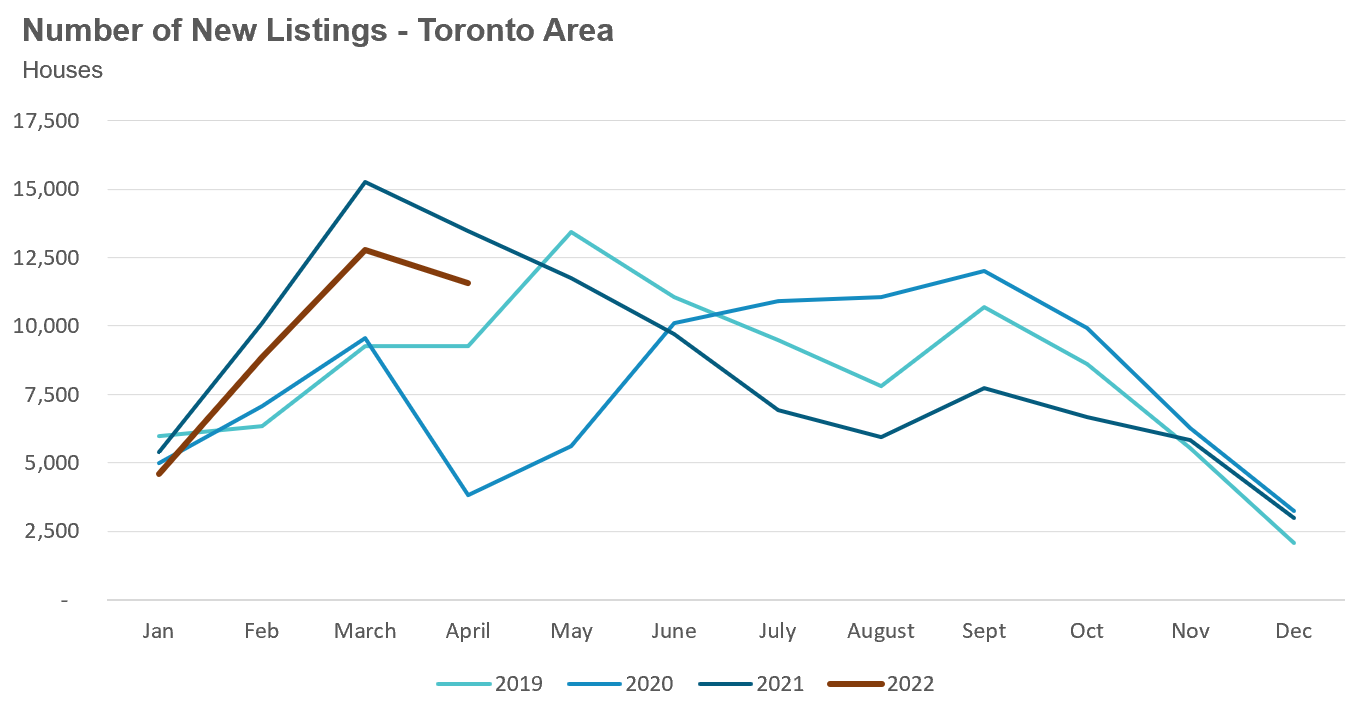

New house listings in April were down 14% over last year, but still very strong compared to previous years while the number of houses available for sale at the end of the month, or active listings, at the end of April was up 7% over last year.

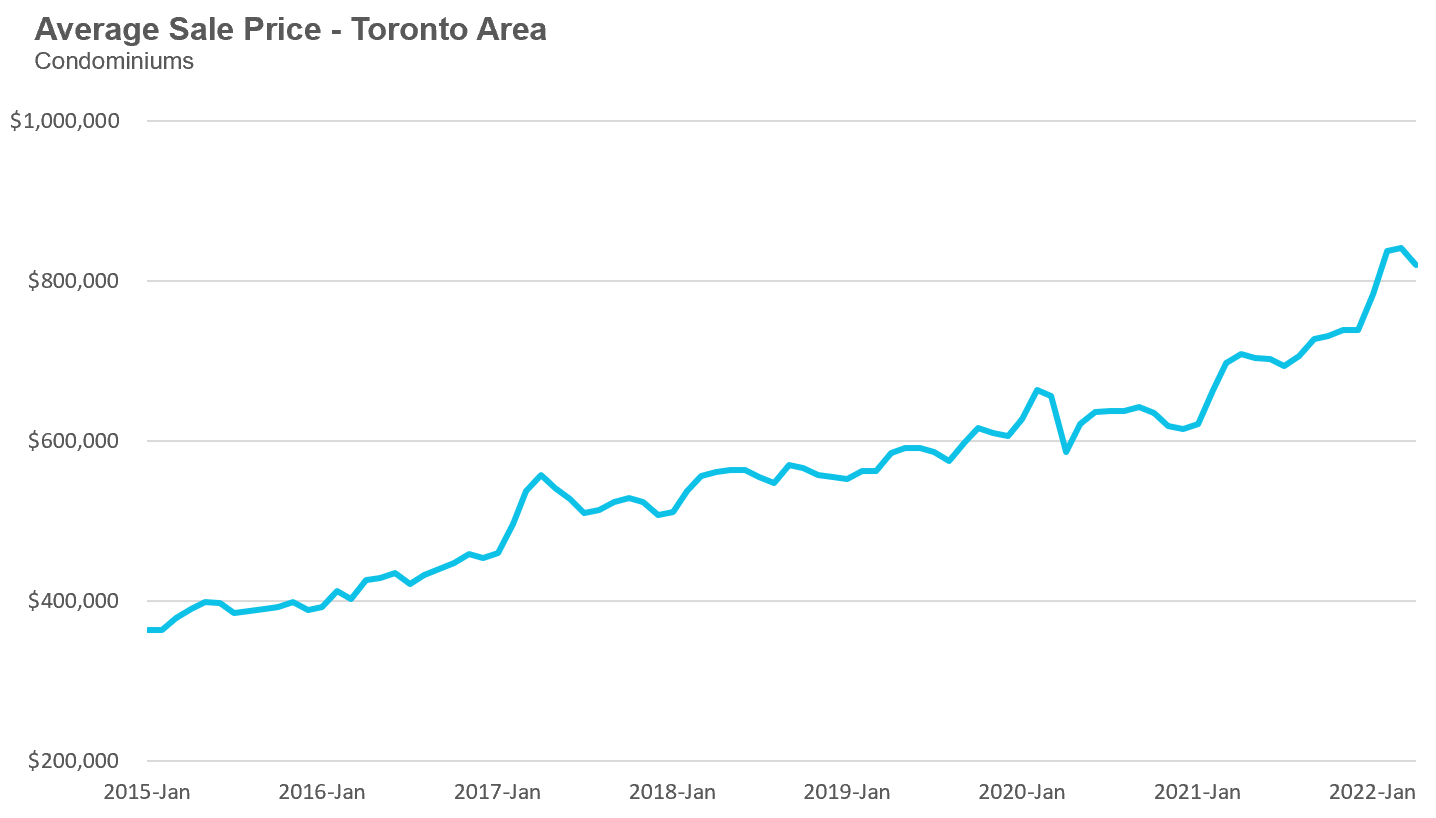

The average price for a condo in April fell to $819,698, down from $840,444 in March. The average price is up 16% over last year. The median price for a condo in April was $750,000, up 16% over last year, but down from $777,000 over last month.

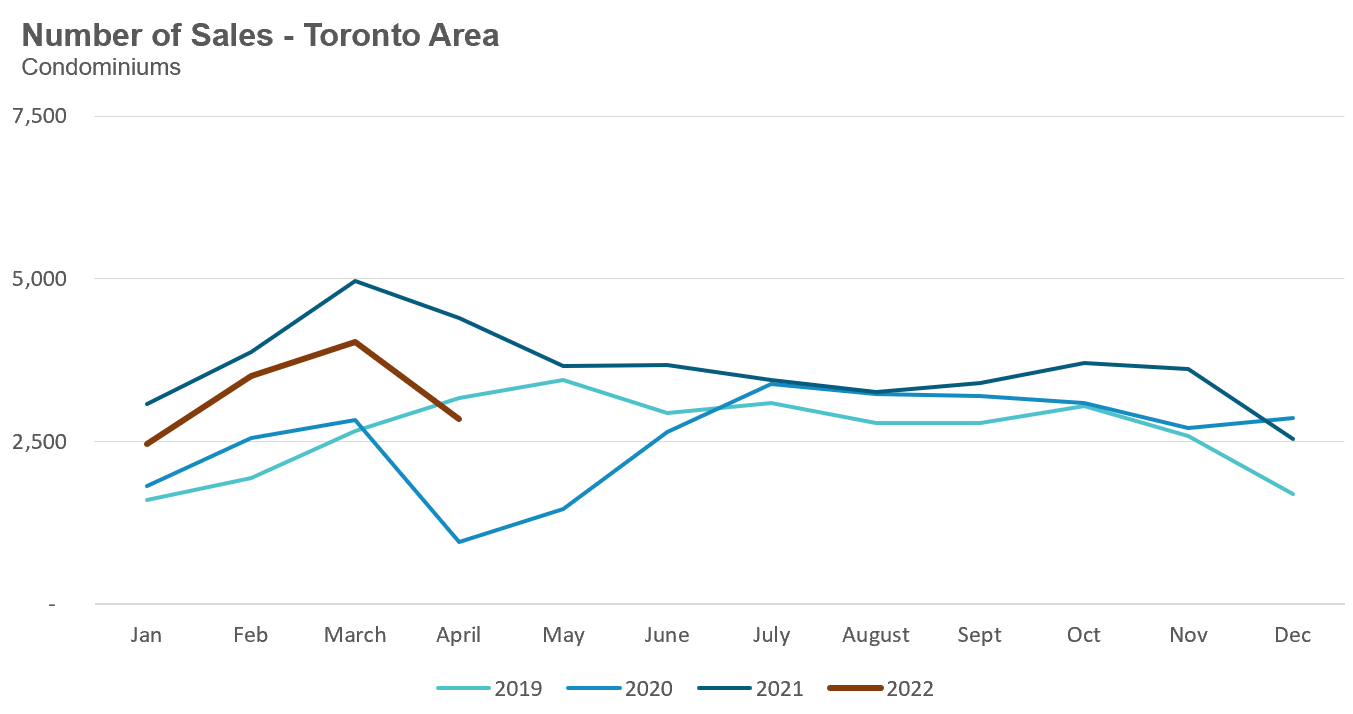

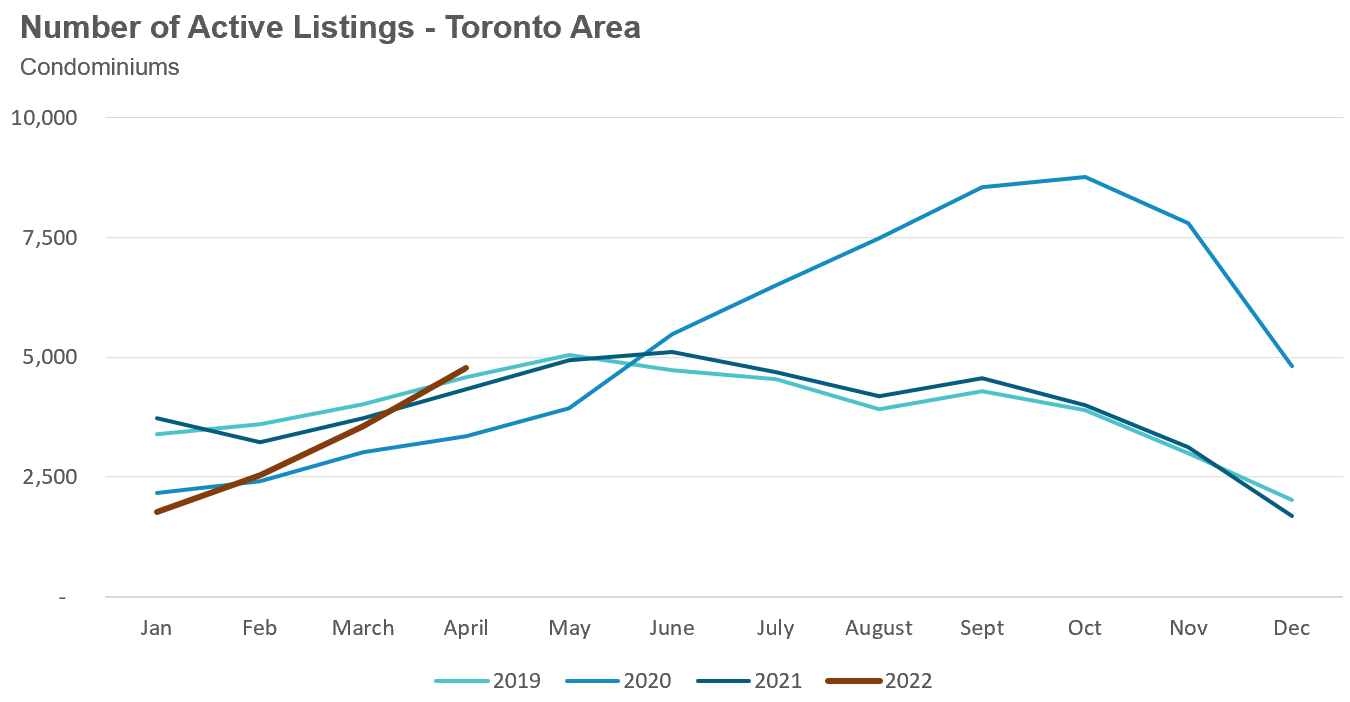

Condo sales were down 35% in April over last year and below pre-Covid sales volumes in 2019.

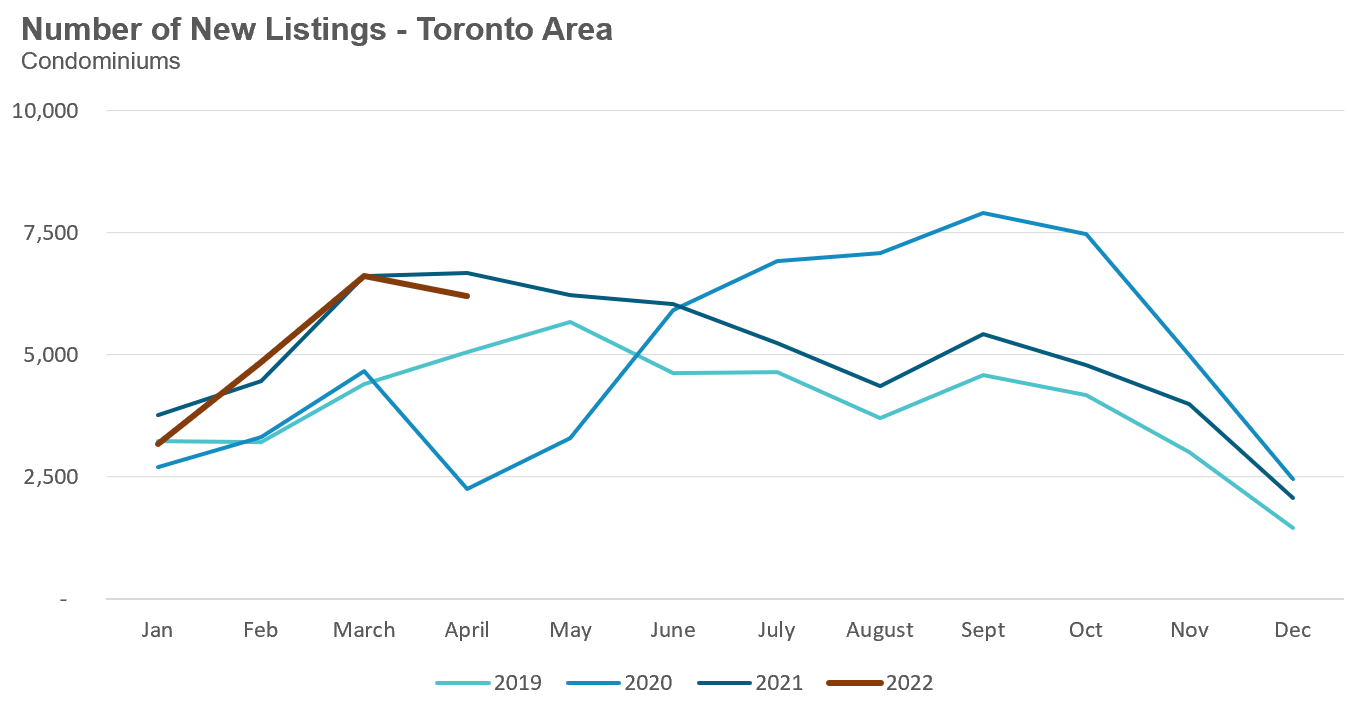

New condo listings were down 7% over last year, but well ahead of the new listing volume in 2019 and 2020. The number of active listings for condos was up 10% over last year.

For detailed monthly statistics for the Toronto Area, including house, condo and regional breakdowns, see the final section of this report.

How Your Strategy Should Adjust to a Suddenly Changing Market

As we are seeing in the market numbers for April (see ‘The Market Now’ section above and full data in the ‘Monthly Statistics’ section below), the Toronto area real estate market is losing steam. Regular readers of my reports will recall that in my March 2022 report, I noted that at our brokerage Realosophy Realty, we were seeing very early signs of Toronto’s housing market slowing down on the ground, in advance of seeing this show up in the data.

This change in the market has led to many consumers asking me if they should go ahead with their plan to buy a home before selling their current home or change their approach.

Sudden real estate market changes cause a lot of anxiety for consumers (see ‘Why Are House Prices Dropping So Quickly in Toronto?” section below for more on this).

For real estate professionals, it’s a particularly challenging time to advise clients, because even if we are able to see early signs of a slow down, we can’t be too sure about predicting what will come next. The approach I’ve always taken and trained my team on, is to think about tracking the market very carefully and moving in step with it, discussing the changing pros and cons of various approaches to help our clients decide what approach works given their particular circumstances.

When we first started advising about a slowdown several months ago, we had a number of clients who decided to go ahead with buying a home first knowing that they might be selling in a slowing market because selling first was not a practical option for personal reasons or because they didn’t want to pass up on buying a very unique home.

Given the more challenging nature of this approach, I think it would be helpful to share how we ensured that we were able to help all of these clients successfully sell their home after buying.

Get the Order of Your Steps Right

Prepping a home for sale takes time — between decluttering, purging, making minor improvements and repairing deficiencies, it can take weeks to get a home ready for sale. But there is no time to waste when you are selling after buying as you could potentially be risking selling in an even slower market.

This is why we advise our clients who still plan to buy first to prepare their home for sale right away while they are still searching for their next home. With this approach, we’re often able to list their current home for sale within a week or two of them buying.

We also focus on helping our clients negotiate a longer closing date on the home they purchase, typically at least ninety days.

Understand Your Current Market

Before listing your home for sale, your realtor needs to give you a very good breakdown of the market dynamics in your particular neighbourhood. While I breakdown market trends in this report to see what is happening with different segments (houses vs. condos) and municipalities and regions in the Toronto area, we need to drill down even deeper when our clients are selling.

Non-professionals often underestimate just how differently every neighbourhood (and sometimes even micro areas within them) can behave, with some areas with fewer homes for sale remaining relatively hotter than those with quickly rising inventory.

While we track months of inventory of data by neighbourhood carefully (you can see this data at movesmartly.com), we also get way more granular. It’s critical for us to talk to other agents with similar homes for sale in the same neighbourhood and know how many showings and offers these homes are getting and what these agents are experiencing.

Most agents don’t do this type of homework. Instead many rely on looking at listing info only. On seeing that a similar home down the street recently sold for $150,000 over the asking price, they assume the market is still very busy and advise their client to take the same approach — list with a low price to attract many buyers with offers on a set offer night.

But often the real story doesn’t show up on paper. Calling the agent who sold that home for more than asking and you might find that they had very few showings and were lucky to get one offer on their offer night.

This type of information helps us arrive at a more resilient strategy for pricing and marketing your home, one that takes into account what could happen if the conditions you are expecting don’t materialize.

Follow a More Nuanced Strategy

Before going on the market for sale, you have to decide if you’re going to use a common pricing strategy seen in hot markets — listing with a low price to attract as many buyers as possible competing against each other in order to get a price well above your list price — or going with the strategy of listing your home for what it’s worth and accepting offers any time.

There are pros and cons to each approach — deciding on which strategy is right for you depends on the current market conditions in your area but also your own personal circumstances. Your marketing and pricing strategy will need to be very different if you only have three weeks to sell your home as opposed to two months. With a two month timeline, you can be a bit more patient, listing your home at the high end of its value range, and adjusting the price if you don’t get the buyer interest and traffic you want. When you only have three weeks to sell, it is harder to use this type of wait and re-assess strategy.

Have Realistic Price Expectations

If you’re listing your home for sale today it may be unrealistic to assume you will achieve the same price that similar homes sold for a few months ago in February. I say “may” because this is dependent on the type and location of the home. Downtown Toronto homes and most condos have not seen much downward pressure on prices yet. Many low-rise suburban homes, on the other hand, have seen a decline in prices (see ‘Data Dive’ section below) which means your price expectations need to be in line with the location and segment of your particular market.

If one homeowner decides to sell their home for a significant discount from their market value, it doesn’t mean you have to follow them and accept such a low sale price — one comparable sale does not make a market.

You need to base your price expectations on all of the most recent comparable sales, ideally homes that have sold in the past two to three weeks.

In a normal balanced market, it’s common to use comparable sales of homes that have sold 3 to 4 months ago, but in a slowing market in which prices are changing quickly you need to use more recent sales.

The flip side to having realistic price expectations is to not be too desperate. Many of the sellers who we recently helped sell their home after they bought found that the first offer they received for their home was below what they wanted — and below what they eventually sold their home for. When a market begins to change, it is common to see a lot of buyers start to test sellers to see how desperate they are and we are seeing this on the ground. Some inexperienced agents may be pressuring their clients to take these low-ball offers if they are also panicked (see again ‘Why Are House Prices Dropping So Quickly in Toronto?’ below).

A Surprising Turn Away From Normal Market Patterns

The spring market is usually the busiest time of the year for real estate sales with sales typically increasing between March and April. Over the last decade in the Toronto area, this increase has averaged 8% per year.

But this year, the opposite is happening.

Home sales in the Toronto area were down 26% in April over last month and lower than sales in February as well.

I believe there are three primary reasons for why this is happening.

Rising Interest Rates

The most common explanation we are hearing for the decline in sales is rising interest rates, but I don’t think that’s the primary reason yet. Many home buyers who get a mortgage pre-approval from their lender will typically also get an interest rate hold — a written commitment from their lender to finance their mortgage at a given interest rate provided that the buyer purchases a home within 120 days. While five-year mortgage rates are in the 4% range today, many active home buyers secured a rate hold back in February when mortgage rates were in the high 2% range and these buyers are likely feeling a sense of urgency — not hesitation — as they want to buy before their rate hold expires. Given this, I think we will need to wait until next month, when many of these rate holds will expire, to see more clearly how higher rates impact demand.

This is not to say rising rates are not also causing some reduced demand as well as some buyers move to the sidelines for now in the expectation that higher rates may cause home prices to decline further as we move into the summer and fall market. Rising rates are causing a mix of effects.

Fast-Tracked Demand

I believe another key factor is an expected and natural decline after the surge in sales we have experienced over the past two years. The Covid-19 pandemic along with record low interest rates pulled a lot of people’s home buying plans forward, which has caused a surge in demand (and prices) for homes over the past two years across the Toronto area and beyond. As this demand is fulfilled, we should expect to see a corresponding decline following the boom. Accordingly, I noted the first signs of slowing in demand back in February, before the surge in 5-year mortgage rates and before the Bank of Canada started their super-sized interest rate hikes.

Increased Buyer Anxiety

Among a particular set of home buyers, upsizers and downsizers who want to move from one home to another, the uncertainty of the market right now is causing a pullback from the market. These would-be buyers who would need to sell their current home in order to afford their next home are seeing that the market is slowing and prices softening and do not want to find themselves pressured to have to sell in a slowing market after they have bought at a peak. This group will only return to the market if the market stabilises or — in the event of continued slowdown — they decide to sell first before buying.

How Consumer - And Agent - Anxiety is Playing a Role

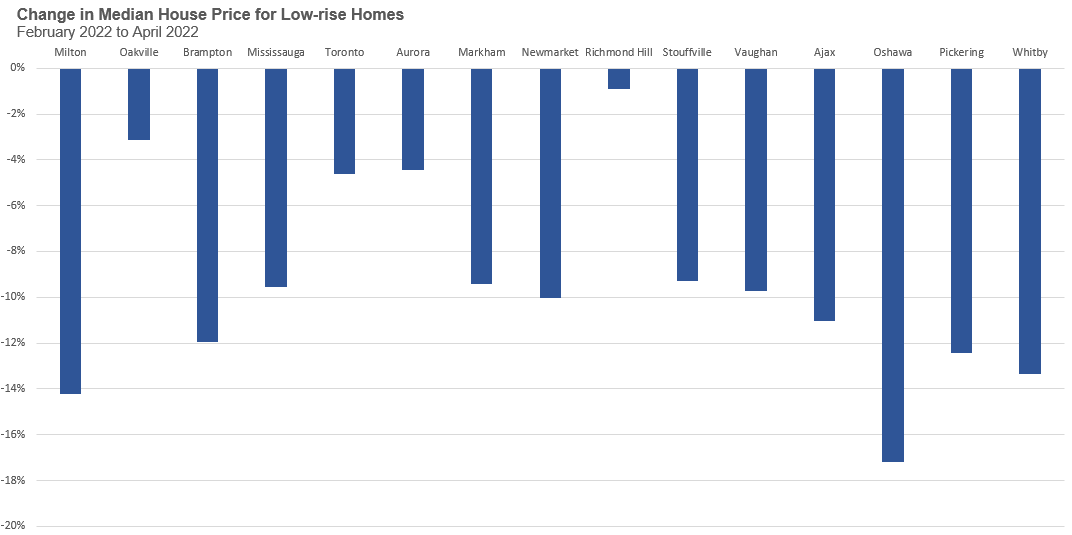

The latest market numbers are showing that low-rise home prices in the Toronto area are down a surprising 9%, roughly $150K, in two months since February.

This is surprising given what housing economists normally expect to see once an accelerated period of price growth, particularly those thought to have reached ‘bubble’ territory, starts to subside.

“This is the way the bubble ends: not with a pop, but with a hiss. Housing prices move much more slowly than stock prices. There are no Black Mondays, when prices fall 23 percent in a day. In fact, prices often keep rising for a while even after a housing boom goes bust.”

- Paul Krugman, "That Hissing Sound", The New York Times

The prominent economist Paul Krugman is right that house prices are usually “sticky” on the way down, meaning that they fall more slowly than stock prices. This ‘lag’ in adjusting to market conditions is believed to happen for a number of reasons. Firstly, most investors are prone to a phenomena known as “loss aversion” and home sellers are no exception. When a homeowner sees a neighbour selling for $900K, they want to achieve the same and see anything less than this as a financial loss. These sellers tend to stick to their desired price even if it takes them a lot longer to sell in a slowing market. This in turn results in an increase in the number of homes available for sale on the market. As this inventory of homes for sale increases, getting the price that sellers initially expect becomes more difficult and eventually the sellers who are most motivated to sell will start adjusting their price expectations downwards.

So why have some Toronto home prices started to fall so quickly already?

A large reason is a behavioural change amongst consumers due to a change in Toronto real estate market conditions. Given how competitive the market normally is for buyers, most choose to buy first and then list their current home for sale. But when the market starts to slow down, this behaviour becomes less of a default.

When my agents and I first started noting signs of a market slowdown back in February (as discussed above), we were seeing that homes were getting fewer showings (i.e., buyer viewings) and fewer to no offers on their set offer nights. And with each week that passed, there were fewer buyers in the market, fewer showings and fewer offers.

We then started to see some homes selling in their first week on the market for around $100K less than what it likely would have sold for only weeks earlier.

So why the panic?

First, sellers who had already bought their next home and needed to sell their current home to make the move, started to panic when they were only getting 10 to 20 showings their first week on the market (down from the 50+ showings being seen in the market only weeks before). Those who had agreed to a relatively short closing date of 45 to 60 days for their new home, assuming their current home would quickly sell in a hot market, faced even more pressure. In a slowing market, home sales — particularly those that need to achieve a particular price in order to make another home purchase viable — take longer.

In addition to these sellers panicking, many of their agents only added to their panic.

In the Toronto area, there are a very high number of part time agents who sell fewer than four homes per year; these agents tend to rush into the profession during the boom times that have recently characterised the Toronto market for a rather long run. If these agents have been in the business for less than five years, they only know what it’s like to work in a seller’s market in which homes are getting multiple offers and selling for well over asking price very quickly.

In private Facebook groups for realtors, these listing agents shared their sense of panic and asked their fellow realtors what to do when getting very few to no offers on their offer night.

Needless to say, when a seller is already nervous and their agent is too, it increases the chances of them accepting the first low-ball offer they get — something that runs counter to the “sticky” price phenomena we normally see in the market.

The agent’s job is to stay calm when the market is uncertain and to try to balance their client’s need to sell while mitigating the downside risks in the market. I offered a number of examples of how our agents helped their clients manage these risks when they found themselves needing to sell in a slow market (see ‘How to Sell a Home in a Slowing Market’ above).

Areas That Saw The Fastest Gains During the Pandemic Are Now Coming Down

As discussed earlier in this report, one of the big drivers behind the decline in prices we are seeing for low-rise homes in the Toronto area is that buyers are pulling out of the market.

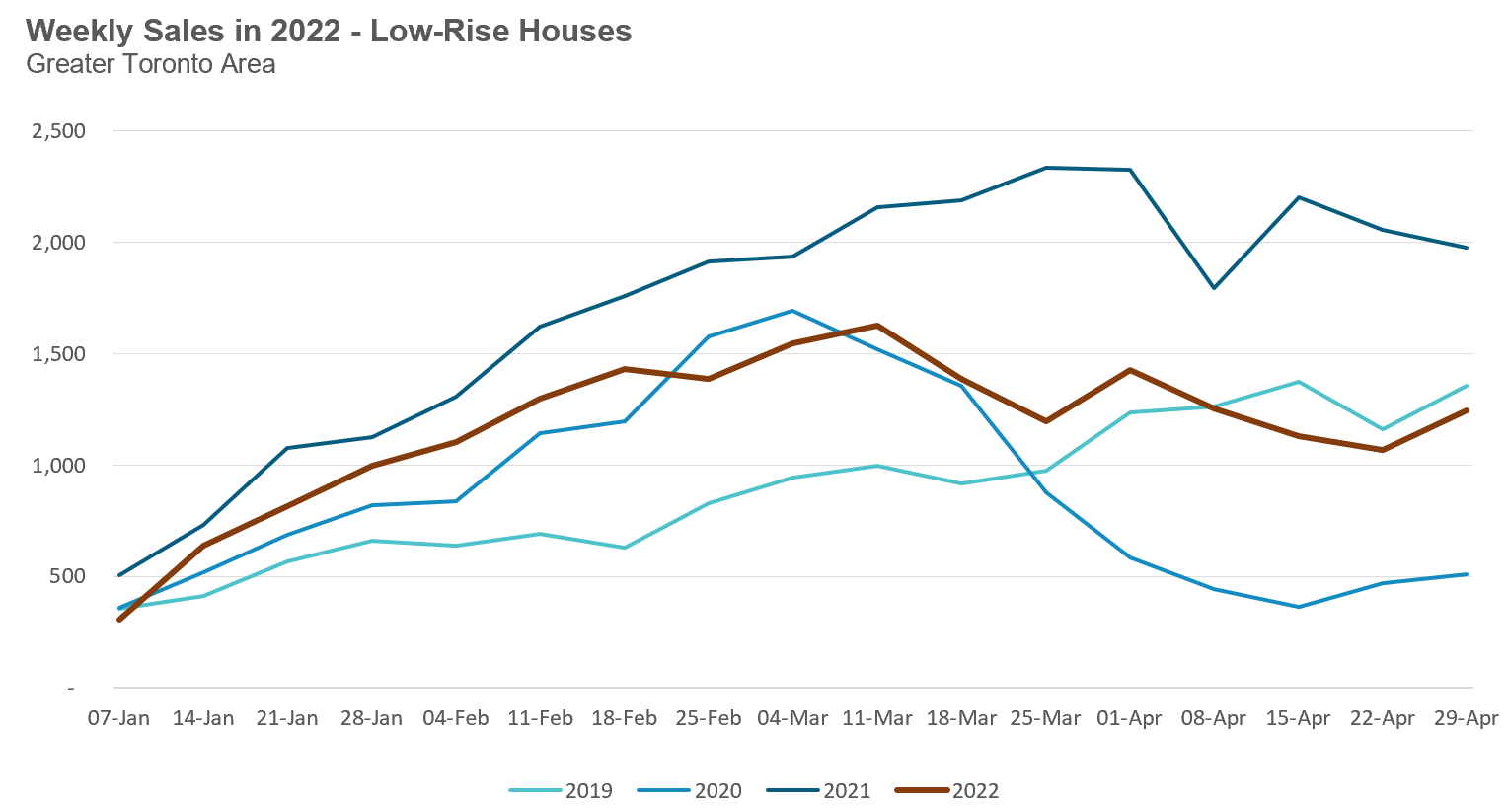

The best way to see this trend is to look at the number of home sales on a weekly basis.

Looking at this chart below for all of the Greater Toronto Area, we can see that low-rise house sales peaked in early March and have been on a downward trend since then. As discussed, this is a surprising trend during what is normally a busy time (see ‘It’s Spring Market Time So Why Are Toronto Home Sales Falling’ section above).

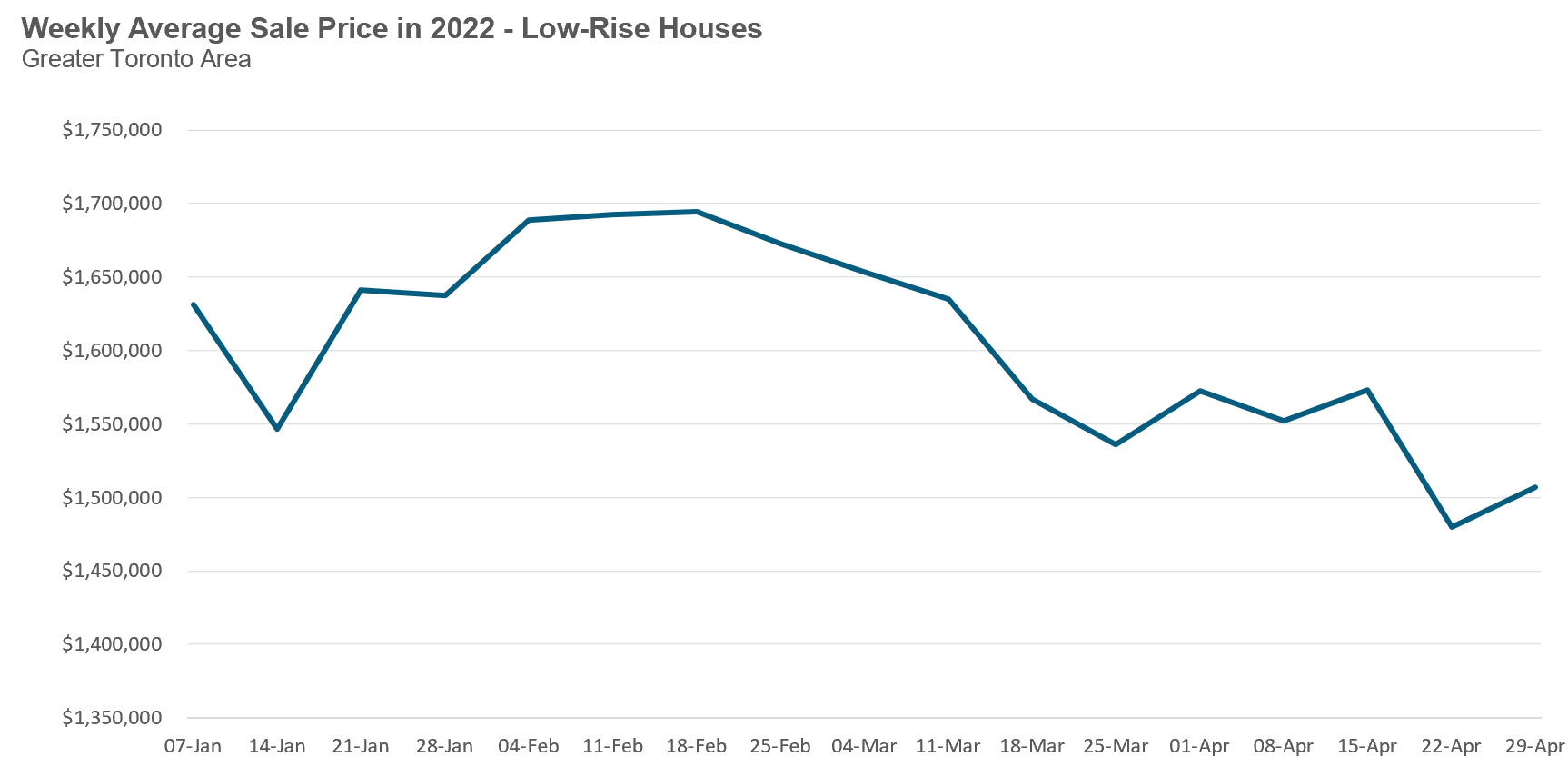

While sales were still trending up in early March, we can see from this next chart that average house prices began to trend down in late February. As discussed earlier in this report, this corresponds with the observations I shared in my March market report about the low-rise market beginning to cool down in mid to late February.

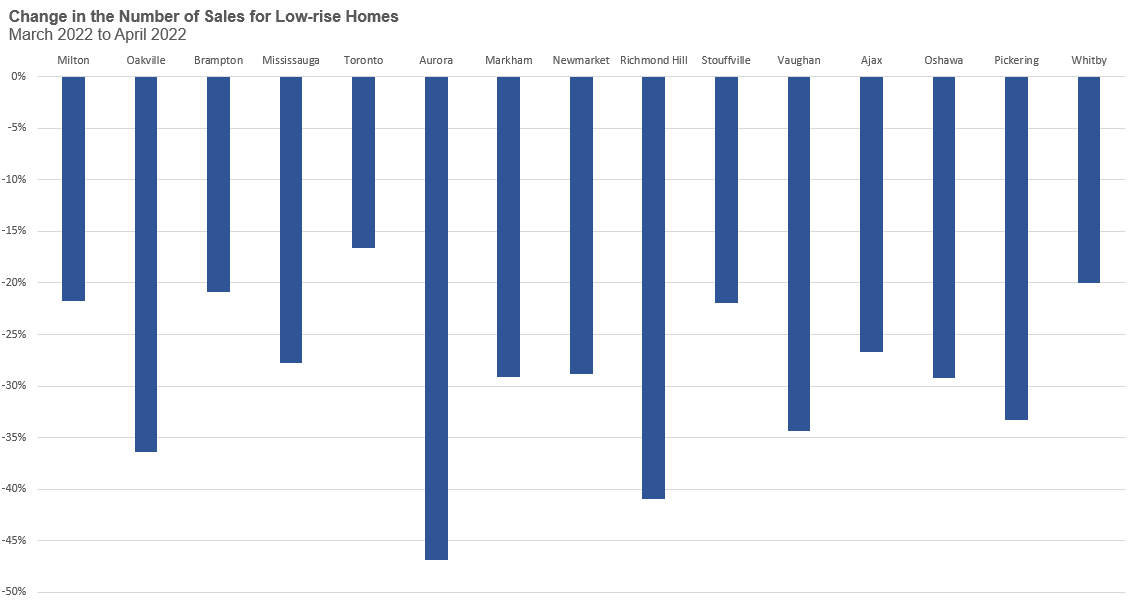

Over the past ten years, home sales across the Greater Toronto area have increased by an average of 8% between March and April. We can see from the chart below that a number of municipalities in the Toronto area are now seeing sales fall by more than 25% over the past month.

Since house prices peaked in February of this year, in the next chart below, I’m now going to compare the change in median house prices over the past two months. We typically don’t compare changes in median prices on a month-over-month basis because seasonal differences can impact prices. That being said, over the past ten years, median and average prices haven’t changed very much between February and April, and where they have, they’ve trended up slightly.

It’s also worth noting that while we typically compare house price changes on a year-over-year basis, doing so in a slowing market can be very misleading. Median house prices are actually up 18% over last year which suggests prices are trending up, but on the ground we can see that prices have actually been trending down the past couple of months.

It’s difficult to explain all of the regional differences we are seeing in the change in sales and prices particularly as we are only looking at a couple of months of data.

But the one trend that is starting to stand out is how the City of Toronto has performed relative to the suburban market — urban houses have performed better than suburban houses; even within the City of Toronto, the areas that tend to be slower are the neighbourhoods that are further from the downtown core, moving towards the suburban markets.

The urban housing market has performed better in part because house prices in these areas did not grow as much as they did in the suburban market (an illustration of the ‘the higher up, the further to fall’ phenomena). This means that when compared to suburban houses, urban houses are a better value today than they were before the pandemic. This is a trend that may continue as people return to their offices and gas prices continue to surge — and the urban exodus we saw during Covid-19 pandemic may begin to reverse.

April 2022

House sales (low-rise detached, semi-detached, townhouse, etc.) in the Toronto area (GTA) in April 2022 were down 44% over the same month last year, but slightly above levels for the same month in pre-Covid 2019. However, the more important trend is that house sales are trending down during a period when they should be trending up. The downward trend in sales in 2020 was due to initial lockdowns in Ontario due to the Covid-19 pandemic.

New house listings in April were down 14% over last year, but well above the volume seen in 2019 and 2020.

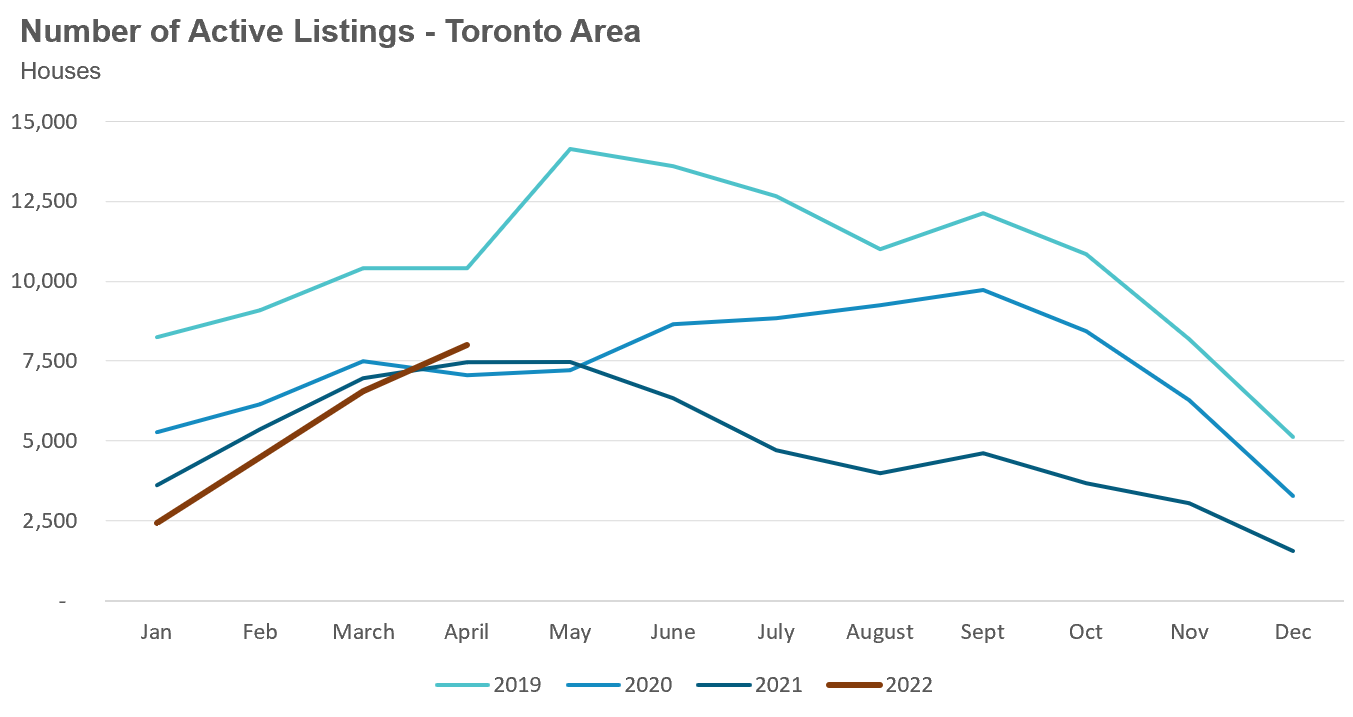

The number of houses available for sale (“active listings”) was up 7% when compared to the same month last year but still 23% below pre-Covid levels in 2019.

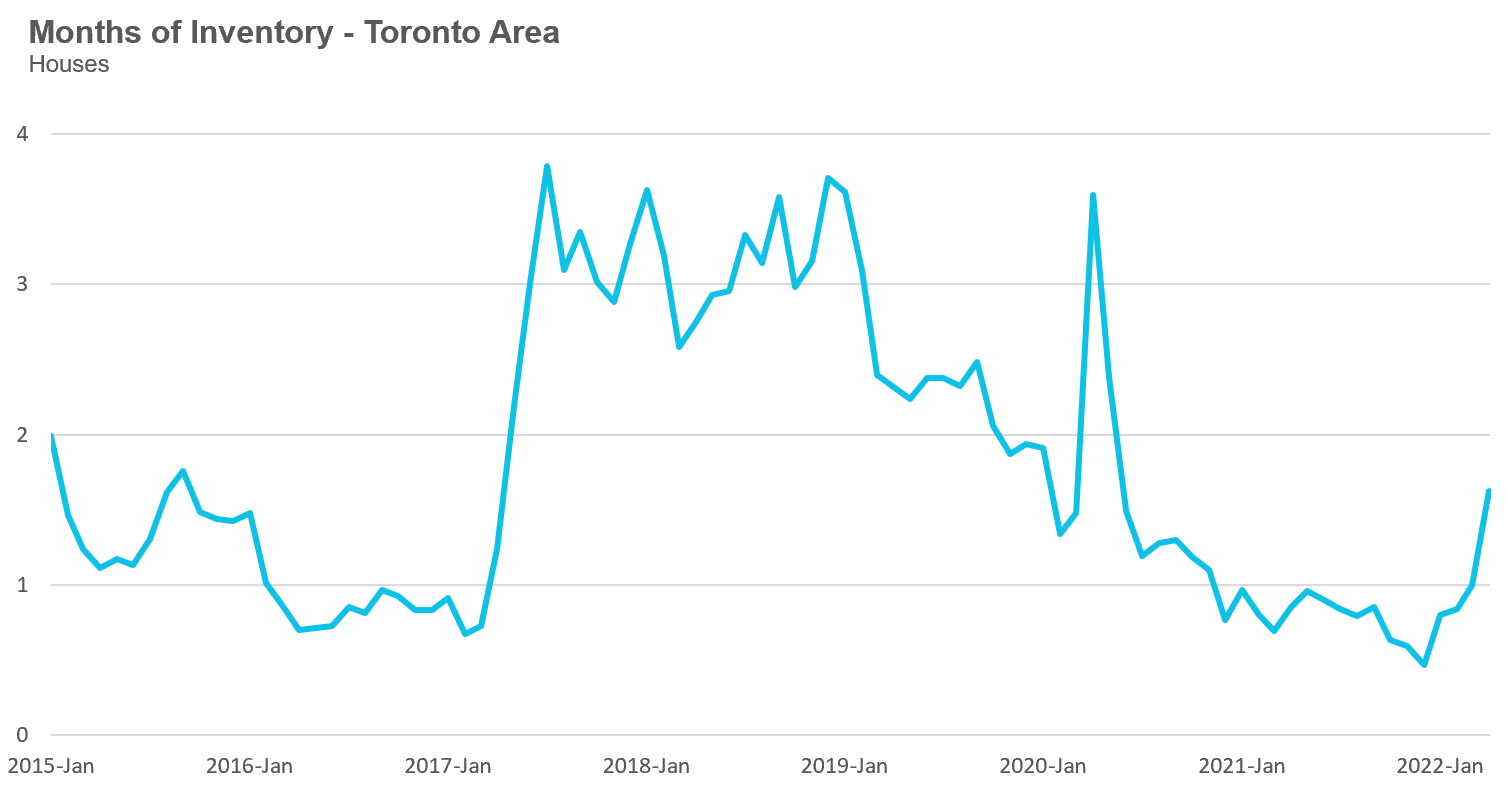

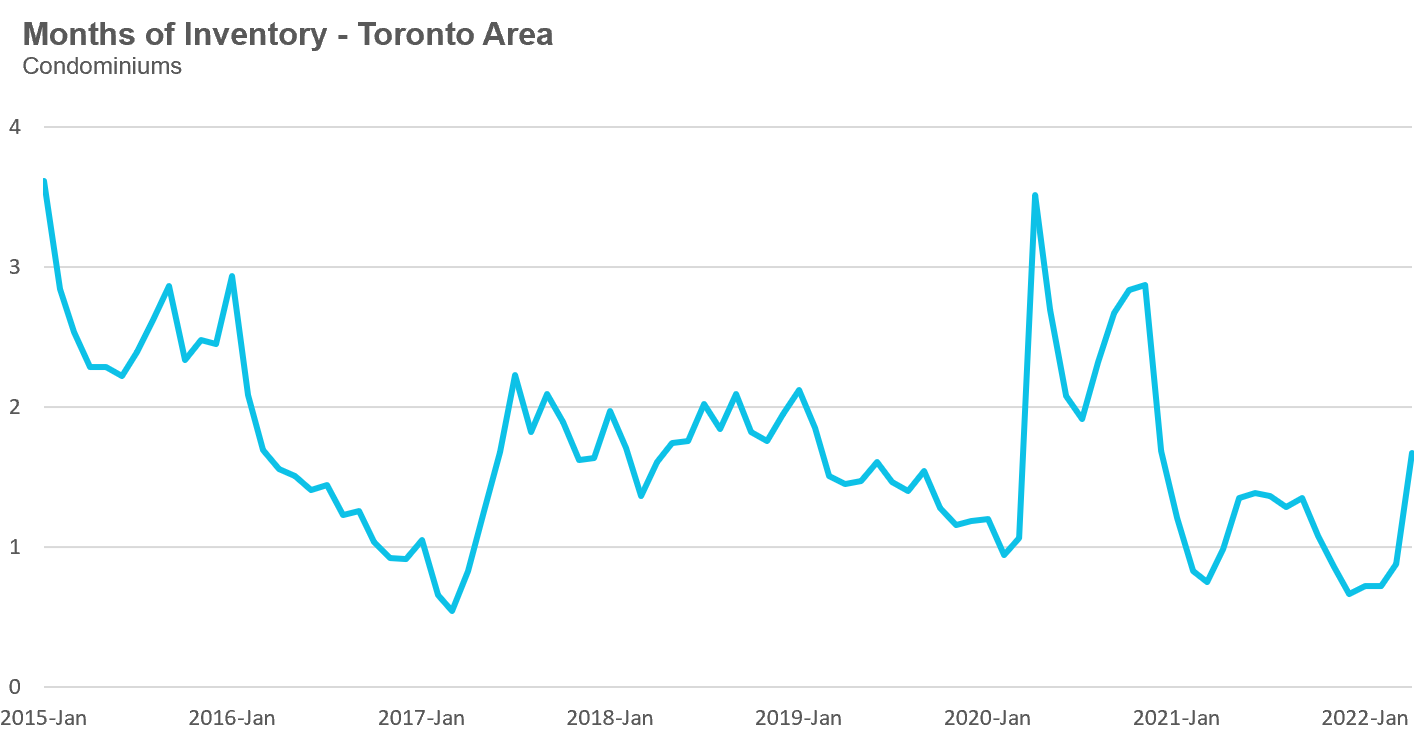

The Months of Inventory ratio (MOI) looks at the number of homes available for sale in a given month divided by the number of homes that sold in that month. It answers the following question: If no more homes came on the market for sale, how long would it take for all the existing homes on the market to sell given the current level of demand?

The higher the MOI, the cooler the market is. A balanced market (a market where prices are neither rising nor falling) is one where MOI is between four to six months. The lower the MOI, the more rapidly we would expect prices to rise.

While the current level of MOI gives us clues into how competitive the market is on-the-ground today, the direction it is moving in also gives us some clues into where the market may be heading.

While below a very competitive 1 MOI since last year, house inventory in the Toronto area increased to 1.6 MOI in April.

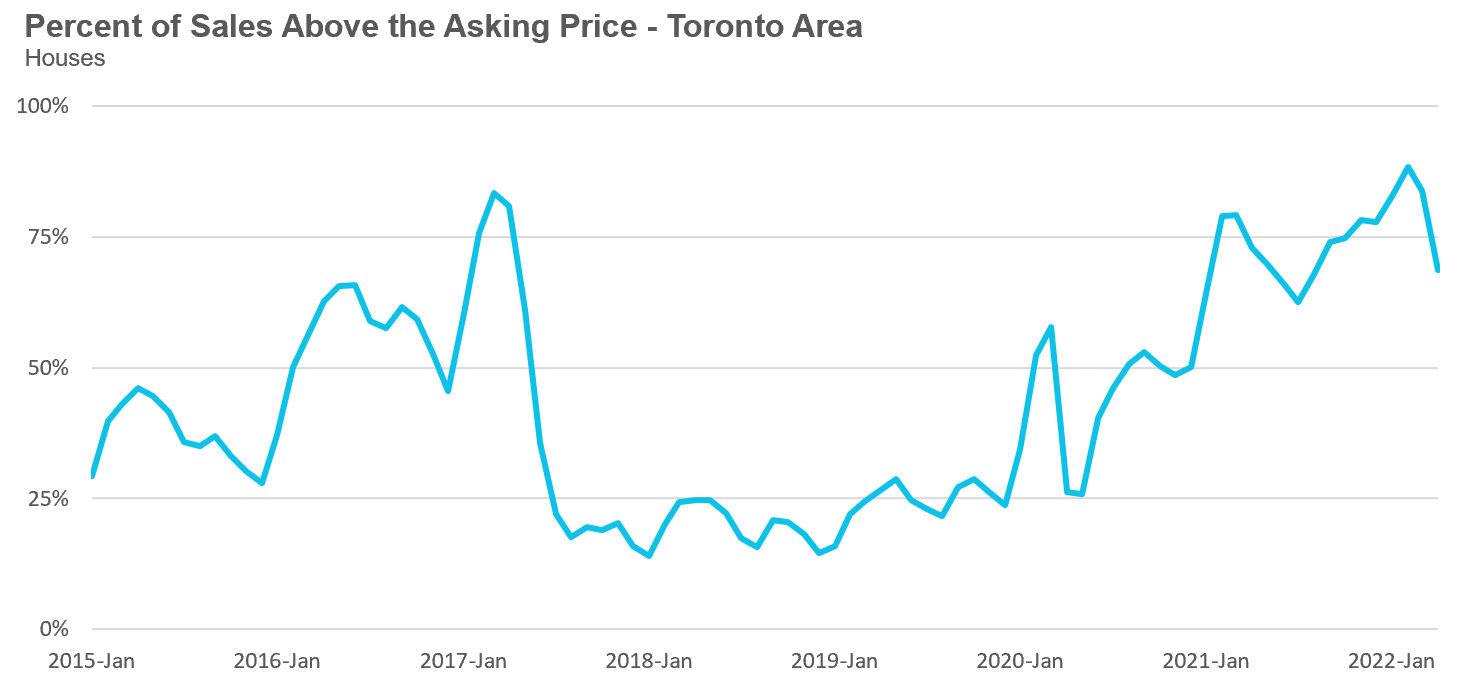

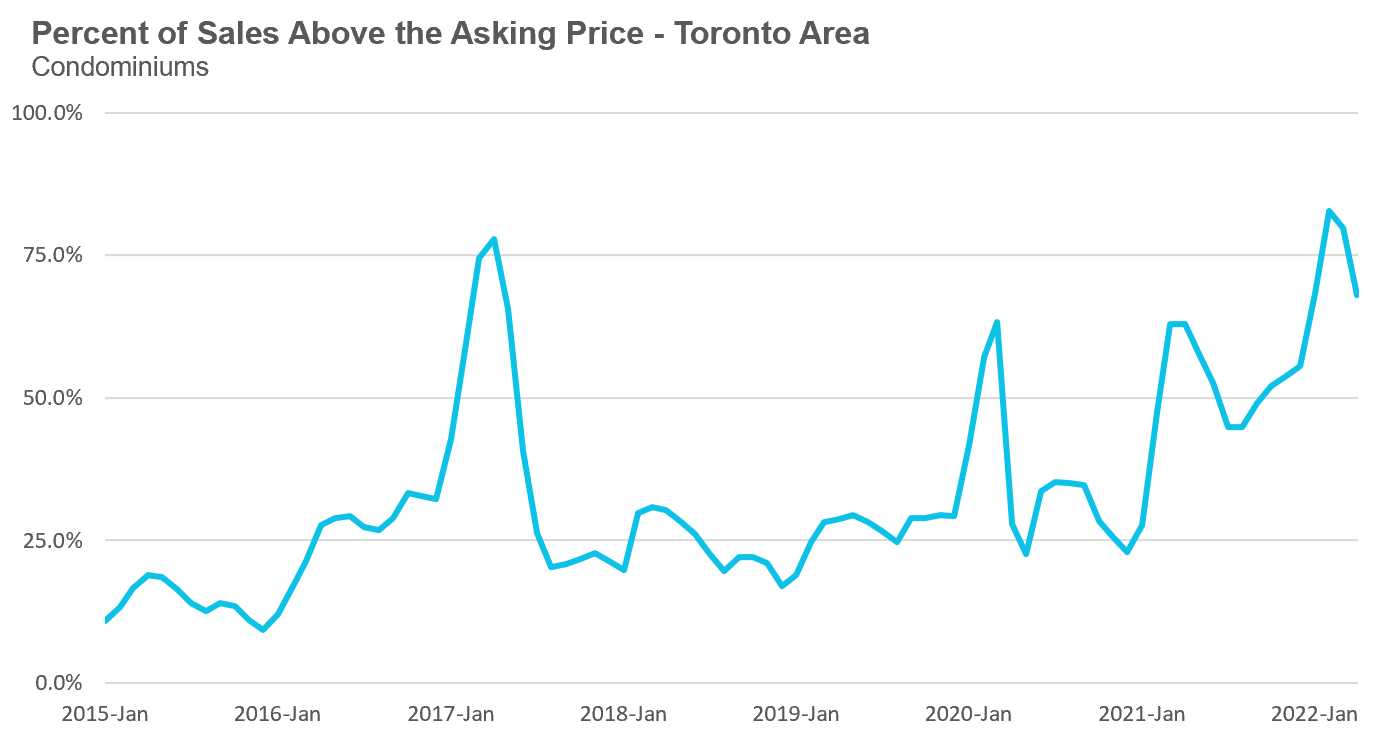

The share of houses selling for more than the owner’s asking price declined to 69% in April.

The average price for a house declined month-over-month to $1,527,743 in April 2022 and is well below the peak of $1,679,429 reached in February. Compared to last year, the average price in April is up 17%.

The median house price in April was $1,348,940, up 18% over last year, but below the peak of $1,485,000 reached in February.

The median is calculated by ordering all the sale prices in a given month and then selecting the price that is in the midpoint of that list such that half of all home sales were above that price and half are below that price. Economists often prefer the median price over the average because it is less sensitive to big increases in the sale of high-end or low-end homes in a given month which can skew the average price.

Condo (condominiums, including condo apartments, condo townhouses, etc.) sales in the Toronto area in April 2022 were down 35% over last year and below pre-Covid sales volumes in 2019.

New condo listings were down 7% April over last year and well ahead of the listing volume in 2019 and 2020.

The number of condos available for sale at the end of the month, or active listings, was up 10% over last year.

The MOI increased to 1.7 in the month of April.

The share of condos selling for over the asking price declined to 68% in April.

The average price for a condo in April fell to $819,698, down from $840,444 in March. The average price is up 16% over last year. The median price for a condo in April was $750,000, up 16% over last year, but down from $777,000 over last month.

Houses

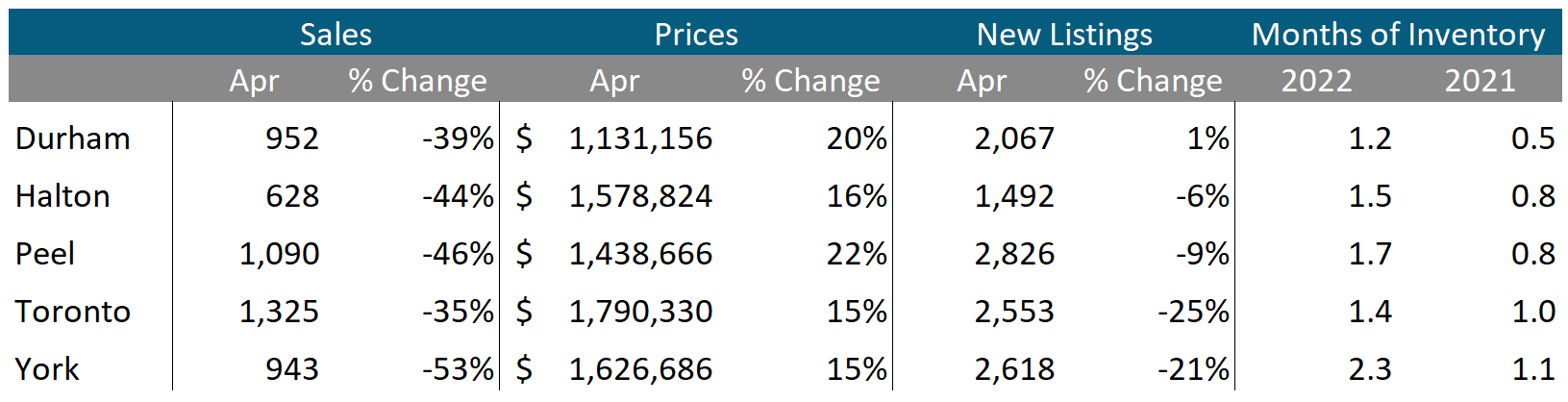

While average prices were up on a year-over-year (YOY) basis across all five regions in the GTA, sales were down significantly and inventory levels were well ahead of last year’s level, indicating some market slowing.

Condos

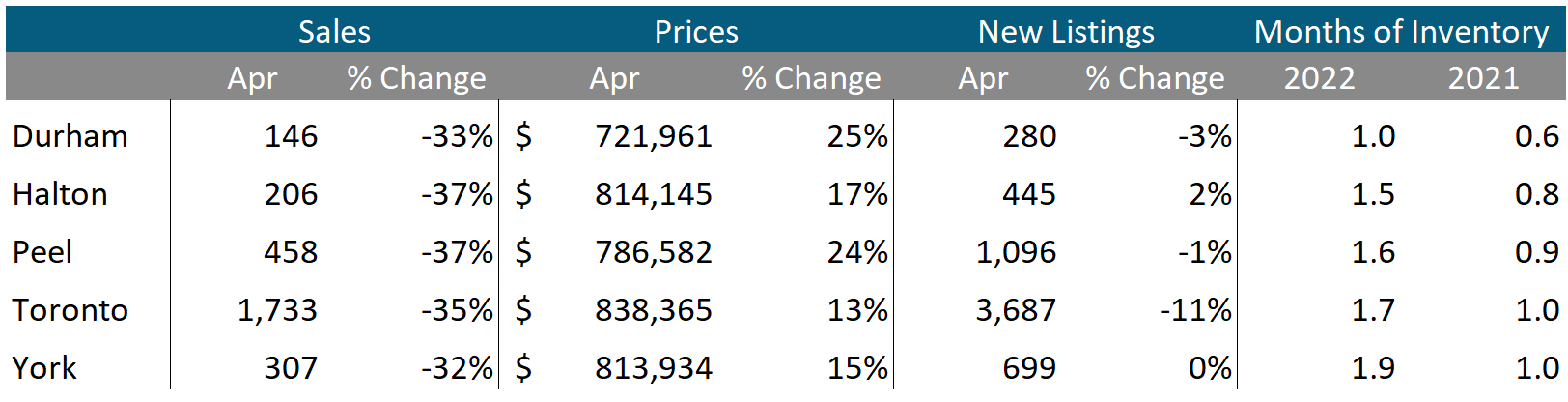

While condo sales were down across the GTA, average prices continue to be up double digits in all five regions. Current MOI levels are at or above 1 across the GTA signalling a slowing market.

See Market Performance by Neighbourhood Map, All Toronto and the GTA

Greater Toronto Area Market Trends

GET MORE DATA

This monthly Move Smartly Toronto Area Real Estate Market Report is powered by Realosophy Realty. Get the same up-to-date Toronto area market data on realosophy.com and additional information on every home for sale, including building permit history, environmental alerts and more when you buy a home with Realosophy Realty.