Can buying in outlying areas normally thought of as 'cottage country' be a viable way to get onto the housing ladder?

There has been recent talk in the media about a shift in consumer purchasing habits when it comes to buying homes: some would-be Toronto area homebuyers are dismissing the idea of purchasing a home in the area they would like to live and instead buying a property hours away from the city.

Is the dream of homeownership dead?

Not in the slightest - which is why I believe this shift has become so prevalent.

With Greater Toronto Area (GTA) home prices reaching record highs, anecdotally I can say that some buyers are just not interested in spending seven figures on a home. That said, many still desire the perceived perks and feeling of financial security that comes with owning a property - the Ontario Securities Commission found that 45% of pre-retired homeowners are banking on their properties to help fund retirement.

With home prices in areas further from the city being a steal in comparison to Toronto, it’s no wonder that these communities have seen an influx of city-buyer competition. Prospective home buyers get the opportunity to enter the market at a lower price point, while building equity that could help fund future expenditures. Win-win, right?

Not necessarily.

Just as there are risks with any home purchase, buying a cottage property comes with its own set of potential pitfalls.

- Recreational properties typically take longer to sell

For many, cottages and recreational properties alike are a “nice-to-have” not a “must-have” - this means that typically cottage type properties sit on the market longer than homes would in the GTA. Utilizing months of inventory (MOI), the time it would take for all active listings to sell with current levels of demand, we can see a clear difference. For example, the average months of inventory for a detached home in the GTA as of July 2018 is 3.5 months, versus the long-run average of 7.6 months of inventory for Sudbury, Ontario (CREA Stats).

This means that these recreational properties are typically less liquid than traditional city homes - in a pinch it could take many months for you to sell and recoup your cash, which is an important factor to consider.

- Market volatility

Purchasing in a location where many of the other properties are also rentals could lead to market volatility - similar to what we have seen with speculative investments in certain areas of the GTA. If there are changes to rules, regulations, legislation, or changes to the market, i.e., higher unemployment or a recession, properties surrounded by investments could be some of the hardest hit in terms of value if investors all start to pull their money at the same time. An influx of new listings to the market, as a large group of people try to exit simultaneously, can put a downwards pressure on prices.

- Appreciation isn’t typically as high as what the GTA has seen

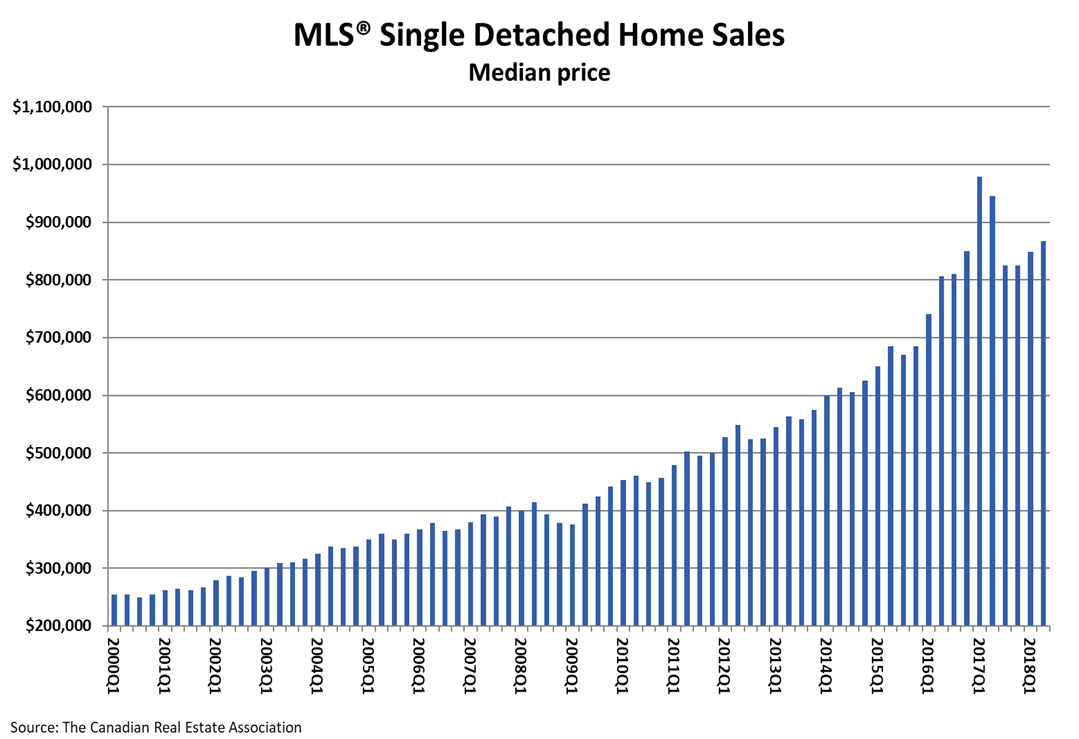

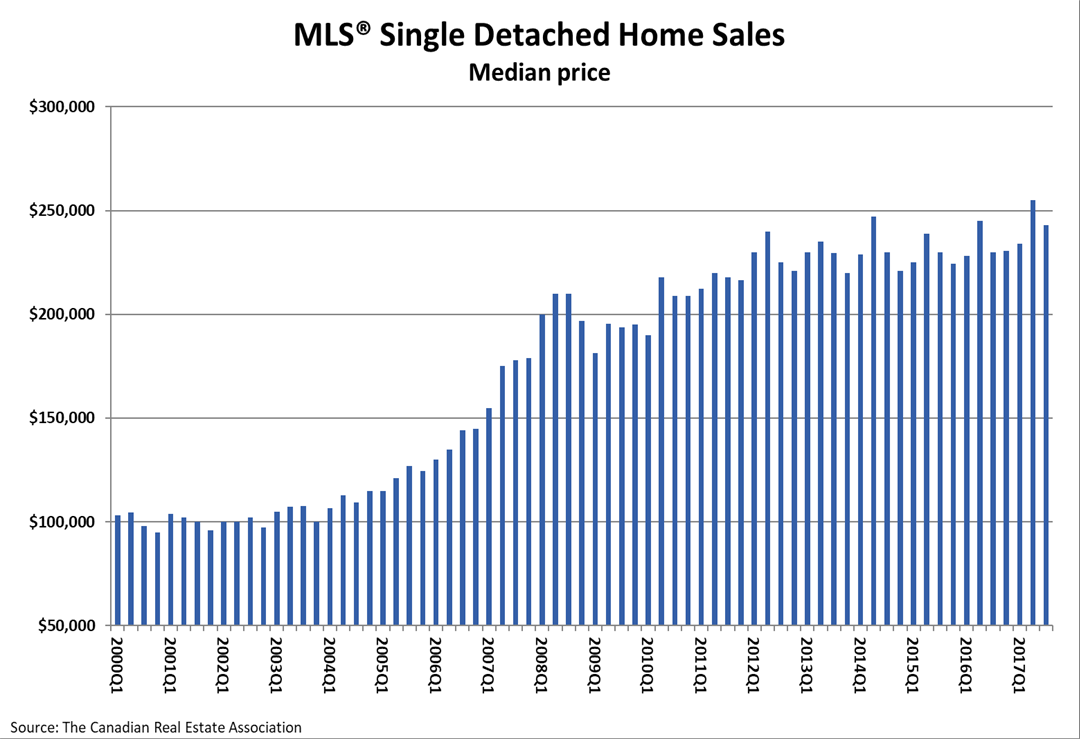

Historically, prices in the GTA have increased at a higher rate than many cottage country locations. Using our previous example of Sudbury, Ontario median prices have increased approximately 150% since 2000, versus GTA median prices which have increased approximately 240% during the same time period.

Greater Toronto Area

Sudbury, Ontario

- Short term rentals like AirBnB could be banned in the future

If you’re planning to rent your property on short term rental sites like AirBnB, know that the ability to do this may be short lived. Many communities are reviewing their policies surrounding short term rentals as they are impeding rental supply for residents who actually live in the area. As of April 2018 Niagara Falls has implemented changes to their plans to restrict short term rentals in the city. If you are banking on short term rentals to fund your purchase, I would proceed with caution.

- Managing a short-term rental has its own costs

When you own a short-term rental property it’s important to also consider the ongoing costs and time it will take to run it: advertising, reference and background checks, cottage maintenance, cleaning, and management of all activities will need to be completed (and it can be costly).

- Potential for capital gains taxes if property is a rental only

To avoid paying capital gains tax on your cottage when you go to sell it, the property would need to be designated as a primary residence. If your cottage is primarily a rental, it’s possible that the CRA may question your primary residence status. Always consult with a tax planning professional about your personal situation prior to purchase.

Top image credit: littleartvector

Nicole Harrington is a Sales Representative with Realosophy in Toronto. She specializes in using data and analytics to help her clients make smarter real estate decisions, concentrating on Toronto and the GTA, and hosts her own website: SheSellsToronto.com.