Share This

Author John Pasalis is the President of Realosophy Realty, a Toronto real estate brokerage which uses data analysis to advise residential real estate buyers, sellers and investors. He is a top contributor at Move Smartly, a frequent commentator in the media and researcher cited by the Bank of Canada and others.

FREE PUBLIC WEBINAR: WATCH REPORT HIGHLIGHTS

Join John Pasalis, report author, market analyst and President of Realosophy Realty, in a free monthly webinar as he discusses key highlights from this report, with added timely observations about new emerging issues, and answers your questions. A must see for well-informed Toronto area real estate consumers.

The Market Now

Cold weather and snow storms in January did nothing to cool down Toronto’s red hot housing market.

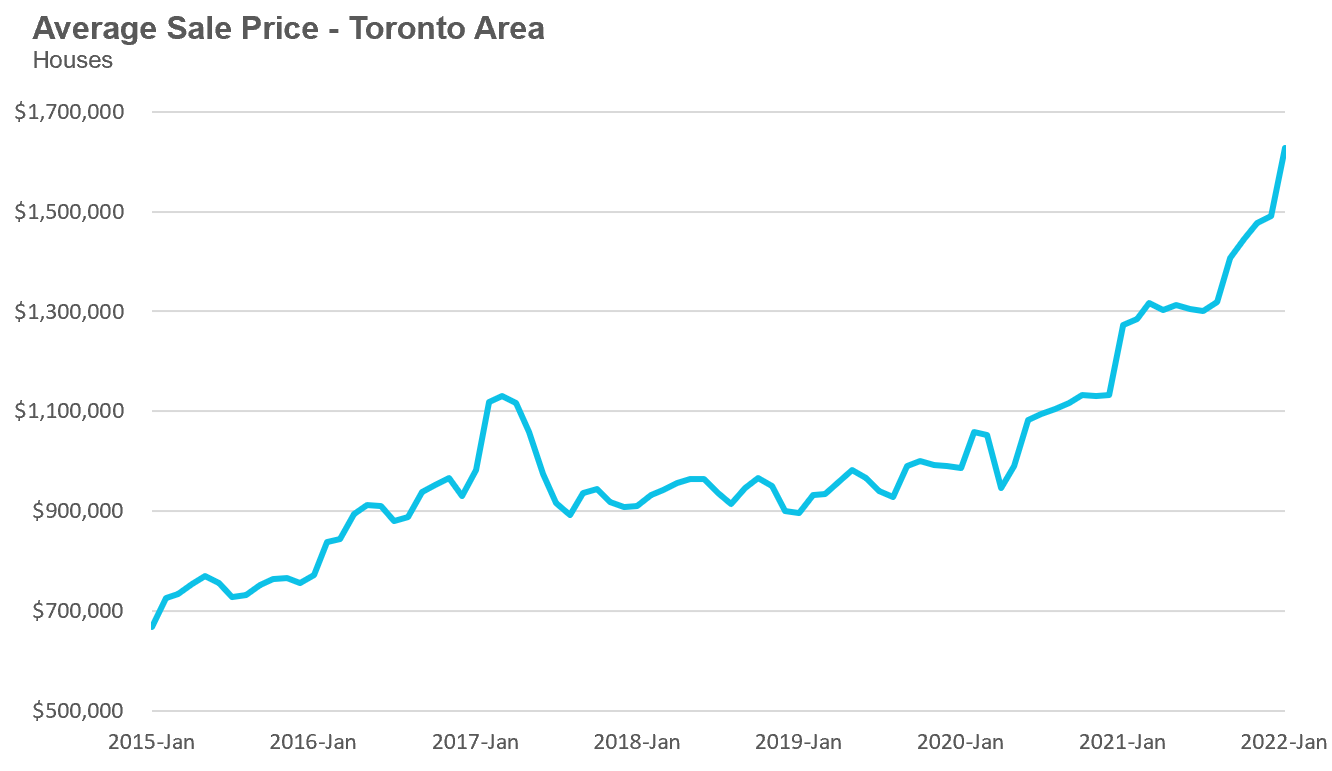

The average house price for January 2022 was $1,627,691, up 28% over the same month last year and up 23% since August.

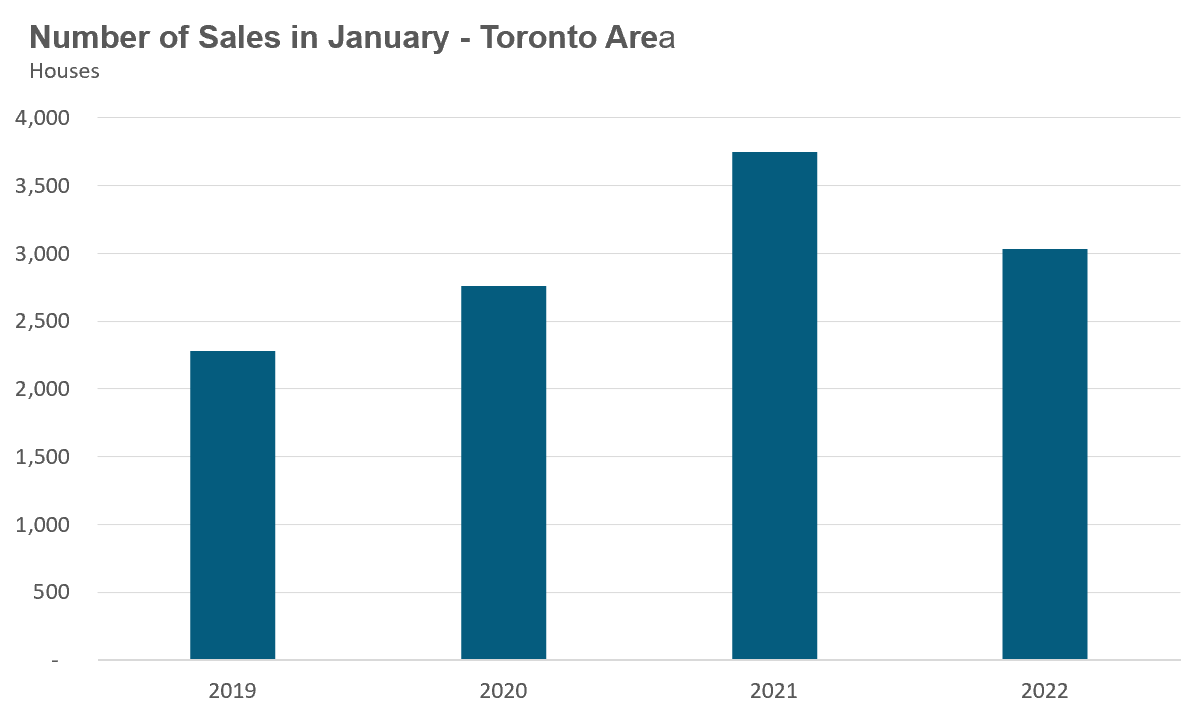

House sales were down 19% on a year-over-year basis in January, but well above levels for pre-Covid-19 pandemic January in 2019 and 2020.

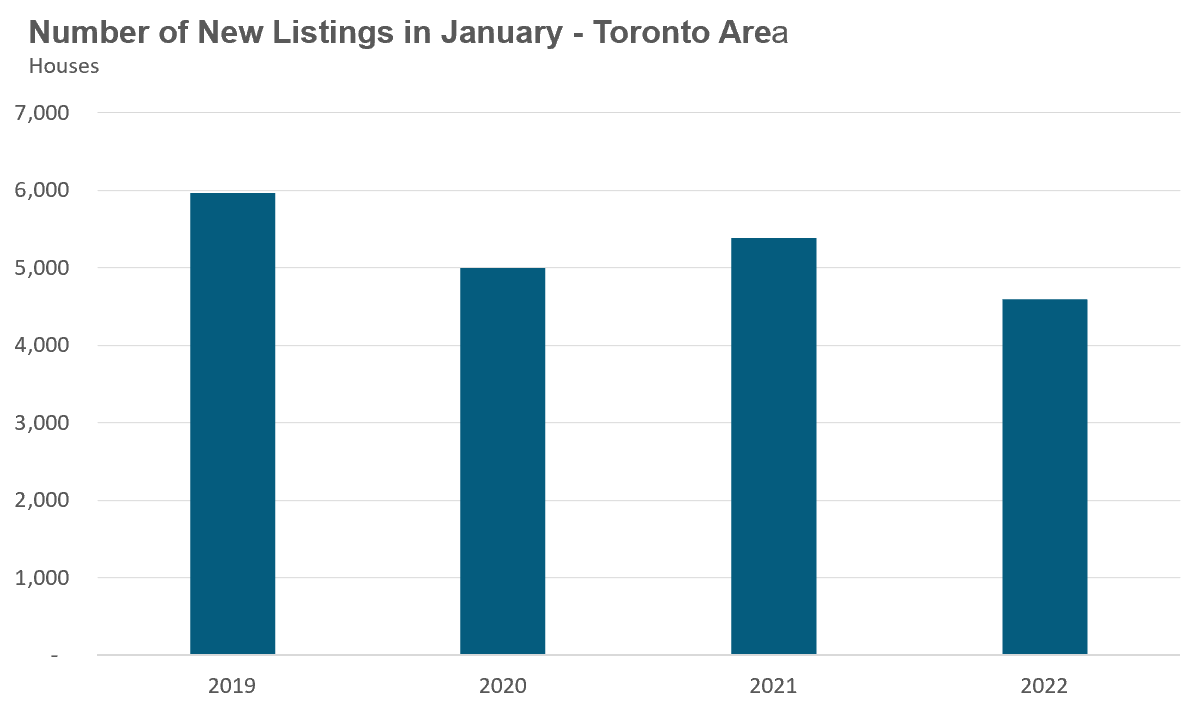

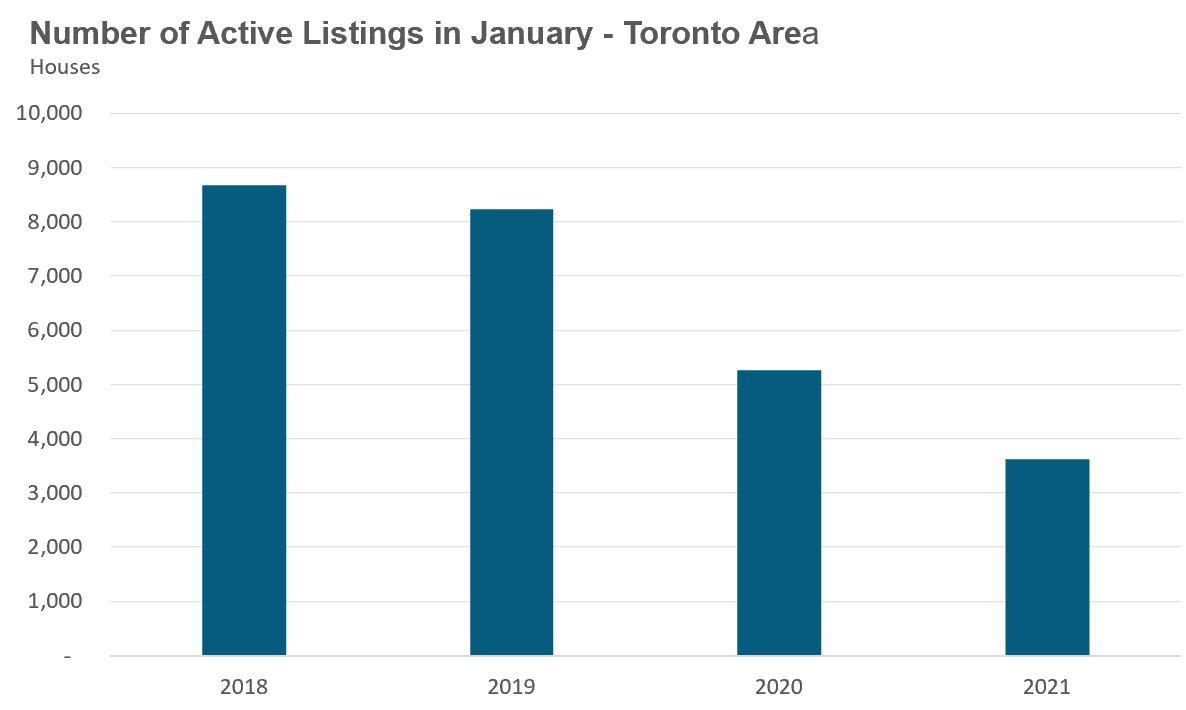

New listings in January were down 15% over last year while the number of active houses for sale at the end of January fell to just 2,427, a 33% decline over last year.

The average price for a house in January was $1,627,691, up 28% over last year and up 23% since August. The median house price in January was $1,450,000, up 31% over last year.

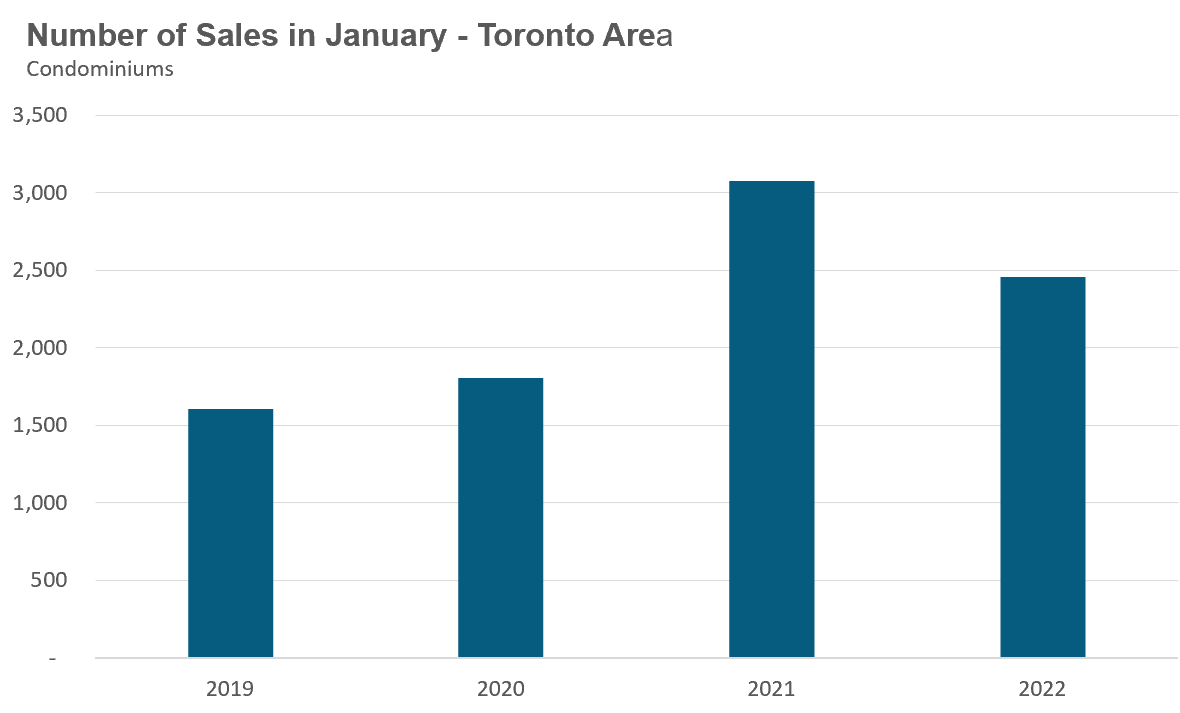

Condominium (condo) sales were down 20% in January over last year, but well above the levels for pre-Covid-19 pandemic January in 2019 and 2020.

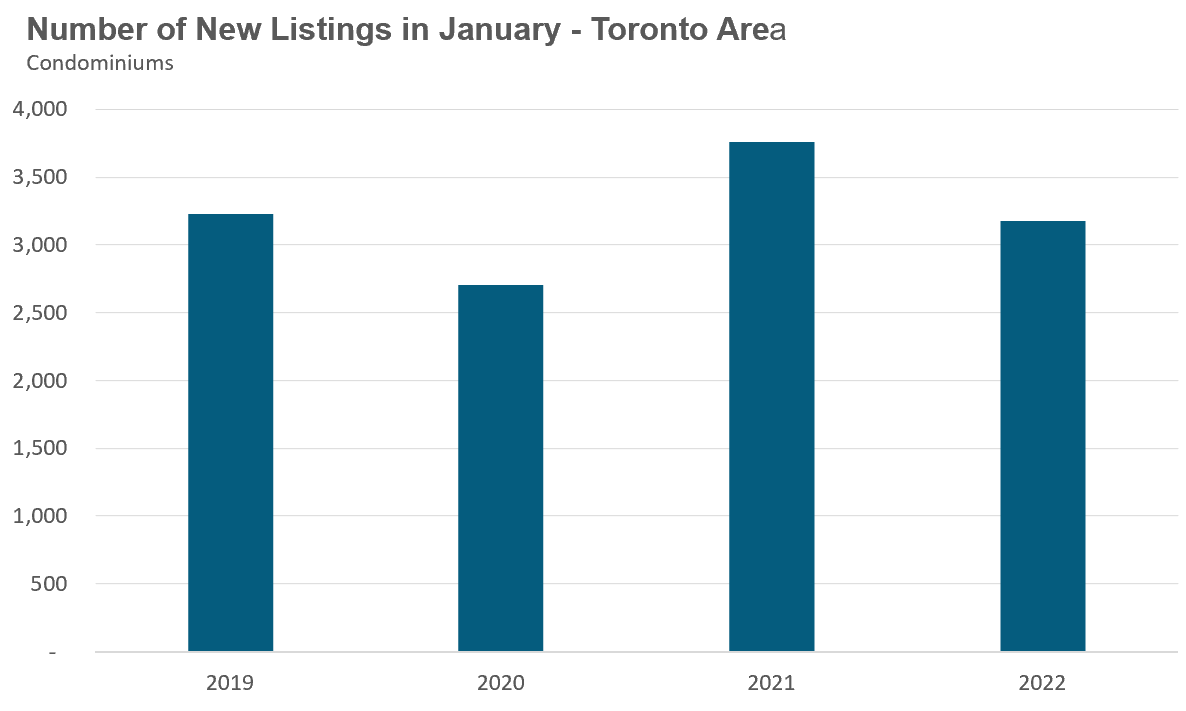

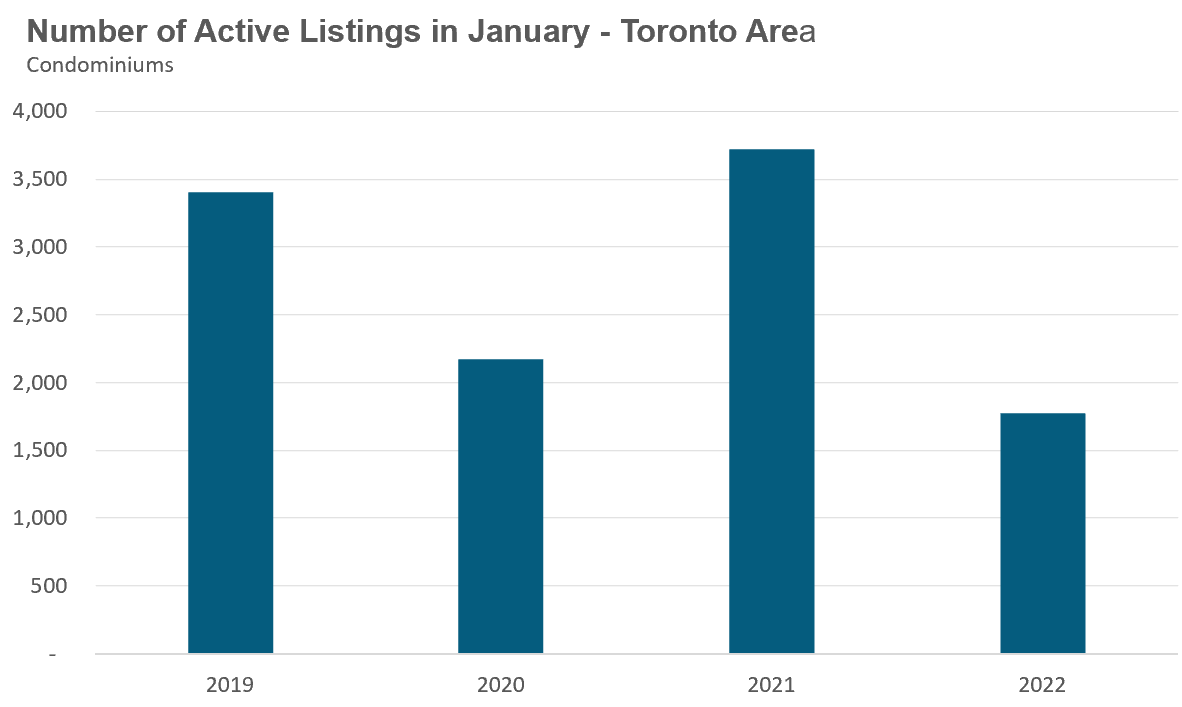

New condo listings were down by 16% in January over last year, but above the volumes in 2020. The number of condos available for sale at the end of the month, or active listings, was down 52% over last year.

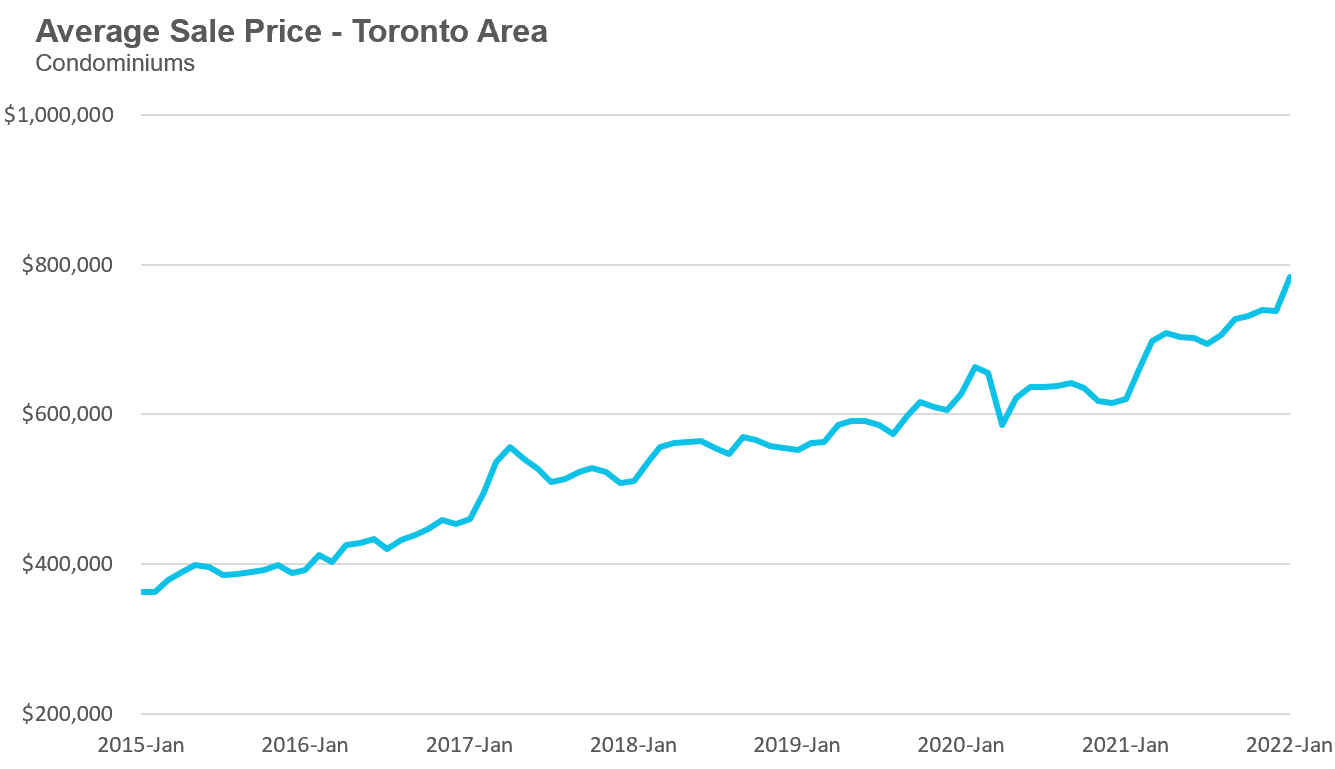

The average price for a condo in January reached $783.942, up 26% over last year; the median price for a condo in January was $722,000, up 24% over last year.

(For all monthly statistics for the Toronto Area, including house, condo and regional breakdowns, see the final section of this report.)

On February 16th this month, my new online course starts. If you are planning to buy a home or are already home buying — whether for first time or the fifth time — this course will teach you how to get an edge in Toronto’s competitive real estate market, understand where the market is heading and more. Click on the image below to see more details and sign up.

Peter Routledge, head of the Office of the Superintendent of Financial Institutions has just cautioned that higher interest rates this year could put an end to the “speculative fever” in Canada’s housing market.

“In some markets, where you had really rapid increases in prices, you could see a fall of 10 per cent, 20%.”

- Peter Routledge, OSFI

This is a striking change in position from Routledge who only two months ago was very supportive of the speculative frenzy driving up home prices. During a BNN Interview host Amanda Lang asked Routledge for his thoughts on recent data from the Bank of Canada showing a surge in investors buying single family homes and a concern from the Bank that price expectations may have become extrapolative, Routledge had this to say: “The investors are making an investment to generate a return, that’s a free market economy, more power to them.”

What solution was Routledge advocating for in November 2021 to cool Canada’s investor driven housing boom? Build more homes! (See my views on this solution further below in this report)

Two months later, it has become abundantly clear that Routledge’s solution isn’t working out as well as he had hoped. A country can’t build their way out of a speculative housing boom — buyer expectations move far more rapidly than new housing construction.

However, while Routledge’s more cautious tone about Canada’s housing market is a step in the right direction, I’m not entirely convinced we are going to see a 20% decline in house prices this year.

As I discussed in last month’s report, home prices tend to be sticky on the way down, and while, in more recent memory, the Toronto area did see a rapid 20% decline in house prices in 2017 as I tracked and reported then, I’m not convinced we’ll see the same type of rapid shift in buyer and seller beliefs to see a similar rapid decline for the reasons I discussed in January.

Low-rise home prices rising by 30% per year in the Greater Toronto Area is masking an even more alarming trend — that prices are rising far more rapidly than this in the outer suburbs.

It’s not uncommon to see homes selling for 40 to 50% more than what the current owner and/or investor bought the home for just one year earlier (without any modifications made to the home).

For anyone outside of the housing market looking in, house prices rising 40 to 50% per year understandably appears irrational, which of course raises the question — why are so many buyers willing to pay prices that seem irrational?

The answer to that question requires some thought into the beliefs and expectations that are driving home prices.

Clearly, enough buyers don’t believe it’s irrational to pay 50% more than what similar homes were selling for a year ago. If buyers thought this level of price growth was irrational and unjustified, they would stop buying. That’s typically how housing bubbles end, when buyer beliefs about the future path of home prices turns from optimistic to cautious and eventually pessimistic

So what is fuelling this buyer belief?

The simple answer is that the average home buyer is listening to what leading economists are telling them about the housing market.

Buyers are hearing that the current price growth is the result of a lack of supply and that affordability will not improve until we build more houses.

Now to most people, the above statement does not sound problematic or controversial at all. In fact, it’s the narrative we have been hearing for years about Toronto’s housing market. But when I hear these statements, I like to think about how they shape people’s beliefs about the housing market and how those beliefs explain the current house price dynamics we are seeing.

Lack of supply has been the dominant narrative Canadians have been hearing over the past two years as an explanation for the boom in Canadian home prices. Politicians at both the federal and provincial levels, economists from Canada’s big banks, Canada’s banking regulator OSFI and even some academic economists have repeatedly argued that the reason home prices are exploding in Canada is because of a lack of supply, and the only solution is to simply build more homes.

While there are supply constraints affecting the market (or more accurately a demand-supply disconnect as we are not building enough for our population growth as I discuss in my report last month and again further below in this report), the real question I'm thinking about in this instance is -- Does this belief in lack of supply explain the explosive price growth we are seeing?

When economists say that the 30% price growth we are seeing for low-rise homes in the Toronto area, and the 40 to 50% growth in the suburbs, is the result of a lack of supply they are making the case that this growth in house prices is being driven by fundamental factors (in this case a lack of supply) and that this growth is both understandable and rational.

The alternative thesis is that underbuilding may explain part of the price growth we are seeing, but not all of it. During housing bubbles, house prices get pushed up by the optimistic beliefs of home buyers and investors — the expectation that prices will keep going up and that real estate is a good and safe investment. During these speculative periods, the demand for homes significantly exceeds supply which of course drives home prices up even higher, making real estate look like an even better investment each day that passes.

By this time, this supply shortage is not due to a lack of new houses being built, but because there is a surge in demand from people looking to capitalise on rapidly rising home prices

While many experts claim that actual supply issues are causing home price acceleration, some have acknowledged that there is buyer belief issue at hand as well.

Recently, the Bank of Canada’s Deputy Governor Paul Beaudry did raise concerns that home price expectations have become “extrapolative”:

A particularly worrisome development is that price expectations in some areas may have become extrapolative. This happens when people think house prices will be even higher in the future, and it can lead them to rush into the market to buy.

Extrapolative is the term modern day central bankers use to describe a market driven by “irrational exuberance”.

But very few other economists today are raising any concerns that today’s price dynamics might be ‘irrational’. Instead, they keep encouraging buyers that this rapid price growth is an obvious and rational result of a shortage of housing supply.

This is another important narrative that leading economists have been communicating lately.

“If we don’t fix this, if we don’t right-size the number of homes in Canada or Ontario relative to population needs, things are never going to be more affordable.”

- Jean-Francois Perrault, Scotiabank Chief Economist

Narratives like this one are quite important because they are forward looking statements about the housing market.

To say that housing is never going to be more affordable until we increase new housing supply is another way of saying prices are not going to fall until we build more homes.

It’s of course possible that Mr. Perrault did not intend this, but that is the narrative that eager home buyers are hearing. And to be fair to Mr. Perrault, he’s not the only economist making these types of forward looking statements.

If the economists arguing that ‘we just need to build more homes’ are correct, we shouldn’t see much downward pressure on home prices in the future because prices are being supported by market fundamentals (i.e., as there is not enough supply to meet demand).

But if they're wrong, and we see a decline in home prices, their assertions about supply will have been a part of the 'irrational' price growth we are seeing today.

“Is increasing home supply the only way to bring down home prices?”

This was the question that Ontario Real Estate Association CEO Tim Hudak and I were recently asked to debate for Post City magazine and their “Streets of Toronto Blog”. While Hudak argued for the supply solution, I shared the following about what I feel is a more immediate and important demand-side issue.

As Canadian home prices reach a crisis level, the debate about the cause and potential solution has become very myopic. Politicians, the real estate industry and some economists have argued that high home prices are simply the result of a lack of supply and the only solution is to simply build more.

But when we consider the key drivers of high home prices — strong demand from Canada’s booming population growth and a supply shortage of new housing completions from the private sector — any potential solution must begin with the policies that our federal and provincial governments have the most direct control over.

In the years before the Justin Trudeau-led Liberal government took over in Ottawa, Canada’s population was growing by roughly 350,000 people per year, the highest population growth rate in the G7 since 2000. During that same period Canada was completing roughly 170,000 new homes per year.

In 2018 and 2019, the years immediately preceding the current Covid-19 pandemic, Canada's population growth accelerated to over 500,000 people per year, the result of higher immigration targets and a surge in non-permanent residents. How did Canada’s new housing completions change in response to this surge in population?

Not at all.

This experience offers two important insights. While it’s very easy for Canada to accelerate its population from 350,000 to 500,000 people per year, it’s not as easy to quickly build the additional 70,000 homes per year that would be needed to meet this surge in demand for housing.

Supply issues go well beyond regulatory issues. While we don't often have much sympathy for the home building industry in an ever hotter market, the fact is that home building is a complex undertaking. Scaling up Canada's housing completions would have required a decade of planning between all levels of government and the private sector to address many issues including how to ensure that the industry has enough skilled tradespeople to meet such targets.

Recent research from the Bank of Montreal found that countries with the fastest growing populations also tend to see the most rapid growth in house prices as seen in New Zealand and Canada .

A lack of link up between immigration and housing planning is likely a key reason why.

A more prudent approach to address Canada’s dual needs for strong immigration and affordable housing is to determine the rate of population growth that would meet our economic needs while remaining sustainable from a housing perspective. As policy makers find solutions to increase the supply of new housing, Canada's population growth could be increased without putting undue pressure on home prices.

But our governments have taken the opposite approach — they’ve decided to rapidly increase Canada’s population growth and now they are scrambling to try to figure out how to build the additional homes we need, while all Canadians — including newcomers — grow increasingly dismayed as home prices skyrocket out of reach.

Increasing Canada’s supply of housing will always be a continual problem that will need to be managed — in acknowledgement of this, syncing up our demand side management, primarily in the form of population growth, is the most important and doable first step. As long as Canada’s population grows faster than our ability to build homes for all Canadians, we will continue to see untenable pressure on home prices.

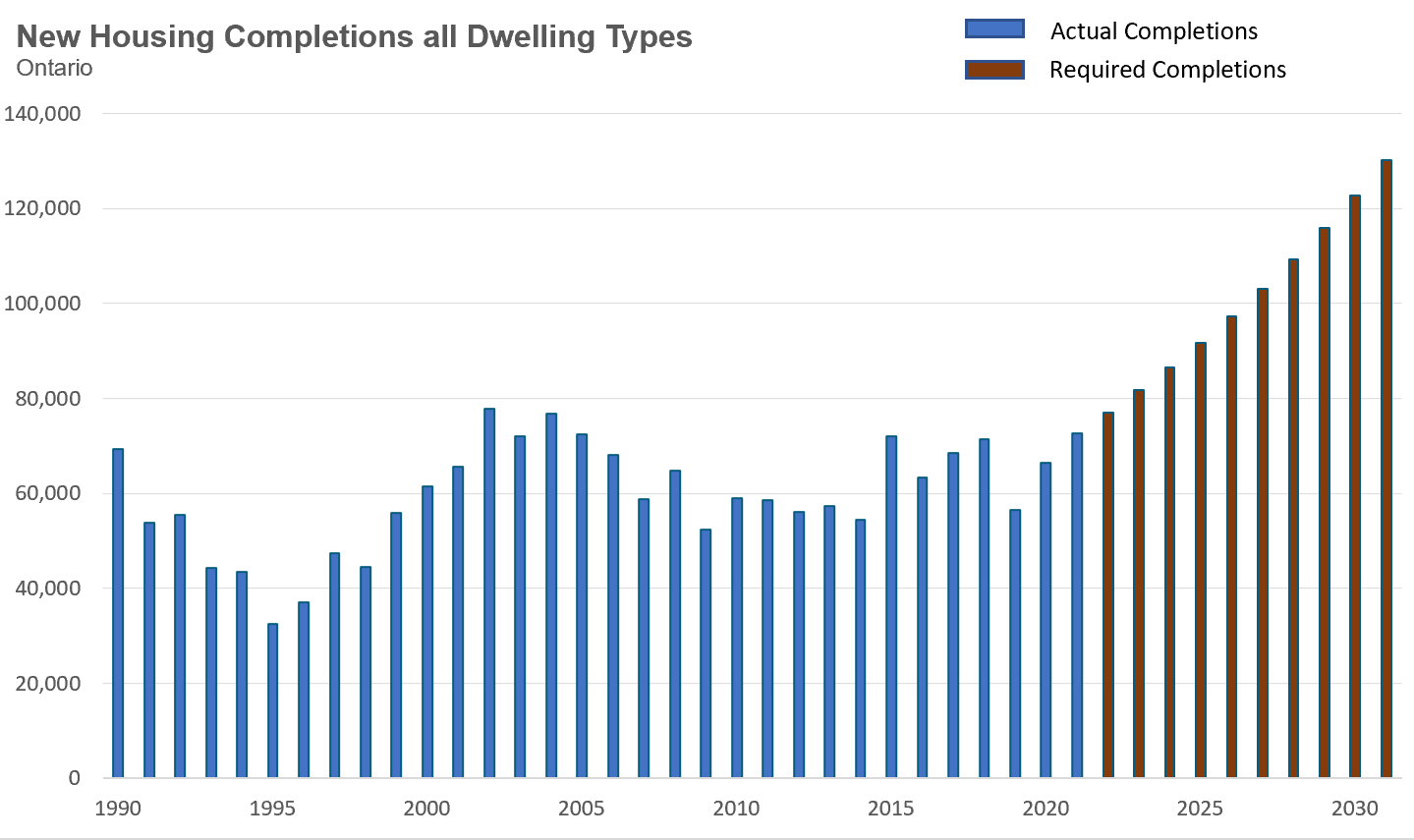

A common narrative we hear about our housing market is that Ontario’s supply of homes is not keeping up with demand (as I discuss above, but just how wide is this gap between supply and demand and what impact will that have on the housing market?

In his report “Baby Needs a New Home” for the Smart Prosperity Institute, economist Mike Moffatt gives us some insight into how many homes Ontario will need to complete over the next ten years to keep up with Ontario's projected population growth.

Moffatt started by looking at Ontario’s population growth between 2016 to 2021 and calculated the number of households that would typically be formed given the demographic profile of the population increase. His analysis found that 413,753 households would have been formed during that period, but only 349,039 homes were built, a supply gap of 64,714.

He then used the same approach to project the number of households that should be formed over the next ten years using the Ontario Ministry of Finance’s population projections and came up with a striking conclusion.

“Adding together the unformed households from 2016-21 due to the supply gap of homes, along with the formation of new households, we project, on net, an additional one million households to be formed in the next ten years, requiring one million new homes.”

- Mike Moffat

So how likely are we to build one million homes over the next ten years?

According to the CMHC, over the past ten years, Ontario has completed an average of 63,844 homes each year, well below the 100,000 net new homes we would need to build each year over the next ten years.

It’s worth noting that using new completions as measured by CMHC is not entirely accurate because this does not take into account the number of homes demolished and removed from our housing stock each year. In order to have 100,000 net new homes each year, Ontario would need to build a new home for every one removed from our housing stock, pushing the required annual completions above 100K.

If Ontario is averaging 63,844 completions per year, it’s clear that we are not going to get to 100K annual completions overnight and it will take the housing market some time to get to that level. But by that time, the shortfalls each year will need to be caught up on too.

If we use a constant rate of growth in new competitions that would allow us to achieve 1 million new completions over the next ten years, we end up with this chart showing the required completions in red over the next ten years, peaking at just over 130K completions in 2031.

What is the likelihood that Ontario will go from completing 64,000 homes on average per year to over 130,000 completions in ten years?

Considering that the Ontario government only appointed a Housing Affordability Task Force tasked with making recommendations to increase housing supply just two months ago in December 2021, it's clear that the probability that Ontario will build 1 million homes in ten years is practically 0%.

Accelerating Ontario’s average annual housing completions from 64,000 to 100,000 per year would have required over a decade of planning and coordination between the public and private sectors.

This means that we not only need to scale up our housing completions rapidly, we need to make drastic changes to the types of homes we are building.

January 2022

House sales (detached, semi-detached, townhouse, etc.) in the Toronto area in January 2022 were down 19% over the same month last year, but were above levels for the same month in pre-Covid 2019 and 2020.

New listings in January were down 15% over last year, and below the volumes seen in 2019 and 2020.

The number of houses available for sale (“active listings”) was down 33% when compared to the same month last year and 54% below the inventory levels seen in 2020. Toronto’s dwindling inventory is partly due to the decline in new listings last month, but the bigger factor is the surge in demand we saw during the second half of 2021.

This acceleration in demand absorbed much of the active inventory in 2021 which means we started the year with fewer active listings from last year. In 2018, for example, we ended the year with just over 8,000 active listings compared to December 2021 where we ended the year with just over 1,500 active listings. The low number of active listings that carried over from 2021 contributed to the tight market conditions at the start the year.

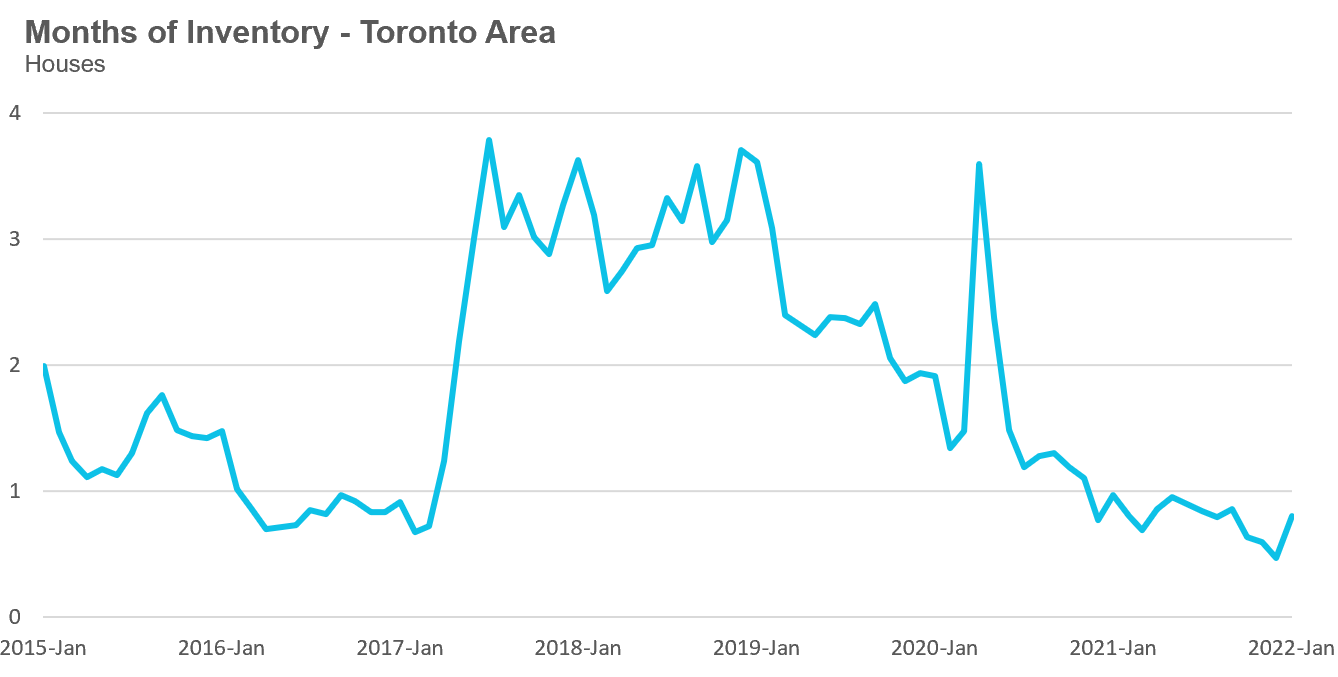

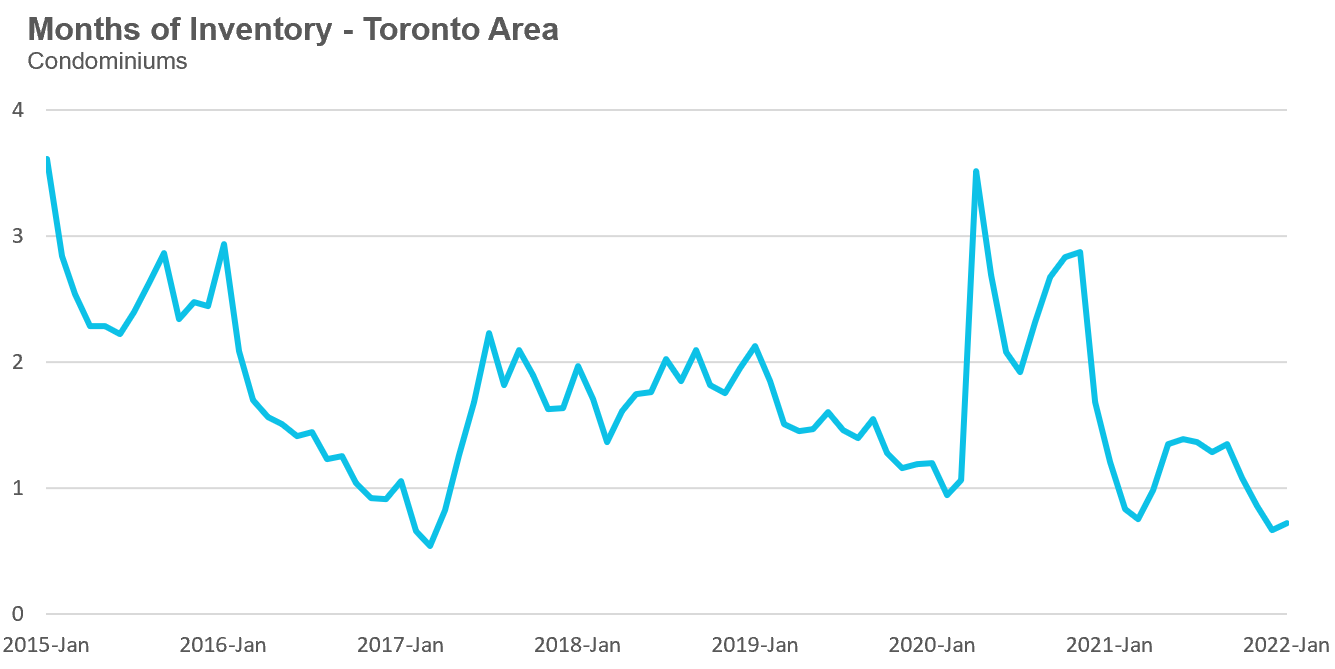

The Months of Inventory ratio (MOI) looks at the number of homes available for sale in a given month divided by the number of homes that sold in that month. It answers the following question: If no more homes came on the market for sale, how long would it take for all the existing homes on the market to sell given the current level of demand?

The higher the MOI, the cooler the market is. A balanced market (a market where prices are neither rising nor falling) is one where MOI is between four to six months. The lower the MOI, the more rapidly we would expect prices to rise.

This January, the market remained very competitive with under 1 MOI.

While the current level of MOI gives us clues into how competitive the market is on-the-ground today, the direction it is moving in also gives us some clues into where the market may be heading. The MOI has been below a very competitive 1 MOI for the past twelve months.

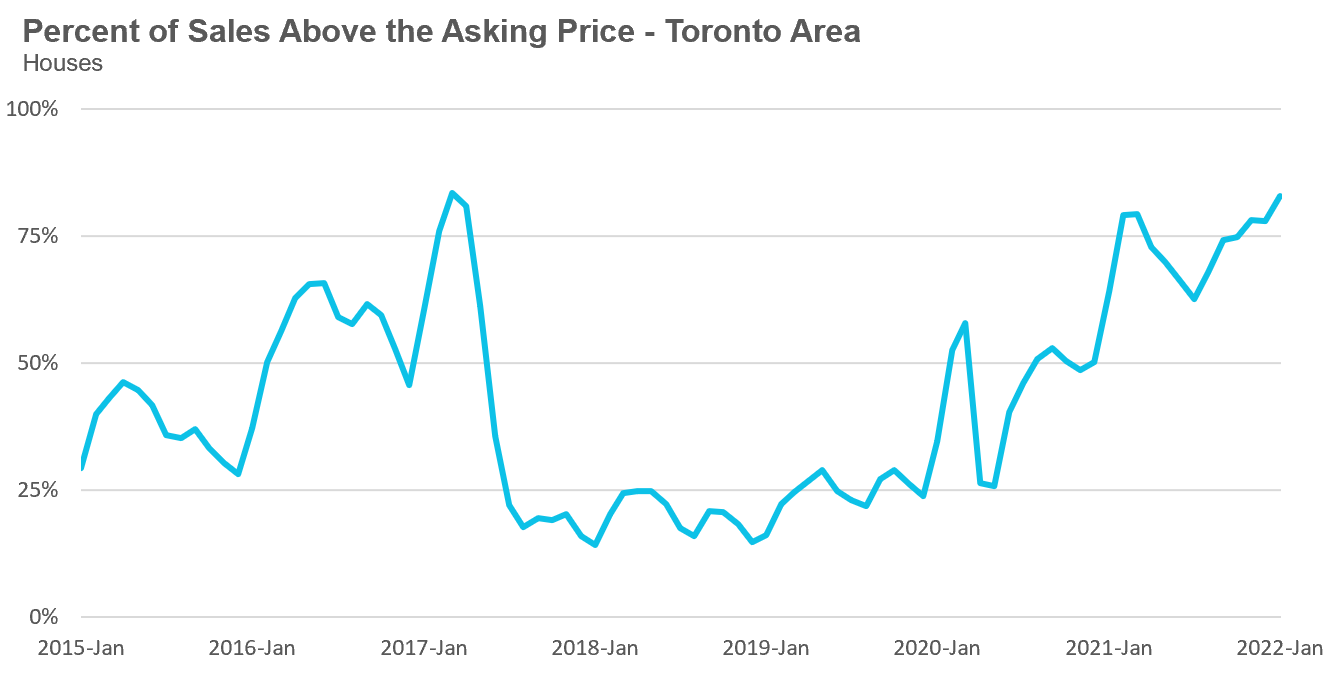

Over the past 5 years, the share of houses selling for more than the owner’s asking price climbed from 68% in August to 83% in January.

After a brief plateau in house prices during the first half of 2021, average house prices have been accelerating since September 2021. The average price for a house has climbed from $1.32M in August to $1.627M in January 2022, a 23% increase in just 5 months and up 28% over last year.

The median house price in January was $1,450,000, up 31% over last year when the median house price was $1,103,500.

The median is calculated by ordering all the sale prices in a given month and then selecting the price that is in the midpoint of that list such that half of all home sales were above that price and half are below that price. Economists often prefer the median price over the average because it is less sensitive to big increases in the sale of high-end or low-end homes in a given month which can skew the average price.

Condo (condominiums, including condo apartments, condo townhouses, etc.) sales in the Toronto area in January 2022 were down 20% over last year and up 26% compared to pre-Covid 2020.

New condo listings were down by 16% in January over last year, but well above the volumes in 2019 and 2020.

The number of condos available for sale at the end of the month, or active listings, was down 52% over last year, a period that saw a surge in condo listings due to declining prices, falling rents and rising vacancy rates.

The strong demand helped keep the MOI below 1 MOI for the month of January.

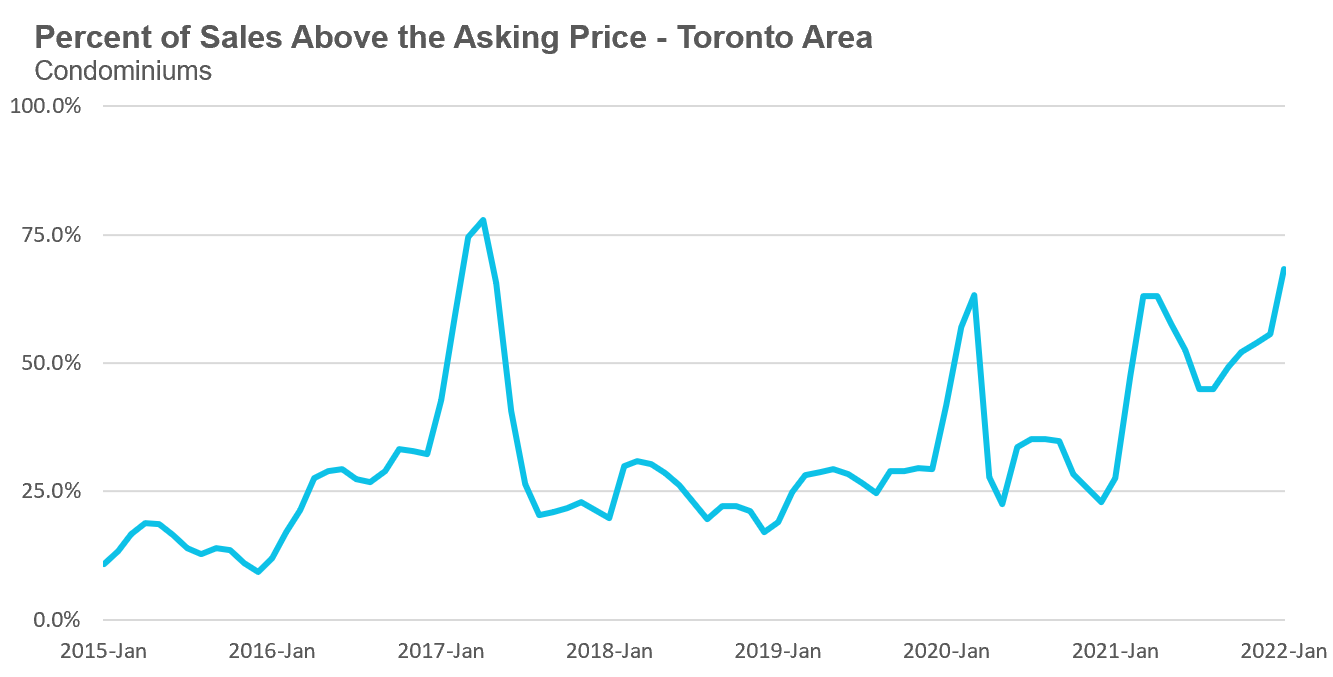

The competition for condos picked up significantly with the share of condos selling for over the asking price rising from 45% in August to 68% in January.

Average condo prices in January reached $783.942, up 26% over last year. The median price for a condo in January was $722,000 up 24% over last year.

Houses

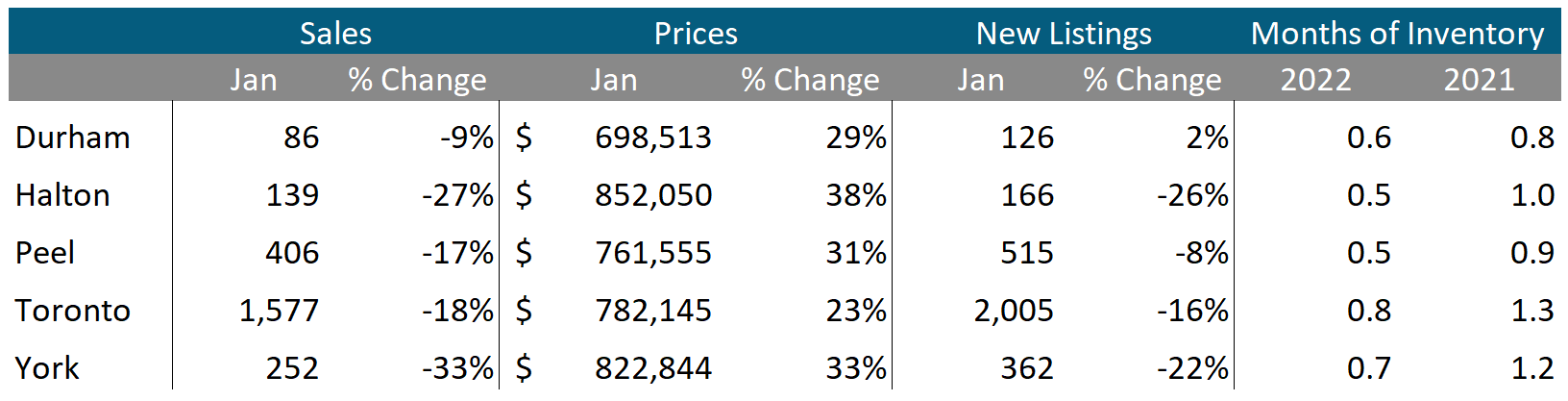

Sales across all five regions in the GTA were down in January while average prices were up on a year-over-year basis. The decline in new listings helped keep the market competitive with MOI below 1 across the entire GTA, indicating a strong seller’s market.

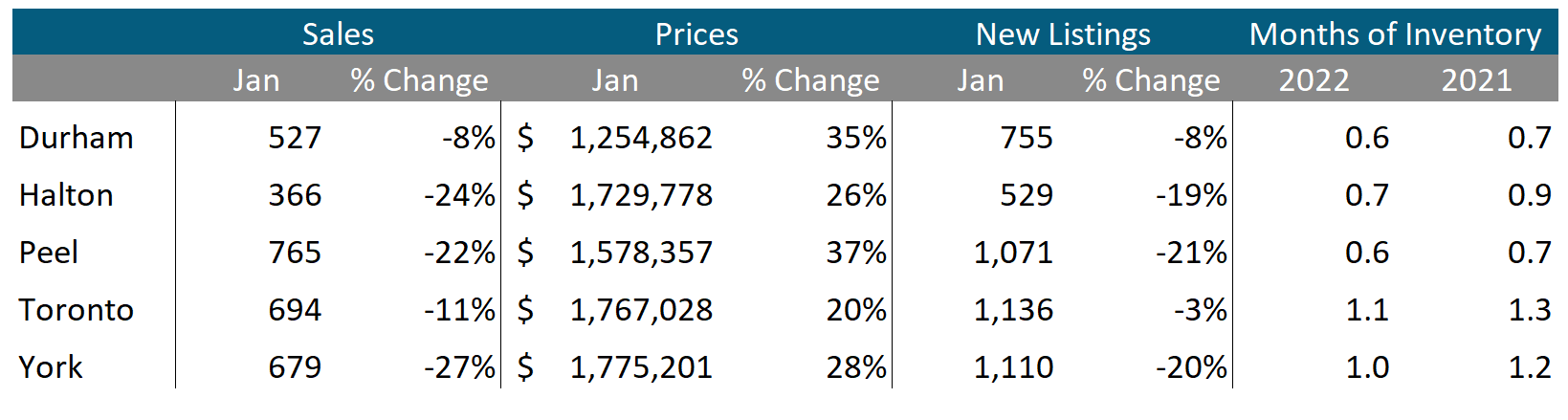

Condos

Condo sales were up in Durham but down across the rest of the GTA in January. Average prices were up double digits in all five regions. Current MOI levels are below 1 across the GTA signalling a strong seller’s market.