Author John Pasalis is the President of Realosophy Realty, a Toronto real estate brokerage which uses data analysis to advise residential real estate buyers, sellers and investors. He is a top contributor at Move Smartly, a frequent commentator in the media and researcher cited by the Bank of Canada and others.

FREE PUBLIC WEBINAR: WATCH REPORT HIGHLIGHTS & Q/A - Wed Nov 16th 12PM ET

Join John Pasalis, report author, market analyst and President of Realosophy Realty, in a free monthly webinar as he discusses key highlights from this report, with added timely observations about new emerging issues, and answers your questions. A must see for well-informed Toronto area real estate consumers.

The Market Now

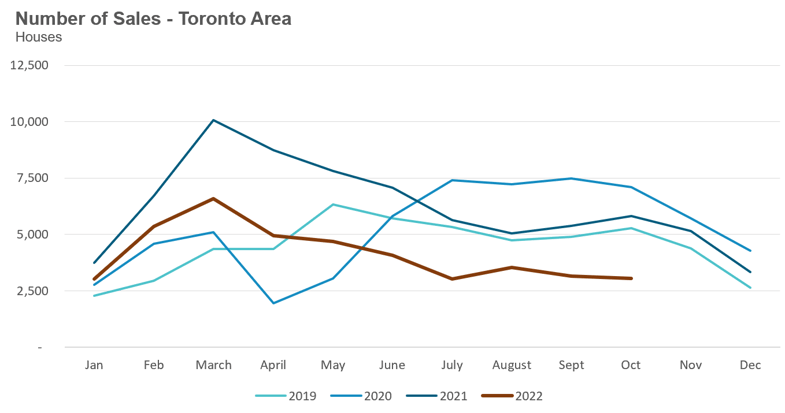

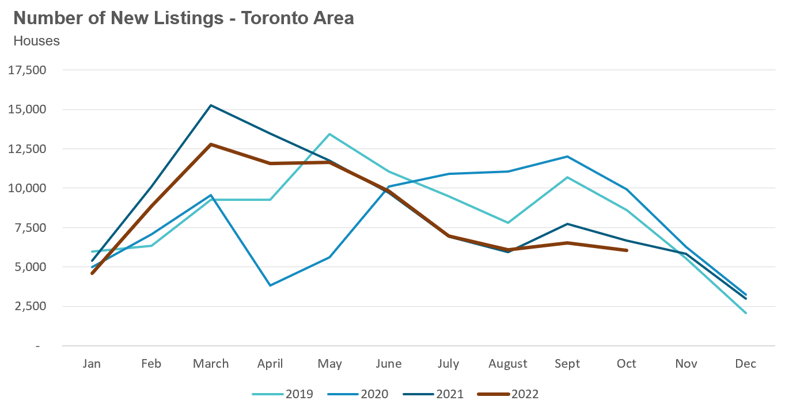

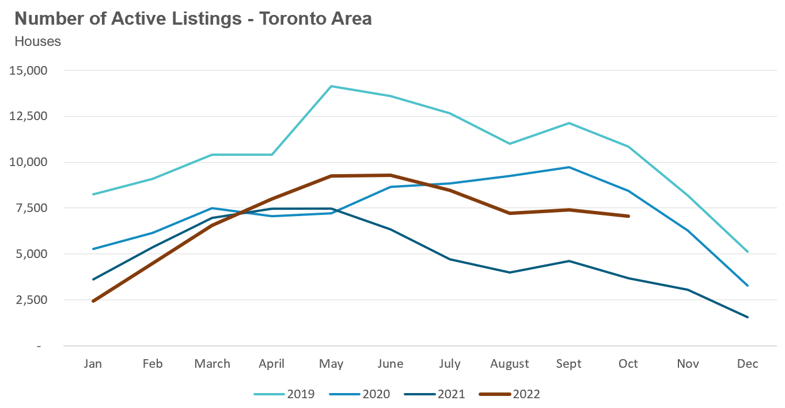

Looking at the most recent statistics for the Greater Toronto Area (GTA) market for the latest month available, October 2022, we are seeing that even as sales numbers remain at 20-year lows, home prices have stabilized since July in part because there are relatively few homes available for sale as new listings were also at a 20-year low in October.

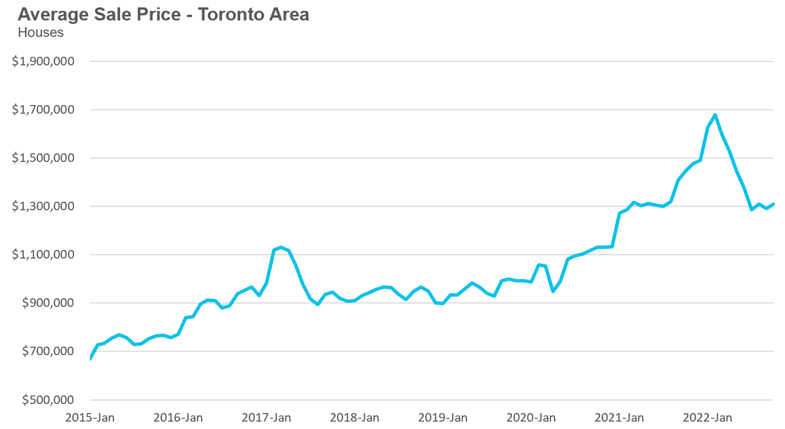

The average price for a house was $1,309,055 in October, down 22% from the most recent peak of $1,679,429 in February, and down 9% over the same month last year. The median house price in October was $1,130,000, down 24% from $1,485,000 in February, and down 11% over last year.

House sales in October were down a whopping 47% over last year while new house listings were down 10% compared to last year. The number of houses available for sale at the end of the month, or active listings, was up 91% over last year, when demand was notably high; excluding that year, the active listings number today is well below historical norms for the month of October.

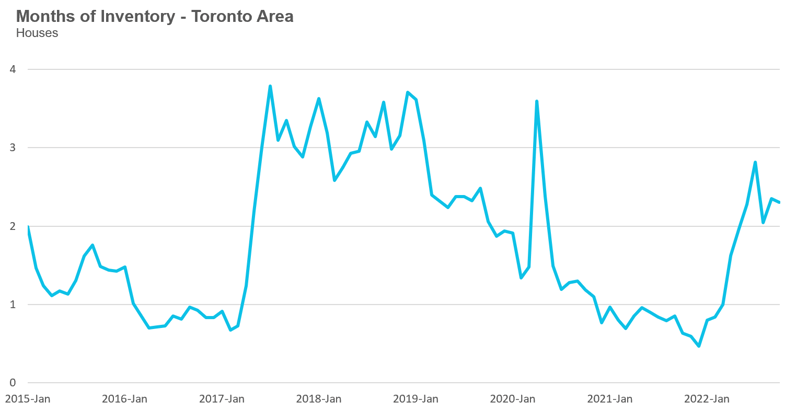

The Months of Inventory (MOI) which is a measure of inventory relative to the number of sales each month (see Monthly Statistics section below for more information on this measure) was unchanged at 2.3 MOI in October, indicating tight supply conditions.

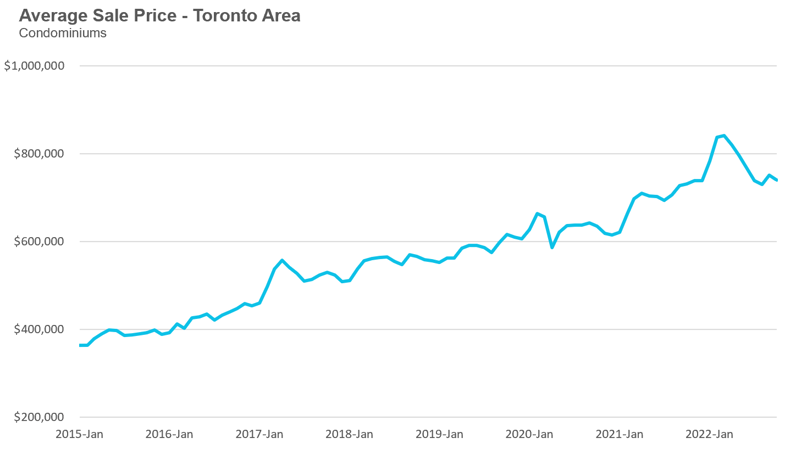

The average price for a condo fell to $739,099 in October, down 12% from the most recent peak of $840,444 in March, but still up 1% over last year. The median price for a condo in October was $667,750, down from $777,000 in March, but again up 1% over last year.

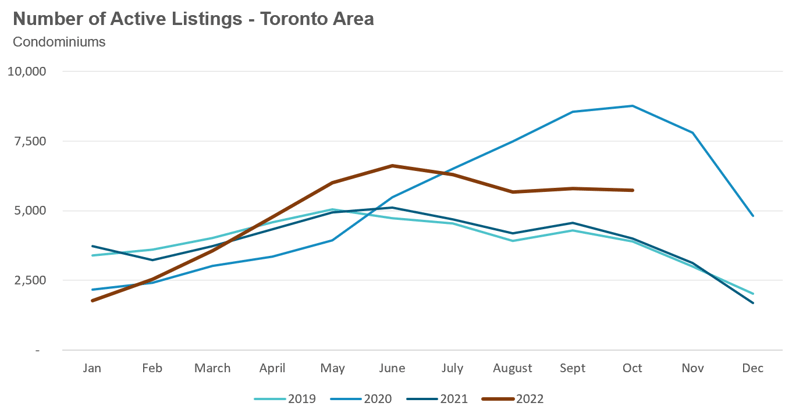

Condo sales in October were down 53% over last year and below pre-COVID sales volumes for the month in 2019. New condo listings were down 16% over last year while the number of active condo listings was up 44% over last year. The MOI was unchanged at 3.3 MOI in October, indicating that supply is slightly less constrained than for houses.

For detailed monthly statistics for the Toronto Area, including house, condo and regional breakdowns, see the final section of this report.

Toronto’s housing market continues to remain very sluggish with very few sales.

However, this low level of sales is not entirely down due to a drop off of buyer demand, but also seller supply, as very few homes are being made available for sale.

The relatively tight inventory of homes available for sale has made this market challenging for buyers eager to purchase a home. Many clients at my own brokerage are eager to buy, but they also don’t want to compromise too much because — unlike in the very hot competitive market conditions we’ve been seeing in so many past years — right now, they don’t feel like there is any urgency to buy.

Because of this, the nicest homes that are coming onto the market each week are receiving a lot of interest while homes that have features that buyers might find slightly less desirable are sitting on the market for months.

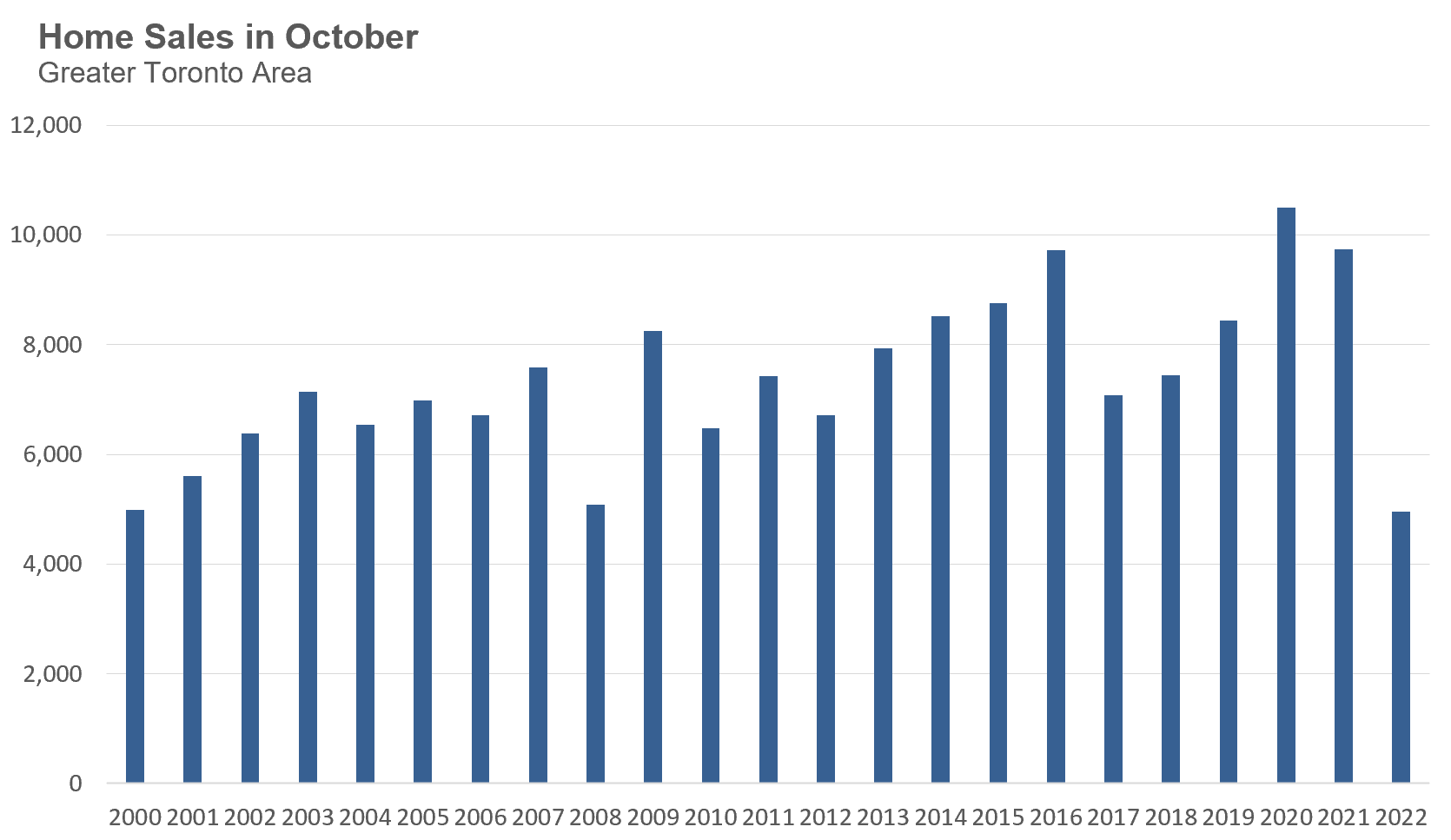

In the chart below that shows the number of homes that sold during the month of October in the GTA since 2000, we can see that sales last month were at their lowest level since 2000.

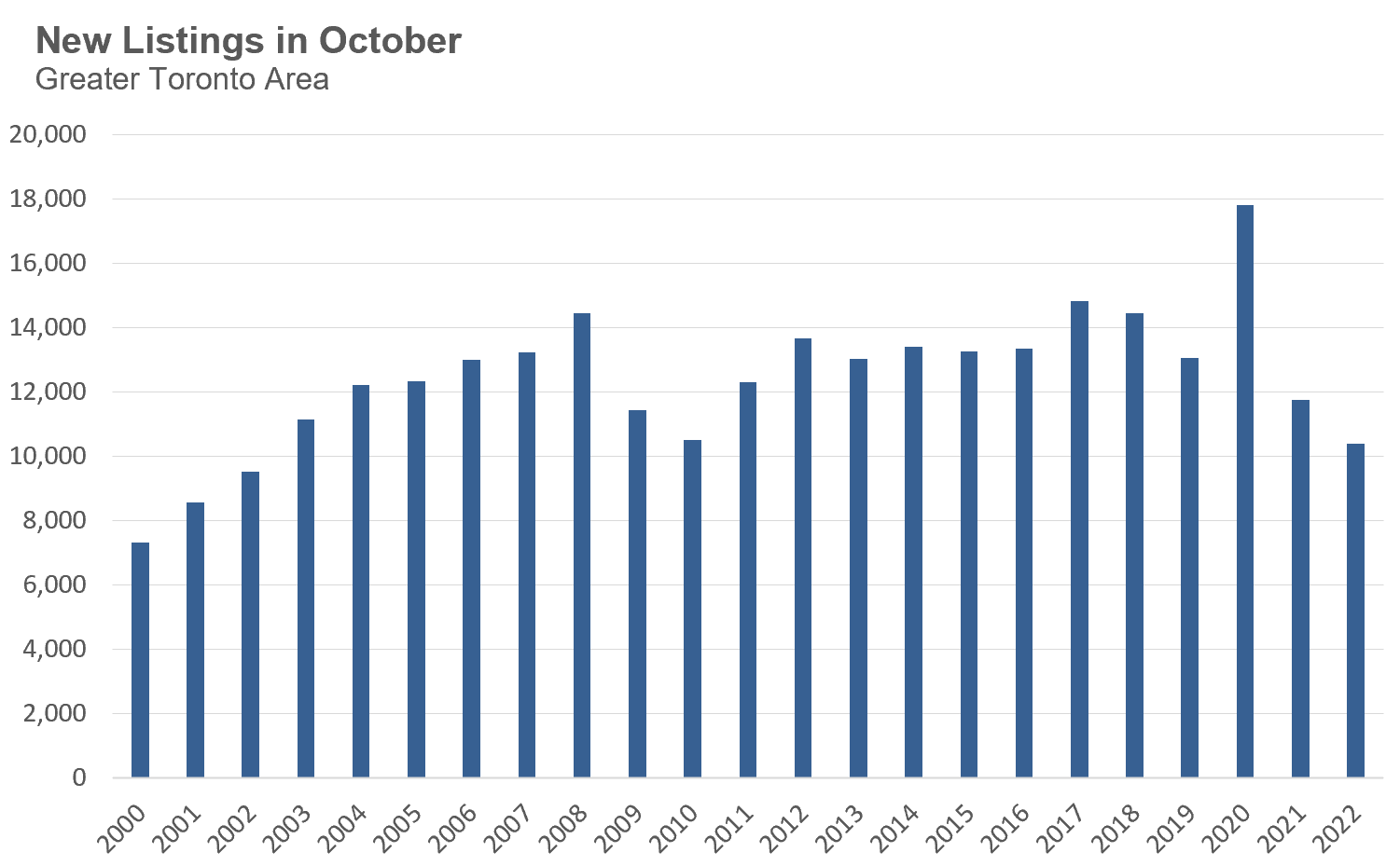

New listings last month were at their lowest level since 2002.

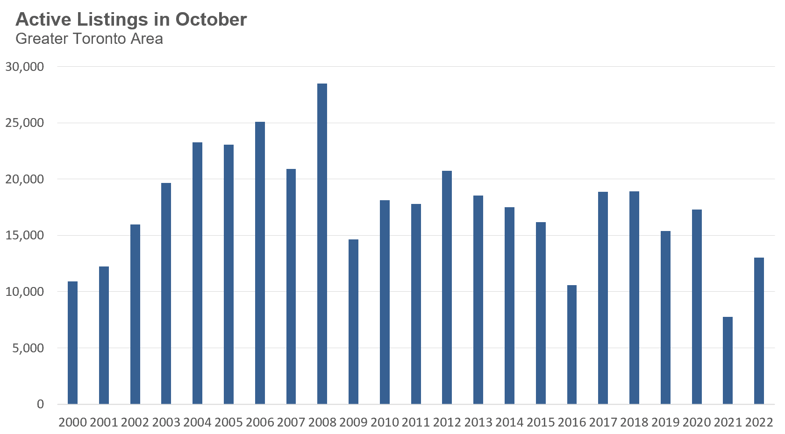

When looking at the active listings on the market, we see that active listings were lower in 2016 and 2021 due to the fact that the housing market was in the midst of a housing bubble in those years in which buyer demand overwhelmed supply. Those two years aside, the last time we had so few homes on the market for sale for the month of October was in 2001.

While higher interest rates have definitely driven much of the decline in demand we have seen since the first quarter of this year, part of the soft sales volume today is also a function of the fact that there are relatively few homes available for sale. Buyers can only buy what is available for sale.

The last time October sales were close to this year’s volumes was during the financial crisis in 2008, but the big difference between then and now is that there were 28,000 homes available for sale at that time compared to just 13,000 today.

This lack of seller activity resulting in a low inventory of homes available for sale has helped to keep home prices relatively flat since July.

In last month’s report, I discussed that the one significant risk facing Toronto’s housing market lies with the pre-construction condominium market, specifically the thousands of investors who are having a hard time getting financing to actually close on the investments they purchased.

Since then, I’ve been seeing more stories about distressed condo investors in the press, and their stories paint a vivid picture of the harsh reality they are faced with.

Consider this story reported by the Toronto Star:

Ujjwal Jain never thought when he bought his pre-construction condo in April 2020 that it would cost him his life savings.

As the date for him to take possession of the condo nears, the bank appraisal, which is done to ensure the current market value of a property is in line with the size of the mortgage loan, determined the unit is worth $150,000 less than what he agreed to pay for it two years ago, before shovels were in the ground.

“How am I supposed to close the transaction? Appraisals are coming in so low, people don’t have $100,000 to $200,000. I have had friends who have had to declare bankruptcy, and I am in the same boat,” Jain said.

The distress facing many investors is not only due to declining condo values as in Jain’s case above. Even in cases where the condominium is worth more than what the investor bought it for, some investors are having a hard time qualifying for a mortgage at today’s high interest rates. And the traditional fallback plan for investors struggling to get a mortgage, private lenders who don't need to stress-test buyers but charge much higher interest rates in exchange, is not as viable an option today as it has been in the past since many private lenders have slowed down financing new mortgages.

The challenges for Toronto’s pre-construction condo market may come to a head in 2023 when, according to condo research firm Urbanation, a record 31,000 condominiums are scheduled to be completed with just under 19,000 of those scheduled for completion in the first half of the year.

If 10% of those purchasers find themselves in a similar situation as Jain described above, potentially needing to declare bankruptcy because they don’t have the financial means to close on the investment they purchased, this could have a ripple effect into the broader resale housing market since the vast majority of these investors are also homeowners.

We will likely find out sooner rather than later what impact, if any, the distress we are hearing about in the pre-construction condo market might have on the resale housing market.

Canada’s federal government knows why home prices have continued to surge out of reach of most Canadians. Here’s Canada’s Prime Minister, Justin Trudeau, commenting on what is driving high home prices earlier this year in April 2022.

“One of the challenges we are facing in Canada is our population, with immigration, and other things has been growing over the past years and housing construction hasn’t kept up which is a real problem. That’s why one of the initiatives we are working on, $4B to municipalities in order to double the construction of new housing over the coming years. This is something that is going to help. Whether it’s enough….we’ll have to see.”

- Justin Trudeau, Prime Minister of Canada

But we already know that the promises to double the construction of housing in Canada is just a political exercise in smoke and mirrors. Pre-construction condo sales plummeted 79% during the third quarter, leading developers to shelve their projects which is leading to a record decline in the value of building permits in October with Ontario seeing the biggest decline.

Knowing that we have a housing crisis and the construction of new housing will be declining in the years ahead, the federal government’s decision to actually increase their immigration target to 500K per year by 2025 was an obvious attempt to further drive the price of houses and rents up in the long term. Housing analyst Ben Rabidoux posted that a federal MP advised him that “high immigration supporting house prices” was a key consideration in the federal government’s increase in their immigration target.

While Trudeau’s increased immigration targets cannot prevent a decline in house prices in the year ahead as the market adjusts to today’s higher interest rates and a likely recession, it is leaving existing homeowners, investors and even home buyers optimistic that any decline in home prices will be short-lived.

While the extent and length of any further downturn in house prices is impossible to predict, the fact is that if Canada’s booming population isn’t putting pressure on home prices, it is going to continue to drive up rents which are already up 20% over last year in Toronto.

This federal government’s decision to ensure the demand for housing exceeds the supply is not only failing Canadian’s but also new immigrants and refugees. On the same day the Liberal’s announced their increased immigration targets, it was reported that Palestinian refugee Aziza Abusirdana stabbed herself while meeting with a federal government official because of our government’s indifference about her ability to find adequate housing.

“I put a knife in my body because no one cares. Seriously no one cares.If you [the government] know that there’s no suitable place for me to stay, why did you accept me to come [to Canada]?”

- Aziza Abusirdana, Palestinian refugee in Canada

Last month, I discussed on Twitter how the sentiment in Toronto’s housing market today is not nearly as pessimistic as it was in the spring, a comment which of course was not well received by housing bears (those that hold negative outlooks on the market’s prospects going forward).

But market sentiment is often misunderstood, with some assuming that low sales volumes alone tells the entire story and others that the sentiment they see reflected in equity and bond markets automatically extends to the residential housing market — which is not necessarily the case.

Shifts in market sentiment are critically important to understand because they are often the key driver behind the big shifts in home prices during booms and busts. But the challenge with tracking changes in market sentiment is that there are no great real time measures of real estate consumer sentiment.

Given this, I’m going to walk through some of the big shifts in buyer sentiment since the start of COVID pandemic period in March 2022 while discussing some of the measures we might look at to measure these changes in sentiment. I’ll then end with looking at some of the latest shifts in sentiment I’m currently seeing in Toronto’s housing market.

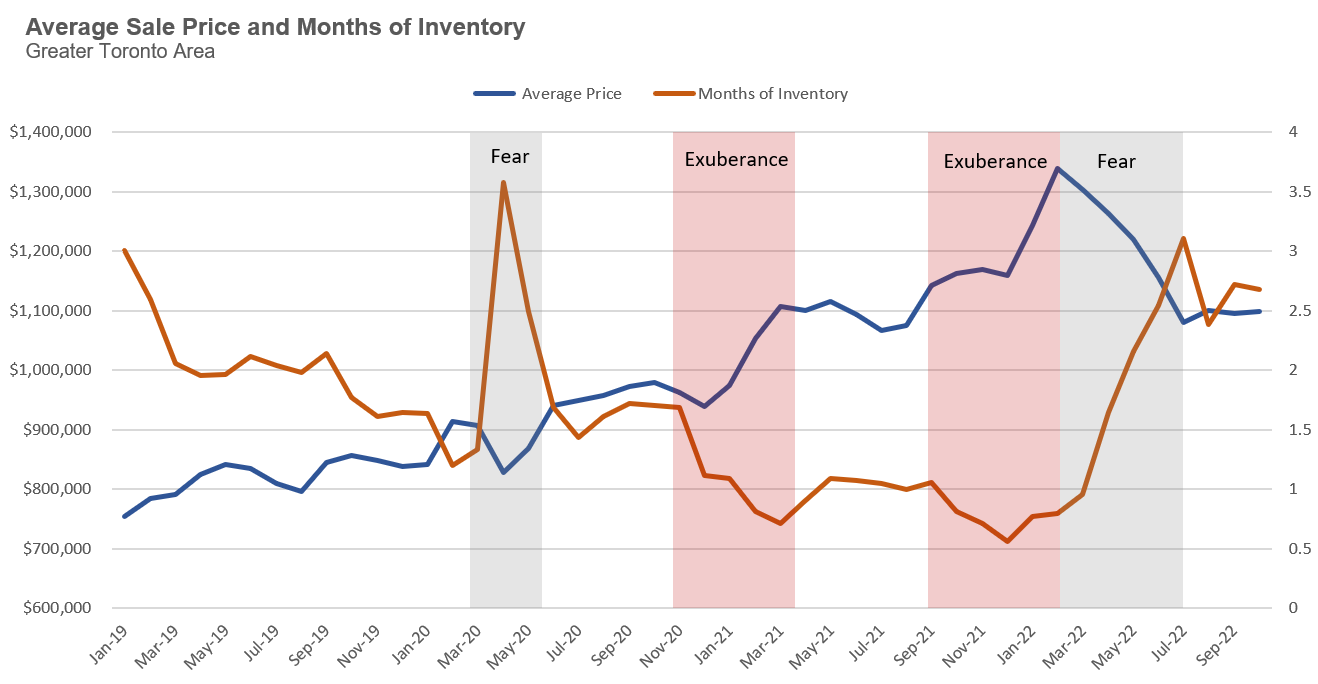

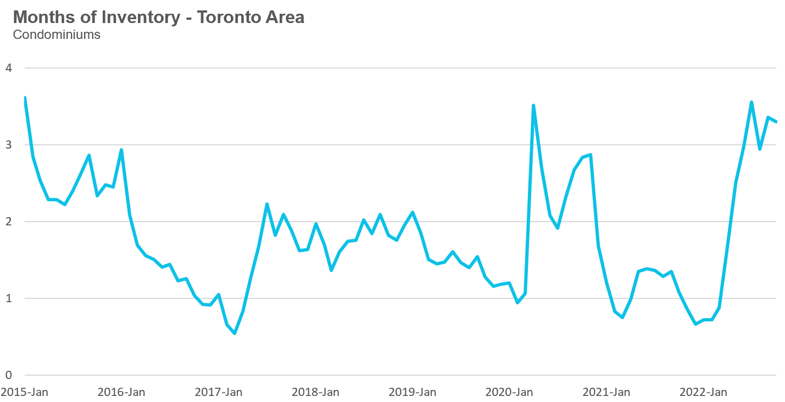

For this overview, I’m going to primarily focus on two metrics — the MOI, or months of inventory, which is the number of active listings in a month divided by the number of sales for the same period, and the average price.

The MOI is an important metric because it captures both demand (via the number of sales) and supply (via active listings) in one metric which gives us insight into how competitive the market is at any given moment. But what’s often more important than the actual level of the months of inventory at any given moment is the rate at which it is changing over time.

As the months of inventory declines, the market becomes more competitive as inventory tightens, putting upward pressure on prices. When MOI increases, it reduces price growth and may even lead to a decline. When the MOI remains relatively unchanged from one month to the next, this is usually a sign of some balance in the housing market. But balance doesn’t necessarily mean flat or rising prices, it just indicates the consistent speed or ‘cruise control’ — whether the market isn’t heating up or cooling down.

Toronto’s housing market was relatively calm and balanced in 2018 for two reasons. Firstly, Toronto’s housing market experienced a dramatic housing bubble in the suburbs that saw home prices surging by over 30% per year during the first quarter of 2017 only to see home prices fall sharply in the second half of 2017. While Torontonians were adjusting to this rapid decline in prices, Canada’s banking regulator, the Office of the Superintendent of Financial Institutions (OSFI), introduced a mortgage “stress test” on all uninsured mortgages that took effect on January 1, 2018. The stress test, which requires borrowers to quality at a rate that is at least 2% higher than what they would actually pay on their mortgage, made it harder for home buyers to qualify for a mortgage, which pushed some home buyers to the sidelines.

By 2019, the worries and distress of the 2017 Toronto suburban housing crash were a distant memory and home buyers and investors had adjusted to the mortgage stress test, the housing market started to heat up again. We can see the housing market heating up by the rapid decline in the MOI in 2019, which fell from 3 at the beginning of the year to 1.5 by the end of the year.

This entire year was a build up to what likely would have been a very exuberant housing market in early 2020 had there not been a global pandemic. By February 2020, home prices were up 17% over the previous year and all signs at the time were that things were going to get more competitive.

In March 2020, the first COVID lockdowns happened and a market that was on the verge of exuberance suddenly tipped over to fear. As buyers stayed home and hit pause on their home buying search, inventory levels surged; prices began to fall because some sellers needed to sell (due to the purchase of another home or other life changes), and as there were very few buyers in the market, these sellers felt pressured to take whatever offer they got.

By the spring of 2020, buyers started to jump back into the market, though buyers of low-rise homes were still very cautious — Ontario was still largely under a lockdown and there was still a lot of economic uncertainty.

The sentiment in the condo market was far more pessimistic. Renters were leaving the city as pandemic restrictions shut down work places, vacancy rates were on the rise, and rent prices were falling as some existing tenants were negotiating rent reductions and others were refusing to pay rent due to unemployment (aided by the province introducing an eviction ban on tenants during the lockdown period).

This led to a significant surge in the number of condominiums listed for sale by the summer of 2020 as many investors were looking to cash out of their investments.

But as we moved towards the fall, the market sentiment slowly started to shift and by November the market had turned on a dime from pessimistic to optimistic and eventually exuberant. We saw this on the ground as more buyers wanted to re-enter the market after hitting pause and new buyers jumped in eager to capitalize on ultra low interest rates.

With condo prices falling in the summer and early fall months of 2020, investors saw this as a buying opportunity and suddenly rushed back into the market during the last two months of 2020.

We can see this rapid shift in sentiment in the chart above by looking at the dramatic decline in the MOI from November 2020 to March 2021 and the corresponding surge in home prices which went from $961,738 in November 2020 to $1,107,537 in March 2021, a 15% increase in just four months. Note that the slight dip in average prices in December 2020 was due to a much higher share of condos selling that month which pulled the average down since condominiums have a lower average price when compared to low-rise homes.

When we think about the demand for homes in any given month, analysts often measure that by looking at the number of homes that sold. Sales may be an accurate measure of demand in markets where homes sit on the market for a long period of time and rarely sell with multiple buyers competing for the same home. But in Toronto where homes sell quickly and often with more than one buyer making an offer, the number of buyers making offers but not getting the home is an additional measure of demand for homes that is difficult to measure, which is why I often refer to it as the shadow demand for homes.

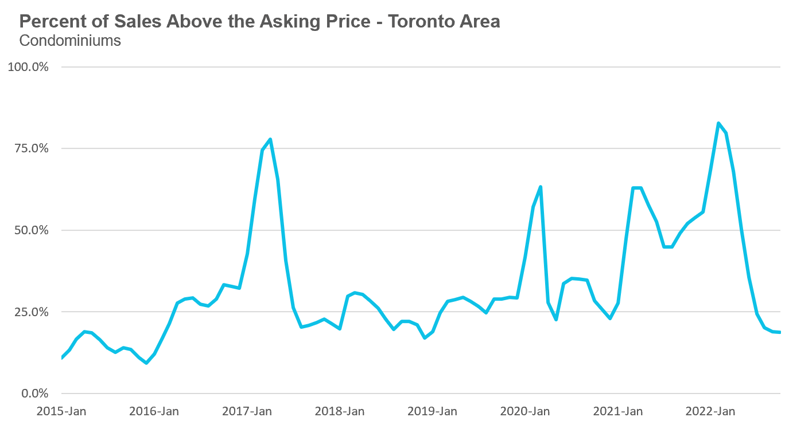

During that period of exuberance, the end of 2020 and the first quarter of 2021, homes were receiving significantly more offers on their offer nights than they were just months earlier. This number of people competing for homes is not only an indicator of the true demand in the market, but it also has the effect of influencing home buyer behaviour.

Home buyers begin to panic and feel more anxious when every time they make an offer on a home they find themselves competing with 20 other buyers. This panic and anxiety often leads them to offer a little bit more on the next home they are bidding on just so they can finally win on offer night. We don’t see this type of panic and anxiety when homes are receiving two or three offers on their offer night, with buyers feeling that it’s likely just a matter of time before a seller accepts their offer. This is why the high level of shadow demand, thousands of buyers making offers and losing on any given night, helped fuel the rapid surge in prices in that short period of time.

And then, all of a sudden, during the 2nd and 3rd quarters of 2021 the market calmed down.

Even though we saw just a modest increase in inventory, there were suddenly far fewer buyers in the market. Fewer homes were receiving multiple offers while some homes were sitting on the market for weeks. We had clients making offers on homes with conditions on financing and home inspection during this period, something that wouldn’t have been possible during the frenzy we saw during the first quarter of 2021.

The sentiment from buyers had turned from FOMO (fear of missing out) to patience and a bit of greed since they saw some homes selling for a bit less than they would have expected. We can also see this in the fact that prices saw very little movement on a month over month basis during that period.

Why the sudden shift in sentiment? It’s difficult to say, but in the case of the condo market, a lot of the deals investors were likely getting because of high levels of inventory had disappeared and the overall rapid increase in prices may also have pushed some buyers to the sidelines.

And then just as suddenly, the sentiment in the market shifted again as we moved towards the fourth quarter of 2021. Buyers started to rush back into the market, and the MOI declined from an already low of 1MOI to just a half a month of inventory. During the fourth quarter the momentum and the exuberance in the market were building and by the first quarter of 2022 average prices had accelerated by 15%, or over $150,000, in just two months eventually peaking at $1,338,611 in February 2022.

It was not uncommon during the first two months of 2022 to see homes that had 40 to 60 buyers all making an offer on the same home and the eventual sale price being 5 to 10% more than what comparable sales at that time could justify. This was irrational exuberance and the fear of missing out (FOMO) was in the air.

And then of course the sentiment in the market turned yet again, from FOMO to fear (for remaining sellers) and greed (for remaining buyers). The combination of high home prices, buyer fatigue and news of rate hikes in the future pushed many buyers to the sidelines.

Sellers who had already bought a home were getting fewer showings and offers than they had expected, and in some cases, no offers on their scheduled offer night. Caught between two transactions (because they had already bought a home), many of these sellers agreed to sell for tens of thousands less than what a similar home sold for just a week earlier. By July, the average price for a home in the Greater Toronto Area had declined from $1,338,611 in February to $1,079,432 in July, down by just over $250,000 or 19% in just five months.

Since July, inventory levels have declined and prices have plateaued which has once again led to a shift in market sentiment. Sellers are far more patient today and not as fearful because most of those remaining in the market have not already committed to buying another home and are not under pressure to sell their current home as soon as possible.

In my September report, I showed that an increasing number of sellers are simply taking their homes off the market if they can’t achieve the price they want and, in some cases, renting their property out instead. Many are optimistic that Canada’s increasing immigration targets coupled with a decline in new home sales will eventually lead to upward pressure on home prices again.

Buyer sentiment has also shifted considerably since the spring market. The buyers I hear from still recognize that there is a high likelihood that prices will fall further in 2022, but, like many sellers, they see this as a short-term cyclical trend rather than a long-term decline. Many of them just need a home to buy and are finding it increasingly difficult with so few homes currently available for sale.

But hopefully one takeaway from this section is that the sentiment among buyers and sellers in the housing market is very fickle and can turn on a dime at any moment.

And if we think about how the market sentiment might change in 2023, I think the odds are that things will turn a bit more pessimistic as households adjust to today’s higher interest rates and possibly layoffs as businesses adjust to our slowing economy. If we do in fact see a ‘white-collar recession’ some households with a heavy debt load may have to deal with a shock in their surging debt payments and a loss in income — and the mood may shift once again.

Houses - Condos - Regional Trends

House Statistics

House sales (low-rise detached, semi-detached, townhouse, etc.) in the Greater Toronto Area (GTA) in October 2022 were down 47% over the same month last year and represents a 20-year low for the month of October. Home sales were also down over the previous month, a period when sales are usually up month over month.

New house listings in October were down 10% over last year, and represent a 20-year low for the month of October.

The number of houses available for sale (“active listings”) was up 91% when compared to the same month last year, but still well below pre-COVID levels for the month of October. It’s worth noting that the low inventory levels in the second half of 2021 were due to a surge in demand as the market accelerated towards the peak in February 2022.

The Months of Inventory ratio (MOI) looks at the number of homes available for sale in a given month divided by the number of homes that sold in that month. It answers the following question: If no more homes came on the market for sale, how long would it take for all the existing homes on the market to sell given the current level of demand?

The higher the MOI, the cooler the market is. A balanced market (a market where prices are neither rising nor falling) is one where MOI is between four to six months. The lower the MOI, the more rapidly we would expect prices to rise.

While the current level of MOI gives us clues into how competitive the market is on-the-ground today, the direction it is moving in also gives us some clues into where the market may be heading.

The MOI for houses remained unchanged at 2.3 MOI in October.

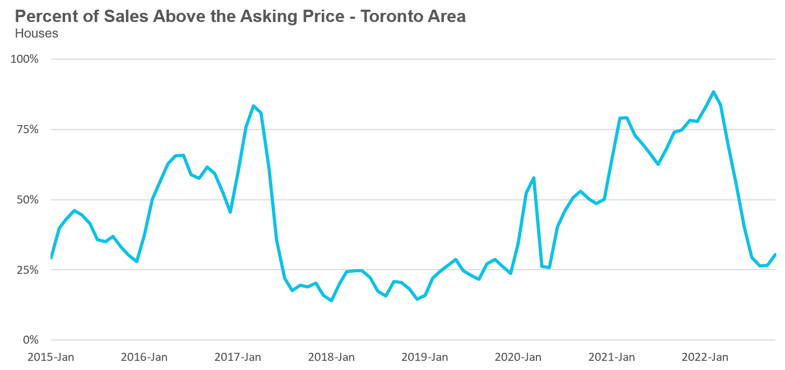

The share of houses selling for more than the owner’s asking price increased slightly to 30% in October.

The average price for a house in October was $1,309,055 in October 2022, well below the peak of $1,679,429 reached in February and down 9% when compared to the same month last year.

The median house price in October was $1,130,000, down11% over last year, and below the peak of $1,485,000 reached in February.

The median is calculated by ordering all the sale prices in a given month and then selecting the price that is in the midpoint of that list such that half of all home sales were above that price and half are below that price. Economists often prefer the median price over the average because it is less sensitive to big increases in the sale of high-end or low-end homes in a given month which can skew the average price.

Condo Statistics

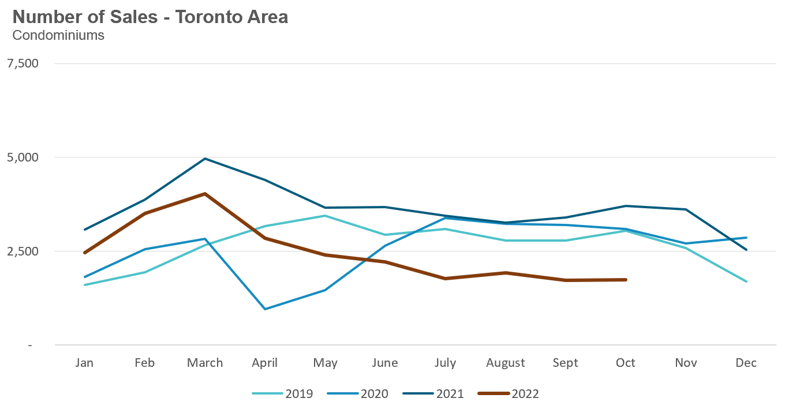

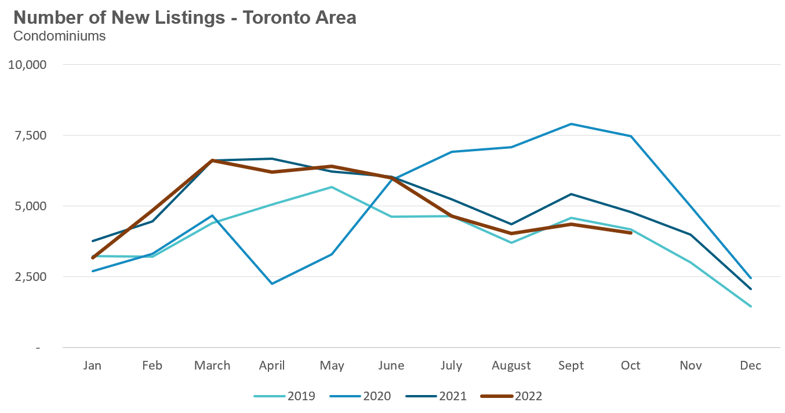

Condo (condominiums, including condo apartments, condo townhouses, etc.) sales in the Toronto area in October 2022 were down 53% over last year and well below pre-COVID sales volumes for the month of October.

New condo listings were down 16% in October over last year and in line with historical listing volumes for the month of October.

The number of condos available for sale at the end of the month, or active listings, was up 44% over last year.

Condo inventory levels remained unchanged at 3.3 MOI in October.

The share of condos selling for over the asking price was unchanged at 19% in October.

The average price for a condo in October was $739,099, down from the peak of $840,444 in March, but up 1% over last year. The median price for a condo in October was $667,750, up 1% over last year, but down from $777,000, the March peak.

Regional Trends

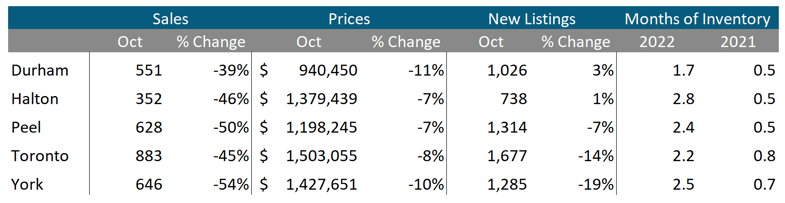

Houses

Average prices were down over last year across all five regions with York and Durham Regions seeing the biggest decline in prices. Sales were down significantly across all regions and inventory levels were well ahead of last year’s level.

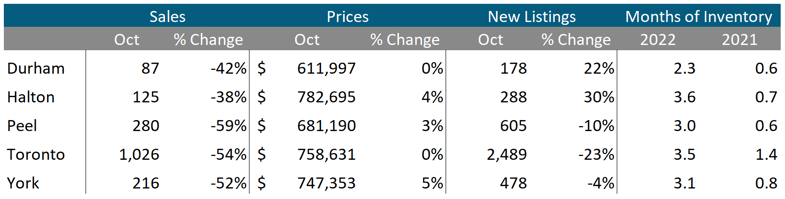

Condos

Average condo prices continue to be flat or up over last year in all five regions. Sales were down significantly across all regions and inventory levels were well ahead of last year’s level.

See Market Performance by Neighbourhood Map, All Toronto and the GTA

Greater Toronto Area Market Trends

GET MORE DATA

This monthly Move Smartly Toronto Area Real Estate Market Report is powered by Realosophy Realty. Get the same up-to-date Toronto area market data on realosophy.com and additional information on every home for sale, including building permit history, environmental alerts and more when you buy a home with Realosophy Realty.