Author John Pasalis is the President of Realosophy Realty, a Toronto real estate brokerage which uses data analysis to advise residential real estate buyers, sellers and investors. He is a top contributor at Move Smartly, a frequent commentator in the media and researcher cited by the Bank of Canada and others.

Toronto Home Prices Level Off Due to Low Inventory

FREE PUBLIC WEBINAR: WATCH REPORT HIGHLIGHTS & Q/A - THURS SEPT 15th 12PM ET

Join John Pasalis, report author, market analyst and President of Realosophy Realty, in a free monthly webinar as he discusses key highlights from this report, with added timely observations about new emerging issues, and answers your questions. A must see for well-informed Toronto area real estate consumers.

The Market Now

Looking at the most recent statistics for the Toronto area market for August 2022, we are starting to see signs that prices may plateau for now (after falling over the previous months) as inventory levels remain low.

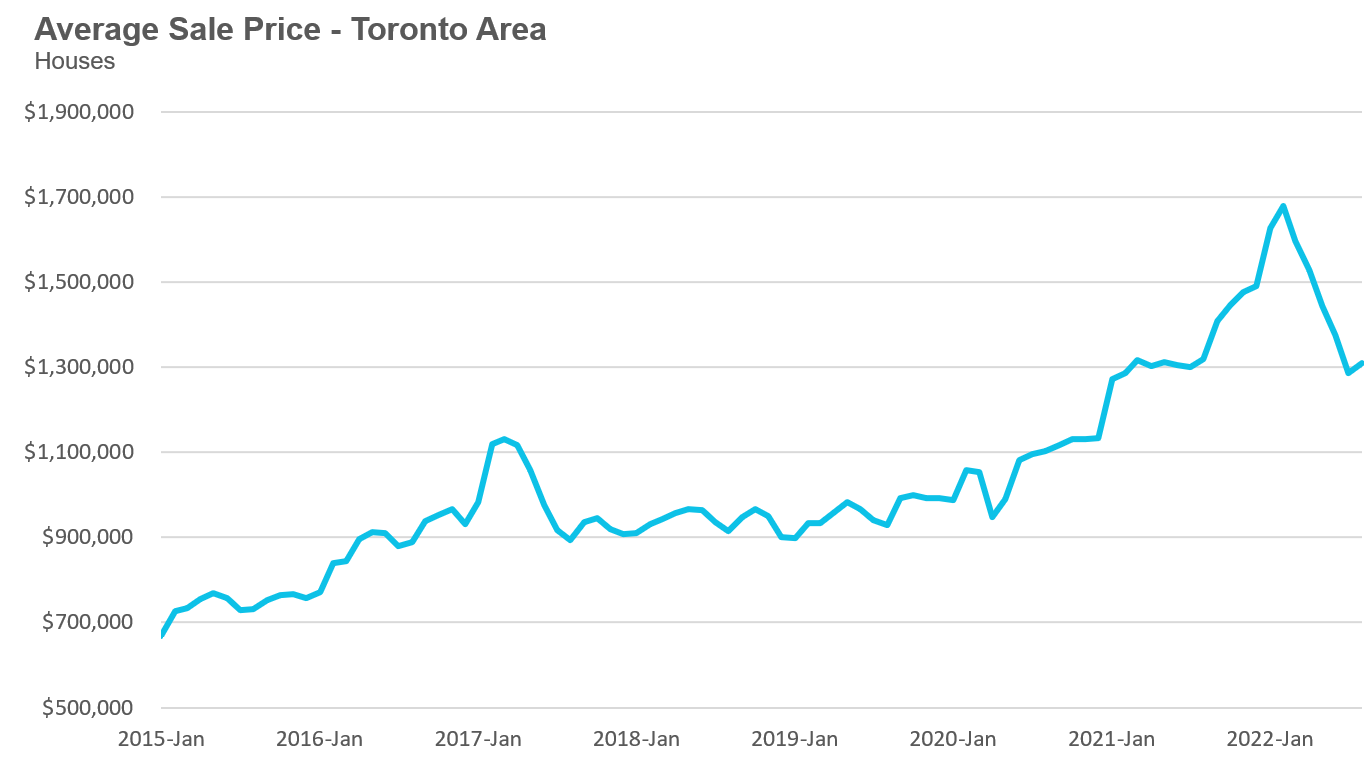

The average price for a house was $1,310,025 in August, down 22% from the most recent peak of $1,679,429 in February, and down 1% over last year. The median house price in August was $1,105,000, down from $1,485,000 in February, and down 5% over last year.

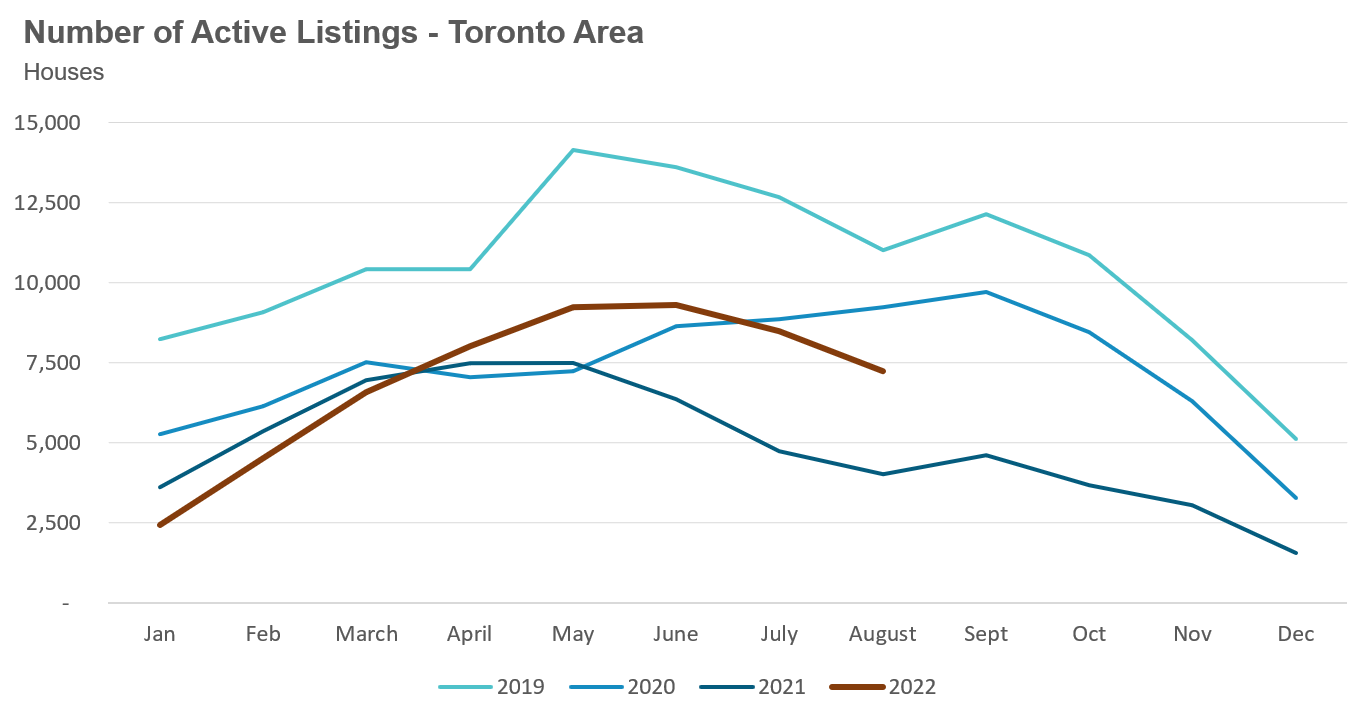

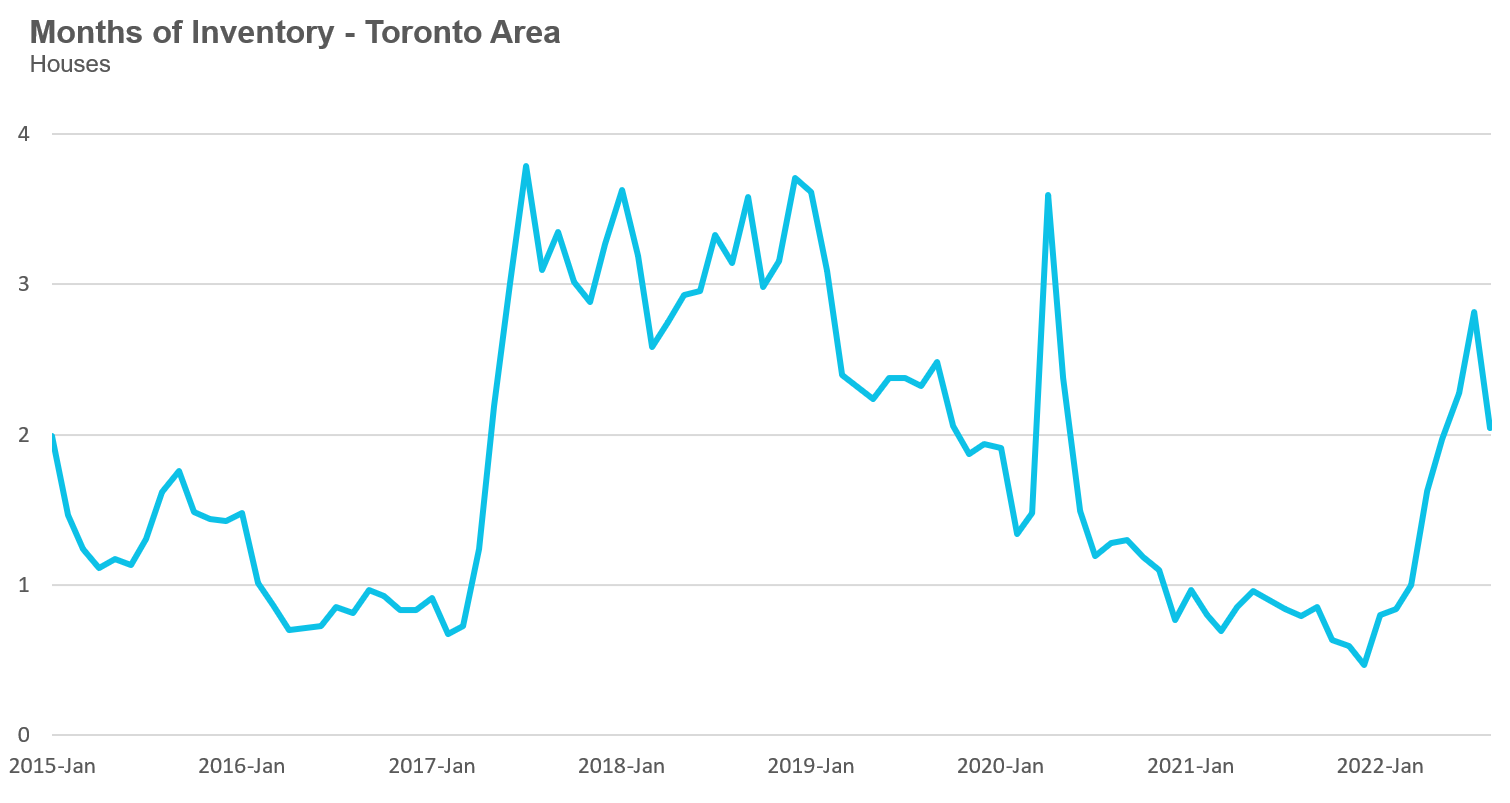

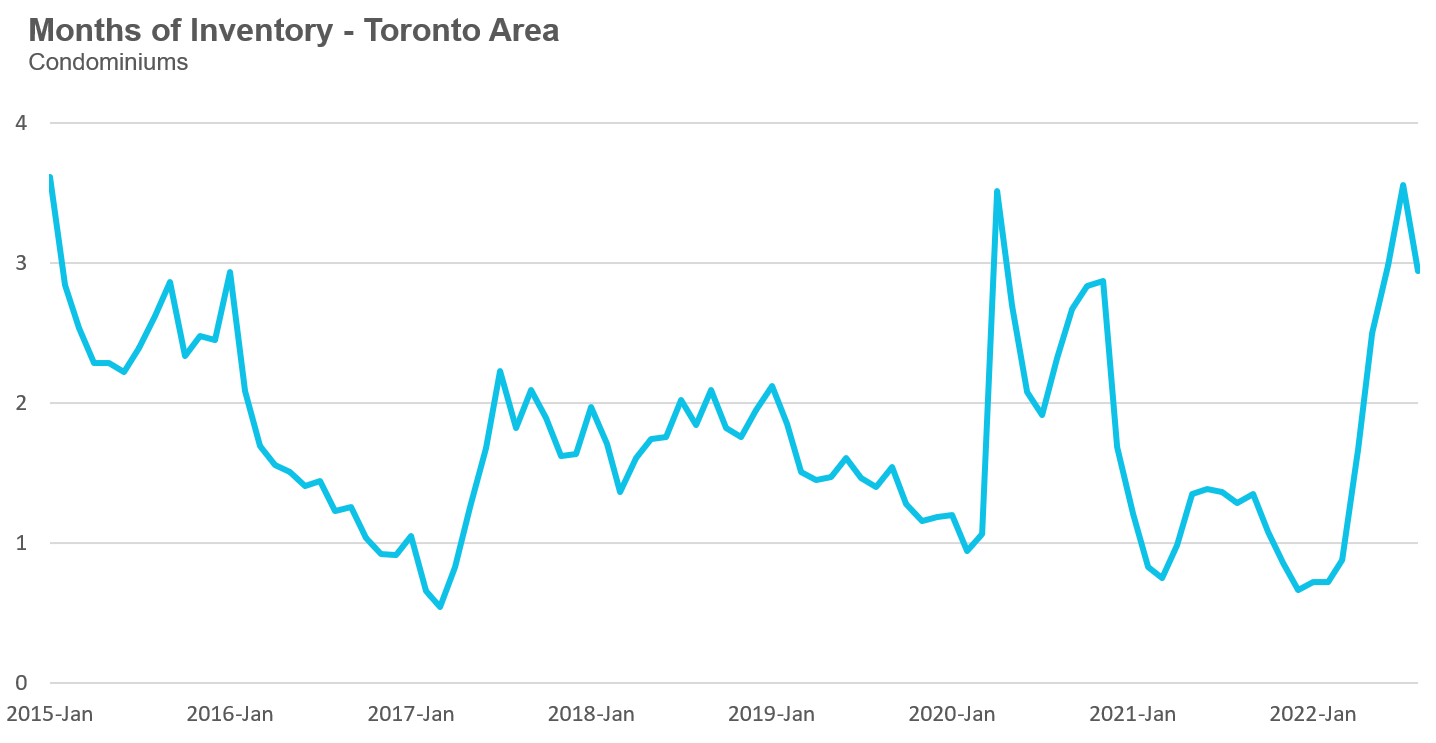

House sales in August were down 30% over last year, but up 17% compared to July. New house listings were up 2% compared to last year. The number of houses available for sale at the end of the month, or active listings, was up 80% over last year, when demand was notably high; the active listings number today is under 2019 and 2020 levels. The Months of Inventory (MOI) which is a measure of inventory relative to the number of sales each month declined from 2.8 MOI in July to 2 MOI in August, indicating tightening supply conditions.

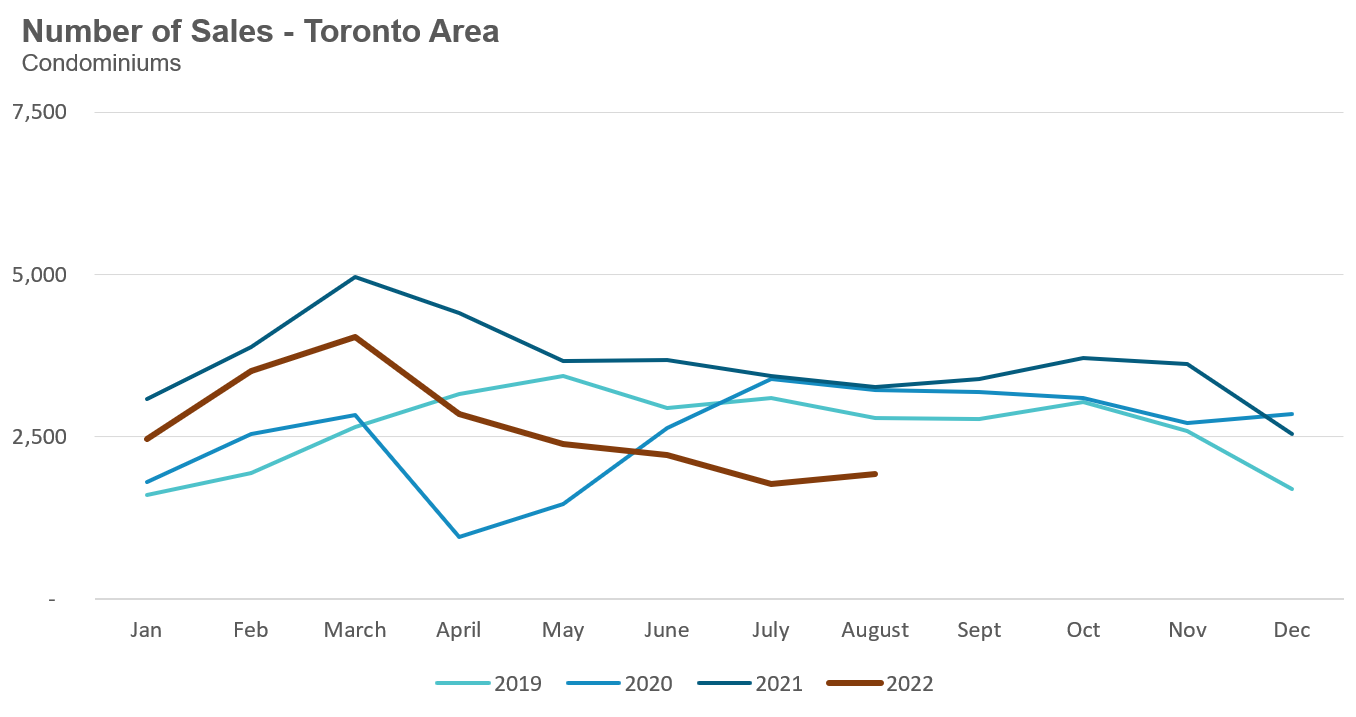

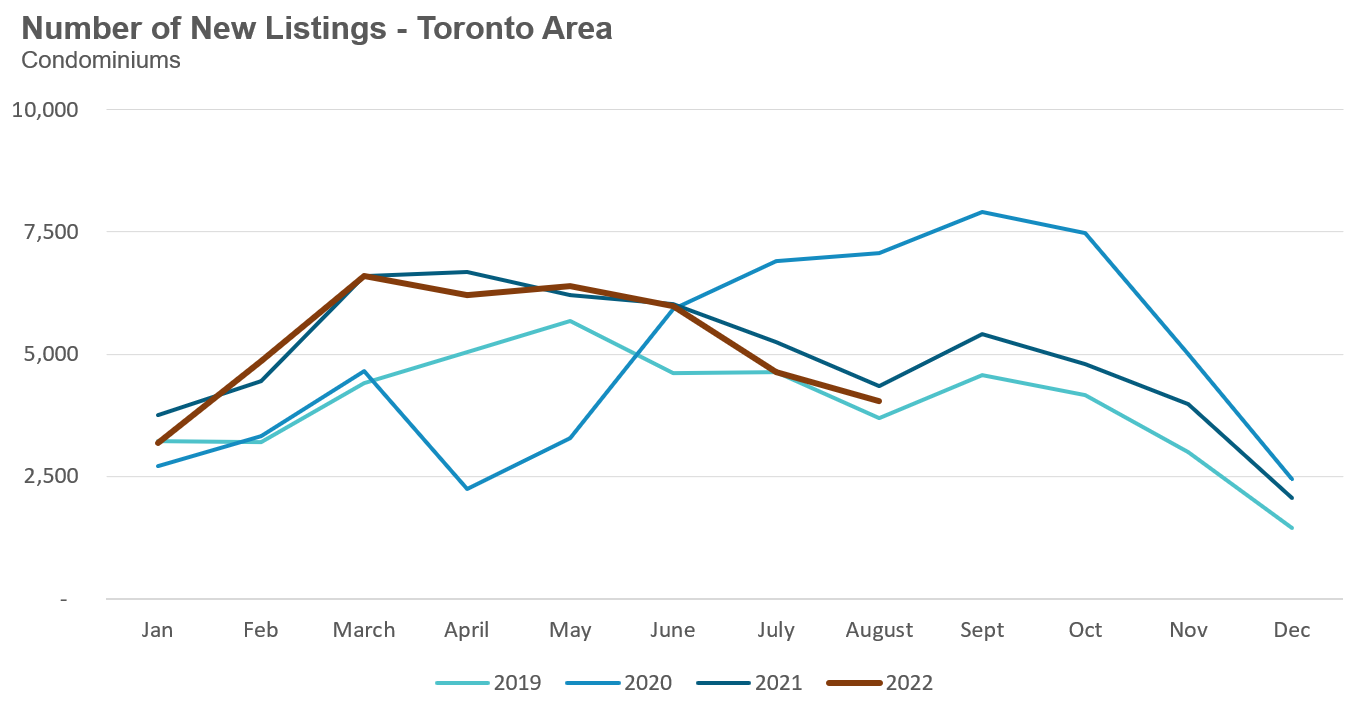

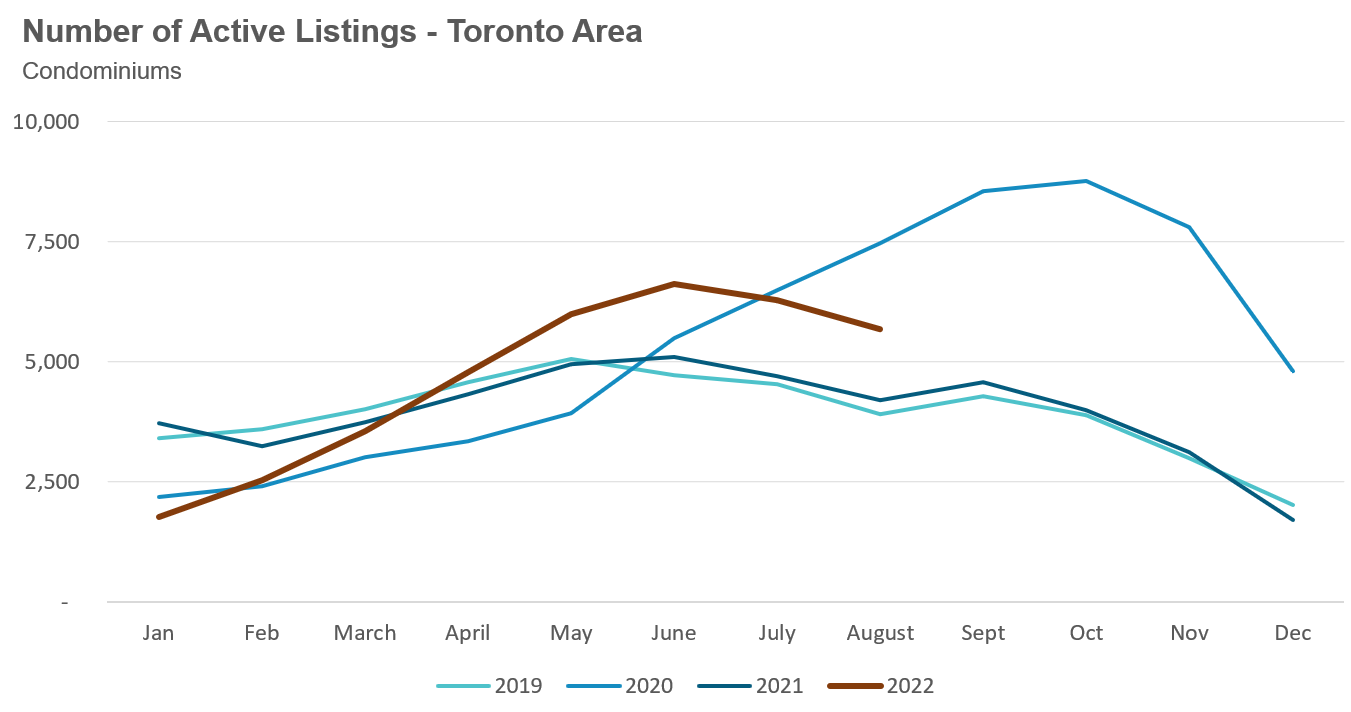

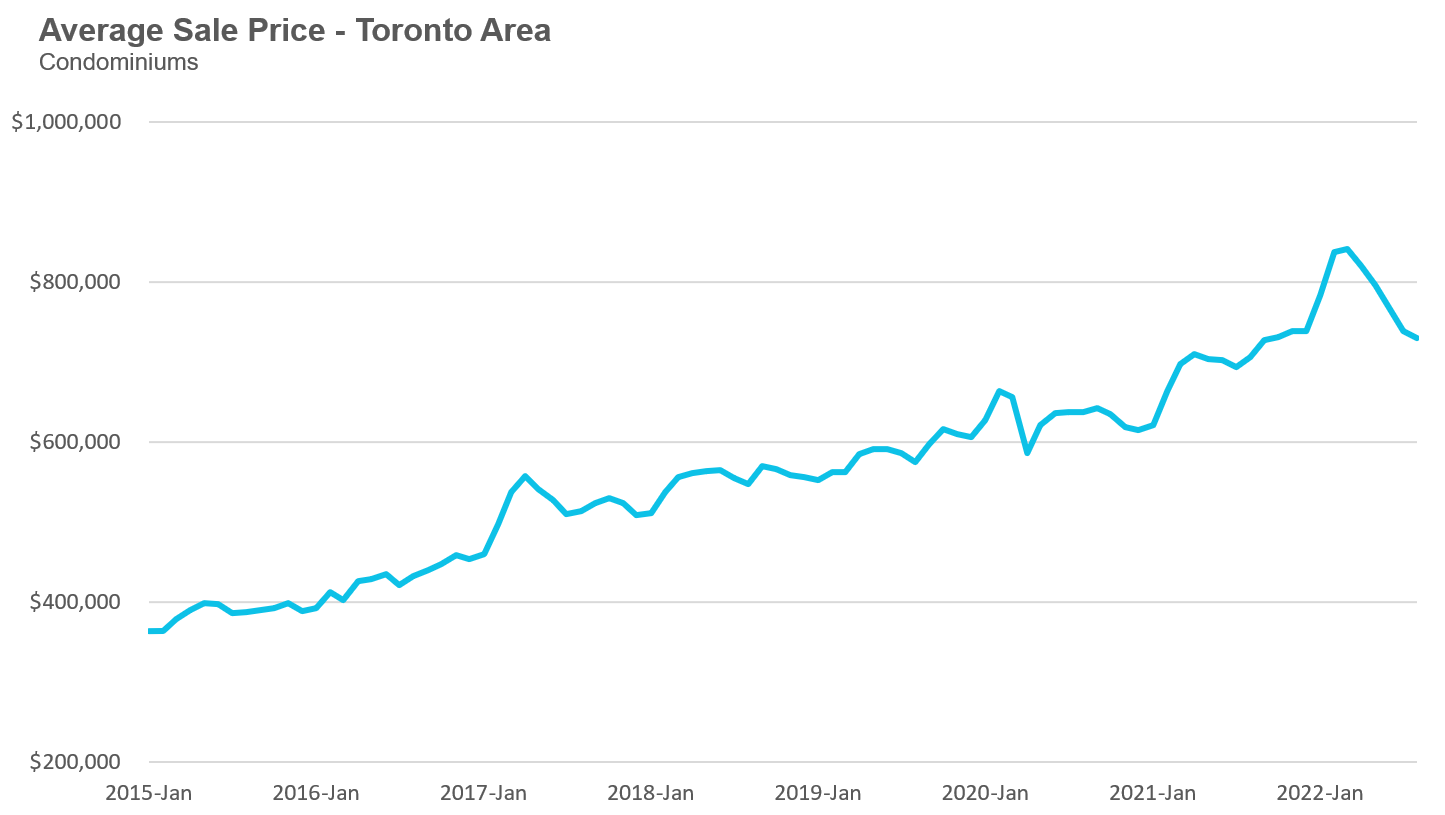

The average price for a condo fell to $730,188 in August, down from the most recent peak of $840,444 in March, but still up 3% over last year. The median price for a condo in August was $670,000, down from $777,000 in March, but again up 5% over last year.

Condo sales in August were down 41% over last year and below pre-COVID sales volumes for the month in 2019. New condo listings were down 7% over last year while the number of active condo listings was up 35% over last year. The MOI fell from 3.6 in July to 3 MOI in August.

For detailed monthly statistics for the Toronto Area, including house, condo and regional breakdowns, see the final section of this report.

We’ve been seeing some interesting trends on the ground over the past month in the Toronto area that line up with what we are seeing in the August sales statistics.

Firstly, buyers are deciding to jump back into the market this fall. Home buyers will often hit pause on their home buying plans during the summer months and start looking again in September, but given today’s higher interest rates and cooling prices I wasn’t certain what this fall market would look like. We have been seeing a lot more activity and interest from buyers and many actually started their home search a bit early in late August rather than September. This helped push August sales above July levels, a period when sales typically fall on a month over month basis.

The other trend we are seeing is a lot more patience from sellers. The days of panicked sellers who were desperate to sell because they already bought a home as the market started to slow down earlier this year are behind us. Many of today’s sellers are deciding to list their home for sale before they buy their next home which is allowing them to be a bit more patient. In some cases, sellers are deciding to take their homes off the market if they are not getting the price they want (see Data Dive section in this report for more on this).

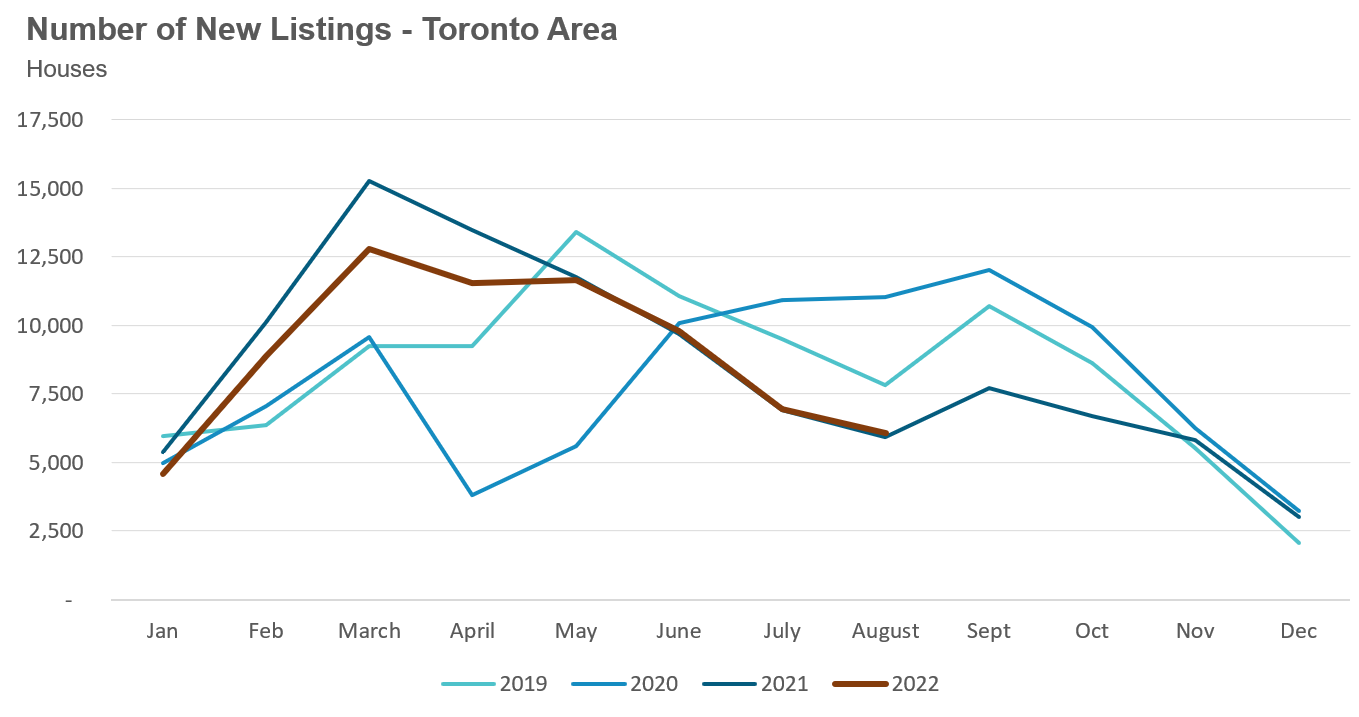

While high interest rates will definitely continue to dampen buyer activity, how this impacts prices depends a lot on the volume of new listings. If new listings surge, we may see further downward pressure on prices. But at this point, I don’t think we’re going to see a significant increase in new listings and inventory this fall.

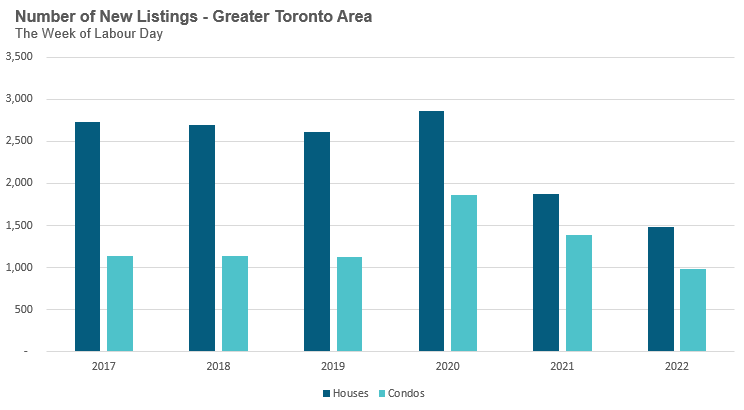

As we see in the chart above, if the lower number of new listings coming onto the market in the first week after Labour Day is an indicator of how eager low-rise home sellers are, we may find the market relatively tightly supplied in the months ahead which could constrain sales volumes.

Condo listings for the first week after Labour Day appear more inline with historical trends.

Rising Rents Are Keeping Investors Optimistic - For Now

Housing markets that have a high share of real estate investors are often more vulnerable to a sharp decline in prices when the market slows down as it recently has in the Toronto area because investors tend to be more willing to sell and exit the market than end-users or owner-occupiers (i.e., those who live in their homes) are. Investors are typically the first ones to exit when the housing market begins to cool because unlike owner-occupiers, they are less attached to their properties and approach selling as a business decision rather than a personal decision to uproot oneself and one’s family.

We saw this occur in the real estate bubble years preceding the 2008 US financial crisis when the states that had the highest share of investors buying homes saw the biggest decline in house prices.

More recently, we saw this dynamic unfold in Toronto’s condo market, which has a high share of units owned by investors. During the first year of the COVID-19 pandemic, falling prices and rents resulted in a surge in condo listings and in my April 2021 report, I showed that an increase in the share of investors selling was a large part of the story.

But if that’s the case, why aren’t investors rushing to sell now as the market cools?

This time around, a very strong rental market with rapidly rising rents has helped keep investors optimistic about their investments. In 2020, when investors rushed to sell, prices and rents were trending down which made many investors very pessimistic. Today, only prices are trending down and condo prices are actually holding up better than low-rise prices. Condo rents, on the other hand, are up 20% in Toronto hitting a record average of $2,806 in August according to research firm Urbanation, making investors optimistic about the future path of home prices and rents.

Now, we are likely only past the first phase of potential investor action — in the early stages of a downturn, investors exit when they believe prices will be lower in the future and want to avoid future declines.

In the later stages of a housing cycle, some investors exit the market due to financial distress.

The more leveraged an investor is, the more sensitive and vulnerable they are during periods of rapidly rising interest rates. If investors are unable to afford their higher debt payments once their mortgage comes up for renewal, they may decide to unload one or more of their properties to reduce their debt load. We have yet to see investors exiting in any significant numbers because most have not felt the impact of today’s higher rates on their debt payments yet but this may gradually change.

In the case of investors who bought pre-construction houses and condos with down payments, there’s a chance that some of them won’t be able to qualify for a mortgage at current rates to actually take possession of the property. We are seeing early signs of distress among these investors who are eager to ‘assign’ or ‘flip’ the contracts for these properties (i.e., sell to another buyer) before they have to close and take possession of the property. Many are willing to take a financial loss on the transaction to avoid defaulting on their purchase, but the appetite from buyers for assignment sales is very low at present.

I’ll expand on these dynamics in the pre-construction market in a future report.

Sudden Momentum Changes Have a Big Impact

The median price for a home in the Toronto area in August was $930,000, a 23% decline from the peak of $1,205,000 in February.

The common explanation for this rapid decline in home prices is that the rapid increase in interest rates dampened buyer demand; while rising interest rates have contributed to slower demand, it is also possible that the market was naturally slowing down after a huge surge in demand during the pandemic.

But regardless of what causes it, falling demand doesn’t always result in immediate decline in prices. As economist Karl Case explains, when housing markets cool, demand typically falls, inventory rises and prices actually ‘stick’ or plateau for a while before actually falling, as described here:

“Another important aspect of housing market efficiency is that prices tend to be sticky downward. In most markets, when excess supply develops, prices fall quickly to clear the market. But housing downturns have been characterized by sticky prices. Sales and starts drop but prices are slow to respond.”

- Karl Case

Why are home prices typically sticky on the way down?

Case offers a couple of explanations:

“Prices might be slow to respond to imbalances for various reasons. Since housing is heterogeneous, comparable sales do not represent identical units,so sellers are uncertain of the actual worth of their property….. Also, sellers tend to view the worth of their property as embodied in comparable sales at the peak. The dramatic rise in inventory of unsold homes at the beginning of every downturn is strong evidence of this stickiness”

- Karl Case

In short, in a typical housing downturn a decline in demand is followed by a dramatic rise in inventory as owners are slow to adjust their prices. As the inventory of unsold homes continues to build, this eventually leads to a decline in home prices.

But if prices are sticky on the way down, why did median home prices in the Toronto area fall 23% in just six months this year? Furthermore, if this decline was entirely about interest rates, why didn’t home prices everywhere else in Canada fall just as rapidly?

High interest rates, and the expectation that interest rates would keep rising this year, did cool the demand for homes dramatically. Many home buyers hit pause on their home search towards the end of the first quarter of this year which is why home sales since May have been at a 20-year low.

But why didn’t these sellers remain patient and stick to their price, resulting in the steep inventory increase and sticky prices we’d expect to see during the beginning of any housing downturn?

The answer lies in the sudden nature of the housing market downturn with prices and sales hitting a record peak in Feb after which prices started to tumble down. Typical of a buoyant market, sellers had already committed to buying a home weeks earlier and needed to sell their current home to afford the home they had just bought. When they saw that their properties were getting very few viewing from buyers, sellers were very quick to adjust their price expectations down to ensure their current home sold so as not to default on their other home purchase.

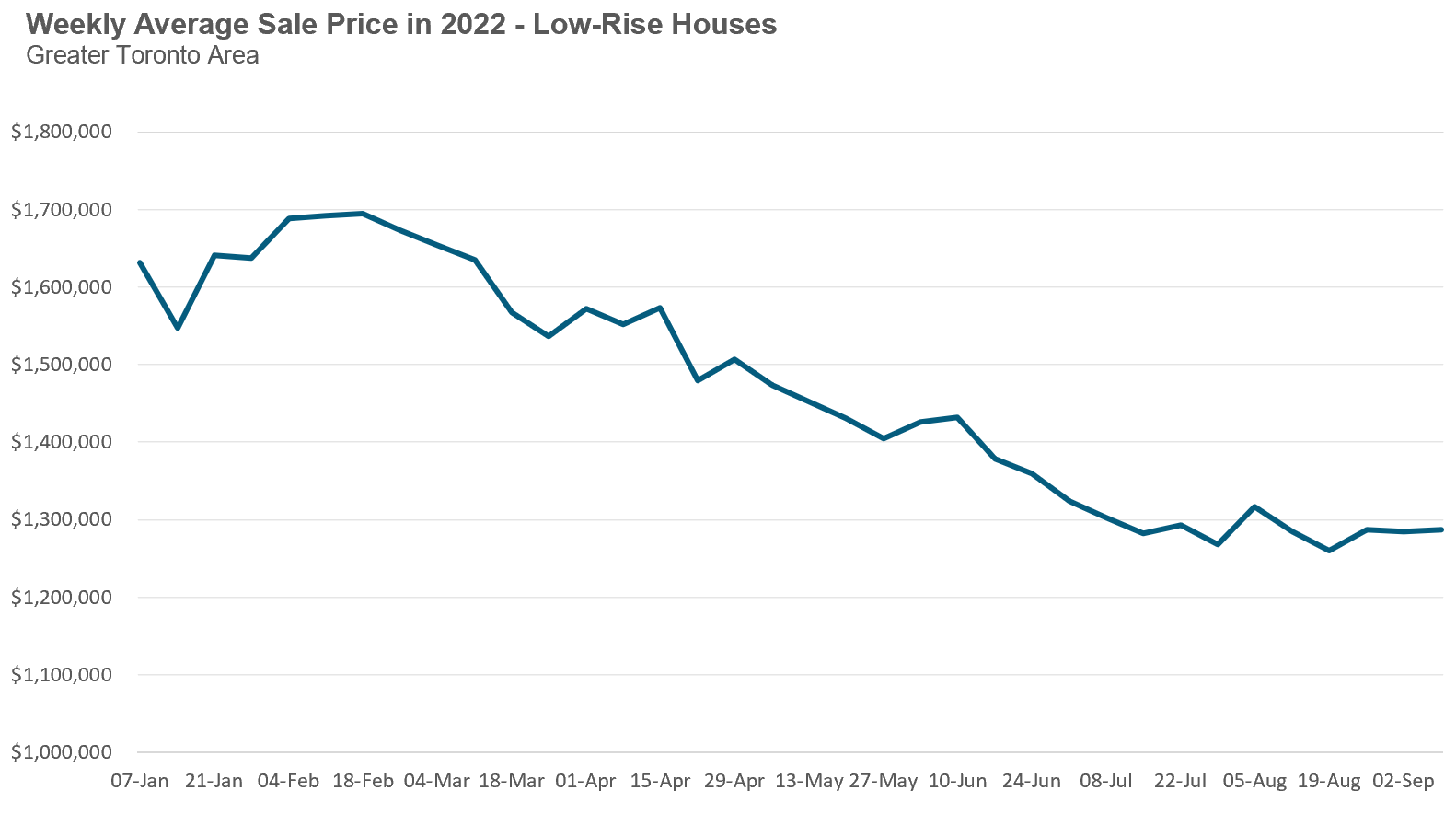

This led to the rapid decline in prices, in particular for low-rise homes. We can see from the chart below that average prices have been trending down virtually every week since late February, but appear to have plateaued over the past two months.

Prices have started to plateau because there are very few sellers left who urgently need to sell their current home. Once a market starts to cool down, most consumers switch to selling their home before buying a new one so they are not as pressured. Without this urgency, sellers appear to be behaving the way Case describes above in being very slow to adjust their price expectations downwards. Furthermore, a high proportion of sellers are simply taking their homes off the market rather than taking a deep discount on their asking price (see the Data Dive section in this report for more on this).

It’s unlikely we’ll see another sudden and rapid drop in home prices the way we experienced earlier this spring — unless the majority of buyers start buying homes before selling their current home again, which is unlikely to happen in a slowing market. I expect that any potential future decline in prices would likely follow the typical pattern Case described above: a low number of sales leading to an increase in inventory with prices ‘sticking’ and plateauing for a little while before sellers start adjusting their prices down.

If that is the case, the first indicator that prices will resume falling will be rising inventory levels so we’ll keep an eye on this key metric.

Businesses and Consumer Beliefs About Future Are Key

One of the big factors that will influence the direction of Toronto’s housing market over the next couple of years is the inflation rate, which is currently at a high of 7.6%.

A high inflation rate doesn’t just mean our cost of living is going up, it also means that interest rates are also likely to remain high. The primary policy tool the Bank of Canada leans on to fight high inflation and keep it within their 2% target range is their policy rate.

Interest rates matter because they are a key factor that influences the demand for real estate, and, by extension, the price for real estate. Very low interest rates tend to accelerate demand, which we saw first-hand the past two years when the Bank of Canada pushed their policy rate to 0.25%. Higher interest rates drive up mortgage payments and carrying costs which puts downward pressure on the demand for real estate and on prices.

If the inflation rate influences interest rates and if interest rates influence home prices, then to get a sense of where home prices might be tomorrow, we want to think about where the inflation rate might be in the future.

One important factor behind the inflation rate tomorrow is inflation expectations today. A recent conversation I had with a friend highlights why expectations about the future path of inflation matter a lot, and why they can end up being a self fulfilling prophecy — at least in the short term.

My friend is in the construction industry, a supplier to builders of multi-unit housing. He typically bids on projects two years before they actually start their work. Higher prices for material and labour today are impacting the finances of the projects they bid on more than two years ago in some cases leaving them with very little, if any, profit.

So going forward, all of the projects he bids on will assume prices for materials and labour are rising at a much higher rate than they budgeted for in the past to ensure that their projects are financially viable when they start them two to three years from now. When today’s construction contracts are pricing in the expectation that inflation will remain high two years from now, they are actually contributing to the high inflation that the Bank of Canada is trying to avoid by setting future prices well above today’s prices.

If in two years the actual inflation rate ends up being higher than what my friend’s firm budgeted for then finances will once again be strained. On the flip side, if inflation starts to trend down then their future profit will likely be higher. As the inflation rate starts to decrease, and as business owners expect this trend to continue, business owners will also reduce their inflation expectation when bidding on projects to ensure their prices are competitive.

All this to say that inflation expectations matter a lot when we are trying to think about how long it might take for inflation to return to the Bank of Canada’s target.

In the Bank of Canada’s recent September announcement which announced that their policy rate would be increased by 75 Basis Points (BPS), or .75%, taking the overall rate to 3.25%, they had this to say about inflation expectations:

“Surveys suggest that short-term inflation expectations remain high. The longer this continues, the greater the risk that elevated inflation becomes entrenched”

- Bank of Canada

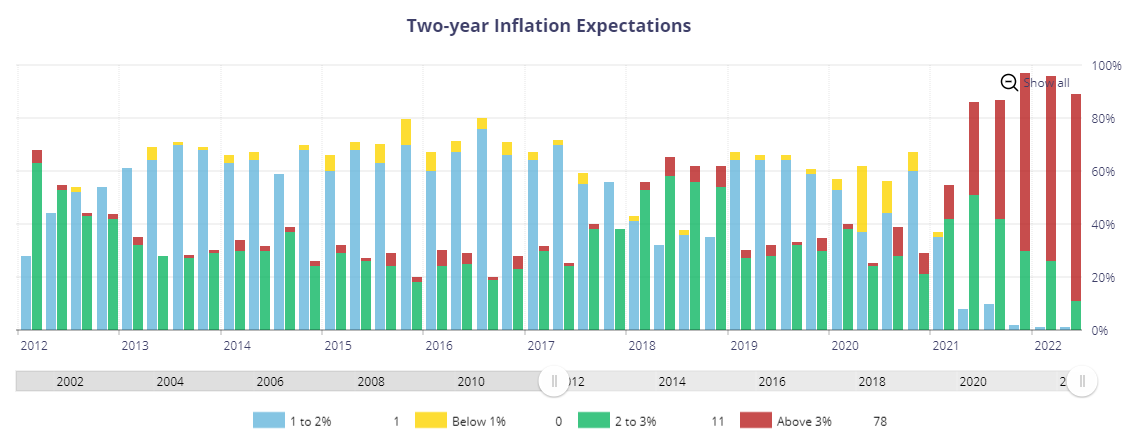

The chart below shows the two-year inflation expectations from the Bank of Canada with 78% of respondents expecting inflation to be above 3%. If the majority are correct, then there is a good chance that interest rates will remain relatively high over the next couple of years which could continue to dampen the demand for real estate.

Sales Activity Signals Seller Patience

These questions cannot be answered by simply looking at aggregate MLS new listings and sales statistics due to the way the number of new listings are reported by the Toronto Regional Real Estate Board (TRREB). Because an agent can cancel and re-list the same home multiple times and each time they re-list that same home it counts in TTREB as a “new listing”, this data is skewed as a single property would be showing up multiple times, overstating the number of new listings.

Here’s how we can get to the root of what has really been happening.

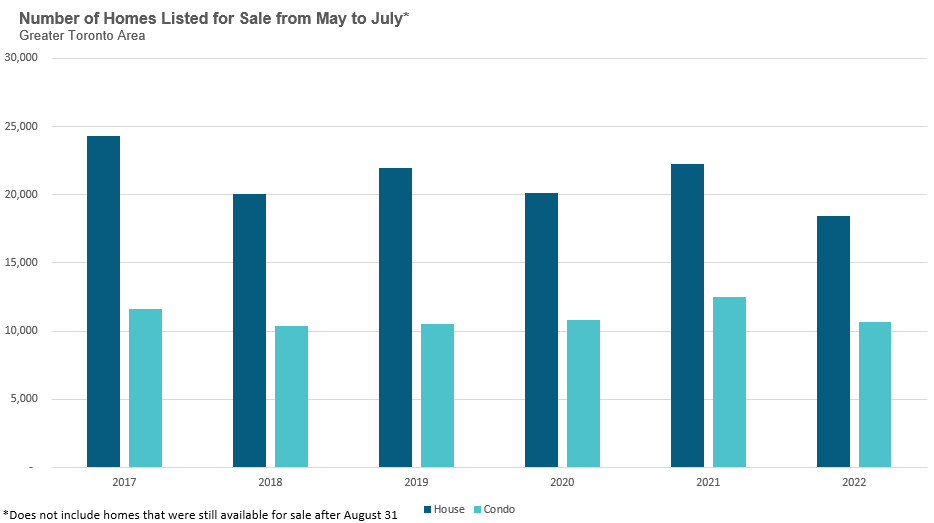

I’m going to be analyzing all the homes that were listed for sale between May and July 2022 by eliminating duplicate listings for the same house or condo so we can zero in on the number of distinct (or unique) homes listed for sale over that three month period.

Of all of the distinct homes that were listed for sale during that three month period, we are only going to analyze the homes that were no longer available for sale at the end of August. I have this condition because I am primarily interested in developing a better understanding of what is happening to the homes that are no longer available for sale — are they selling or are sellers simply taking their homes off the market?

The chart below shows the number of homes that were listed for sale between May and July that were also no longer available for sale at the end of August. We can see that the number of houses listed for sale is below previous years while the number of condo listings is more inline with numbers between 2018 to 2020.

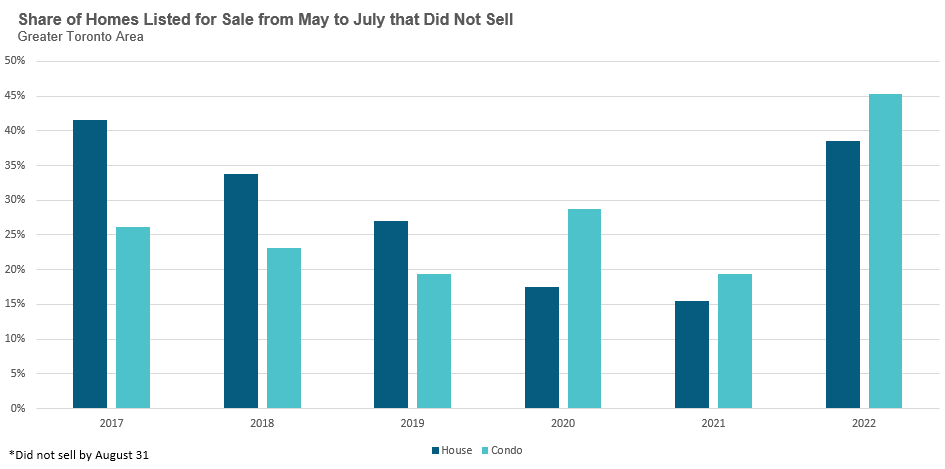

For each of the homes included in our sample above, there are only two possible outcomes: 1) the house sold or 2) the listing was cancelled. The table below shows the share of house and condo listings that were cancelled.

Out of all the houses that were listed for sale, 39% of them did not sell and were simply taken off the market. This is well above levels over the previous four years, and just below 2017.

Toronto’s housing market experienced a rapid increase in low-rise house prices in 2016 and the first quarter of 2017 with prices falling sharply just after the province of Ontario introduced a non-resident speculation tax in April 2017. You can read more about the 2017 house price bubble and correction in my report, A Sticky End: Lessons Learned From Toronto's 2017 Real Estate Bubble. These price dynamics in 2017 are similar to the price dynamics we are seeing in today’s market.

Turning to the condo market, 45% of condo listings in 2022 did not end up selling, well above levels seen in previous years. (It’s worth noting that the condo market was far more balanced in 2017 and did not see the same type of sharp decline in prices we saw in the low-rise house market as seen by the numbers of cancelled listings for each segment in the chart above).

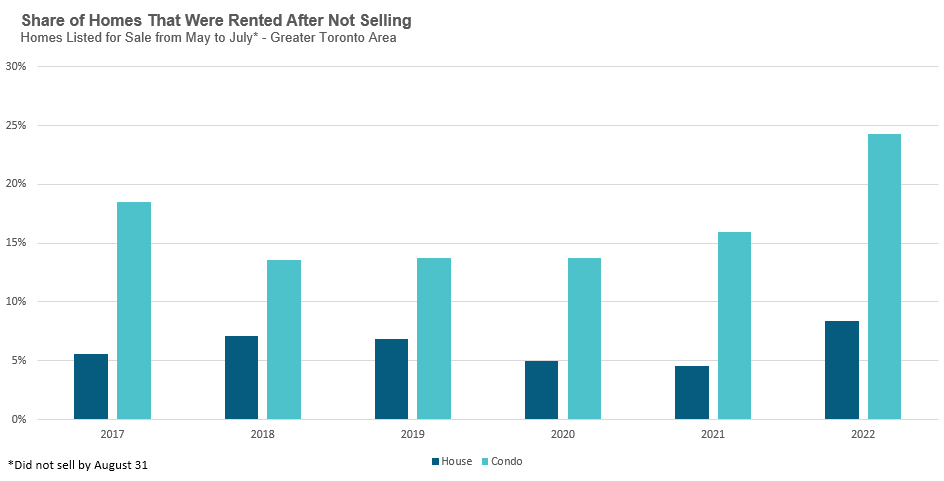

Finally, when looking at all of the houses and condos that did not sell, another question arises — what share of those cancelled listings ended up being rented out instead? There is no precise way of measuring this because there is no way of tracking private rentals or rentals posted on third party websites other than the MLS. But if we base our analysis on the subset of houses and condos that are listed for rent on the MLS system, we can see the share they represent in the chart below.

The share of houses and condos being rented after not selling in 2022 was well above previous years.

These trends suggest that homeowners are becoming more patient and are less willing to take a dramatic reduction in the sale price of their home relative to recent comparable sales, with some taking their home off the market and others renting them out instead. If this trend continues, we are likely to continue to see some stability in house prices in the months ahead.

Houses - Condos - Regional Trends

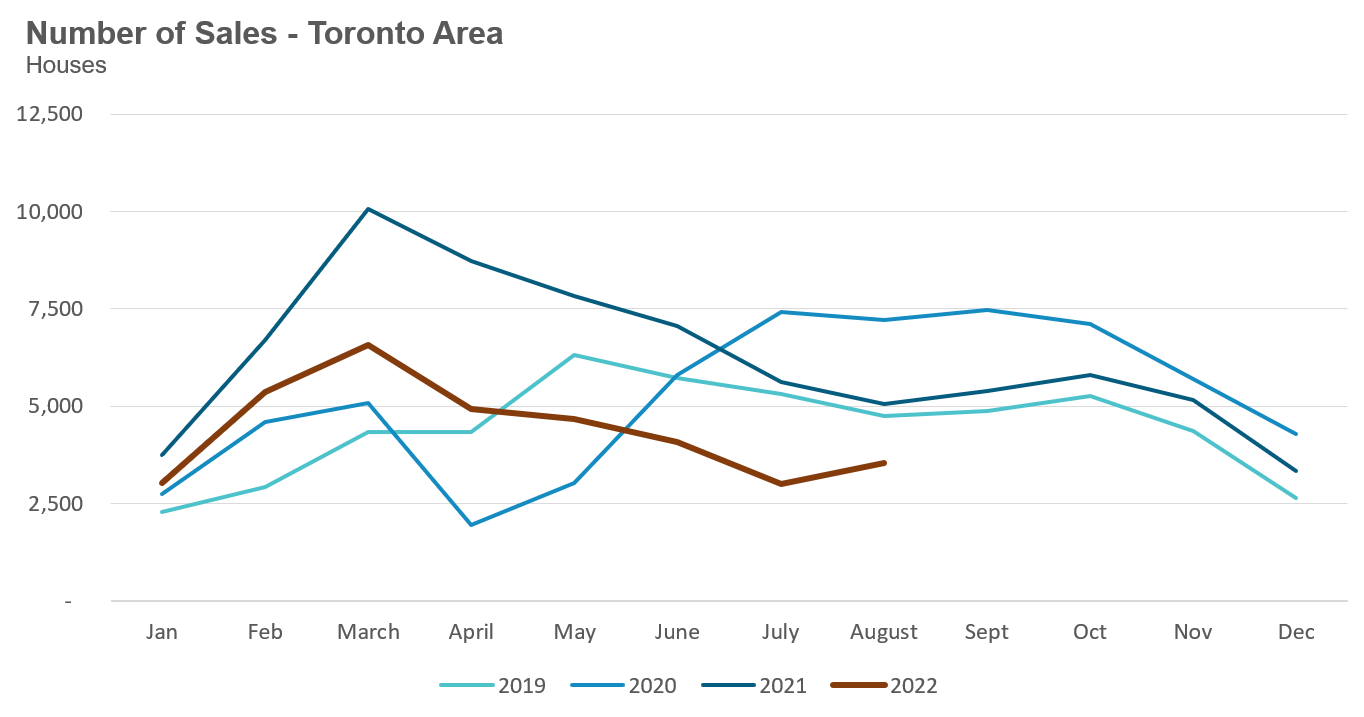

House sales (low-rise detached, semi-detached, townhouse, etc.) in the Greater Toronto Area (GTA) in August 2022 were down 30% over the same month last year and represents a 20-year low for the month of August. While home sales typically decline from July and August, we did see a 17% increase in home sales in August compared to July.

New house listings in August were up 2% over last year, but below typical new listing volumes for the month of August.

The number of houses available for sale (“active listings”) was up 80% when compared to the same month last year, but still well below pre-COVID levels for the month of August.

The Months of Inventory ratio (MOI) looks at the number of homes available for sale in a given month divided by the number of homes that sold in that month. It answers the following question: If no more homes came on the market for sale, how long would it take for all the existing homes on the market to sell given the current level of demand?

The higher the MOI, the cooler the market is. A balanced market (a market where prices are neither rising nor falling) is one where MOI is between four to six months. The lower the MOI, the more rapidly we would expect prices to rise.

While the current level of MOI gives us clues into how competitive the market is on-the-ground today, the direction it is moving in also gives us some clues into where the market may be heading.

The MOI for houses declined from 2.8 MOI in July to just 2 MOI in August. The decline in the MOI is a function of a higher number of sales and fewer active listings in August when compared to July.

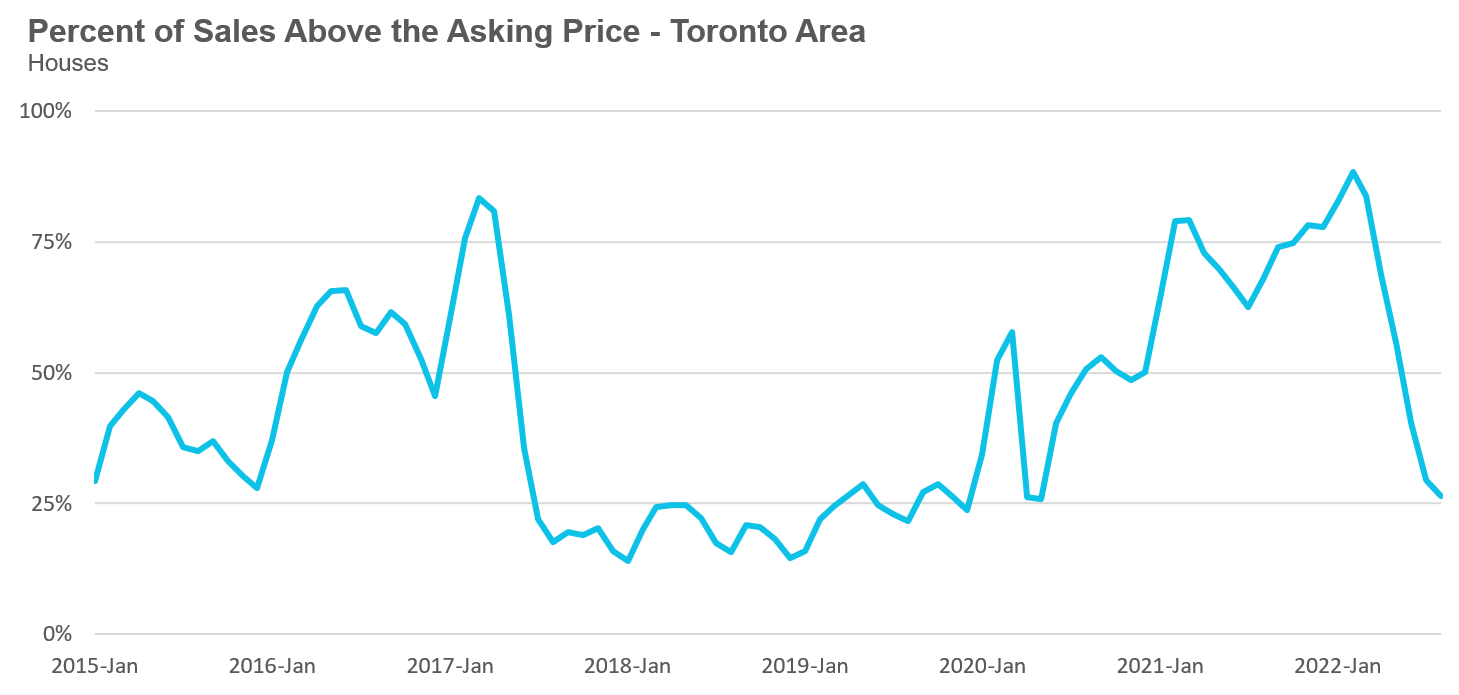

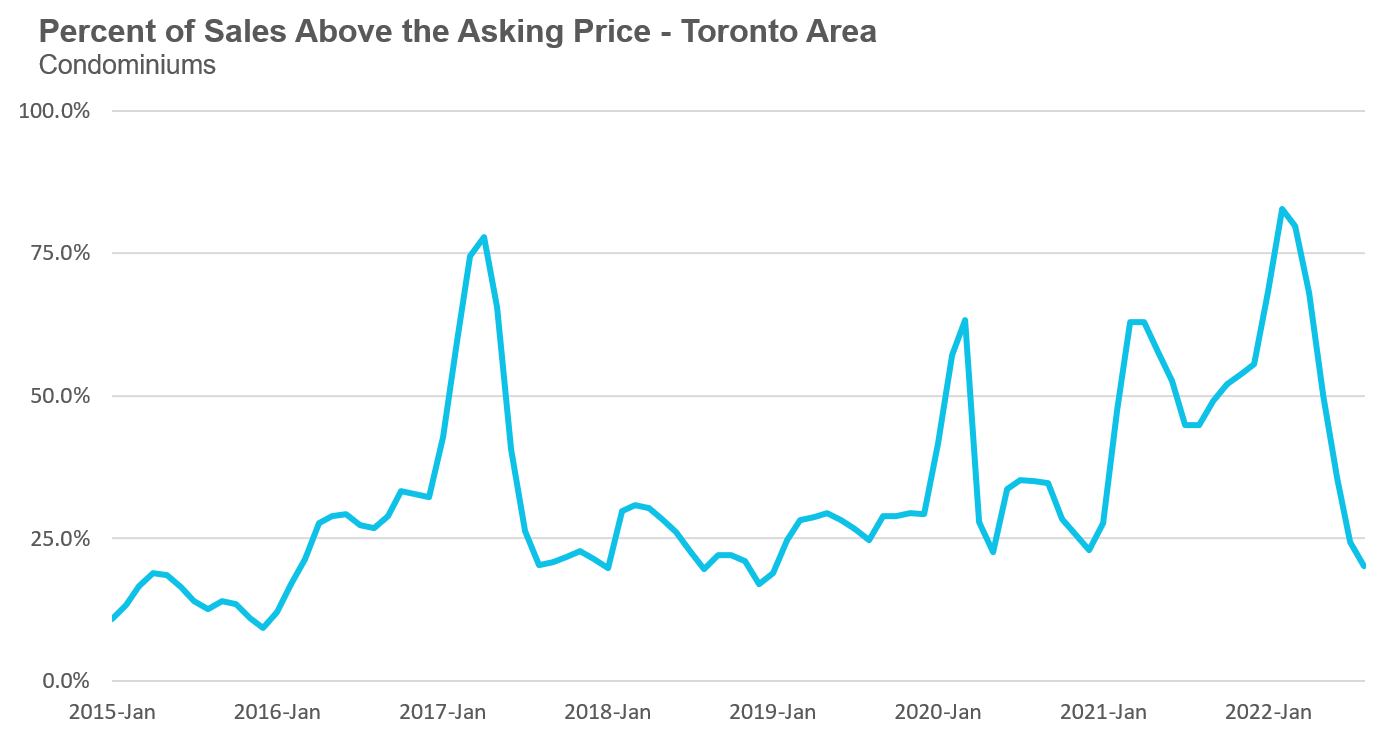

The share of houses selling for more than the owner’s asking price declined to 26% in August.

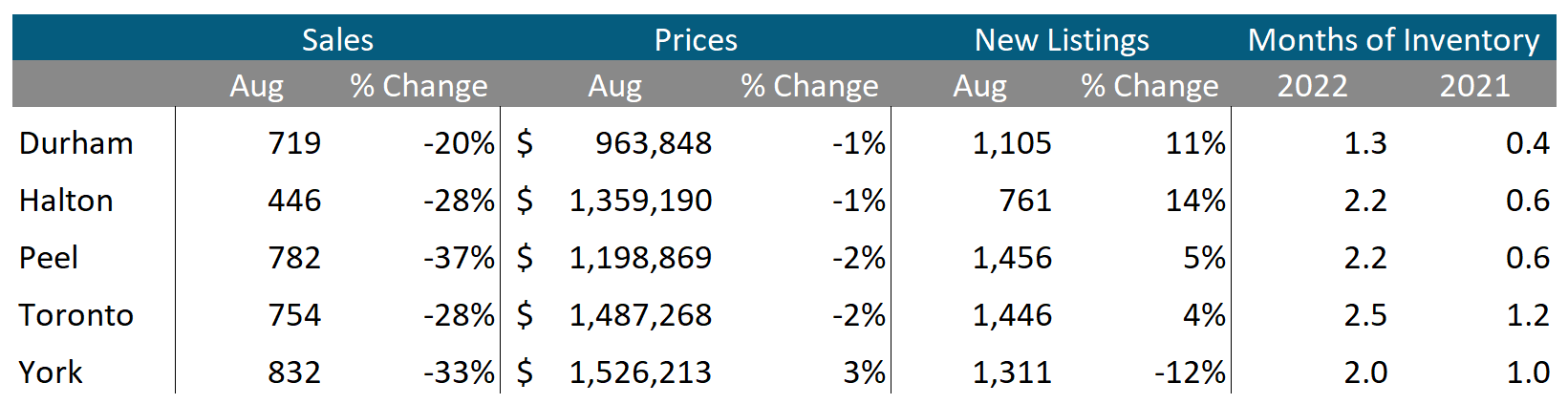

The average price for a house in August was $1,310,025 in August 2022, well below the peak of $1,679,429 reached in February and down 1% when compared to the same month last year.

The median house price in August was $1,105,000, down 5% over last year, and below the peak of $1,485,000 reached in February.

The median is calculated by ordering all the sale prices in a given month and then selecting the price that is in the midpoint of that list such that half of all home sales were above that price and half are below that price. Economists often prefer the median price over the average because it is less sensitive to big increases in the sale of high-end or low-end homes in a given month which can skew the average price.

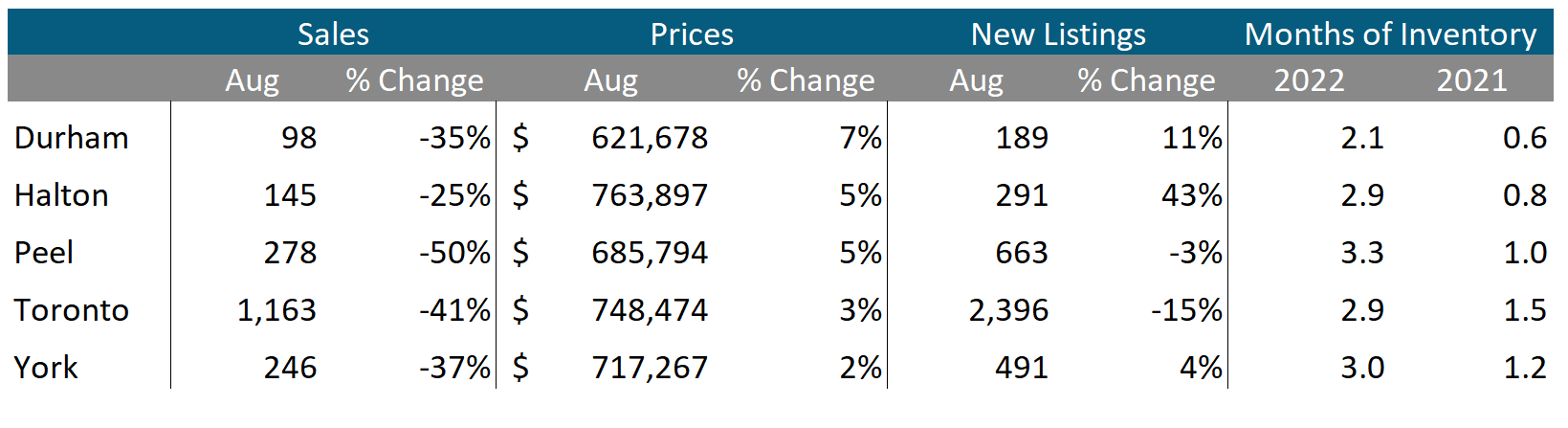

Condo (condominiums, including condo apartments, condo townhouses, etc.) sales in the Toronto area in August 2022 were down 41% over last year and well below pre-COVID sales volumes for the month of August. Sales were up 9% over the previous month.

New condo listings were down 7% in August over last year and in line with historical listing volumes for the month of August.

The number of condos available for sale at the end of the month, or active listings, was up 35% over last year.

Condo inventory levels declined from 3.6 MOI in July to 2.9 MOI in August. This decline was due to a higher number of sales and lower inventory levels in August compared to July.

The share of condos selling for over the asking price declined to 20% in August.

The average price for a condo in August fell to $730,188, down from the peak of $840,444 in March. The average price is up 3% over last year. The median price for a condo in August was $670,000, up 5% over last year, but down from $777,000, the March peak.

Houses

Average prices were down over last year in Durham, Halton, Peel Regions and the City of Toronto, but still up slightly in York Region. Sales were down significantly across all regions and inventory levels were well ahead of last year’s level.

Condos

While condo sales were down across the GTA, average prices continue to be up over last year in all five regions. Sales were down significantly across all regions and inventory levels were well ahead of last year’s level.

See Market Performance by Neighbourhood Map, All Toronto and the GTA

Greater Toronto Area Market Trends

GET MORE DATA

This monthly Move Smartly Toronto Area Real Estate Market Report is powered by Realosophy Realty. Get the same up-to-date Toronto area market data on realosophy.com and additional information on every home for sale, including building permit history, environmental alerts and more when you buy a home with Realosophy Realty.