Urmi in Urban Issues, Toronto Real Estate News

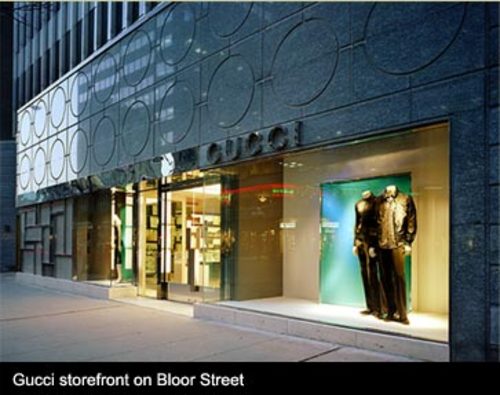

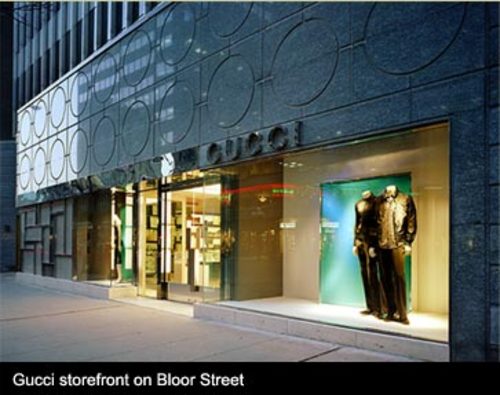

A Bay St. heavyweight's startling prediction for Toronto's real estate market will worry HomeBuyers looking to become a part of the city's core, unless you are a visiting oil czar. Under a rather ominous title, "Silent Money Pours into Toronto," Dr. Sherry Cooper, Executive Vice-President at BMO Nesbitt Burns, reports on Toronto's increasing propensity for attracting foreign capital to its downtown luxury condos and hotels. Wealthy investors from Russia to Hong Kong are looking to diversify their assets away from the U.S., and Toronto - with its pricey Bloor St. baubles and tendency to bore terrorists - makes for a perfect acquisition.

Photo credit: FORT Architect Inc.

Cooper is frank in assessing implications. The City of Toronto would benefit as its tax base grows to include rich buyers - enter the new land transfer tax here. At least one astute urban issues observer, Wendy Walters, doubts whether this expanded tax base would be enough. Existing HomeOwners in the core would see properties appreciate even more. Cooper argues that gentrification - the nightmare of city dwellers in New York, London and Vancouver - may follow. Torontonians have long preserved their dignity by dismissing upwardly-mobile acquaintances in glamorous locales as life-long renters or even worse - forced suburbanites. We now have the opportunity to live the same dream.

Cooper consigns her micro-trend spotting to the anecdotal file, since Statistics Canada does not track these more nuanced investment flows. Walters wonders if the forecast is exaggerated. Look for numbers soon - only this week, a Globe and Mail researcher contacted our team at Realosophy to talk gentrification. Taking Cooper's observations as valid for now, I add three of my own.

First, wealth moving into Toronto can certainly be a good thing - philanthropy has been a driver of arts, culture and public life in New York and London. I am not sure, however, that absentee billionaires make for the best benefactors. (Though it must be said that some of our locals are also notorious for bad tipping.) Even when the condos in question are not luxe stopovers, but those that investors buy to rent out to the less affluent, the danger is that the city will increasingly lack the permanence that made once-affordable areas like Little Italy and Riverdale great. John points out that the City Place condo complex targets investors by demanding an immediate $500 deposit - but housing a high rental population means that residents keep moving up and out.

Second, there is a lot to be said for volume over wealth when it comes to lively city streets. I attend the annual all-night street event that is Nuit Blanche, but I don't go for the art, which ensures that I, unlike most, am never disappointed. I go for the people clogging up the sidewalks and streets. It's a shot of adrenaline which allows me to imagine how much more we could live and do in Toronto...if we were more densely-populated. (Speaking of dense, at least one exhibit this year, The Diamond Necklace, or a bunch of lights tangled up in a bunch of balloons above Trinity College, worked. Not as art, but as a public service announcement testifying to the dangers of drinking and quad-decorating.)

For a big but dispersed city, downtown Toronto has been remarkably mixed-used, which means that at different times of the day, someone is out and about using the streets. This generally means less crime and decay. Residents buy from fruit stands, local schools keep museums full, workers make public transit a first-order demand, the affluent and the aspiring shop on their preferred streets, and would-be creatives watch bad theatre and dwell on it in cafes. Building volume should be about pulling in diverse city residents. While investors are part of the mix, they work best in limited quantities. A recent 60 Minutes documentary on the wonder that is Dubai, a built-from-scratch financial hub in the Middle East, reveals stunning but empty neighbourhoods anchored by foreign owners. Bejeweled phantoms are notorious no-shows.

I fear Toronto's timing may be off. While gentrification is a naturally-occurring phenomenon, Toronto's newfound popularity with global real estate investors accelerates it (the City's new tax on HomeBuying won't help the cash-strapped either). If the downtown core gentrifies as it fills up, the party could be over before the drinks loosen up the crowd. New York and London were teeming with all kinds of people long before the end of rent control and hedge funds entered the picture and scattered them all around - several Greenwich Villages had at least taken root. (Nowadays, super-gentrification of the kind seen in the UK can shove out an established author let alone the scribbler who has yet to publish.)

If reports of gentrification are not greatly exaggerated and the fabulous but fiscally-constrained HomeBuyer is pushed out of the core, another possibility emerges. The core may shift. Could Scarborough or North York emerge as a dense, diverse and lively urban centre?

Here's to the spirit of Brooklyn.

Urmi Desai is an economic analyst and a freelance writer specializing in urban issues. She is editor of the Move Smartly blog.

Subscribe to Move Smartly by Email

Related Posts:

Dreaming the Big Dreams in Toronto: New Urbanism, Smart Growth and High-Density Development