Realosophy Team in Media Roundup, Toronto Real Estate News

All you need to know regarding the housing market in Toronto, Canada and abroad.

This week in Toronto: Speculators are super-heating the real estate market, 'marginal' home buyers set market value and Ontario finance minister wants Ottawa to help curb speculation.

Elsewhere: What the Canadian federal budget means for housing, where the American dream goes to die and a grassroots fight against gentrification in Berlin.

Toronto

Data Shows That Investors Are Now Speculating on Single Family Houses Across GTA (Move Smartly)

I had to innovate a reasonable way to get a look at the investors I was interested in so to quantify this investor demand, I looked at every freehold house (detached, semi and rowhouse house as opposed to condo) that has sold over the past five years and then checked to see what percentage of buyers listed their property for rent shortly after taking possession.

Speculators super-heating the Toronto real estate market (The Globe and Mail)

The study was undertaken by Realosophy president and broker John Pasalis, who noticed a twist in market psychology. People began moving from the time-honoured principles of real estate investing – that the cash flow from renting out the property should cover the expenses – to the assumption that it was okay to lose money every month because bigger gains would come from the sale of the property later on.

Toronto Property Speculators, Investors Snatch Up 3 In 10 Homes: Study (Huffington Post)

“What was unusual is that, unlike regular investors, many of them were not particularly concerned about the rental income they could generate and were even willing to buy a property that didn't earn enough to cover all expenses,” Pasalis wrote in a blog.

‘Marginal’ home buyers setting market value in Toronto (The Globe)

A term that’s circulating more often is the “marginal” buyer. These are the outliers who pay huge premiums over the “consensus price” that experienced agents would come up with based on previous sales and micromarket factors. Even though they make up only a small subset of buyers, they determine market value.

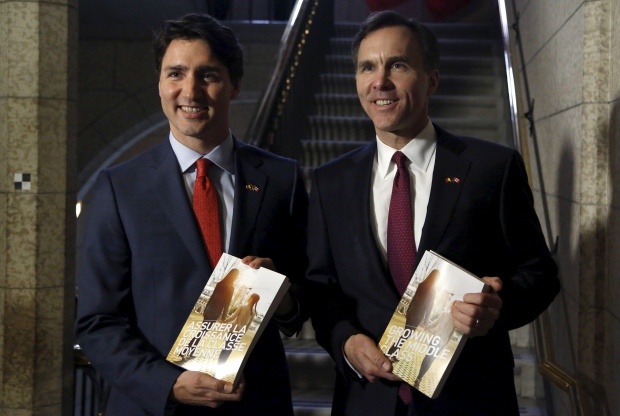

Ontario finance minister wants Ottawa to help curb real estate speculation (Toronto Star)

“Uncertainty in the housing market has been partially driven by speculation,” Sousa told the house on Monday after sending an open letter to Morneau imploring him to act. “I’ve sent a letter to the federal minister of finance to request that the federal government consider increasing the capital gains inclusion rate for non-principal residences,” the provincial treasurer said.

No Fixed Address: How skyrocketing GTA rents left this woman an 'emotional mess' (CBC)

At her posh office in Bloor West Village, psychotherapist Toni Gordon says even among her more affluent clientele, 50 per cent of the people she helps now cite housing expense or instability as a major source of stress on their mental health.

Canada

Toronto is expected to continue to lead the pack in sales of homes worth over $1 million, while Vancouver's high-end home sales will continue to normalize. Calgary's market is forecast to continue its cautious recovery from the oil price shock and sales in Montreal are anticipated to grow modestly, according to the report.

Solving the enigma of Canada’s housing bubble (The Globe)

If you’re already a homeowner, it’s wonderful. If you’re a young person, an immigrant or middle-class, it’s depressing. If you’re an economist or a banking regulator, it’s terrifying.

USA

For China’s middle class, Brooklyn real estate offers more than a green card (CNBC)

Seismic cultural shifts that occur as one immigrant population eclipses another are a classic part of New York life and are now responsible for dim sum and dumplings outnumbering pizza joints and spumoni shops. Yet rapidly rising rents and the frenetic pace of gentrification are resulting in a parallel form of Chinese migration, focused on money: foreign buyers, including extended members of Chinese families, who view Brooklyn real estate as a secure, high-return investment.

Does Airbnb decrease housing values, as Miami Beach mayor says? (PolitiFact)

Jack McCabe, a South Florida real estate analyst, said it’s premature to make broad claims about the impact of Airbnb because it hasn’t been around for long and only represents a slice of the residential market.

Where the American Dream Lives and Dies (City Lab)

How will these embattled American Dream-seekers fare under the new presidential administration? Trump seeks to cut key programs that offer food and rental assistance in poor urban and rural populations and foster economic development in Appalachia, and the GOP health care plan, experts say, will particularly hurt older, low-income rural voters. In other words: Some of the economic conditions have led voters to put their trust in Trump are likely to be exacerbated further by his administration’s policies.

“Massive crowding is happening to the extent that a lot of people can’t pay their rent, or they are having their leases canceled for the slightest triviality,” said Sara Walther, one of the organizers, stubbing out a rolled cigarette. “People are finally starting to defend themselves.”

Every year China investors are given the warning that Shanghai housing prices are out of control. They have been rising precipitously now for at least a decade, with an average 1,000 square foot apartment in Shanghai going for $725,000, or around five million yuan. Shanghai's average salary per month is 7,108 yuan ($1,135) or 85,300 yuan a year. That puts local property in Shanghai at about 50 times median salaries in the city. Housing costs in Shanghai are unsustainable.