The number of homes listed under the critical $1 million mark increases as the Toronto area real estate market continues to slow down.

As Featured in the monthly Move Smartly Report for August 2022 - read story below and go to report to read all stories for the month

FREE PUBLIC WEBINAR: The Market Now with John Pasalis

Join John Pasalis, report author, leading market analyst and Move Smartly contributor, and President of Realosophy Realty, and in a free monthly webinar as he discusses key highlights this month's report and answers your questions. A must see for well-informed Toronto area real estate consumers.

Register now to get recording of latest session and access to future sessions.

In Canada, homes that sell for over $1 million require a minimum 20% down payment while homes selling for under this amount can be purchased with as little as 5% down — and it’s this difference that makes the $1M threshold an important one for most first-time buyers.

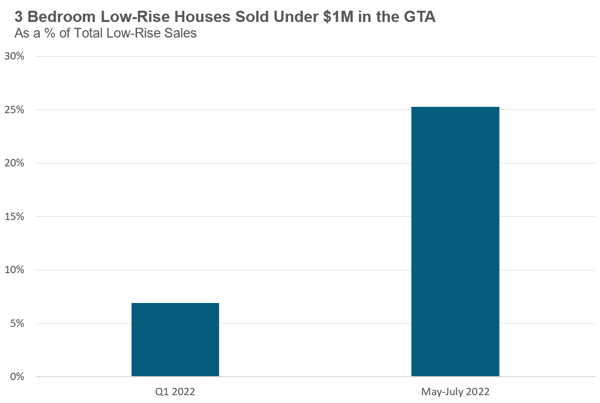

During the first quarter of 2022, first-time buyers looking for a 3-bedroom family low-rise house for under $1M had very few options as these houses made up just 7% of all low-rise house sales. Over the past three months, these houses have now come to account for 25% of all sales.

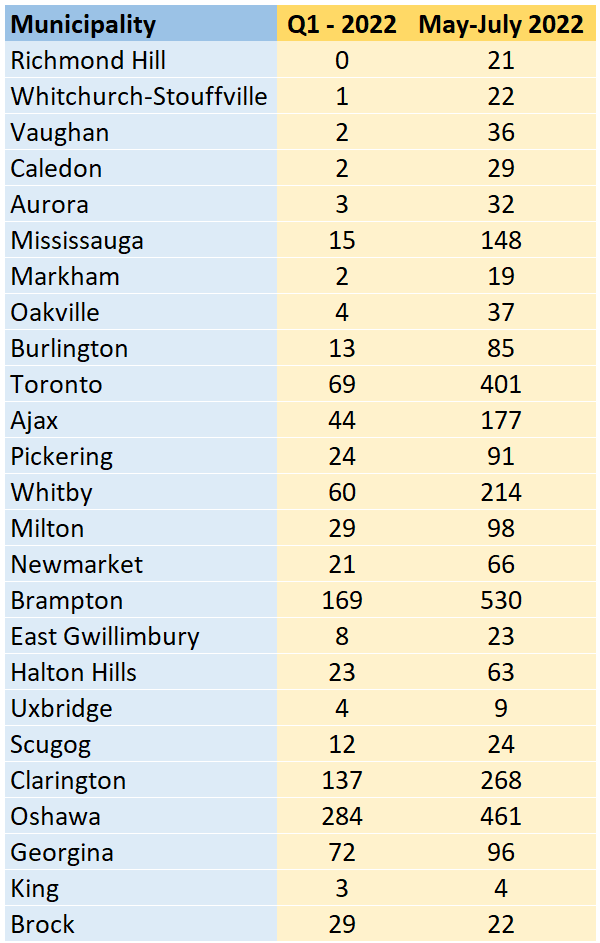

The table below shows the number of 3-bedroom low-rise houses that sold during the first quarter compared to the number of sales over the most recent previous three months, sorted by the municipalities seeing the biggest % change in sales in this category.

This significant increase in the share of house sales under $1M means that many families who were priced out of buying a ‘starter home’ just a few months ago due to limits to their down payment (and/or income) are finding more options in today’s market, particularly in areas showing the most change (as seen in the table above).

However, these falling prices have come with a cost — today’s home buyers find themselves paying a much higher interest rate on their mortgage which imposes a budgetary limit on their home buying costs as their monthly payments rise.

Top Image Credit: Getty/iStock

The Move Smartly monthly report is powered by Realosophy Realty Inc. Brokerage, an innovative residential real estate brokerage in Toronto. A leader in real estate analytics, Realosophy educates consumers at Realosophy.com and MoveSmartly.com and helps clients make better decisions when buying and selling a home.

John Pasalis is President of Realosophy Realty. A specialist in real estate data analysis, John’s research focuses on unlocking micro trends in the Greater Toronto Area real estate market. His research has been utilized by the Bank of Canada, the Canadian Mortgage and Housing Corporation (CMHC) and the International Monetary Fund (IMF).

.png?width=600&name=Public%20Webinar%20%E2%80%93%20July%202022_MoveSmartly_%20600x300%20(3).png)