Author John Pasalis is the President of Realosophy Realty, a Toronto real estate brokerage which uses data analysis to advise residential real estate buyers, sellers and investors. He is a top contributor at Move Smartly, a frequent commentator in the media and researcher cited by the Bank of Canada and others. See John Full Bio

The market is still deeply in seller’s market territory but we are seeing the first signs of a market that is starting to decelerate — a welcome sign for buyers engaged in frustrating bidding wars.

Have questions about this unpredictable market? John is hosting a monthly webinar for past and present clients of Realosophy Realty. Hear key takeaways from this month's report and get answers to your own questions.

The Market Now

What a year it’s been — and with Ontario in yet another lockdown, our journey continues.

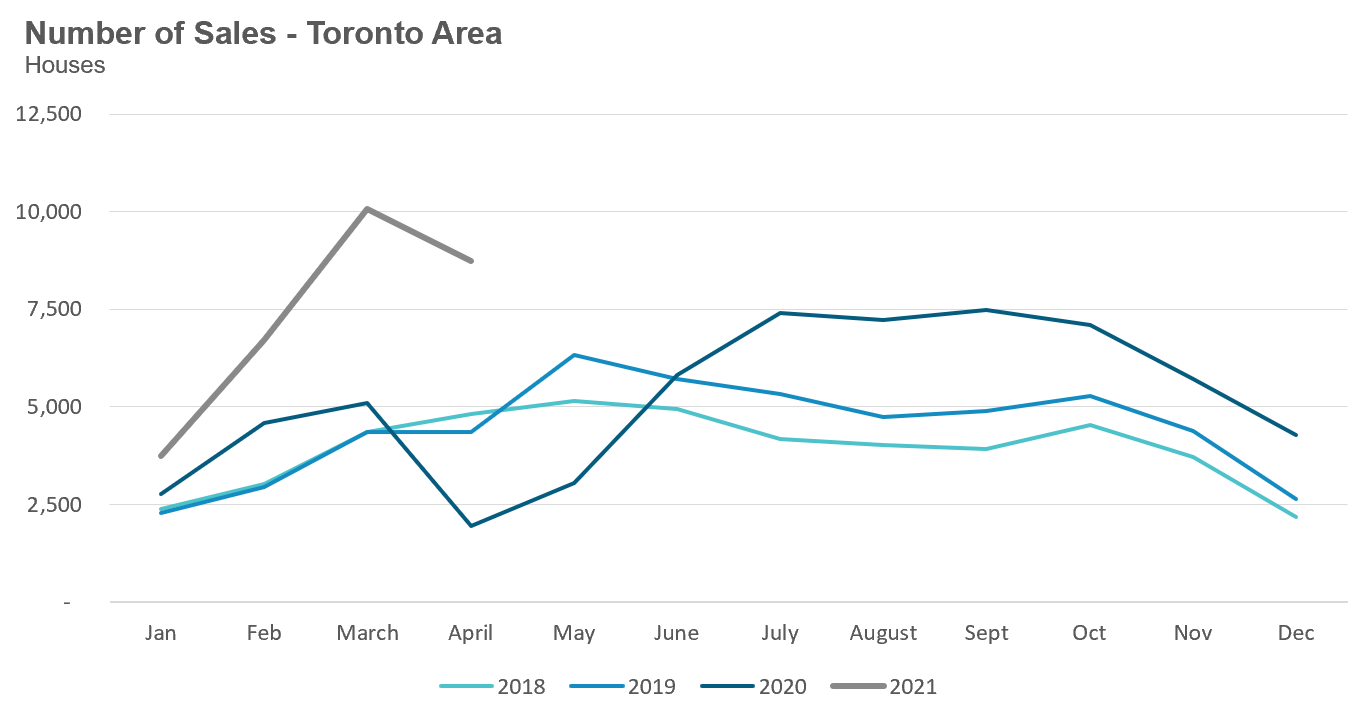

Year-over-year comparisons of Toronto’s housing market over the next two months (see 'Monthly Statistics' section in this report) will not tell us much about what is actually happening on-the-ground in our real estate market because the period we are comparing against a year ago, April 2020, marked the first full month of Ontario’s COVID-19 lockdowns which also resulted in a virtual freezing of the resale housing market. Then, sales plummeted 67% over the previous year and average prices fell 10% over the previous month because the homes that were selling were in a much lower price range.

Instead I’ll share with you the key things you need to know about Toronto’s housing market now based on our interpretation of current data and on-the-ground trends.

The most important trend of note now is the start of a gradual cooling down in the market for houses (detached, semis, rows) across the Greater Toronto Area. The market is still deeply in seller’s market territory but we are seeing the first signs of a market that is starting to decelerate — a welcome sign for buyers engaged in frustrating bidding wars.

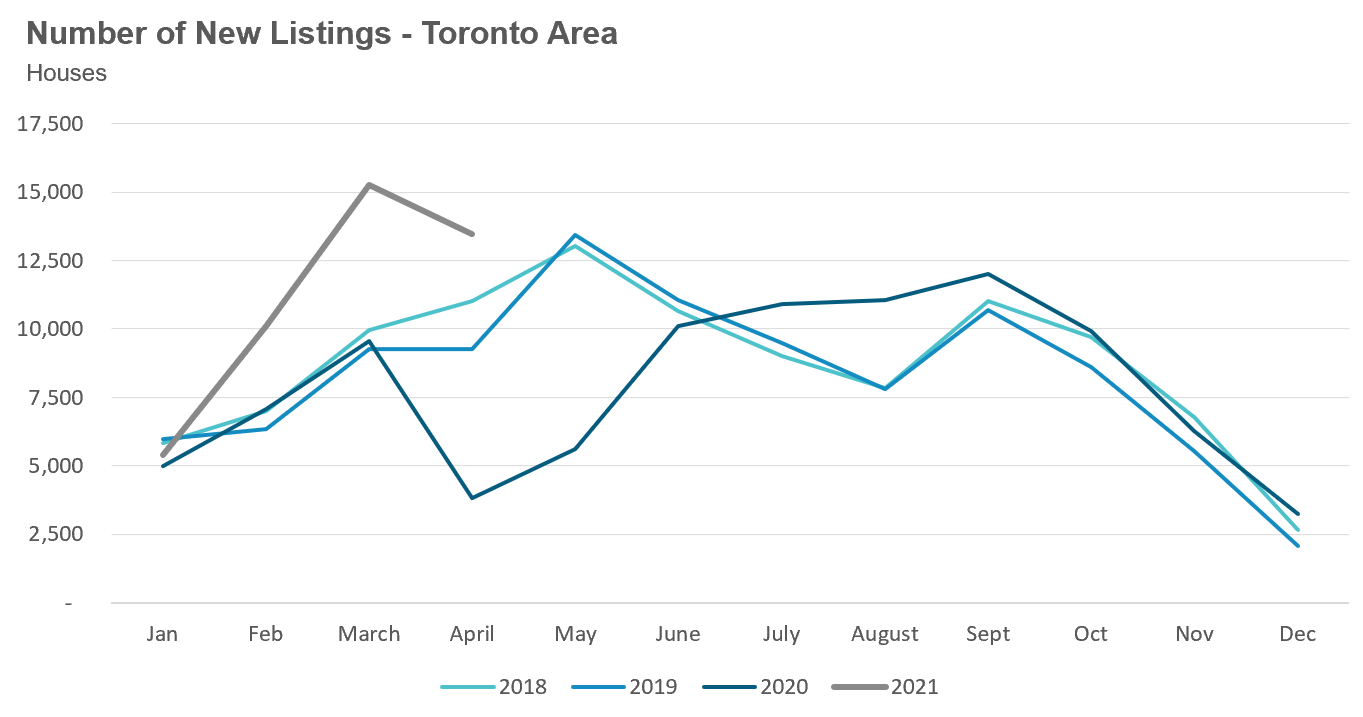

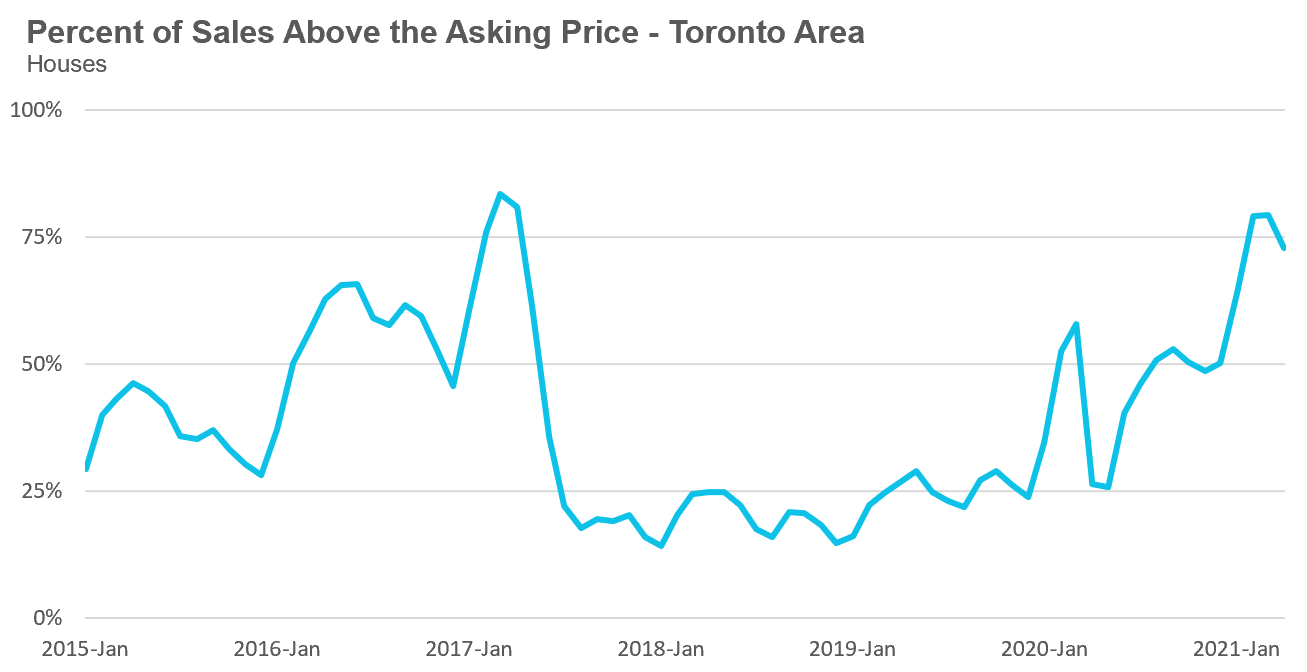

Houses receiving multiple offers continue to be the norm across the Toronto area with 73% of homes selling for more than the owner’s asking price (a slight dip from 79% last month). But sellers are getting fewer offers on their offer night — and in some cases no offers at all. The surge in demand we saw due to Covid-19 induced moves appears to be running its course as sales in April declined 12% over March — of note, as sales don’t typically decline as we head into (what is normally the busiest) spring market. A surge in new listings over the past two months has also helped take some of the heat out of the market.

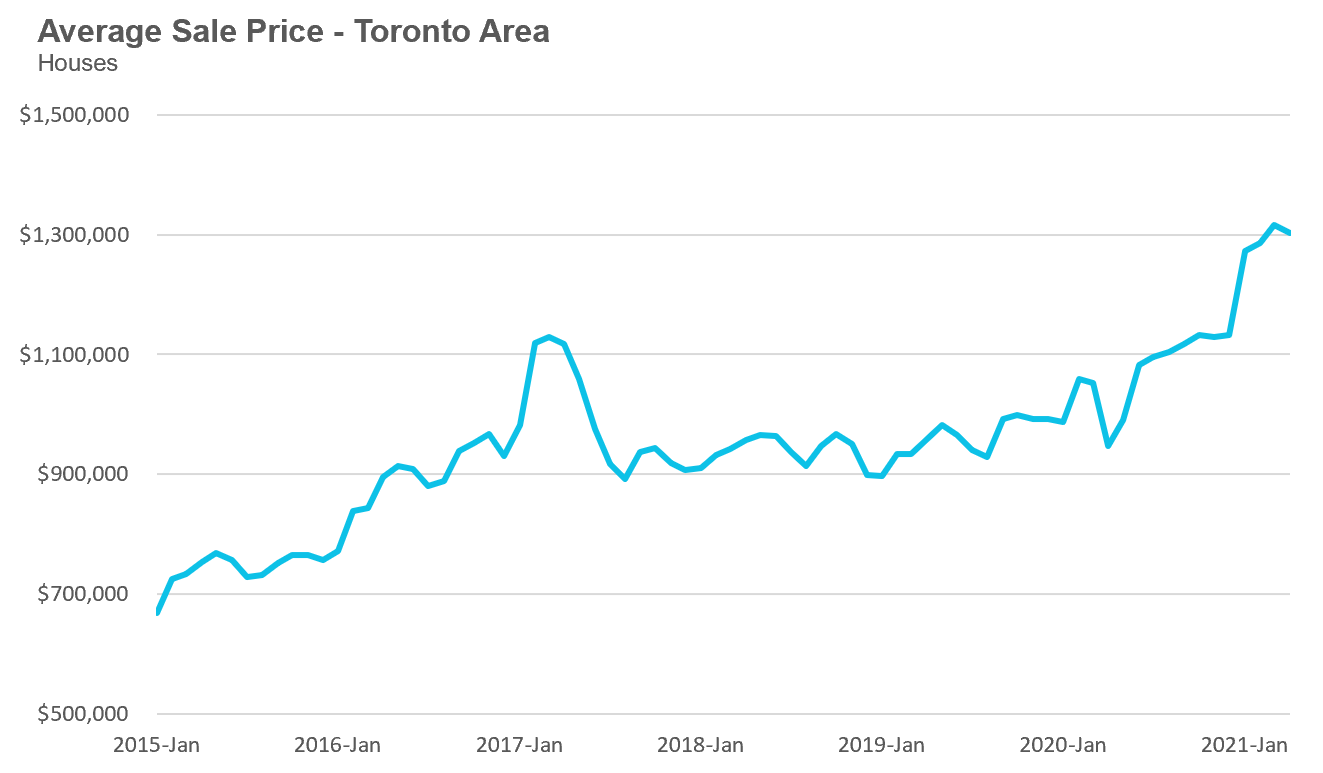

Most importantly, home prices are no longer accelerating on a month-over-month basis and appear to have plateaued the past few months with average prices around $1.3M.

The condo market on the other hand has been accelerating over the past five months and has shown no signs of slowing down quite yet. While average house prices have been flat since January, condo prices have climbed 14% from $620K in January to $709K in April.

Condo inventory levels remain very tight and 63% of condos are selling for more than the owner’s asking price. But anecdotal accounts suggest that a significant portion of the change in demand for condos over the past five months has come from renewed interest from condo investors — especially in the downtown area (see 'Data Dive' section in this report). But with condo prices rising rapidly and interest rates up slightly, we may see the condo market begin to cool in the months ahead.

There were plenty of great columns over the past month discussing how Canada’s runaway housing market is impacting people, our country and our economy.

There were plenty of great columns over the past month discussing how Canada’s runaway housing market is impacting people, our country and our economy.

The Globe and Mail’s Rob Carrick does a great job of unpacking why the housing boom is ripping apart the financial fabric of Canadian life:

"A whole new parental financial burden has been invented: making sure your adult kids get into the housing market.....$2.8-billion was withdrawn last year from home equity lines of credit for the purpose of gifting or lending money to a family member to buy a house."

The National Post’s Sabrina Maddeaux channels all the anger that I’m hearing from millennials who, despite earning a decent income and saving a good down payment, cannot afford to buy a home. This is leading to an exodus of young people out of markets like Toronto in favour of areas that are more affordable.

Economist David Rosenberg raises some important concerns about the outsized role housing has played in Canada’s economic recovery:

If the real estate gravy train ever does end, considering the outsized impact it has exerted on the economy, there is no reopening large enough to offset the housing reversal and all the negative multiplier effects that will reverberate across the entire economy.

While many banks and international institutions have been sounding the alarm bells about Canada’s housing market for a decade, Ian McGugan reminds us in his Globe and Mail column that our housing market hasn’t been just about “irrational exuberance” the entire time. There have been a number of fundamental factors that have pushed house prices up in the GTA including a boom in population growth due largely to a surge in non-permanent residents combined with a very tight supply of new housing.

I had a number of people on Twitter ask me how a surge in non-permanent residents can result in higher home prices since we assume many of them will rent rather than buy a home. To start, the assumption that all non-permanent residents will rent is a false one. Many of Toronto’s non-permanent residents were students and many of those students have wealthy parents who bought houses or condos for their children to live in while at university. This is why the province of Ontario agreed to offer foreign students a rebate on the provincial foreign buyer tax which would normally apply to non-permanent residents. Apparently one of the big draws of Canadian universities is that parents also get to invest in Canada’s housing market and capitalize on rapidly rising house prices — which would effectively cover the entire cost of their children’s tuition.

The non-permanent residents who rent helped push condo rent prices up 33% from 2015 to 2019, attracting more and more investors to the condo market which helped push prices up 50% over the same period.

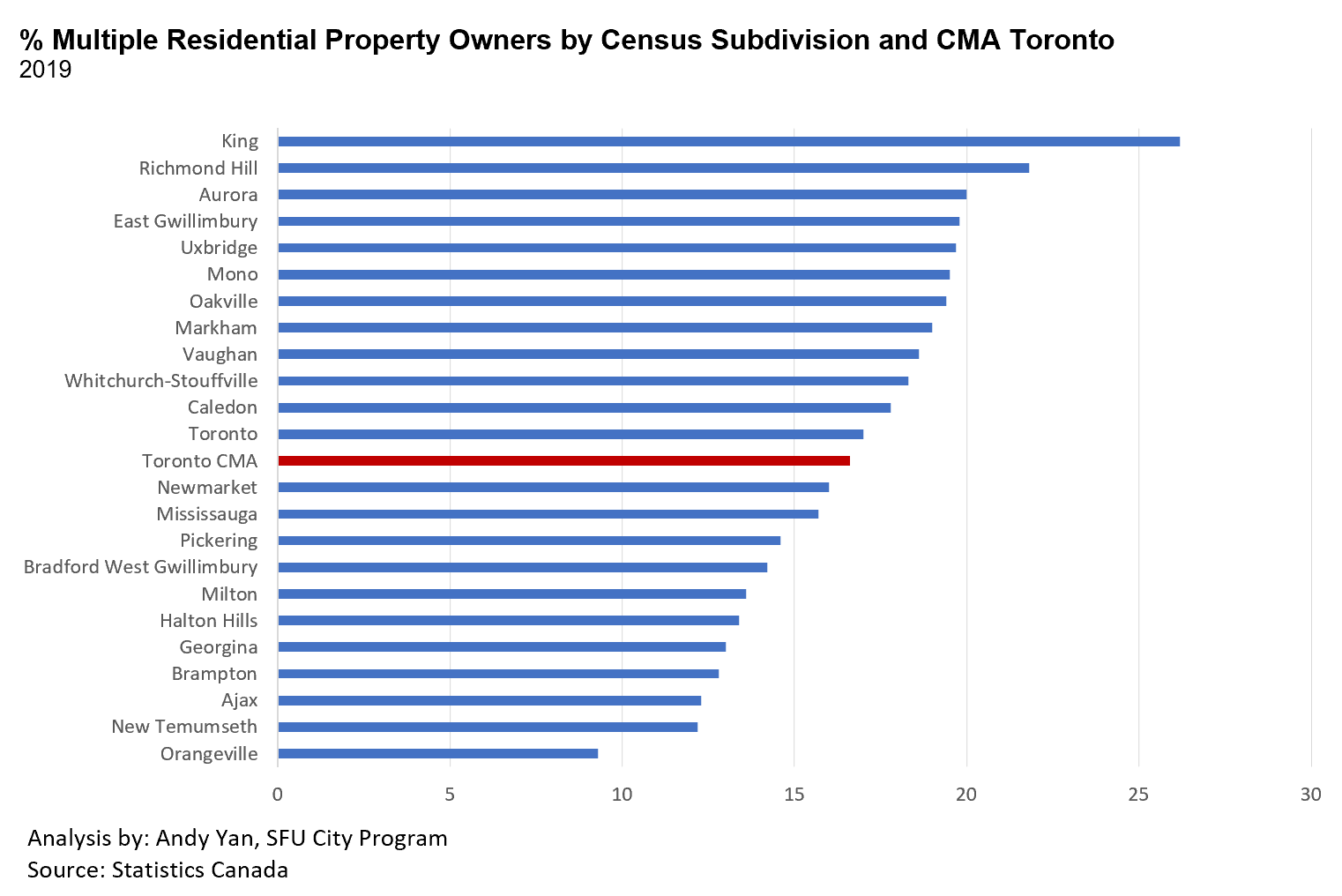

Speaking of investors, new data from the Canadian Housing Statistics Program showed that 17% of homeowners in the Greater Toronto Area own two or more properties. The data below which was prepared by Andy Yan from Simon Fraser University's City Program shows the percentage of multiple residential property owners by census subdivision and for the Toronto census metropolitan area as a whole.

On the surface, hearing that 17% of homeowners own more than one home doesn’t sound high but it is worth noting that when investors accounted for 15% of all new mortgages in the UK, the Bank of England warned that it was “a threat to the country’s financial stability.” More insight is needed into both the stock and flow of investor owned properties over time.

Why only reporting upbeat and positive information is the domain of old school real estate brokerages.

One of Realosophy’s clients asked me an interesting question last month:

Most home buyers worry about buying a home during a bubble because they fear that home prices are going to crash. So why, as the owner of a real estate brokerage, do you raise the alarm about a housing bubble?

Coincidentally, the same week, a friend who works at one of Toronto’s bigger real estate brokerages messaged me to say that their owners emailed every agent in their company encouraging them not to use the term “bubble” when speaking with clients. The owners argued that simply using that term may scare off buyers (and presumably, reduce the brokerage’s sales volume). Their brokers and agents were encouraged to tell their clients that there is no bubble, there’s just “not enough supply,” leading to rocketing home prices.

Given this concern, which is shared by many real estate brokerages, why do we talk to our clients differently?

An example of this is when I talked about bubble-like conditions appearing in the Toronto area back in December, research that proved to be correct as policy makers and major banks have all since raised the alarm about our overheated housing market.

The first reason is due to our differing perspectives on the importance of giving all residential real estate clients access to as much information as possible so they can make informed decisions. When Canada’s Competition Bureau and the then Toronto Real Estate Board (TREB), now the Toronto Regional Real Estate Board, (TRREB) were in a legal battle to make sold MLS data more publicly available a few years back, I, as founder and head of Realosophy Realty, was one of few people in my industry to testify against TRREB because I believed it was important for consumers to have as much information as could be responsibly shared online when they were making perhaps the biggest financial decisions of their lives. The old school real estate brokerages were fighting to restrict data — they preferred a world where consumers are less informed and more dependent on real estate agents and brokers to get the information they needed about current home prices and more.

The second reason is due to my personal and our firm’s collective commitment to rigorous research into housing markets, including my own academic research. I believe that professional analysis and advice about the housing market can be provided to consumers, but this requires experts to be objective and transparent in sharing all information, including potential red flags in the market so that the public can evaluate such information and make informed decisions. Only reporting upbeat and positive information is the domain of old school, traditional real estate brokerages — not true professionals who seek to provide valued, expert advice.

Lastly, our client’s question is also rooted in a deep misunderstanding that most people, including many working in the industry, have of housing markets and housing bubbles more specifically. For most people the term “housing bubble” implies “sudden housing crash,” which is not the case.

Research shows that housing bubbles and the high house prices they create can go on for a sustained period: crashes — and price declines — are rarely sudden.

In these conditions, we need to be extra careful to look for signs that the momentum of a market, or particular segments of a market, is changing, so that late stage entrants into the market are not the victims of short-term reversals. It’s this concern that keeps us laser focused on spotting turning points in the market — the way we did during Toronto’s last bubble in 2017, when uninformed late stage buyers and sellers in the suburbs of Toronto, particularly in York Region, were caught out in the short-term once the market turned, with some unable to complete their sales and losing their deposits or more. Most home owners can withstand such short-term trends if they are buying and selling for the longer-term.

Another reason for all of us to remain aware of our housing market conditions is because of the impact it has on our overall economy. There are conditions in which housing markets can result in wider knock-on economic effects, as we saw happen in the US subprime mortgage crisis of 2008.

Given the technological age we are living in, today’s consumers have never been more highly informed. We find that our clients value having the most up to date research into Toronto’s housing market, and our insights and advice into making sense of the numbers, rather than being endlessly told that home prices will keep going up “because there’s not enough supply.” Fortunately today’s home buyers and sellers have plenty of options when it comes to the type of real estate advice they receive and I’m grateful that my instinct that such information is wanted and appreciated by consumers has been correct.

Federal Liberals Do Little to Cool Housing + The Bank of Canada Changes its Tune + Stress Test Changes

Federal Liberals Do Little to Cool Housing

Given a national housing boom that saw home prices rise by 30% over last year in Canada, many economists were calling on the federal government to introduce measures to cool the housing market in their April 2021 budget.

But it appears that the Liberal government wasn’t listening.

As I mentioned in last month’s report, I disagreed with policy recommendations that were aimed at curtailing the current surge in demand we are seeing from home buyers. Introducing longer-term policies for what was a short-term exogenous demand shock wouldn’t have solved the immediate problem and would have made it harder for younger and first-time buyers in the longer-term.

But given Canada’s Parliamentary Secretary for Housing Adam Vaughan’s frank comments that Canada’s housing market is great for foreign investors but not Canadians during an interview with TVO’s Steve Paikin, one would have expected a crackdown on foreign capital flowing into Canada’s housing market.

“We’re a very safe market for foreign investment but we’re not a great market for Canadians looking for choices around housing.”

- Adam Vaughan, MP for Spadina-Fort York and Parliamentary Secretary for Housing

The Liberal government introduced a 1% property tax on properties that are owned by non-residents which are vacant which gives the appearance that they’re trying to do something about the negative impact foreign capital is having on home prices — but this tax does very little.

When a foreign investor is expecting the value of their property to go up 8-10% per year, a 1% annual tax is a nuisance tax — it’s not the type of tax that would even discourage them from leaving their properties vacant. But more importantly, this tax targets foreign owners when it should be targeting foreign capital more generally, given that foreign capital often flows into our housing market through those with some residency status here.

Shortly after the federal budget, the Liberals also introduced some updates to the First Time Home Buyer Incentive — a program that sees the federal government providing buyers with 5-10% of the purchase price of a home in return for a proportional equity stake in the property.

For Toronto, Vancouver and Victoria, the CMHC increased the maximum income allowed to qualify for the program from $120,000 to $150,000 and the maximum loan amount went from 4X income to 4.5X income (coincidentally, the Bank of Canada’s threshold for highly vulnerable borrowers).

The mere fact that a household earning $150K — well above the median household income in Toronto — needs financial aid from our government to buy a home is evidence that policy makers have failed Canadians by allowing home prices to get so far ahead of what most can actually afford.

The Bank of Canada Changes its Tune

Canada’s economy appears to be recovering a lot faster and stronger than expected which has led the Bank of Canada to change its message to Canadians regarding the likely trajectory of the interest rates that impact mortgage borrowers.

Since the start of the pandemic, Governor Tiff Macklem was quite clear that rates would stay low for a very long time, suggesting that they would not increase until 2023 at the earliest.

Last month, the Bank of Canada adjusted their timing of a potential rate hike to 2022 and is slowing down its pace of government bond purchases (known as ‘quantitative easing’) to $3 billion per week.

This shift in the Bank of Canada’s forward guidance may be positive because their commitment to keep rates low for a long time may have contributed to some of the exuberance we have seen in Canada’s housing market.

There is some question, however, as to how much Canadian authorities can act ahead of their US counterparts, who continue to show a reluctance to raise rates, as a higher Canadian dollar would risk the recovery of export-dependent areas of our economy.

Stress Test

The Office of the Superintendent of Financial Institutions (OSFI) surprisingly announced that they plan to raise the stress test on uninsured mortgages from the current 4.79% to 5.25% on June 1st.

Superintendent Jeremy Rudin shared OSFI’s motivation for the proposed change to the stress test thus:

“We want to make sure that when the mortgages that are being taken today renew in three, four or five years, that lenders are protected so that borrowers are well-positioned to be able to service those debts, and safeguard the stability of the financial system.”

David Larock from Integrated Mortgage Planners, and a fellow contributor to Movesmartly.com, notes that the change in the stress test will reduce a home buyer’s maximum borrowing capacity by approximately 5%.

In response to anecdotal accounts from agents suggesting that demand from investors has likely exceeded pre-pandemic levels, we dig into the numbers.

In last month’s report, I discussed how, in the wake of the Covid-19 pandemic, we saw a significant increase in the share of investors who were selling their Toronto condos due to a decline in both prices and rents, as residents fled the city core amidst widespread office, workplace and school closures. This trend gradually began to decline as prices started to rise again due to a boom in downtown condo sales that began in December 2020 and continued to surge during the first quarter of 2021. Sales in the City of Toronto for the first quarter were up 74% over last year and the share of units selling for over the asking prices ended the quarter at just under 60%.

It’s difficult to say for certain how much of this demand is being driven by investors, but anecdotal accounts from agents suggests that demand from investors has likely exceeded pre-pandemic levels.

While our real estate brokerage Realosophy Realty does track the share of properties sold to investors at any given point in time (something you can browse for every neighbourhood and municipality in the GTA on our website) our methodology lags the market by roughly 6-8 months, as we need the time to determine if buyers taking possession of their units then rent them out (i.e., as an investor). This means that the % of investor stats we report for the month of May, for example, reflects the nature of purchases that occurred in September or October in the preceding year.

In the interim, we wanted to get a better sense of the financials that are motivating investors to buy condos so we analyzed all of the condos that closed (i.e., the day ownership transferred and the new buyer took possession) in the old City of Toronto boundaries (browse a map of the area here) during the first quarter of 2021 and checked to see how many of those units were subsequently rented between January - April of this year. We analyzed the old City of Toronto because this was the area hardest hit by the pandemic and the area that has seen the biggest rebound.

There are some flaws with our methodology, specifically that condos that closed in January had a longer time to be rented out then those that closed March, which likely undercounts the share of investors in March. Nevertheless, this admittedly rough analysis still provides us some insight into where market trends may be going.

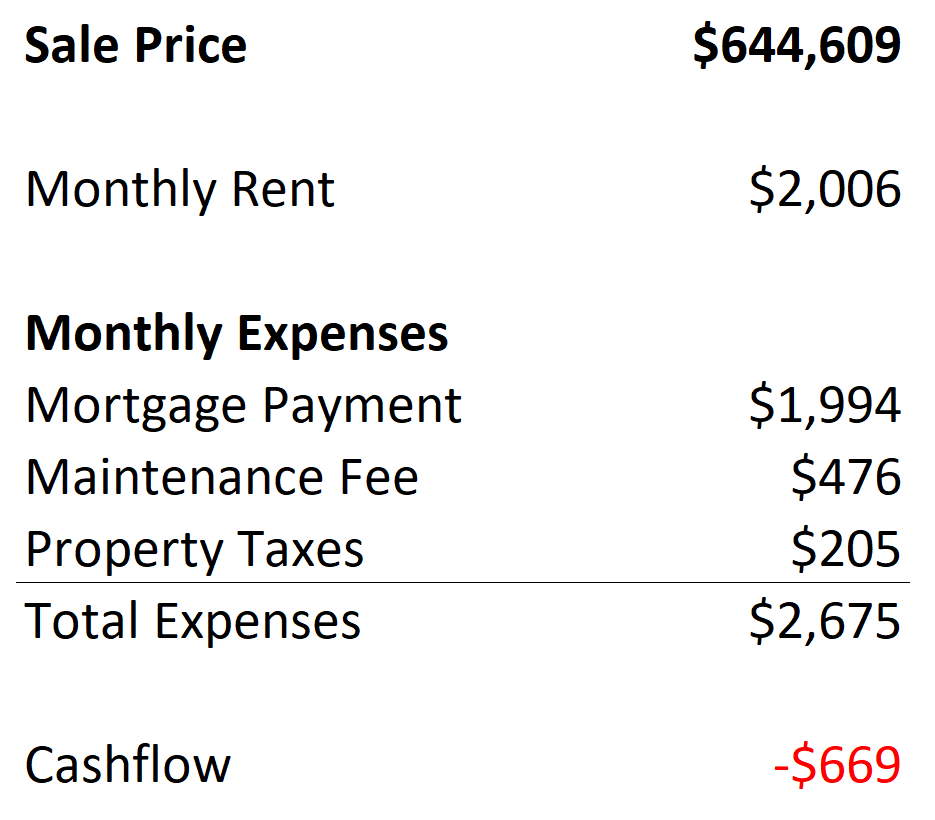

We estimated the cash flow of these investment properties using the actual maintenance fees, property taxes and rent for each individual condo unit that was bought and leased by an investor. We assumed that investors were making a 20% down payment and were paying 2.5% on their mortgage amortized over a 30-year period.

Here’s what we found:

There were a total of 2,634 condominium apartments that closed during the first quarter of 2021. Of those, 447 units (17% of the total) were listed for lease on the MLS during the first four months of the year and of those, 283 or 63% found a tenant and were leased.

Of the properties that were leased, below is an overview of the average purchase price, rent and carrying costs for the properties.

So how does this current cash flow for investment condos compare to the historical average?

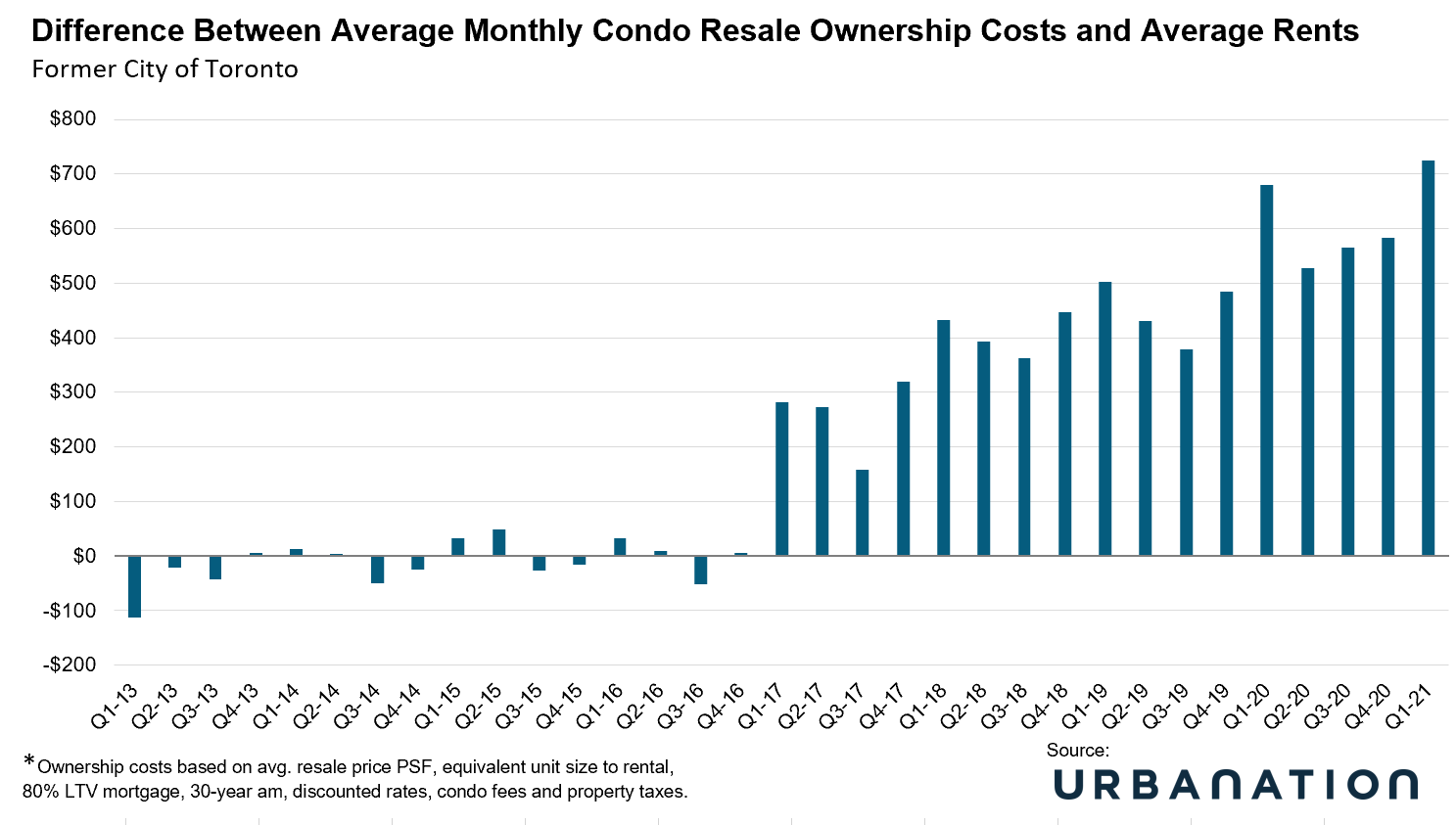

Condominium research firm Urbanation shared their calculations with us that show the difference between condo ownership costs vs. average rents as far back as 2013. We can see that the difference between monthly costs and average rents has been accelerating since 2017.

We can see that the difference between ownership costs and average rents fell after the first quarter of 2020 in the onset of the pandemic due to a decline in condo prices and interest rates — despite the fact that average rents also fell over the same period.

Urbanation’s difference of over $700 during the first quarter of 2021 is above our calculation of $669 due to methodological differences. Firstly, Urbanation uses average rents and sale prices for all properties while we focused exclusively on those bought by investors. But more importantly, the average sale price in our analysis will likely be lower than Urbanation’s because many of the condos that closed during the first quarter of 2021 were actually purchased during the fourth quarter of 2020 when prices were much lower.

So how prudent is it to buy a rental property that is expected to fall short over $700 per month in covering all carrying costs when rented out, before even factoring in vacancy and turnover?

It depends on who you ask.

During a recent study by CIBC and Urbanation that looked at the cash flow of newly completed condos, they asked investors who were cash flow negative by $600 to $700 per month why they were ok with owning an investment condo that is losing that much money each month.

CIBC’s Benjamin Tal, Chief Economist at CIBC, described the answers they received from investors this way:

“We asked them, and they said: No, you don’t understand. We are not losing money. Somebody is paying a portion of our mortgage and over time the price of this property will rise and we will be better off.”

What did Tal think of that answer? He said:

“They are right! It’s not speculation….. If you think Toronto is unaffordable now, you wait!”

While Tal is a very good economist, I’m not sure if I can support the investment advice he’s offering. Investing in real estate is a business, and a business that bleeds cash every single month simply because the owner believes it will be worth more tomorrow is concerning.

Something tells me CIBC would not offer their commercial clients a mortgage if their net operating income couldn’t cover their mortgage payments — and yet CIBC and every other Canadian bank will issue that mortgage to any ‘mom-and-pop’ property investor.

This belief perpetuated by real estate agents, builders and experts like Tal, that it doesn’t matter if your cash flow is short $700 per month on an investment condo, just hurry up and buy now or you’ll never be able to afford one — is the type of belief that fuels speculative real estate bubbles.

Many of the investors who were buying single family houses in Toronto’s suburbs in 2016 and 2017 were buying for the same reasons Benny described. Back then, investors were losing more than $1,100 each month (on properties bought for over $1 million), but they didn’t care because someone else was paying their mortgage and like Tal suggests, they believed that real estate prices will only go one way — up!

Nobody knows where home and condo prices will be tomorrow in part because there are a lot of factors that we can’t predict — like what Ontario’s jobs and immigration numbers will look like post-pandemic. If we see a boom in non-permanent residents similar to what Ontario experienced over the past 6+ years then rents will likely increase quickly which will make these condos more attractive investments.

But if rent growth remains sluggish, perhaps as the pandemic continues to affect parts of the world where this immigration is normally expected from or due to changes in renter behaviours, I’m not sure telling people to buy an investment condo no matter what is the best advice, especially when so much of the reasoning for this advice is that Toronto can never build too many 600 sq. ft. condos.

When investors are driving our new housing supply and when the majority of that supply is a very specific type of property — small condos — there is always the risk that we may be building too many as the money flows in — for now.

Only time will tell.

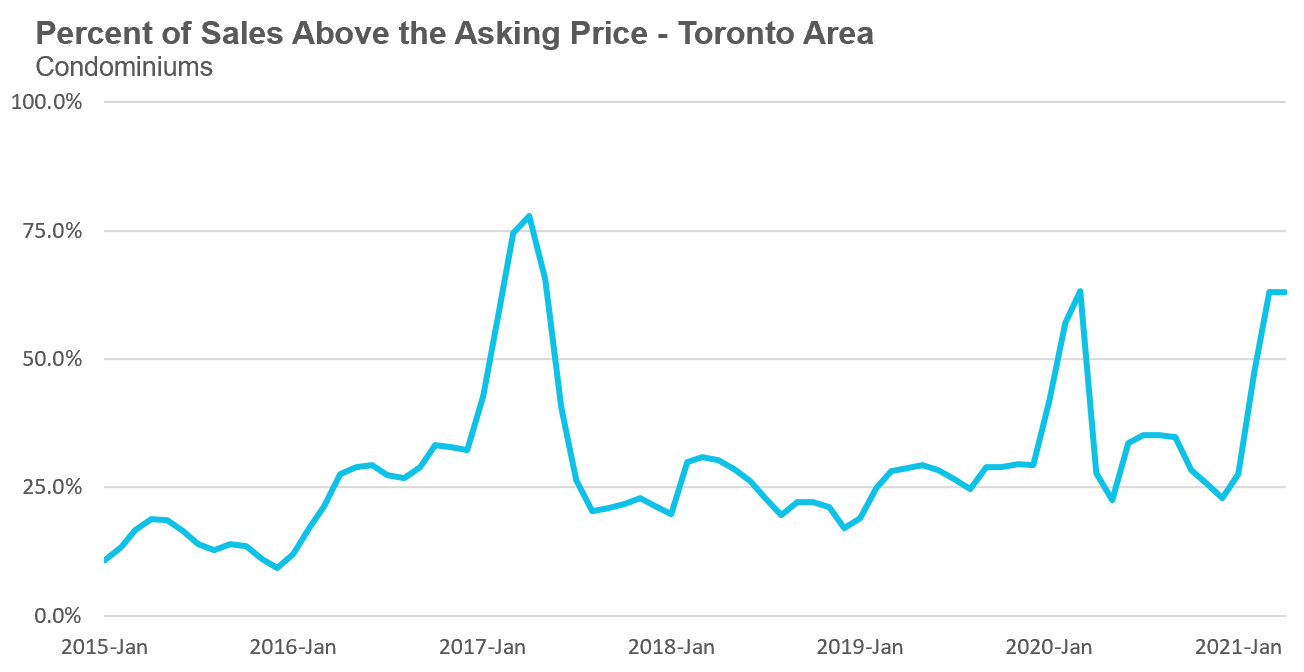

The share of houses selling for more than the owner’s asking price dropped from 79% to 73% in April while the share for condos rose to 63%.

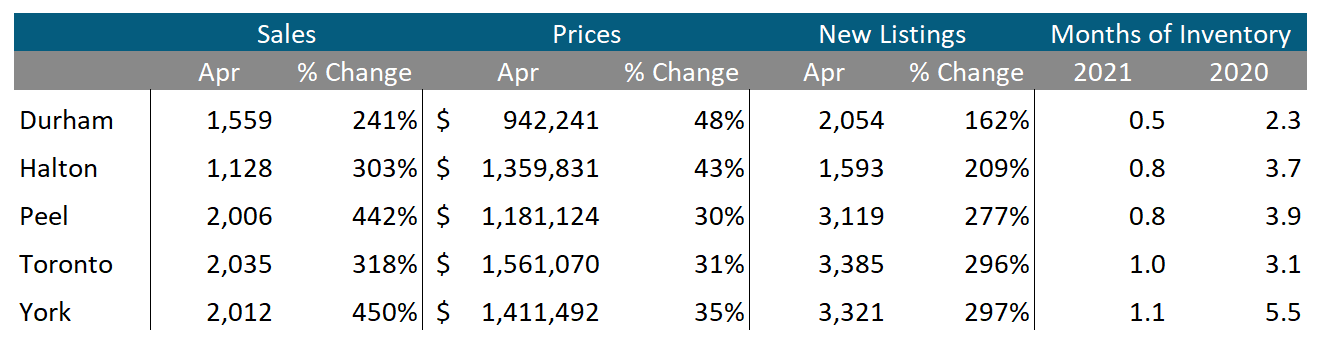

House sales (detached, semi-detached, townhouse, etc.) in the Toronto area in April 2021 were up 346% over the same month last year, which saw very low sales volumes during the first month of Ontario’s COVID-19 lockdowns. The 8,740 sales in April represents a 13% decrease from the record 10,068 sales achieved in March.

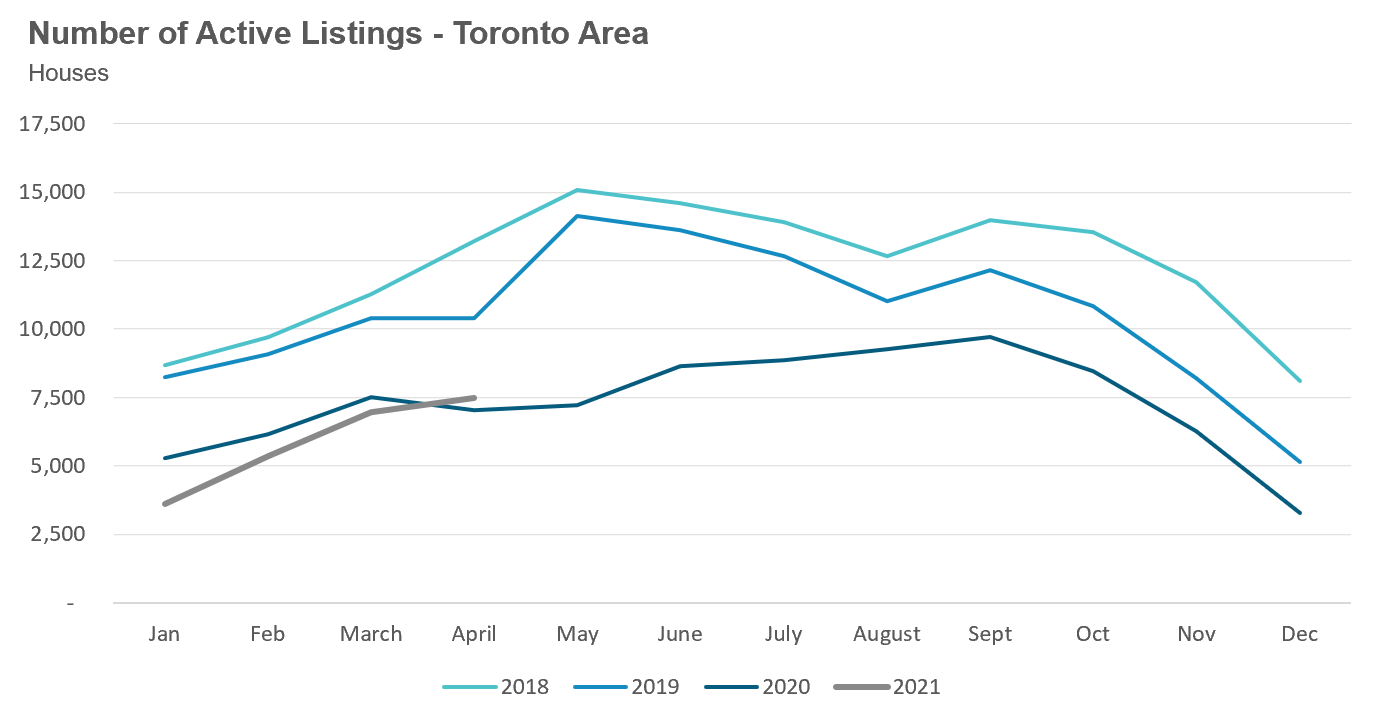

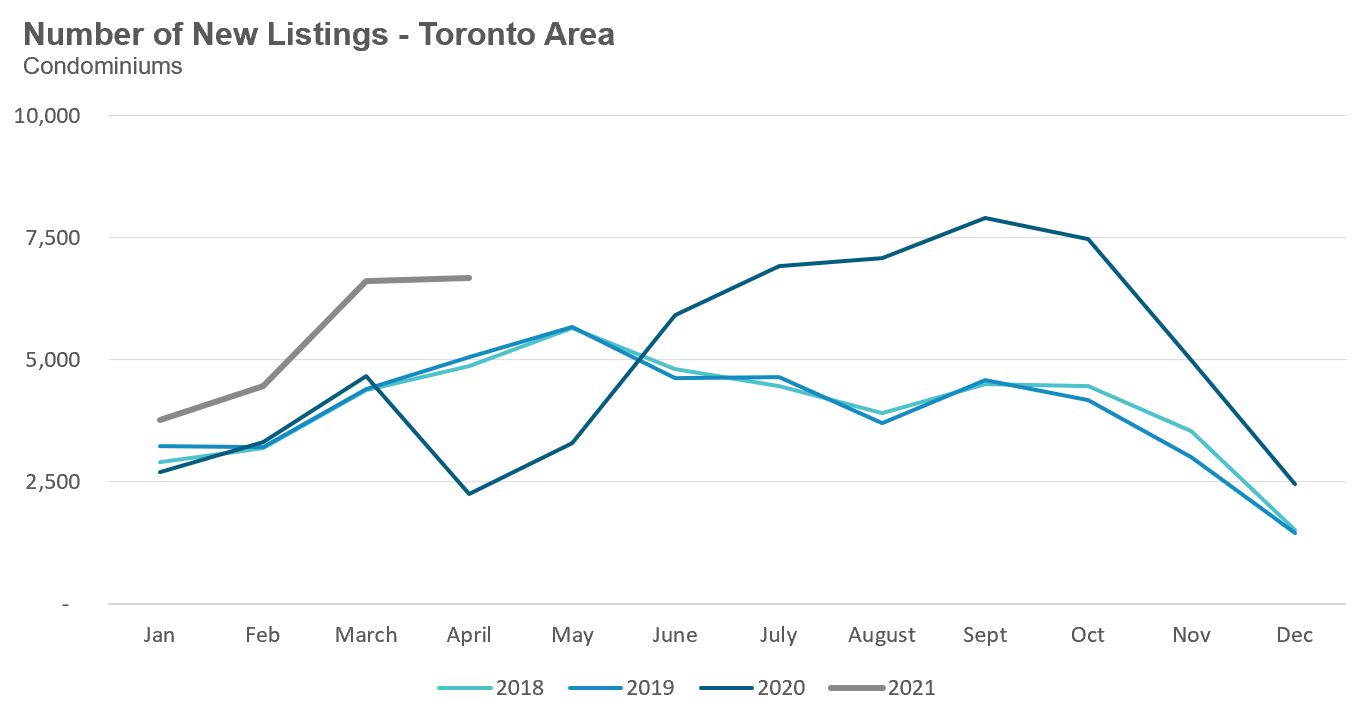

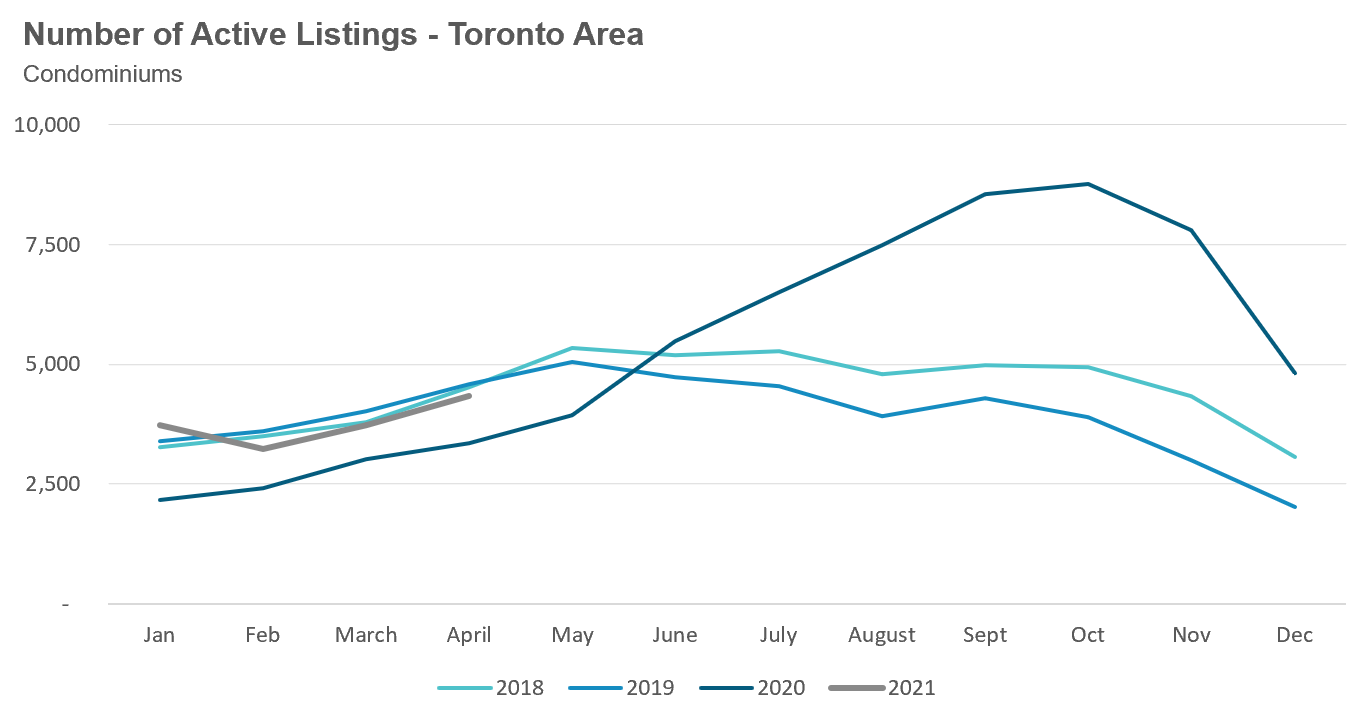

New listings in April were up 253% over last year while the number of houses available for sale (“active listings”) was up 6% when compared to the same month last year.

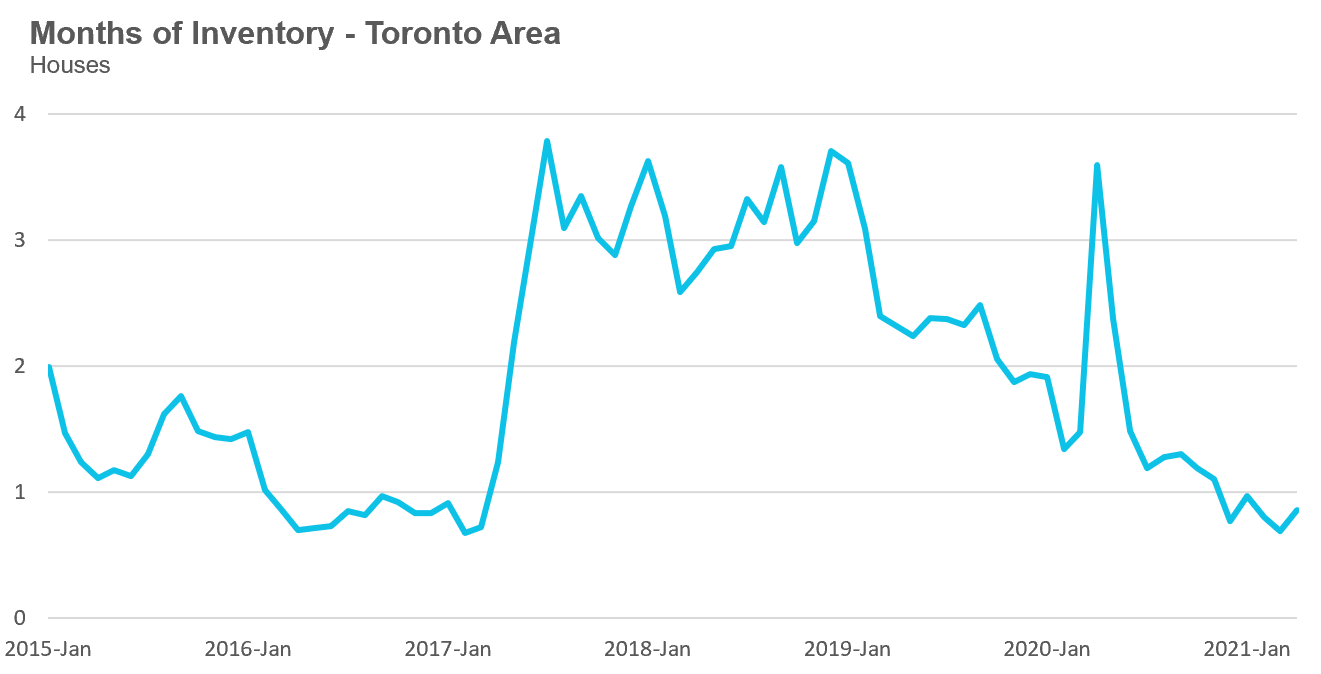

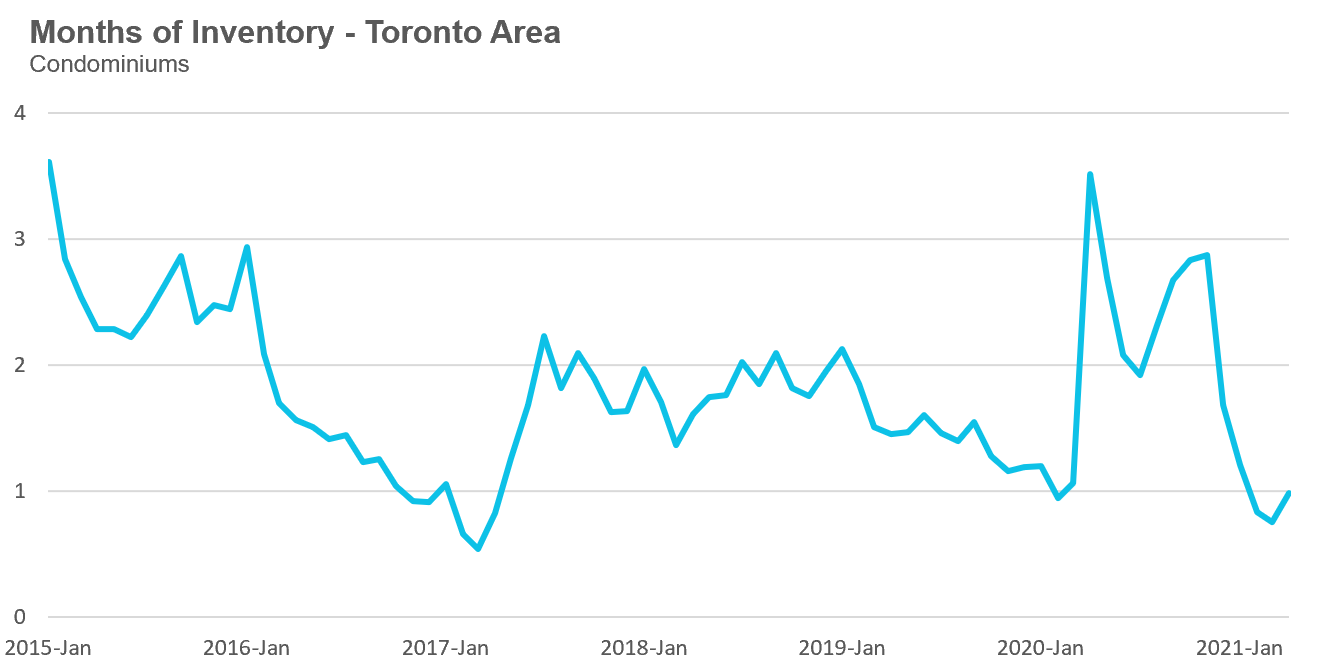

The Months of Inventory ratio (MOI) looks at the number of homes available for sale in a given month divided by the number homes that sold in that month. It answers the following question: If no more homes came on the market for sale, how long would it take for all the existing homes on the market to sell given the current level of demand?

The higher the MOI, the cooler the market is. A balanced market (a market where prices are neither rising nor falling) is one where MOI is between four to six months. The lower the MOI, the more rapidly we would expect prices to rise.

The market remained very competitive in April with an MOI of just 0.9 months.

While the current level of the MOI gives us clues into how competitive the market is on the ground today, the direction it is moving in also gives us some clues into where the market may be heading. The MOI has remained relatively stable at or below 1 MOI for the past five months.

The share of houses selling for more than the owner’s asking price dropped from 79% to 73% in April. While this figure still suggests a very hot and competitive market, we are finding at our brokerage that the number of offers that houses are receiving on their offer nights has declined significantly and in many cases houses may only get one offer. In cases like these, a house priced lower to encourage multiple offers will still likely sell for more than the owner’s asking price because the buyer knows the asking price does not reflect the actual market value of the house.

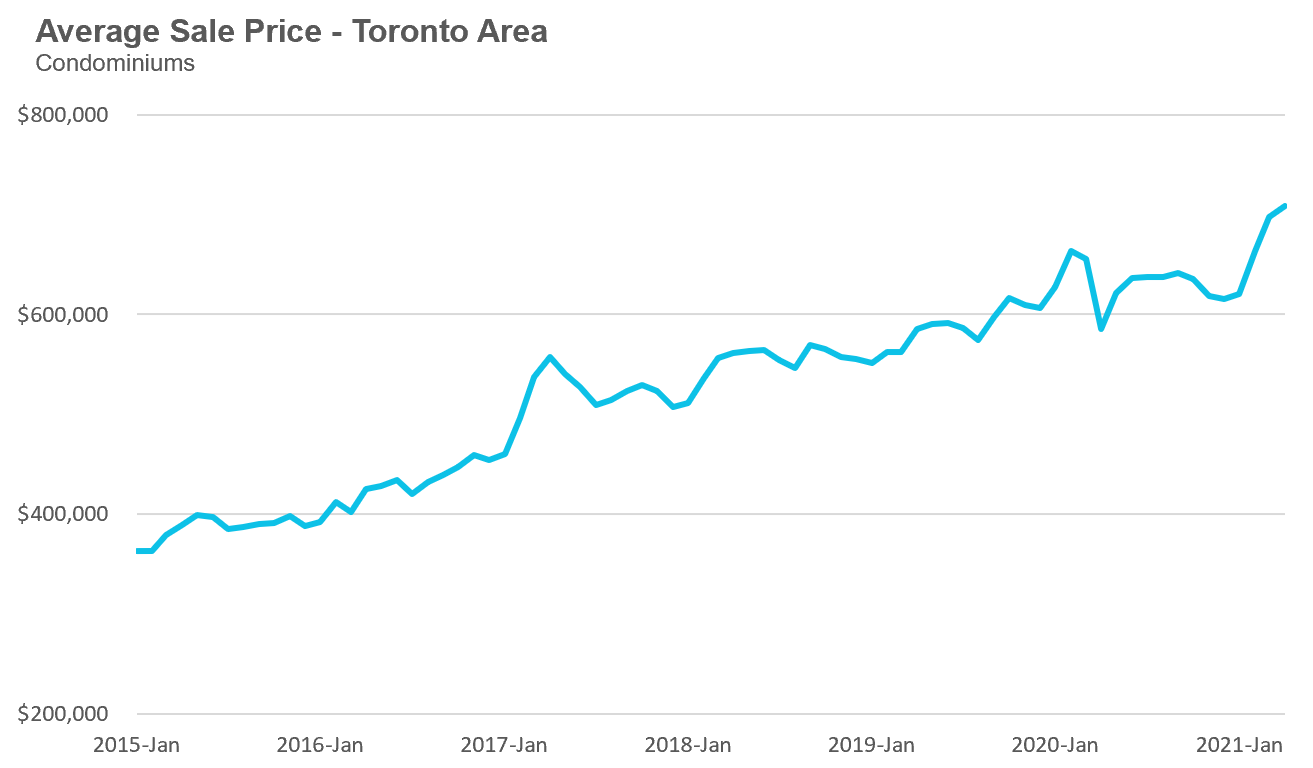

The average house price in April was $1,303,075 while the median was $1,1395,000 which were both up 38% over last year.

While prices are up significantly over last year — in part due to a big drop in prices last year as fewer high-end houses sold during the first lockdown — the key trend right now is that prices appear to have plateaued.

After prices increased by $200,000 between the last quarter of 2020 and the first quarter of 2021, it wasn’t clear if the rapid acceleration in house prices would continue or level off. The surge in new listings over the past few months has cooled house price appreciation.

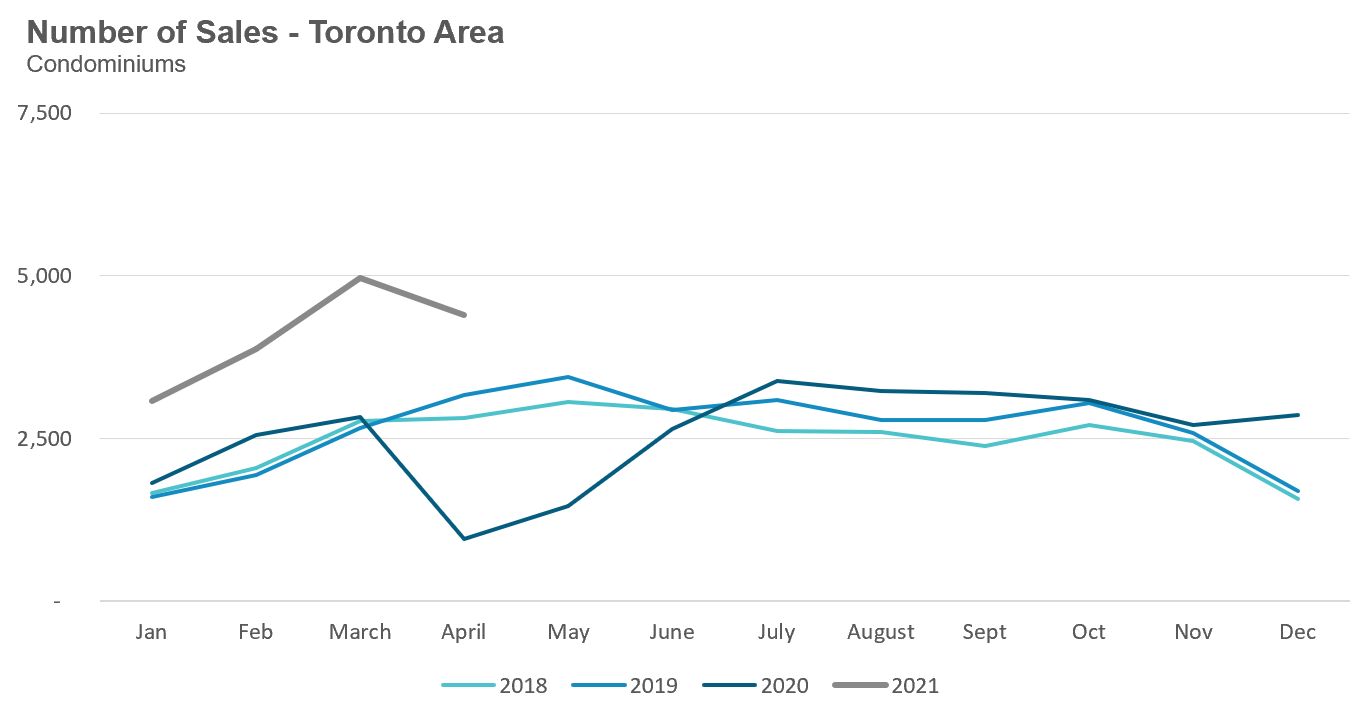

Condominium (condo) sales (condo apartments, condo townhouses, etc.) in April were up by 362% over last year due in part to depressed sales last year during the first month of Ontario’s COVID-19 lockdowns.

New condo listings were up by 198% in April 2021 over last year while active listings were also up 29% over last year.

But the strong sales resulted in a very competitive condo market with the MOI at 1 for the month of April.

The competition for condos has picked up considerably since December when 23% of condos were selling for more than the owner’s asking price. In April, 63% of condos sold for more than the owner’s asking price.

Toronto area average condo prices are up 21% over last year while the median was up 18%. While this big increase is partly due to the sharp decline in average price last year during the first month of the lock down, it’s worth noting that on a month-over-month basis condo prices are accelerating.

Average condo prices were in the low $600K range during the fourth quarter of 2020 and have now surpassed $700K in April.

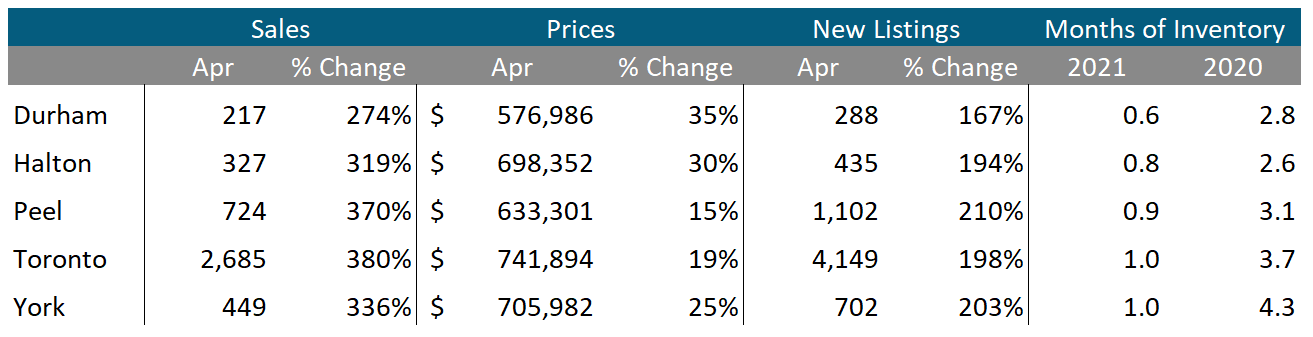

Sales across all five regions in the GTA were up significantly in April as were average prices. Despite the increase in new listings inventory levels are at or below 1 month across the entire GTA.

The surge in condominium sales continued in April across the entire GTA. Average prices were up across the suburban regions with the City of Toronto. Inventory levels are below last year’s levels for all five regions.

Greater Toronto Area Market Trends

Market Performance by Neighbourhood Map, Toronto and the GTA

More Data for Realosophy Clients

Realosophy clients can access the same information above plus additional information on every home for sale, including building permit history, environmental alerts and more. Visit Realosophy.com/buy or contact your Realosophy agent for more details.