What economic research says about how real estate prices tend to move when the market changes suddenly.

As Featured in the monthly Move Smartly Report for September 2022 - watch video above or on our Move Smartly YouTube channel here; read story below and go to report to read all stories for the month.

FREE PUBLIC WEBINAR: The Market Now with John Pasalis

Join John Pasalis, report author, leading market analyst and Move Smartly contributor, and President of Realosophy Realty, and in a free monthly webinar as he discusses key highlights this month's report and answers your questions. A must see for well-informed Toronto area real estate consumers.

Register now to get recording of latest session and access to future sessions.

The median price for a home in the Toronto area in August was $930,000, a 23% decline from the peak of $1,205,000 in February.

The common explanation for this rapid decline in home prices is that the rapid increase in interest rates dampened buyer demand; while rising interest rates have contributed to slower demand, it is also possible that the market was naturally slowing down after a huge surge in demand during the pandemic.

But regardless of what causes it, falling demand doesn’t always result in immediate decline in prices. As economist Karl Case explains, when housing markets cool, demand typically falls, inventory rises and prices actually ‘stick’ or plateau for a while before actually falling, as described here:

“Another important aspect of housing market efficiency is that prices tend to be sticky downward. In most markets, when excess supply develops, prices fall quickly to clear the market. But housing downturns have been characterized by sticky prices. Sales and starts drop but prices are slow to respond.”

- Karl Case

Why are home prices typically sticky on the way down?

Case offers a couple of explanations:

“Prices might be slow to respond to imbalances for various reasons. Since housing is heterogeneous, comparable sales do not represent identical units, so sellers are uncertain of the actual worth of their property….. Also, sellers tend to view the worth of their property as embodied in comparable sales at the peak. The dramatic rise in inventory of unsold homes at the beginning of every downturn is strong evidence of this stickiness”

- Karl Case

In short, in a typical housing downturn a decline in demand is followed by a dramatic rise in inventory as owners are slow to adjust their prices. As the inventory of unsold homes continues to build, this eventually leads to a decline in home prices.

But if prices are sticky on the way down, why did median home prices in the Toronto area fall 23% in just six months this year? Furthermore, if this decline was entirely about interest rates, why didn’t home prices everywhere else in Canada fall just as rapidly?

High interest rates, and the expectation that interest rates would keep rising this year, did cool the demand for homes dramatically. Many home buyers hit pause on their home search towards the end of the first quarter of this year which is why home sales since May have been at a 20-year low.

But why didn’t these sellers remain patient and stick to their price, resulting in the steep inventory increase and sticky prices we’d expect to see during the beginning of any housing downturn?

The answer lies in the sudden nature of the housing market downturn with prices and sales hitting a record peak in Feb after which prices started to tumble down. Typical of a buoyant market, sellers had already committed to buying a home weeks earlier and needed to sell their current home to afford the home they had just bought. When they saw that their properties were getting very few viewing from buyers, sellers were very quick to adjust their price expectations down to ensure their current home sold so as not to default on their other home purchase.

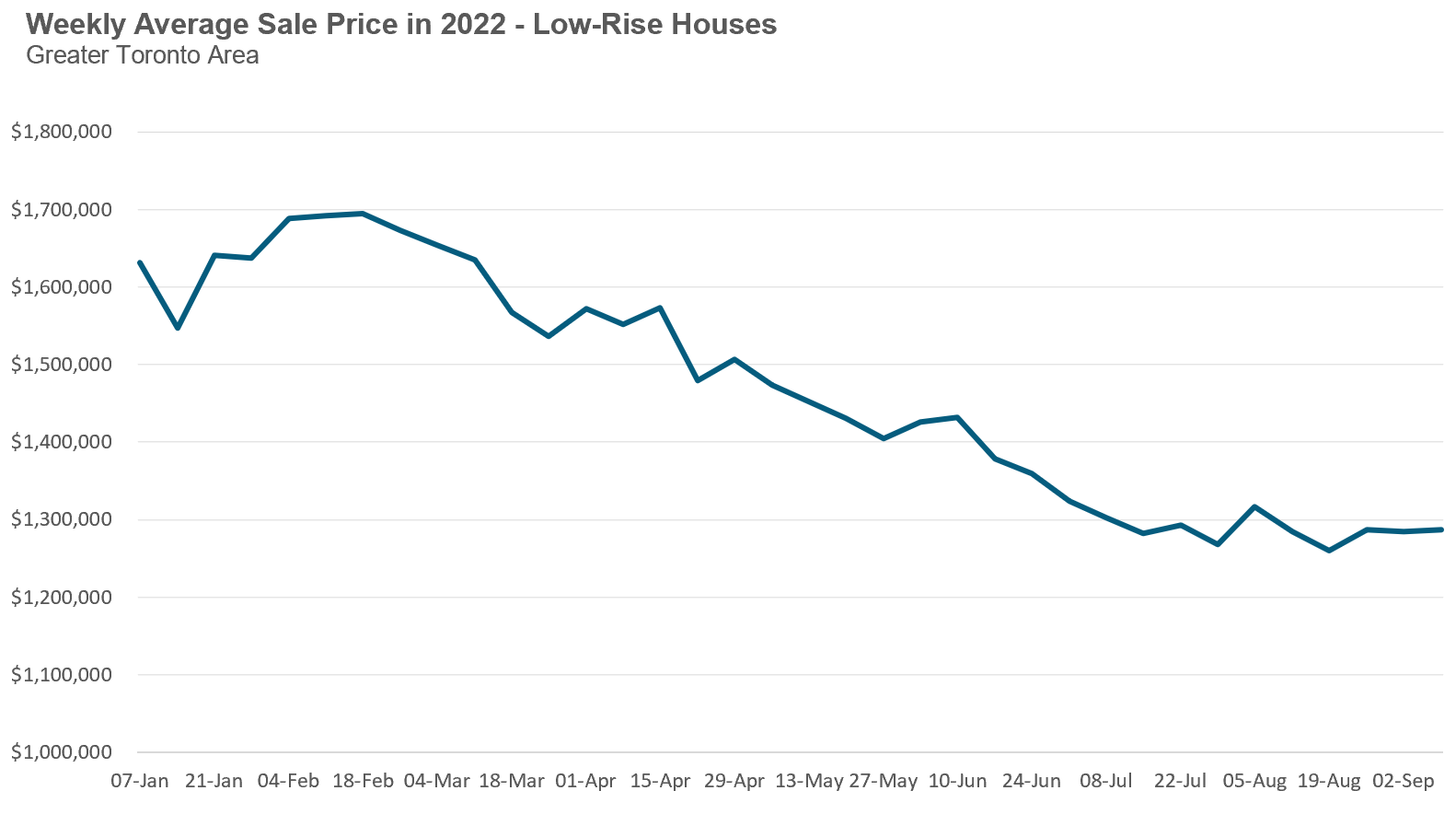

This led to the rapid decline in prices, in particular for low-rise homes. We can see from the chart below that average prices have been trending down virtually every week since late February, but appear to have plateaued over the past two months.

Prices have started to plateau because there are very few sellers left who urgently need to sell their current home. Once a market starts to cool down, most consumers switch to selling their home before buying a new one so they are not as pressured. Without this urgency, sellers appear to be behaving the way Case describes above in being very slow to adjust their price expectations downwards. Furthermore, a high proportion of sellers are simply taking their homes off the market rather than taking a deep discount on their asking price (see the Data Dive section of this month's full report for more on this).

It’s unlikely we’ll see another sudden and rapid drop in home prices the way we experienced earlier this spring — unless the majority of buyers start buying homes before selling their current home again, which is unlikely to happen in a slowing market. I expect that any potential future decline in prices would likely follow the typical pattern Case described above: a low number of sales leading to an increase in inventory with prices ‘sticking’ and plateauing for a little while before sellers start adjusting their prices down.

If that is the case, the first indicator that prices will resume falling will be rising inventory levels so we’ll keep an eye on this key metric.

Top Image Credit: Getty/iStock

The Move Smartly monthly report is powered by Realosophy Realty Inc. Brokerage, an innovative residential real estate brokerage in Toronto. A leader in real estate analytics, Realosophy educates consumers at Realosophy.com and MoveSmartly.com and helps clients make better decisions when buying and selling a home.

John Pasalis is President of Realosophy Realty. A specialist in real estate data analysis, John’s research focuses on unlocking micro trends in the Greater Toronto Area real estate market. His research has been utilized by the Bank of Canada, the Canadian Mortgage and Housing Corporation (CMHC) and the International Monetary Fund (IMF).

.jpg?width=600&name=Public%20Webinar%20Social%20%E2%80%93%20Sept%202022_MoveSmartly_%20600x300%20(1).jpg)