A closer look at the more likely - though yet to be seen - factors.

As featured in our monthly Move Smartly Toronto Area Market Report - Read full report here

A Perennial Question

The start of a new year is a perfect time to tackle what has become one of the most common — and still important — questions I get about the Toronto area housing market — What’s going to cause the market to cool and when is that finally going to happen?

When most people ask this question, what they want to know is when are prices going to fall, but first we have to think about how the market is going to cool down — going from a market where 3 out of 4 homes are getting multiple offers because there is less than 1 month of available inventory (MOI) to a market where closer to 1 in 4 homes are getting multiple offers and MOI is 2 to 3 months.

In other words — before home prices can go in reverse and actually fall, the market needs to slow down first.

So what might cause the market to slow down?

A cool down in the housing market typically starts with a decline in demand (as opposed to a surge in supply) and I think there are multiple factors that may result in a decline in demand this year.

Coming Buyer Fatigue?

This first factor that could lead to a decline in demand is buyer fatigue due to high home prices. First-time buyers are a big driver of housing demand, and among these buyers, those looking for a 3-bedroom family home are being particularly squeezed.

Buying a home for under $1 million is becoming increasingly difficult and many first time buyers in this price range are losing hope.

The under $1M price point is important to first-time buyers because homes over $1M require a bigger down payment, a minimum of 20% (as compared to as little as 5%). Buyers with less than a 20% down payment in Canada are required to purchase mortgage default insurance through the Canadian Mortgage and Housing Corporation (CMHC) or a private insurer and the maximum home price for this insurance coverage is $999,999. This means that a homebuyer spending $999,999 needs a $75,000 down payment while a buyer spending $1M needs a $200K down payment.

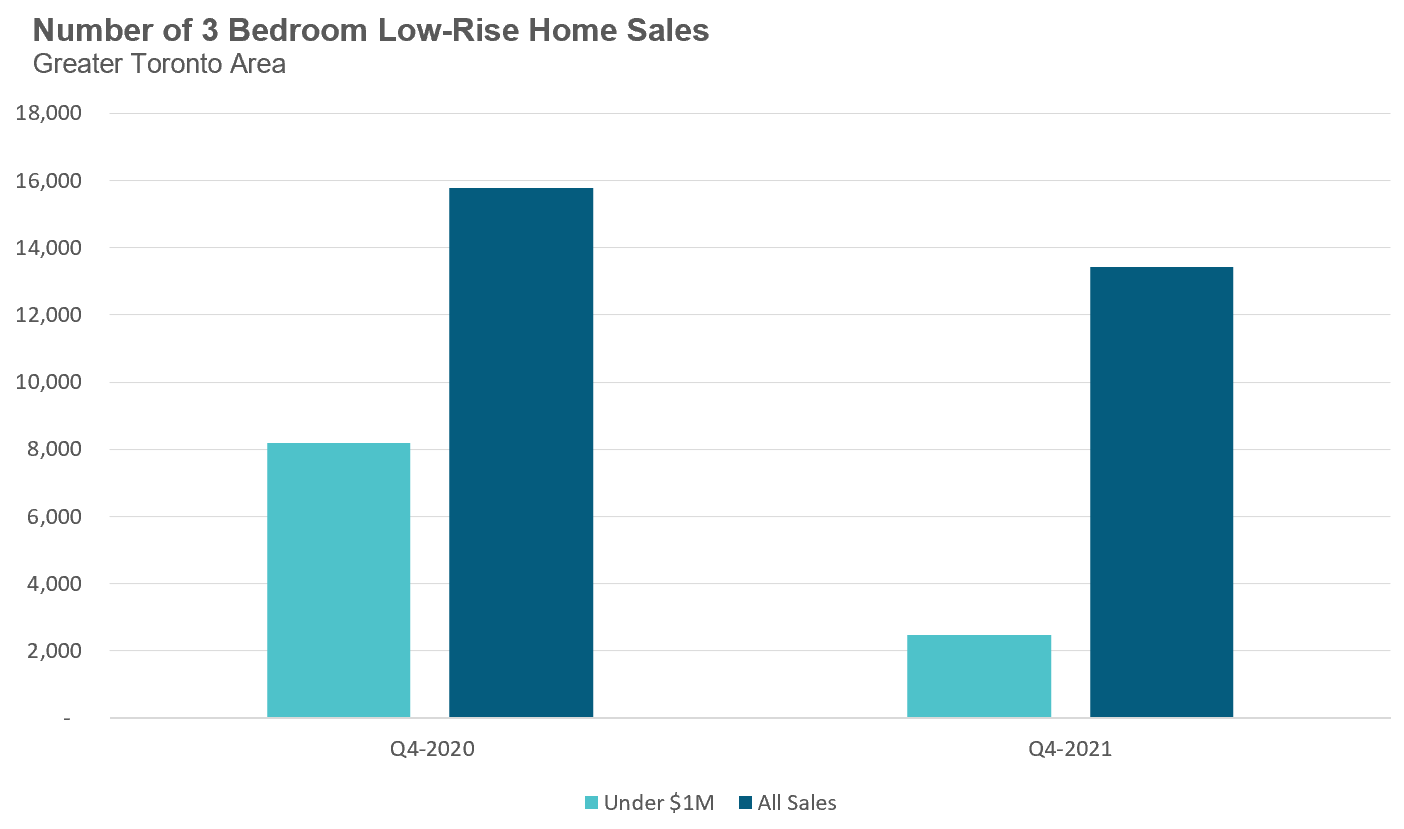

When we look at the number of 3-bedroom houses that sold for under $1M during the final quarter of 2020 vs the same in 2021, we see that the number of sales fell from 8,196 in 2020 to 2,460 in 2021.

While some buyers who were originally looking for a 3 bedroom home might end up buying a condo instead, many families do not consider an 800 square foot condo a substitute for a 3-bedroom home.

Given this, many of these buyers will end up either giving up on the dream of buying a home or will start searching for a home outside of the Greater Toronto Area in cities where homes are more affordable.

It’s worth noting that the federal Liberal government promised to increase the insured mortgage cutoff from $1M to $1.25M during Canada’s last federal election. If the Liberal government follows through with this promise, then the decline in demand I describe above will likely be delayed somewhat since this type of a policy change will stimulate demand. But such a policy move in an already overheated market would be a very misguided one. Policies that stimulate demand and debt are not solutions to housing affordability because they push home prices higher in the short-term, again adding pressure on first-time buyer budgets and leaving them no better off.

A Cap on Investors?

Moving onto another group responsible for significant demand in the market, we come to our second potential cause of a market slowdown. In response to cautions from the Bank of Canada regarding the outsized impact real estate investors are having on the housing market and the risks this presents to Canada’s financial stability, the Liberals have indicated that they are considering an increase in the down payment requirements for investment properties.

If such a change occurs, it would make it harder for investors to buy homes which will take a considerable amount of demand out of the housing market.

Such a policy change would also likely stimulate supply because many of the investors we are seeing today are not actually buying investment properties, but are holding on to their existing home as an investment property when they upsize to a bigger home. Higher down payment requirements make it harder for people to hold onto that existing home, which may have a moderate increase in the supply of new listings.

The Impact of Higher Interest Rates

The other significant factor that may cool demand in 2022 is higher interest rates. Money markets are expecting the Bank of Canada to raise interest rates from 0.25% to 1.5% by the end of the year.

Canada’s mortgage stress test requires buyers to qualify for their mortgage using the greater of the benchmark rate which is currently 5.25% or their actual mortgage rate plus a 2% buffer.

This means that if today’s home buyer is getting a 5-year fixed mortgage at 2.25%, they are actually qualifying using the benchmark rate of 5.25%. If 5-year mortgage rates rise this year to 3.5% then buyers will see their borrowing power reduced slightly because they’ll have to qualify for their mortgage using an interest rate of 5.5%, their mortgage rate plus a 2% buffer.

But where we’ll see the biggest impact of higher interest rates is not with the amount that buyers will qualify to borrow but how much they will be willing to borrow.

Let’s assume for a moment that 5-year mortgage rates go up by just 1% and this has no impact on how much a buyer can borrow — the buyer who qualifies to borrow $800K today with a 2.25% 5-year fixed rate can still qualify to borrow $800K later this year when the rate on 5-year mortgages goes up to 3.25%.

But even though this buyer’s borrowing capacity may not have changed, their borrowing costs have changed considerably. The cost to borrow $800K will increase from just under $3,500 today to just under $3,900 when rates rise to 3.25%. While some buyers will be comfortable spending an extra $400 per month on their mortgage, many will not and will either have to spend less or find themselves priced out of the GTA housing market.

Higher interest rates will also push more real estate investors to the sidelines since record low interest rates were a key driver behind the surge in demand from real estate investors in 2021.

Now, I should stress that even if we do see some or all of these factors arise this year (e.g., buyer fatigue, higher interest rates, tighter credit on investors, etc.), given how competitive the market currently is and how much slack it could take up in terms of reduced demand, I don’t expect to see any on-the-ground impacts on the ground until the second half of 2022.

A Yearly Cooling Pattern

Moving on from special factors, there is a more familiar phenomenon that will likely result in some cooling off of the market later this year, namely the seasonal nature of the real estate market.

The first quarter of every year is typically the most competitive and 2022 will be no different.

Most people assume the spring market is the most competitive because it has the highest number of sales, but it actually contains a few different on-the-ground trends.

Most buyers who want to buy a home in the spring typically start their home search in January or February because they know it will take them several months to buy a home. But the first quarter of every year also has a relatively low number of new listings so we end up with a lot of buyers competing for very few homes available for sale.

As we move toward the spring market, tens of thousands of buyers exit the market because they’ve already bought and thousands more homes get listed which means the market tends to be very busy, but less competitive than it is in the tighter market conditions at the start of the year.

This yearly trend will continue in 2022, and will likely be worse than in previous years given the low inventory currently available for sale. If the market does return to these familiar yearly patterns, we should start to see some cooling by late spring to early summer.

Cooling Down is Not Falling — Yet

All of the above factors may result in the cooling of the market, but as I discussed above, this doesn’t mean that prices are going to fall right away. Given how hot the market is in favour of sellers, what we will first see in the event of cooling is a gradual move to a more balanced market.

In my next post, I'll discuss how likely it is that the Toronto market could cool to the point where home prices actually starting falling.

Top Image Credit: Getty/iStock

John Pasalis is President of Realosophy Realty, a Toronto real estate brokerage which uses data analysis to advise residential real estate buyers, sellers and investors.

A specialist in real estate data analysis, John’s research focuses on unlocking micro trends in the Greater Toronto Area real estate market. His research has been utilized by the Bank of Canada, the Canadian Mortgage and Housing Corporation (CMHC) and the International Monetary Fund (IMF).

Follow John on Twitter @johnpasalis

Email John