In this month's Move Smartly report, we look at key trends to keep an eye on in the Toronto real estate market during 2021.

As Featured in the Move Smartly Report:

Bubble-Like Conditions for Houses

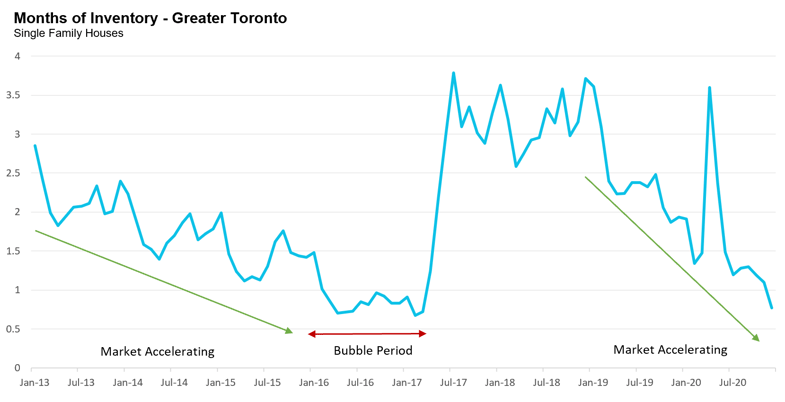

As I noted in my December 2020 report, the market for single-family houses (not condo s) is showing alarming bubble-like symptoms reminiscent of what we saw in 2016 and 2017 in the GTA.

Not only is the GTA’s suburban housing market very competitive today with prices up more than 20% in some regions, like Durham and Halton, but the market keeps getting hotter with every month that passes.

It’s the combination of the velocity (a hot housing market today) and the acceleration in the market (a market that keeps getting hotter) that is concerning.

After GTA home prices fell in 2017, the GTA housing market remained relatively stable for 18 months with roughly 3 months of inventory. But since 2019, inventory has plummeted from 3.6 MOI in Jan 2019 to under one month in December 2020.

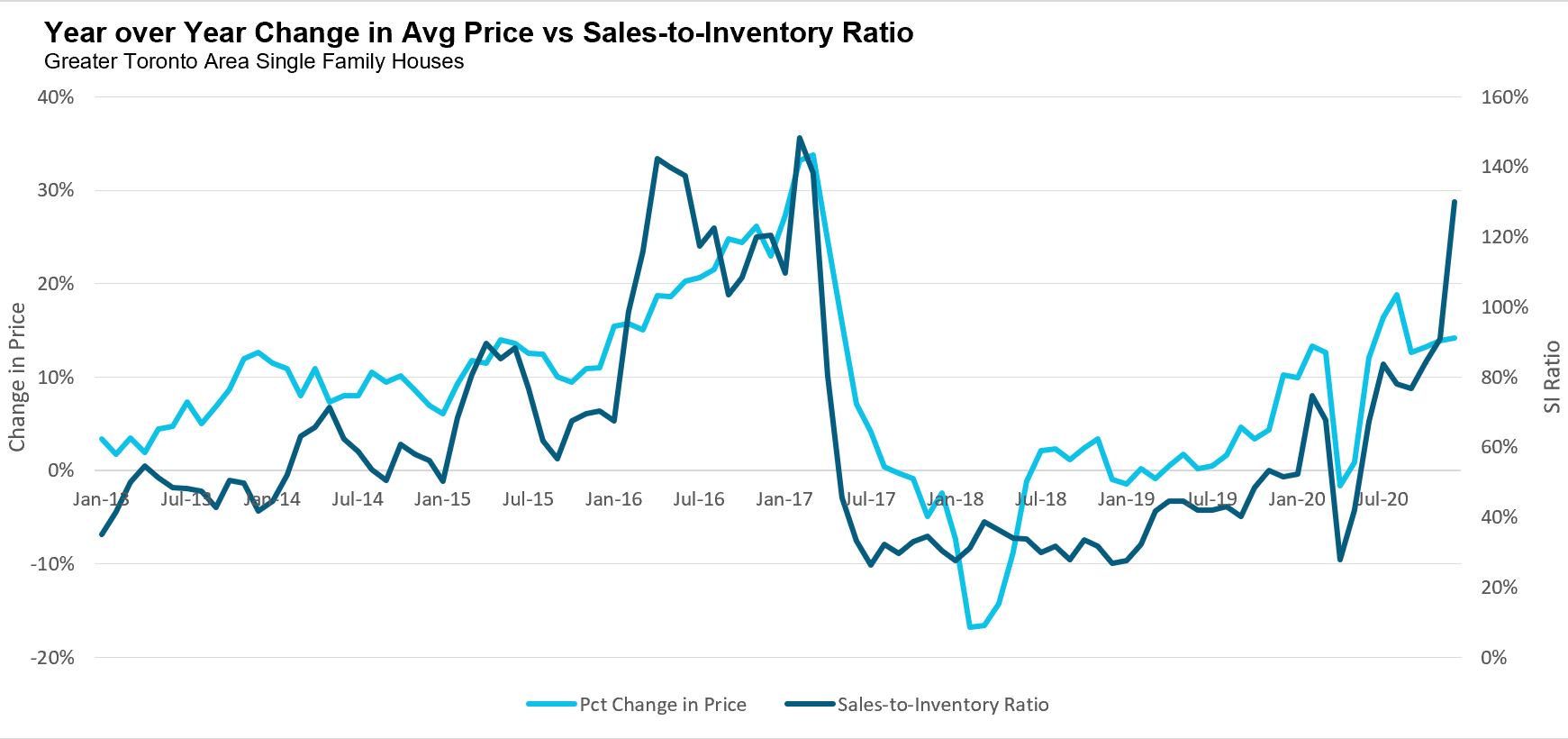

MOI levels are important because they are highly correlated with changes in house prices. We can see this by plotting the year-over-year change in average prices against the inverse of MOI (to make the relationship positive rather than negative) which is called the Sales-to-Inventory ratio.

This tight level of supply is resulting in 50% or more of houses selling for more than their asking price. The last time this happened was in 2016.

All early indicators point to a market that will continue to heat up as we move into the first quarter of 2021 market.

We are even seeing alarming signs of homeowners flipping houses for 25-30% more than they purchased them six months earlier – in the summer of 2020 without doing any renovations. We haven’t seen this type of speculative behaviour in Toronto since the late 1980’s.

If these trends continue, it could lead to an even more rapid acceleration in house prices fueled by extrapolative expectations rather than market fundamentals.

Will Investor Demand for Condos Stick?

The post lock-down rebound in the condo market was far softer than what we saw for houses, with the suburban condo market performing slightly better than the downtown condo market.

But as noted above, during the last six weeks of 2020, we saw a significant rebound in interest from condo investors looking to capitalize on the decline in condo prices with the hope that the rental and resale market will rebound in the near future.

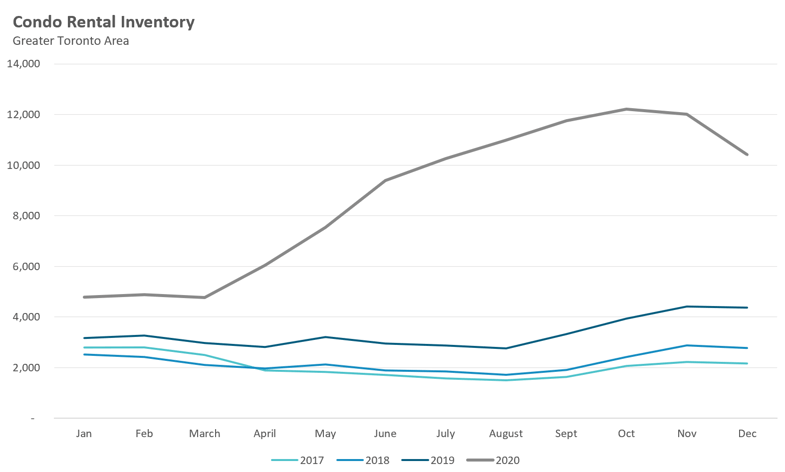

Where the condo market goes from here will largely depend on what the rental market looks like in the first quarter.

If the rental market, both inventory levels and rents, remains stable (i.e., avoiding declines) then I expect investor demand to continue into 2021, effectively setting a floor on resale condo prices - something I discussed further in this BNN Bloomberg interview.

But if the rental market continues to soften, I suspect this may push investors back to the sidelines.

While inventory levels have declined slightly, prices continue to trend down.

Even with the recent decline in condo prices, it takes a lot of confidence to invest in a condo that is priced at 2019 levels when rents are at 2013 levels and falling.

A Look Back at the CMHC Forecast

As mentioned above, shortly after the onset of COVID-19 early in 2020, CMHC came out with the most pessimistic forecast for Toronto’s housing market expecting a sustained decline in both house sales and prices.

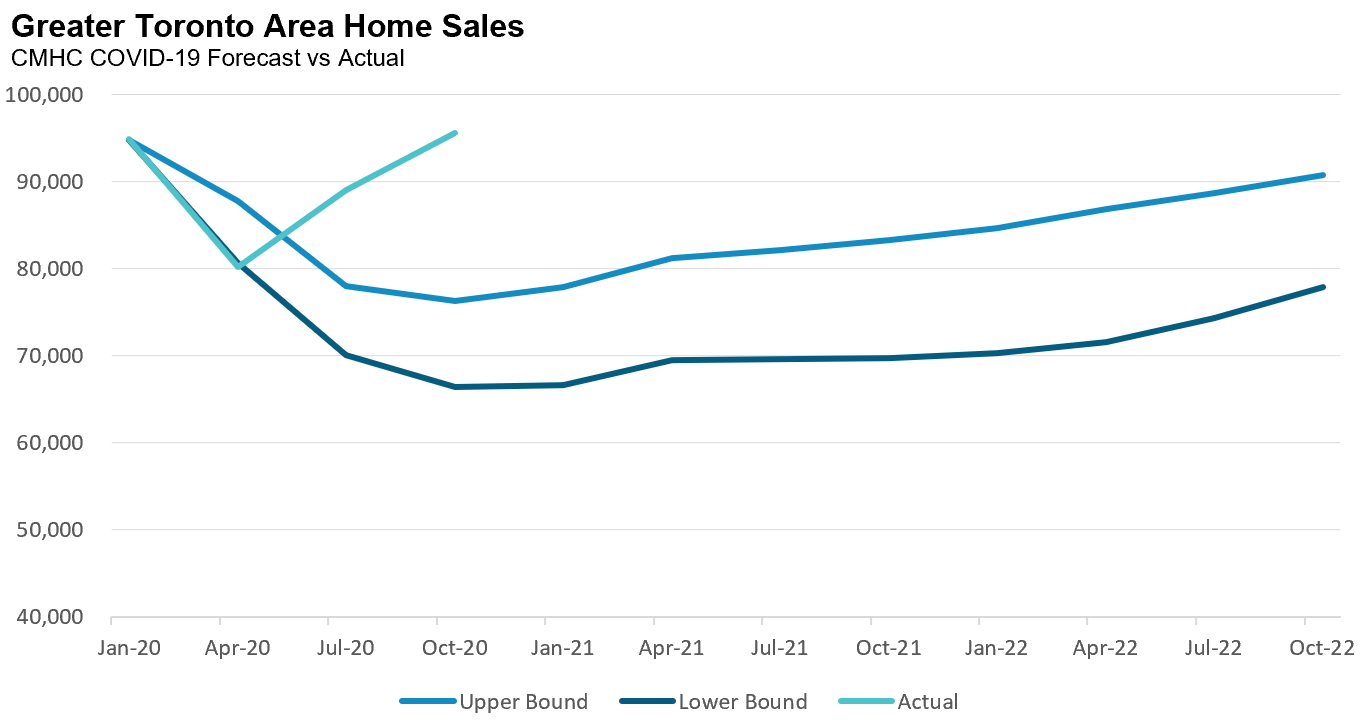

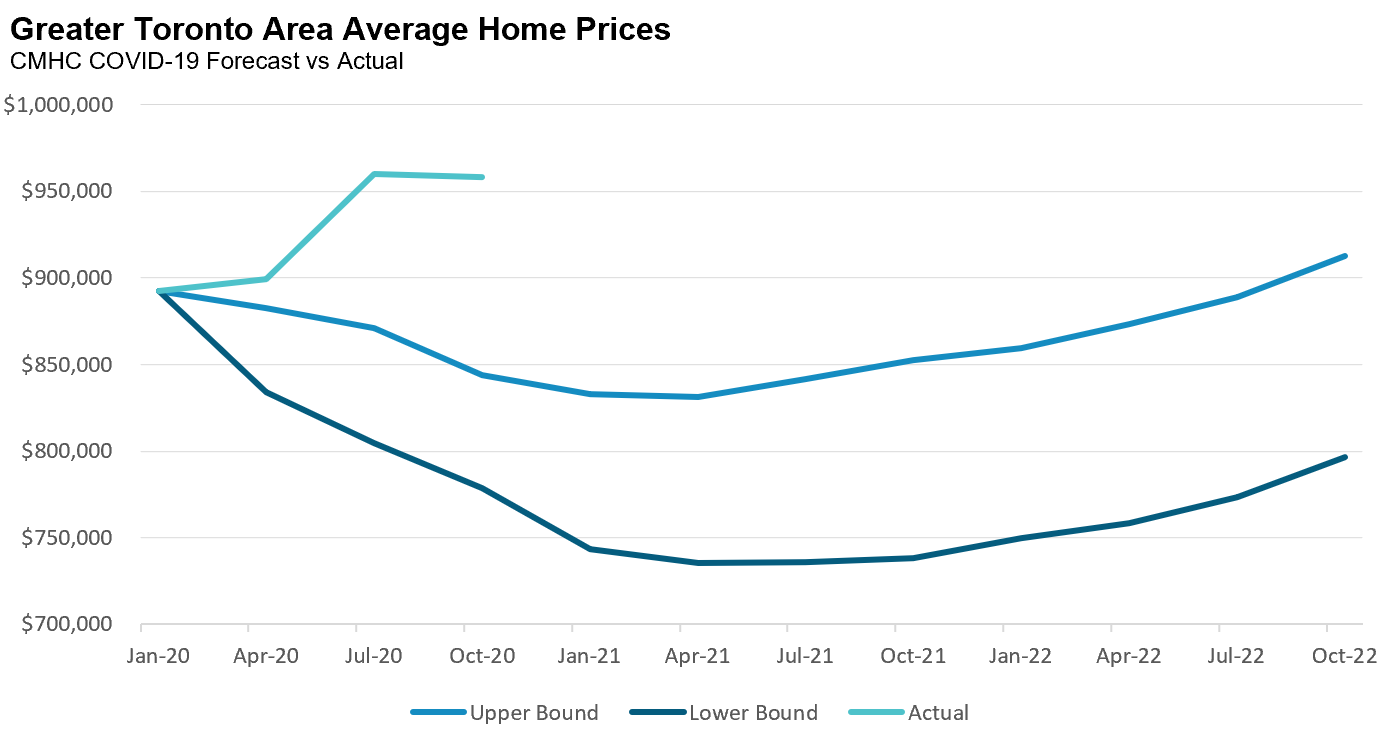

CMHC’s forecast range included an upper (optimistic scenario) and lower (worse than expected) bound. The charts below compare CMHC’s upper and lower bounds for the GTA for its entire forecast horizon against actual sale and price levels so far.

Note that CMHC sales are based on seasonally adjusted annual rates while actual sales are based on actual sales over the pervious twelve months.

Leaving aside the fact that we are still in the middle of this pandemic and that there is a way to go, it’s quite clear that CMHC wasn’t expecting house prices to reach today’s level until 2023 at the earliest. So why did CMHC get their forecast so wrong?

I suspect one of the major reasons has to do with the fact that CMHC was viewing this economic slowdown from the lens of a traditional, and very deep recession, which was probably not the best way to look at the economic impacts from COVID-19, as noted in this Bank of Canada Analytical Note:

The economic impact of COVID-19 is often compared with past recessions, but this pandemic arguably has more in common with natural disasters. The key feature shared by natural disasters and pandemics is a sudden stop of economic activity caused by a shock that is unrelated to economic factors—in this case, a public health crisis. This contrasts with the 2008 recession, which reflected an underlying fragility in the global financial system that resulted in a lengthy downturn.

At our July online summit, Mikael Khan from the Bank of Canada shared with me some of the thinking behind the above-quoted research note — you can see the full Interview here.

But perhaps the biggest problem with CMHC's forecast was not that it was wrong (economists often expect to be), but that it was delivered with overconfidence that a decline in house prices was a foregone conclusion.

In an era when most politicians and civil servants provide scripted answers to questions, CMHC CEO Evan Siddall’s “tell it like it is” style on Twitter was a breath of fresh air for his loyal fans. Take this tweet from May 27th in response to housing analysts that offered a more optimistic outlook for the housing market:

"Please question the motivation of anyone who wants you to believe prices will go up (yes, up) with our economy in slow motion, oil being given away, millions of Canadians on income support and a greater % of mortgages not being paid than we’ve seen since the Great Depression."

The problem with this type of impassioned messaging from the CEO of CMHC is that if you're going to make it, you better be absolutely certain you're going to be right.

If you're wrong, then the message Canadian's take from it ends up being the opposite of what was intended.

Eight months later, we hear the message that many consumers are taking away from this, which is that if home prices didn’t crash “with our economy in slow motion, oil being given away, millions of Canadians on income support and a greater % of mortgages not being paid than we’ve seen since the Great Depression,” then nothing can make house prices crash.

Of course, this is not true. As I mentioned above, we have in recent memory seen housing price corrections, such as the ones seen in the GTA suburbs in 2017 which negatively impacted average consumers.

But when authorities make such strong stands for and against positions, only to be wrong, consumer behaviour is at risk — such bold posturing may fuel the exuberance we are seeing in the housing market today.

Read my full analysis on this and other key trends in the January 2021 Move Smartly Report

Follow John's latest updates on Twitter, YouTube, Facebook or Instagram

John Pasalis is President of Realosophy Realty, a Toronto real estate brokerage which uses data analysis to advise residential real estate buyers, sellers and investors.

A specialist in real estate data analysis, John’s research focuses on unlocking micro trends in the Greater Toronto Area real estate market. His research has been utilized by the Bank of Canada, the Canadian Mortgage and Housing Corporation (CMHC) and the International Monetary Fund (IMF).