We are finally outraged about high home and rent prices enough to have Canadian politicians pledging to do something about it - will any of the proposals actually work?

As Featured in the Move Smartly Report:

FREE PUBLIC WEBINAR: REPORT HIGHLIGHTS

Join John Pasalis, report author, market analyst and President of Realosophy Realty, each month as he discusses key highlights from this report, with added timely observations about new emerging issues, and answers your questions. A must see for well-informed Toronto area real estate consumers.

As we head to the polls this September for the federal election, housing policy is, for once, a big ticket issue as the number of Canadians worried about unaffordability has reached a critical mass.

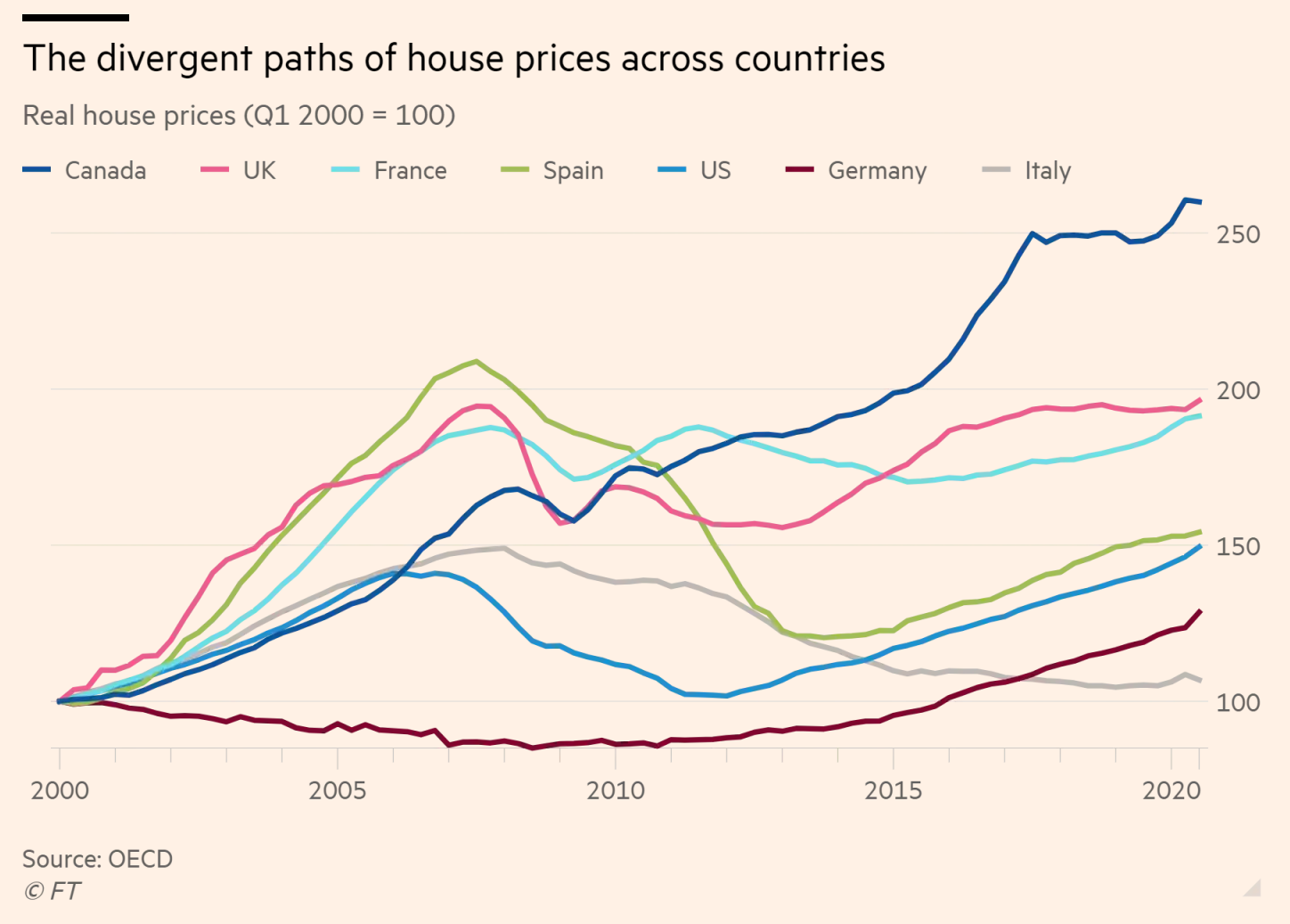

And it’s no surprise why — Canada has far outpaced the rate of growth in house prices in the rest of the developed world as shown in this chart from the Financial Times (see below).

Bringing home prices down is the obvious solution, but with home ownership at over 60% in Canada, a notably high figure it would not be a popular move with voters and it’s a risky prospect for the potential fallout for our economy as a whole as it feeds on rising home prices and household debt.

Given this, it’s perhaps not surprising that what the parties have instead presented are plans that ignore key drivers of housing demand, propose a slew of measures that drive even more demand and propose supply side solutions that are lofty in their ambitions, but unlikely to result in any meaningful change in the short term.

Lead Move Smartly contributor, John Pasalis, Realosophy President, notes that one other option is to stall the rate of growth in house prices for a number of years to allow incomes to gradually catch up with house prices. However, the parties have generally focussed more on lofty and ambitious supply-side solutions unlikely to result in any meaningful change in the short-term, and ignored critical demand-side measures, such as the need to better coordinate immigration and housing policy. Similarly, Move Smartly mortgage and financing commentator, David Larock, notes that almost all of the mortgage-change proposals being made by our three main parties will stoke more demand, which will only exacerbate the problem.

To help you navigate through the flurry of pitches being thrown at us as voters, we’ve assembled this at-a-glance comparison chart of housing policy proposals in official party platforms (note that some parties have made additional announcements, some of which are noted below as well (click on each header to link to actual party platform).

Below, our top contributors assess how likely each proposal will improve housing affordability.

|

Liberal Party of Canada (Liberal) (Incumbent) |

New Democratic Party (NDP) |

|

|

Housing Supply |

||

|

Build 1.4 million new homes by 2025-26:

|

Build 1 million homes in the next three years:

|

|

|

Renting |

||

|

|

|

|

Buyer Protection |

||

|

||

|

Speculation & Money Laundering |

||

|

|

|

|

First-Time Buyers |

||

|

||

|

Mortgages |

||

|

|

|

|

Taxation |

||

|

|

|

|

Homelessness |

||

|

|

|

Housing Supply

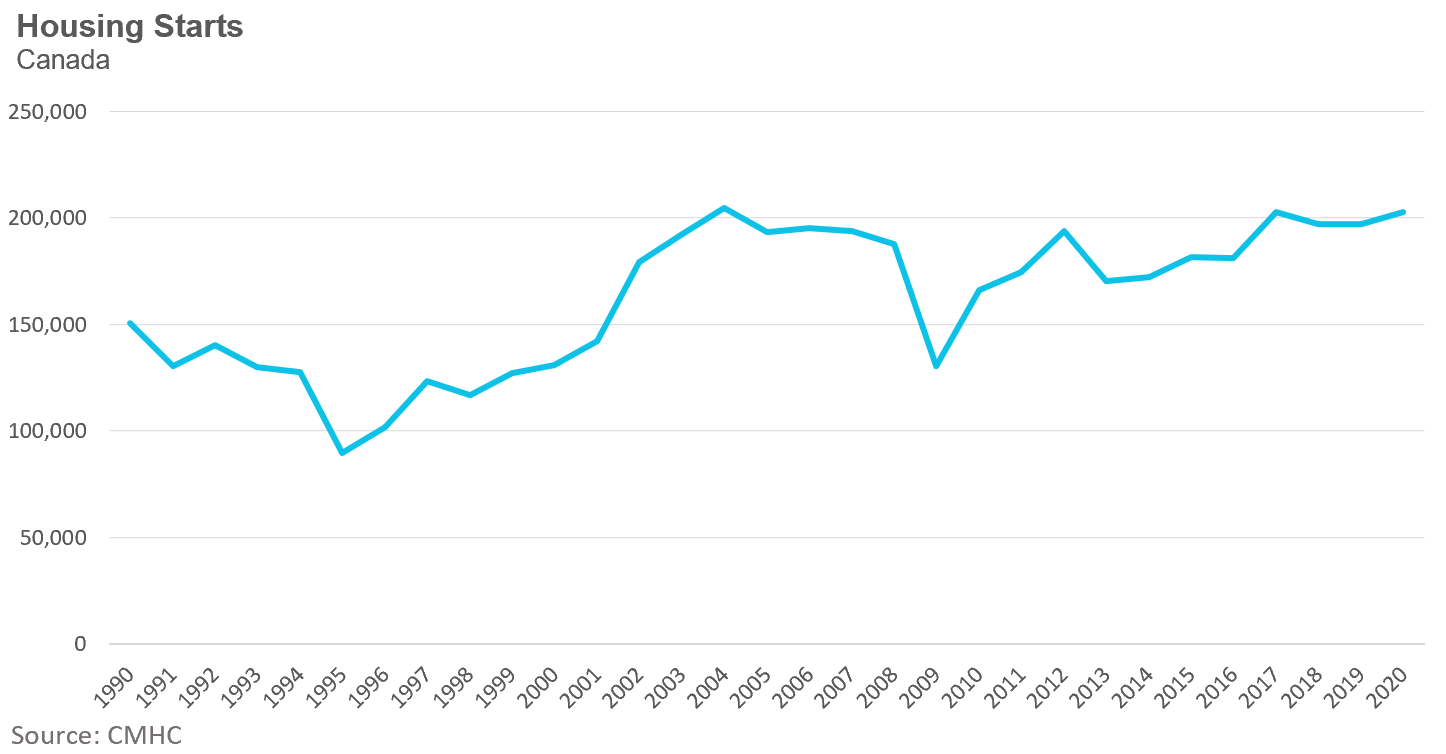

John notes that when hearing political leaders promises of millions of new homes being built, it’s important to put these numbers into context. Over the past twenty years Canada has seen an average of 180,000 housing starts per year.

The Liberal’s are promising 1.4 million new homes by 2026 (but the fine print clarifies that these “new homes” includes renovated and preserved homes — so not entirely new).

The Conservatives plan to start the construction of 1 million new homes over the next three years. Even if their plan includes the roughly 180,000 housing starts we normally expect to see in Canada, it’s unclear how the Conservatives will nearly double the rate of housing construction in Canada —- in just three years. While some ideas, such as the use of “Community Land Trusts”, which would allow for corporations and individuals to donate land to develop housing, mirroring an existing program to do this for ecological reserves, seem more original, there is still very little in concrete details — how much actual take up of this program is realistically expected?

The NDP plan to build 50,000 affordable houses per year is more modest, but even meeting this target would need to be over and above our historical housing start numbers and it’s unclear how the NDP will achieve this goal, much less make it affordable.

Overall, all parties fail to clearly outline how they plan to increase housing starts above Canada’s historical trends. There are many provincial and municipal frictions when it comes to increasing housing supply and while all parties have proposed measures to try to encourage more cooperation with provinces and municipalities, these proposed policies are unlikely to have any impact in the short term.

Renting

John notes that one area in which the incumbent Liberal Party has succeeded is increasing the supply of purpose built rental apartments. This is something that the Liberals have succeeded at doing as purpose built rental constructions starts are the highest they’ve been in decades.

He doesn’t like the Liberal’s “rent-to-own” plan as much as the Conservatives approach to finding new ways to boost affordable housing through new ideas like Community Land Trusts: “The former continues to build on the obsession and glorification of homeownership while the latter aims to make renting an affordable long-term housing option for families.”

Buyer Protection

The Liberals alone have put forward a number of proposals for Buyer Protection, including banning the practice of ‘blind bidding’, the practice in which home buyers make offers on homes without knowing what other parties are bidding.

However, most of the policies proposed by the Liberals here actually fall under the provincial government’s jurisdiction. And some of the proposals, such as requiring agents to disclose when they are on both sides of a sale to all participants in a transaction are already in place in Ontario.

Move Smartly legal expert, Bob Aaron agrees that “the proposals to regulate the real estate market in Ontario are clearly beyond the constitutional jurisdiction of the federal government,” noting that “voters should not be misled by these empty policy proposals.”

Furthermore, Bob notes that regulatory changes should be approached with caution in general: “Every time any level of government interference in the real estate market, they seem to mess it up.”

Speculation & Money Laundering

As recently first reported by a Chinese news source, a 1996 Canada Revenue Agency report that found “rich migrants made more than 90 per cent of luxury purchases in two Vancouver municipalities while declaring refugee-level incomes” has made it clear what many Canadians have long suspected — that foreign capital has played an important role in inflating house prices in Canada.

But John notes that plans to ban and/or tax foreign investors from all three parties have come 25 years too late. These proposed policies are unlikely to have any meaningful impact on the market because there are likely to be a number of exemptions to the tax which will limit their effectiveness. “We can’t forget that several months ago the Liberal party’s parliamentary secretary for housing said: “We have a very good system of foreign investment creating a lot of new housing in Canada.” I’m not convinced that any of the parties want to crack down on this “very good system.”

Mortgages

Move Smartly’s mortgage and financing expert David Larock notes that proposals range from those that are “a statement full of sound and fury that signifies nothing” to a “disaster in the making.” Overall, David argues that many of the proposals just stimulate demand amongst various subgroups, making the problem of housing affordability worse.

Among the proposals that David feels are most risky is the Liberal proposal to require mortgage lenders to defer payments for up to six months. “This proposal would appeal to at-risk borrowers in the short term but it would end up being a nightmare for all of the other borrowers over the long term,” as it would eventually result in increased rates for all borrowers as investors would ask for higher risk premiums to off-set deferrals. He notes that other Liberal proposals for Canadian Mortgage and Housing Corporation (CMHC) insurance changes would only increase demand.

David finds the Conservative proposal to introduce new seven to ten year mortgages potentially a good one, but notes that it’s unclear how the market, currently heavily geared towards 5-year terms, could be incentivized to do this, noting there is a lot of room for errors in trying to implement this. While other proposals are either vague or serve to increase demand, David is happy to see the proposal to remove the requirement for a ‘stress test’ when switching lenders, which is “highly anti-competitive.”

While the NDP proposal to increase access to CMHC mortgages for co-housing and co-ownership is a good one if combined with increasing affordable housing on the supply side, David notes that the introduction of 30-year terms would only stoke demand.

First Time Buyers

Echoing David’s comments on mortgage measures, John also notes that the one challenge with policies aimed at first time buyers is that they are effectively designed to stimulate more housing demand, which of course will only serve to push home prices up even higher.

Taxation

John notes that the anti-flipping is a policy that sounds great but is unlikely to have much of an impact. The tax is unlikely to apply to builders and renovators who are investing in homes and contributing to the economy. The number of investors who simply flip a home within a year without making any material changes to it is a small fraction of sales.

Urmi Desai is Editor at Move Smartly, a leader in Toronto real estate news & analysis, and is Realosophy Realty's Chief Content Officer with responsibility for Realosophy.com and all consumer education and tools.

Urmi holds a B.A. in Political Science and English from the University of Toronto and an M.A. from the Norman Paterson School of International Affairs (Trade Economics) at Carleton University (Ottawa, Canada).