A look back on how housing affordability became one of the hottest issues in today's Canada.

As Featured in the Move Smartly Report:

FREE PUBLIC WEBINAR: REPORT HIGHLIGHTS

Join John Pasalis, report author, market analyst and President of Realosophy Realty, each month as he discusses key highlights from this report, with added timely observations about new emerging issues, and answers your questions. A must see for well-informed Toronto area real estate consumers.

Justin Trudeau has been prime minister for just under six years and with a federal election around the corner the time is right to look back at how Toronto’s housing market has evolved during his time as prime minister.

I’ll be comparing the rate of change in house prices under Trudeau’s government against former prime minister Stephen Harper’s government.

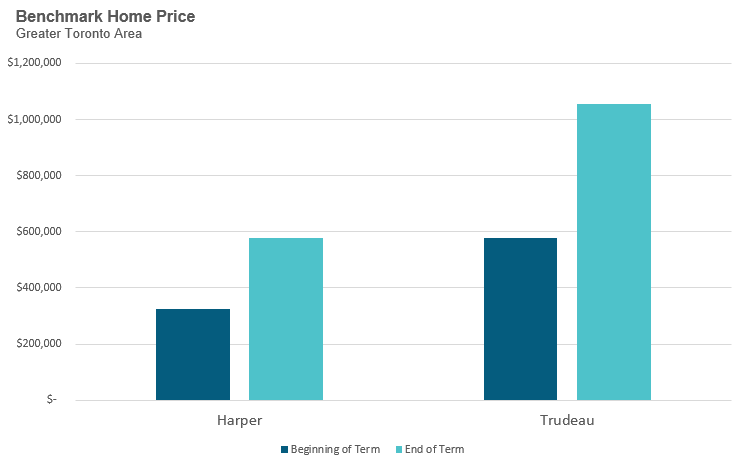

This analysis will be based on changes to the Benchmark Home Price for the Toronto area as provided by the Canadian Real Estate Association at the beginning and end of each prime minister’s term. Because the latest housing data available is for July 2021, I’ll be using this as the end date for Trudeau’s term.

The one thing not captured in this chart is the fact that Stephen Harper’s term was just under 10 years compared to under 6 years for Justin Trudeau.

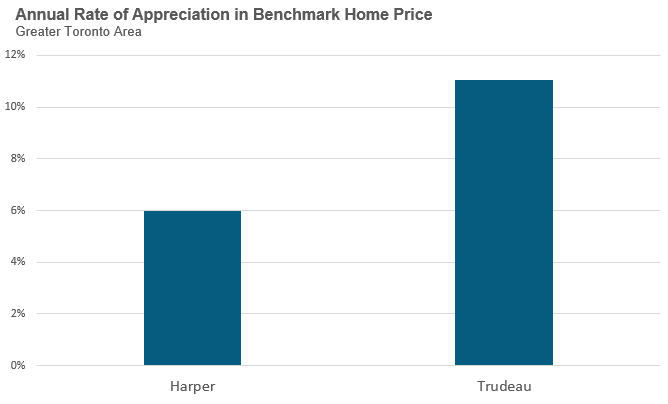

When we look at the annual rate of appreciation in house prices, we find that prices on average had appreciated by 6% per year under Stephen Harper compared to 11% under Justin Trudeau.

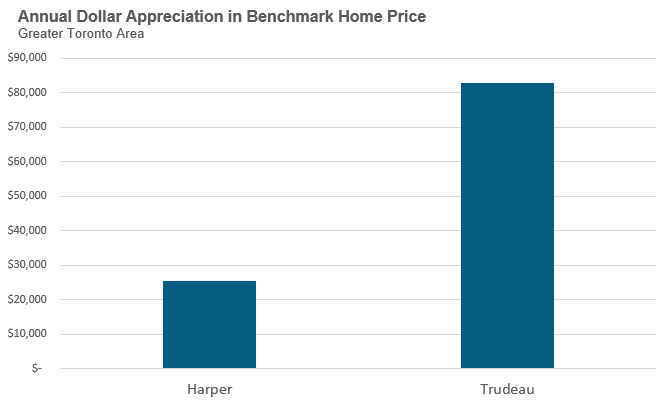

Now let’s look at how quickly home prices were rising in dollars each year, since this is ultimately what impacts households. When we convert the dollar appreciation under each prime minister to an average annual number we find that home prices were rising by an average of $25K per year under Harper compared to $83K under Trudeau.

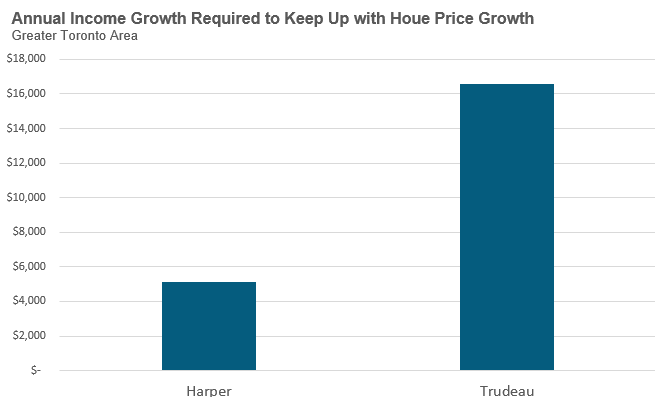

Now the big problem with the explosive growth in house prices under Justin Trudeau’s government is that household incomes have not been rising nearly fast enough to keep up with home prices which means every year that passes houses are becoming less and less affordable.

How much do household incomes need to rise to keep up with house prices?

To answer that, we’re going to consider how quickly home prices were rising each year in dollar terms and assume households are saving 10% of that increase which would be used as a down payment and are able to get a mortgage for the other 90%.

For example, under Harper’s government house prices were rising by $25,536 per year which means households would need to save $2,553 for the down payment and would need to be able to borrow an extra $22,982 to cover the difference.

How much do incomes need to be increasing to afford an additional $22,982 in debt each year?

If we assume a household can borrow no more than 4.5X their household income, we can see that household incomes under Harper’s government would need to increase by $5,107 a year in order for households to qualify to take on that additional $22,982 in mortgage debt each year.

Following the same approach under Trudeau’s government, households would need to save $8,299 per year to ensure their savings are keeping up with home prices and their incomes would need to be rising by $16,598 per year in order to qualify for the additional debt that would be required to keep up with house prices.

The millennial demographic who are in their prime home buying age is the group that has been most impacted by the rapid acceleration in house prices under Justin Trudeau’s government.

Households earning an income in the low $100K range (well above the median household income in Toronto) with a $100K+ down payment effectively stand no chance of buying a 3 bedroom home to raise a family in the Toronto area in 2021, as I discussed in this post. At the start of Justin Trudeau’s term in 2015 this same household would have had plenty of options to buy a family home.

Under Stephen Harper’s government, housing was affordable for the average middle class family that worked hard to save their own down payment.

In Justin Trudeau’s Canada, buying a home in Toronto is reserved for the most wealthy households with wealthy parents who can offer their kids six figure financial gifts to help contribute to their down payment. I don’t think this is the vision millennials signed up for when they helped give Justin his previous two election victories, but with Justin’s millennial support in freefall it’s become clearer that they’re not going to be duped a third time.

Top Image Credit: Getty/iStock

John Pasalis is President of Realosophy Realty, a Toronto real estate brokerage which uses data analysis to advise residential real estate buyers, sellers and investors.

A specialist in real estate data analysis, John’s research focuses on unlocking micro trends in the Greater Toronto Area real estate market. His research has been utilized by the Bank of Canada, the Canadian Mortgage and Housing Corporation (CMHC) and the International Monetary Fund (IMF).

Follow John on Twitter @johnpasalis

Email John