Real buyer demand has explained home prices rises recently, but is a familiar old factor now the story?

During an interview earlier this month, I was asked the perennial question:

Is Toronto in the middle of a housing market bubble?”

My answer was probably not.

Much of the growth in home prices over the past 18 months since the start of the Covid-19 pandemic was largely driven by strong demand from end users (home buyers intending to live in the property), not investors (looking to rent out or just ‘hold onto’ properties given the expectation that prices will keep going up).

In most bubbles, optimistic (or as they’ve been dubbed, “irrationally exuberant”) investors have played a key role in driving up home prices to unsustainable levels that eventually ‘burst’.

But while end-users were the primary driver of the Toronto area’s housing boom in 2020, that trend appears to be changing in 2021, leading me to wonder if we are moving closer to a market where the extrapolative expectations of real estate investors are once again driving home prices.

So what does “irrational exuberance” look like in the real estate market?

When a key driver of home price appreciation is no longer fundamental factors (such as population growth, low interest rates, etc.), but rather the optimistic beliefs of investors who believe home prices will keep going up forever at a rapid rate. This is when you hear about more and more people looking to invest in real estate themselves, after hearing about how well family and friends have been doing with their own properties.

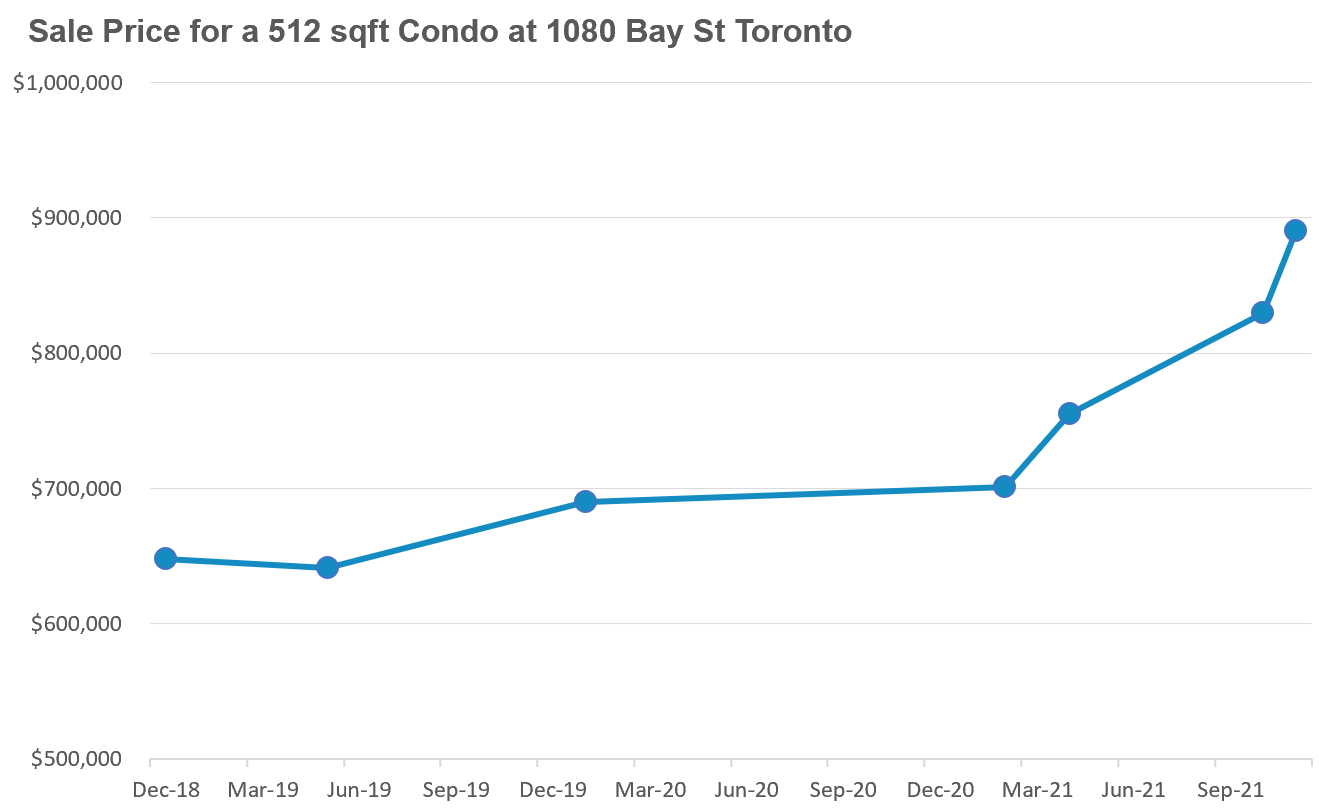

Let’s take a look at what this looks like on the ground by looking at sales prices for identical 512 square foot units (floor level aside) at a condo at 1080 Bay Street in downtown Toronto.

Since December 2018, seven of these units have sold and their sale prices tell an interesting story. The unit that sold in December 2018 achieved a sale price of $648,000; the price growth remained very balanced up until February 2021 when a unit sold for $700,888.

But since then, prices have started to take off.

Only two months later in April 2021, a unit sold for $755,000. Six months after that in October 2021, a unit sold for $830K and a month later in November, the same sized unit sold for $890K.

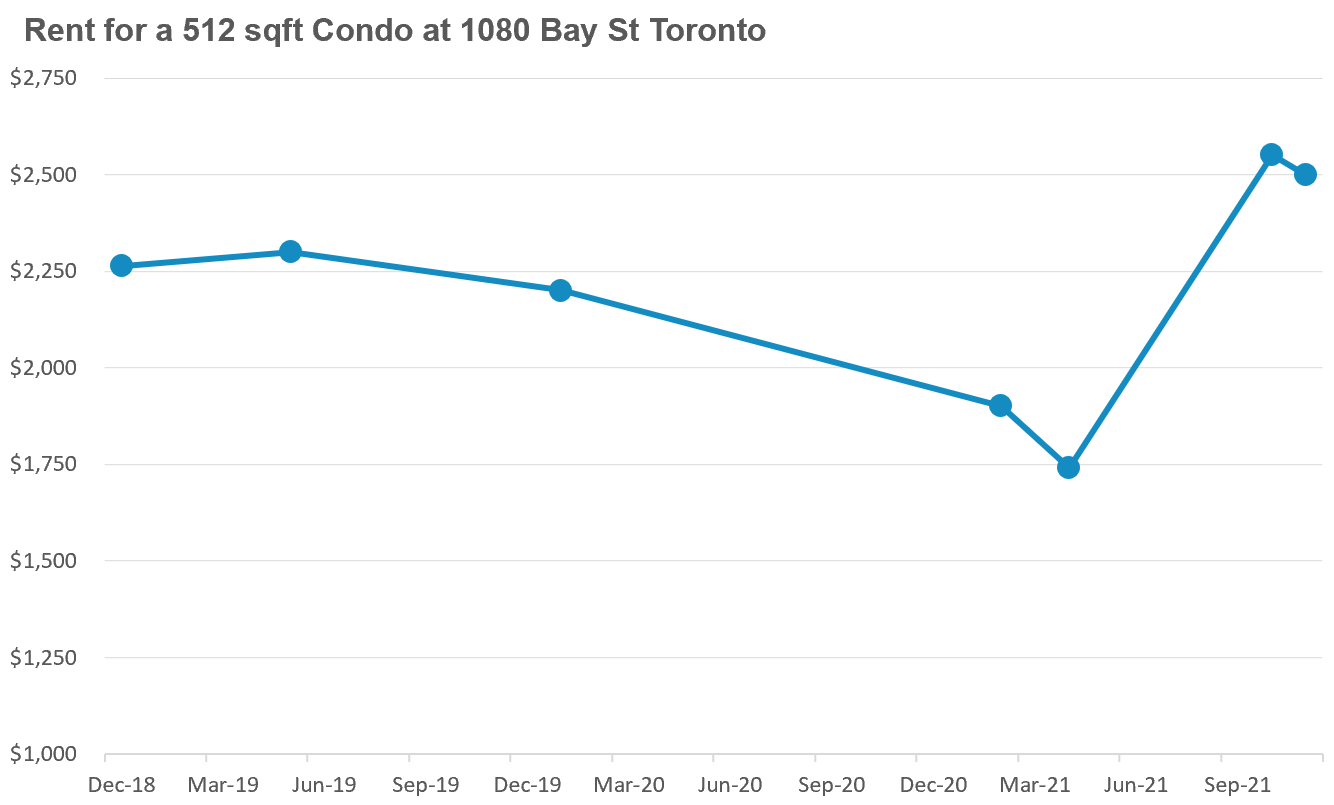

So what’s driving this explosive growth? Have rents surged in Toronto unexpectedly in the same time period?

In March 2021, the market rent for one of these units had fallen to $1,740, down 23% from $2,263 in December 2018.

Since then, rents have rebounded, thanks in large part to a surge in demand in the summer of 2021 from students returning to university after the Covid-19 shutdown.

But current rents are not that far above rents seen in 2018, up just $239 or 10%, while prices have surged $240,000 or 37% over the same period.

And there are some signs that not all renters will be back any time soon, at least in the Toronto downtown core, given the ongoing decrease in retail and restaurant activity in the area.

At the most recent sale price of $890,000 at 1080 Bay Street, the monthly carrying costs (mortgage, maintenance fee and property tax) for an investor with a 20% down payment and a 30-year mortgage would be $3,500 — $1,000 more than the monthly rental income being generated.

So why are investors eager to buy a property where they’ll have to pay $1,000 per month out of pocket to cover the carrying costs?

The primary reason is that investors expect their investments to be worth significantly more a year from now. They don’t care if they are paying $1,000 out of pocket because they expect that their unit is going to be worth $100K more a year from now.

This is very reminiscent of the trends I saw on the ground in 2015/16 when Toronto experienced a suburban housing bubble in 2015-16.

The pre-construction unit that sold in November achieved a price of $1,738 per square foot, which is also notably high given that downtown resale condos are selling for just over $1,000 per square foot on average.

It’s no surprise that some real estate agents are promoting this sale as a “new normal” and using this single sale to argue that paying $1,500 per square foot for a pre-construction condo downtown is “very reasonable”.

I don’t really agree with this conclusion — at $1,400 to $1,500 per square foot, I’m finding pre-construction condos to be a very risky investment given current rents and resale prices.

This leads me to believe that the price trends we are seeing in parts of the resale condo market and the pre-construction condo market are a symptom of irrationally exuberant investors.

And it’s worth noting that this exuberance is not just limited to the condo market, it’s happening everywhere in the Toronto area and beyond.

The rapid acceleration in home prices over the past year has, not surprisingly, made everyone want to become a real estate investor. Our brokerage, Realosophy Realty, is getting more phone calls from investors than end-users looking to buy a home.

This post from prominent mortgage broker Ron Butler highlights what many recent home buyers are experiencing in terms of the price appreciation on their homes which is driving the investor enthusiasm we are seeing in the market today.

Earlier this year, I spoke to students in the real estate management program at Ryerson University. The discussion ended with a brief Q&A and the most popular question students submitted was “What advice do you have for potential residential real estate investors now?”

I was taken aback as I thought that their primary concern would be related to the challenges that young first-time home buyers face trying to buy a home today. But when young university students are more concerned about buying real estate as an investment rather than as a place to live, we should be concerned about the speculative mood that has taken over our housing market.

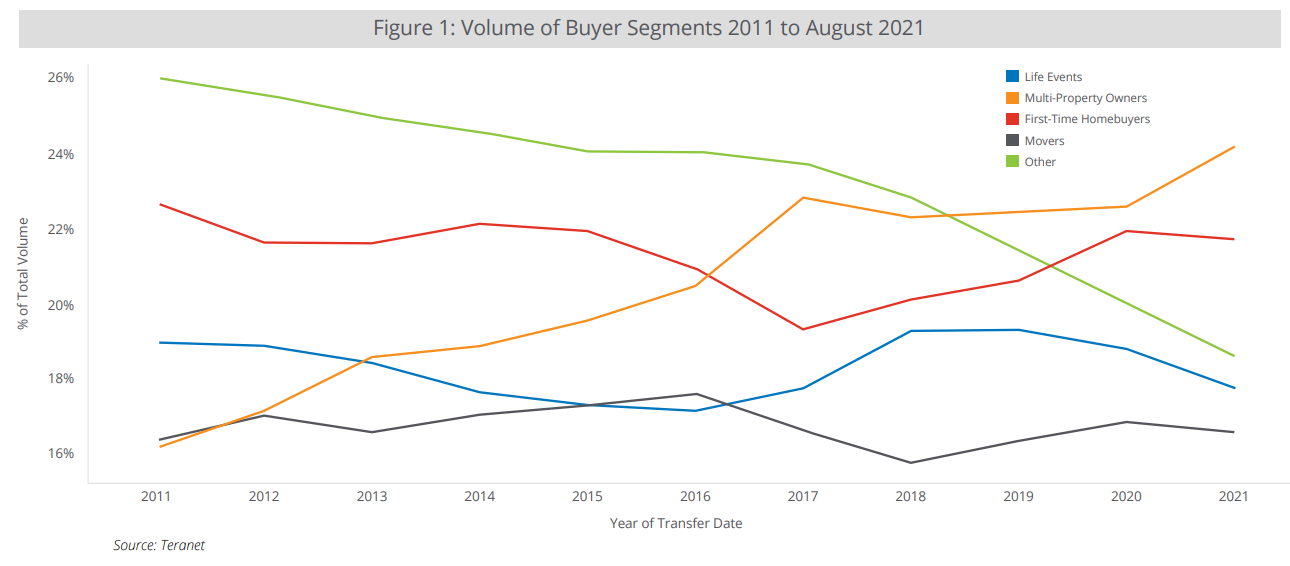

These on the ground observations line up with recent data published by Teranet. Teranet divided buyers of residential homes into segments including first time buyers, movers, and investors (multi-property owners). They found that not only are investors the biggest buyer segment in 2021 (they were the smallest segment in 2011), they are the only segment that actually saw their share of transactions increase in 2021.

Every other type of buyer, including first-time buyers are buying proportionally fewer homes in 2021.

There are two things I think we all need to consider when thinking about these trends.

Firstly, anyone arguing that the rapid acceleration in home prices is justified because of a “lack of supply” is not being entirely honest with you.

This is a common argument among realtors, and the wider real estate industry, including self-described “real estate investment coaches”, which is intended to reassure investors about paying ever increasing prices since prices can ‘never fall’ because ‘there’s not enough supply.’

The fact that some bank economists, likely cognizant of how important real estate is to Canada’s economy, reinforce this narrative is even more troubling.

The fact is that when the dominant buyers of homes are investors, no amount of supply can ever keep up with the appetite and lofty expectations of real estate investors.

To see this in action, we only need to look at cities like Phoenix, Las Vegas and Dubai that have a relatively elastic (not constrained by land or zoning restrictions, etc.) supply of new homes.

Leading up to the 2008 global financial crisis, investors were a key driver of skyrocketing home prices in those cities and having a very elastic supply of housing did not stop them from experiencing a housing bubble which was followed by a deep crash in home prices.

Many economists also argue that it makes no difference if a home is purchased by an investor vs. an end-user, as long as the investor rents the home out. This again is not entirely accurate.

When investors are the dominant buyers in a market they push home prices much higher than they otherwise would be — preventing some end-users from buying homes for themselves. By financing the new construction of homes, such investors may help keep renting more affordable but they make owning far less affordable.

Additionally, having a larger share of investors in our housing market makes our housing economy (and thus our entire economy) far more vulnerable in the event of a sudden investor exit from the market. In my July 2021 report, I unpacked in more detail how investors particularly impact home prices (both on the way up and on the way down).

Now, I should repeat that while the trends I’m seeing on the ground — rapid price acceleration driven largely by strong investor demand — are troubling from a bubble-watching perspective, I don’t expect any dramatic change in the housing market and home prices anytime soon (as I discussed earlier in this report).

This type of investor-led rapid home price acceleration can go on for far longer than you might expect. As long as there is another optimistic investor around the corner willing to pay even more — prices will keep rising.

What is unlikely to rise as rapidly are rents, because unlike home prices, rents are truly constrained by household income. Home prices are a financial asset that when purchased by end-users may be constrained by income, but when purchased by cash-rich investors — the income constraint on prices no longer matters.

So this pronounced investor demand will continue until investors find that the gap between the carrying costs for their investment property and the rental income they may generate from it is too large. If that happens, then the optimistic investor may suddenly turn very pessimistic, much like they did during the initial onset of the Covid-19 pandemic when investors rushing to sell their downtown condos caused prices to suddenly fall.

Given this, it is important for consumers of real estate to be aware of potential issues, particularly in some segments of the housing market, in light of these troubling signs.

Read our full monthly Move Smartly market report for Nov 2021 here

John Pasalis is President of Realosophy Realty, a Toronto real estate brokerage which uses data analysis to advise residential real estate buyers, sellers and investors.

A specialist in real estate data analysis, John’s research focuses on unlocking micro trends in the Greater Toronto Area real estate market. His research has been utilized by the Bank of Canada, the Canadian Mortgage and Housing Corporation (CMHC) and the International Monetary Fund (IMF).

Follow John on Twitter @johnpasalis

Email John