Observers have been worried - but have policy makers done anything to cool prices in the past year?

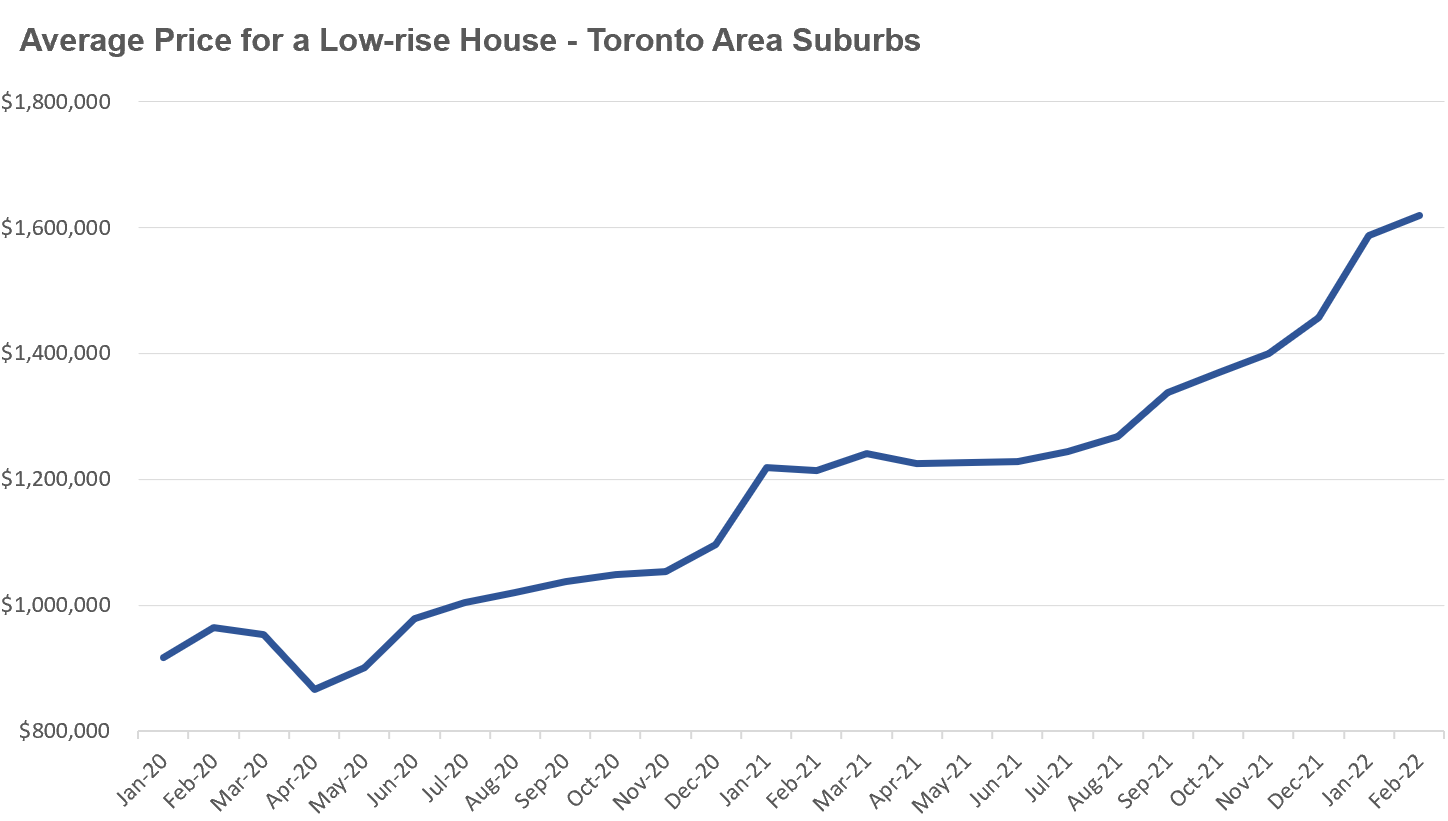

Just over a year ago, in my February 2021 report, I discussed what I saw as signs of a housing bubble in the market for suburban homes in the Toronto area. When I published that report, the average price for a low-rise home in the suburbs was just over $1.21M, up 26% in one year.

A number of big bank economists in March 2021 raised similar concerns that the rapid growth in home prices may at least in part be driven by speculative buying, and they suggested that policy makers might introduce new measures to curb speculation in the housing market.

But no measures were introduced.

When Bank of Canada Governor Tiff Macklem said, “we need the growth we can get,” in response to concerns about rapidly rising home prices at the time, it was clear that inflating home prices was part of the Bank’s plan to get Canada out of this pandemic. Since then, data from both Teranet and the Bank of Canada show that demand from real estate investors actually accelerated in 2021, helping to push home prices even higher.

So what’s happened since last year?

As seen above, over the past year, low-rise suburban home prices have surged from just over $1.21M to $1.62M, a 34% increase.

Over the past two years, low-rise suburban home prices are up 68% so clearly, in spite of some authorities ringing the alarm, they have done little else.

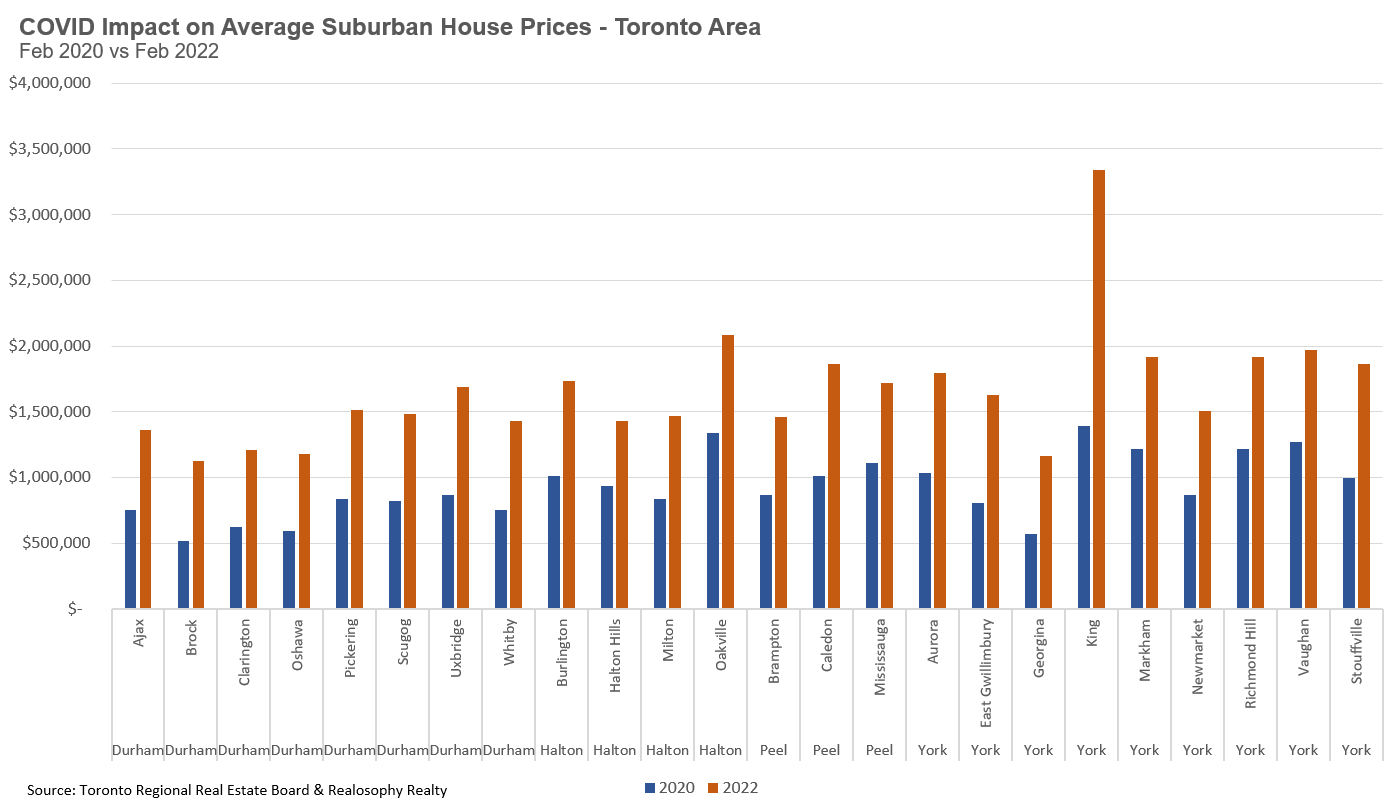

The chart below shows the average price of suburban low-rise homes in February 2020 (pre-COVID) vs February 2022 by municipality. Before COVID, fifteen of Toronto's suburban municipalities had an average price below $1M. Last month, not a single municipality had an average price below $1M.

It is hard to say where the market will go from here, but having this rapid acceleration in home prices as we head into an uncertain economic times due to rising inflation, gas prices surging and potential fallout from the Ukraine conflict is risky. If we find ourselves in a recession a year from now, high home prices and high household debt might make any potential recession even worse.

Conversely, what makes Canada a bit unique from other bubble countries is that its fundamental demand for housing continues to significantly outpace supply. If Canada can meet its lofty immigration targets, the demand for homes will continue to outpace supply, which in theory would put even more upward pressure on prices. But this alone is no guarantee that prices will keep rising at this current rate.

As I mentioned in a previous report, the most important factor to keep an eye on in the months ahead is buyer sentiment as rapid changes in buyer sentiment are one of the key risks of bubbles bursting. If the sentiment of buyers shifts from optimistic to pessimistic, it will be tough for policymakers to counteract that trend.

John Pasalis is President of Realosophy Realty, a Toronto real estate brokerage which uses data analysis to advise residential real estate buyers, sellers and investors.

A specialist in real estate data analysis, John’s research focuses on unlocking micro trends in the Greater Toronto Area real estate market. His research has been utilized by the Bank of Canada, the Canadian Mortgage and Housing Corporation (CMHC) and the International Monetary Fund (IMF).

Follow John on Twitter @johnpasalis

Email John