As agents suggest that demand from investors for Toronto condos has likely exceeded pre-pandemic levels, we dig into the numbers to see.

As Featured in the Move Smartly Report:

In this video (click above), I take you through our deep data dive from this month's Move Smartly report, where we take a closer look at just what is going on in the numbers.

In this video (click above), I take you through our deep data dive from this month's Move Smartly report, where we take a closer look at just what is going on in the numbers.

Story text below - see full report by clicking on report cover to the left.

In last month’s report, I discussed how, in the wake of the Covid-19 pandemic, we saw a significant increase in the share of investors who were selling their Toronto condos due to a decline in both prices and rents, as residents fled the city core amidst widespread office, workplace and school closures. This trend gradually began to decline as prices started to rise again due to a boom in downtown condo sales that began in December 2020 and continued to surge during the first quarter of 2021. Sales in the City of Toronto for the first quarter were up 74% over last year and the share of units selling for over the asking prices ended the quarter at just under 60%.

It’s difficult to say for certain how much of this demand is being driven by investors, but anecdotal accounts from agents suggests that demand from investors has likely exceeded pre-pandemic levels.

While our real estate brokerage Realosophy Realty does track the share of properties sold to investors at any given point in time (something you can browse for every neighbourhood and municipality in the GTA on our website) our methodology lags the market by roughly 6-8 months, as we need the time to determine if buyers taking possession of their units then rent them out (i.e., as an investor). This means that the % of investor stats we report for the month of May, for example, reflects the nature of purchases that occurred in September or October in the preceding year.

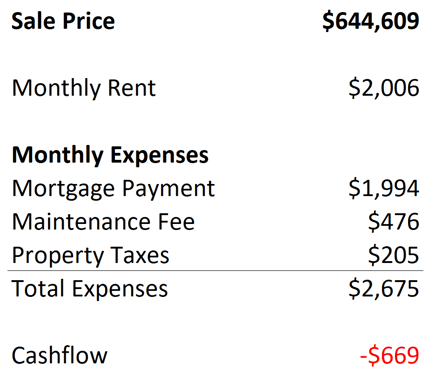

In the interim, we wanted to get a better sense of the financials that are motivating investors to buy condos so we analyzed all of the condos that closed (i.e., the day ownership transferred and the new buyer took possession) in the old City of Toronto boundaries (browse a map of the area here) during the first quarter of 2021 and checked to see how many of those units were subsequently rented between January - April of this year. We analyzed the old City of Toronto because this was the area hardest hit by the pandemic and the area that has seen the biggest rebound.

There are some flaws with our methodology, specifically that condos that closed in January had a longer time to be rented out then those that closed March, which likely undercounts the share of investors in March. Nevertheless, this admittedly rough analysis still provides us some insight into where market trends may be going.

We estimated the cash flow of these investment properties using the actual maintenance fees, property taxes and rent for each individual condo unit that was bought and leased by an investor. We assumed that investors were making a 20% down payment and were paying 2.5% on their mortgage amortized over a 30-year period.

Here’s what we found:

There were a total of 2,634 condominium apartments that closed during the first quarter of 2021. Of those, 447 units (17% of the total) were listed for lease on the MLS during the first four months of the year and of those, 283 or 63% found a tenant and were leased.

Of the properties that were leased, below is an overview of the average purchase price, rent and carrying costs for the properties.

So how does this current cash flow for investment condos compare to the historical average?

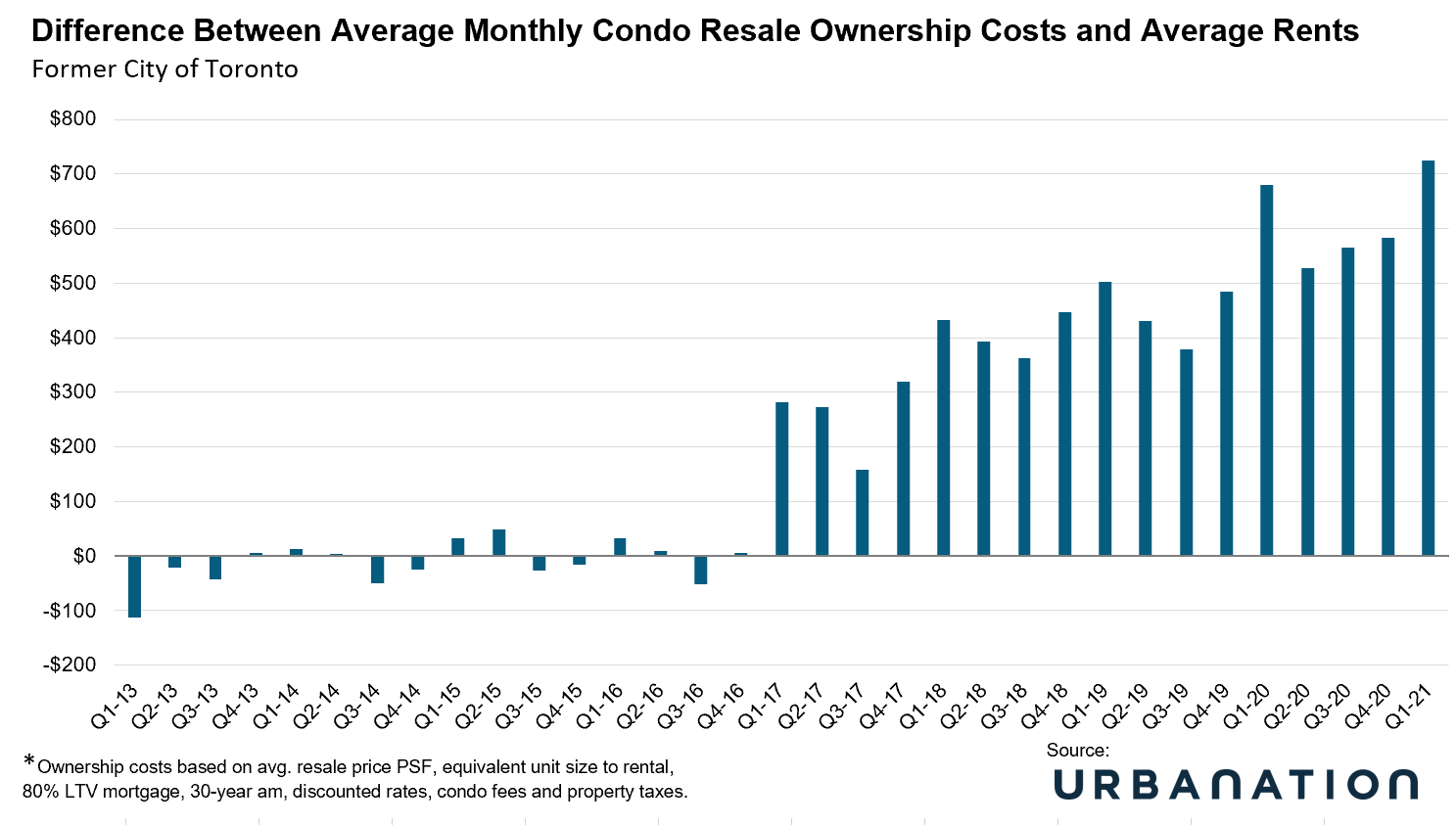

Condominium research firm Urbanation shared their calculations with us that show the difference between condo ownership costs vs. average rents as far back as 2013. We can see that the difference between monthly costs and average rents has been accelerating since 2017.

We can see that the difference between ownership costs and average rents fell after the first quarter of 2020 in the onset of the pandemic due to a decline in condo prices and interest rates — despite the fact that average rents also fell over the same period.

Urbanation’s difference of over $700 during the first quarter of 2021 is above our calculation of $669 due to methodological differences. Firstly, Urbanation uses average rents and sale prices for all properties while we focused exclusively on those bought by investors. But more importantly, the average sale price in our analysis will likely be lower than Urbanation’s because many of the condos that closed during the first quarter of 2021 were actually purchased during the fourth quarter of 2020 when prices were much lower.

So how prudent is it to buy a rental property that is expected to fall short over $700 per month in covering all carrying costs when rented out, before even factoring in vacancy and turnover?

It depends on who you ask.

During a recent study by CIBC and Urbanation that looked at the cash flow of newly completed condos, they asked investors who were cash flow negative by $600 to $700 per month why they were ok with owning an investment condo that is losing that much money each month.

CIBC’s Benjamin Tal, Chief Economist at CIBC, described the answers they received from investors this way:

“We asked them, and they said: No, you don’t understand. We are not losing money. Somebody is paying a portion of our mortgage and over time the price of this property will rise and we will be better off.”

What did Tal think of that answer? He said:

“They are right! It’s not speculation….. If you think Toronto is unaffordable now, you wait!”

While Tal is a very good economist, I’m not sure if I can support the investment advice he’s offering. Investing in real estate is a business, and a business that bleeds cash every single month simply because the owner believes it will be worth more tomorrow is concerning.

Something tells me CIBC would not offer their commercial clients a mortgage if their net operating income couldn’t cover their mortgage payments — and yet CIBC and every other Canadian bank will issue that mortgage to any ‘mom-and-pop’ property investor.

This belief perpetuated by real estate agents, builders and experts like Tal, that it doesn’t matter if your cash flow is short $700 per month on an investment condo, just hurry up and buy now or you’ll never be able to afford one — is the type of belief that fuels speculative real estate bubbles.

Many of the investors who were buying single family houses in Toronto’s suburbs in 2016 and 2017 were buying for the same reasons Benny described. Back then, investors were losing more than $1,100 each month (on properties bought for over $1 million), but they didn’t care because someone else was paying their mortgage and like Tal suggests, they believed that real estate prices will only go one way — up!

Nobody knows where home and condo prices will be tomorrow in part because there are a lot of factors that we can’t predict — like what Ontario’s jobs and immigration numbers will look like post-pandemic. If we see a boom in non-permanent residents similar to what Ontario experienced over the past 6+ years then rents will likely increase quickly which will make these condos more attractive investments.

But if rent growth remains sluggish, perhaps as the pandemic continues to affect parts of the world where this immigration is normally expected from or due to changes in renter behaviours, I’m not sure telling people to buy an investment condo no matter what is the best advice, especially when so much of the reasoning for this advice is that Toronto can never build too many 600 sq. ft. condos.

When investors are driving our new housing supply and when the majority of that supply is a very specific type of property — small condos — there is always the risk that we may be building too many as the money flows in — for now.

Only time will tell.

Top Image Credit: Getty/iStock

The Move Smartly monthly report is powered by Realosophy Realty Inc. Brokerage, an innovative residential real estate brokerage in Toronto. A leader in real estate analytics, Realosophy educates consumers at Realosophy.com and MoveSmartly.com and helps clients make better decisions when buying and selling a home.